Huawei’s Smartphone Business in the US: Huawei Sell Smartphones Us Carriers 2018

Huawei’s journey in the US smartphone market has been marked by both significant growth and unexpected challenges. The company’s presence in the US market, while initially modest, quickly gained momentum, leading to a considerable market share. However, political and security concerns eventually led to a dramatic shift in Huawei’s fortunes in the US.

Huawei’s Early Entry and Growth

Huawei’s entry into the US smartphone market was gradual, starting with a focus on carrier partnerships and niche products. The company’s initial strategy involved building relationships with smaller carriers and offering affordable devices with competitive features. This approach proved successful, allowing Huawei to establish a foothold in the market.

Huawei’s rise in the US smartphone market can be attributed to several factors:

- Competitive Pricing: Huawei offered smartphones with high-end features at prices lower than those offered by major competitors, making its devices attractive to budget-conscious consumers.

- Innovative Features: Huawei incorporated cutting-edge technologies into its smartphones, including advanced cameras, long-lasting batteries, and fast processors. These features appealed to tech-savvy consumers who sought value for their money.

- Carrier Partnerships: Huawei strategically partnered with US carriers, including AT&T and T-Mobile, to expand its reach and distribution network. These partnerships ensured that Huawei’s smartphones were readily available to a wider audience.

- Marketing and Branding: Huawei invested in marketing campaigns to build brand awareness and promote its products in the US market. The company focused on highlighting its innovative features and competitive pricing to attract consumers.

The US Smartphone Market Landscape in 2018

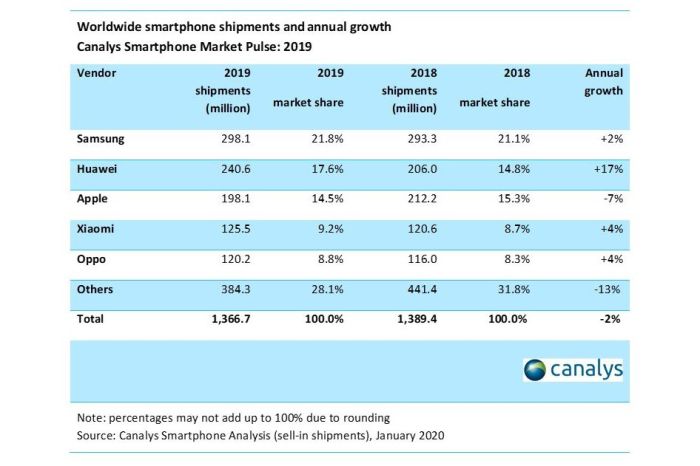

By 2018, the US smartphone market was dominated by a few major players:

- Apple: Apple maintained its position as the market leader, with a strong brand reputation and a loyal customer base. Apple’s iPhones were known for their premium design, user experience, and robust ecosystem.

- Samsung: Samsung was the second-largest player in the US smartphone market, offering a wide range of devices across different price points. Samsung’s Galaxy series was particularly popular, known for its advanced features, large displays, and powerful processors.

- LG: LG was a significant player in the US smartphone market, known for its innovative features and competitive pricing. LG’s smartphones were popular among consumers who sought value for their money.

- Google: Google’s Pixel smartphones gained traction in the US market, known for their pure Android experience and advanced camera capabilities. Google’s focus on software integration and user experience attracted a dedicated following.

The US smartphone market in 2018 was highly competitive, with each player vying for market share. Huawei, despite its growing presence, faced stiff competition from established players with strong brand recognition and loyal customer bases.

US Carrier Relationships in 2018

Huawei’s foray into the US smartphone market in 2018 was marked by a strategic focus on establishing strong partnerships with major US carriers. These partnerships were crucial for Huawei’s success, providing access to a vast customer base and established distribution channels.

Huawei’s US Carrier Partnerships in 2018, Huawei sell smartphones us carriers 2018

Huawei collaborated with several prominent US carriers in 2018, including:

- AT&T: Huawei’s partnership with AT&T was initially announced in 2017 but faced significant hurdles, ultimately leading to its termination. The collaboration was short-lived and focused on the release of the Mate 10 Pro.

- T-Mobile: Huawei’s relationship with T-Mobile was more successful, with the carrier offering several Huawei models, including the Mate 10 Pro, P20 Pro, and Nova 3i. This partnership was characterized by exclusive deals and promotional campaigns.

- Sprint: Sprint also partnered with Huawei, offering models like the Mate 10 Pro and P20 Pro. The partnership aimed to expand Sprint’s smartphone portfolio and provide customers with a wider range of choices.

- MetroPCS: Huawei also secured a partnership with MetroPCS, a subsidiary of T-Mobile. This partnership allowed Huawei to reach a broader audience, including budget-conscious consumers.

Marketing Strategies of Huawei and US Carriers

Huawei’s marketing strategies in the US were often aligned with its carrier partners. Both parties leveraged various marketing tactics, including:

- Exclusive Bundles and Promotions: Carriers often offered exclusive bundles and promotions for Huawei devices, including discounts, free accessories, and data plans. These promotions aimed to incentivize customers to choose Huawei devices.

- Targeted Advertising Campaigns: Huawei and its carrier partners utilized targeted advertising campaigns across various channels, including television, online platforms, and social media. These campaigns highlighted the key features and benefits of Huawei devices.

- Retail Store Displays and Demonstrations: Carriers dedicated prominent space in their retail stores to showcase Huawei devices. They also employed sales representatives to demonstrate the features and capabilities of these devices to potential customers.

Challenges Faced by Huawei in Securing US Carrier Distribution Agreements

Huawei encountered several challenges in securing distribution agreements with US carriers. These challenges included:

- Security Concerns: US carriers were cautious about partnering with Huawei due to concerns about the company’s security practices and potential ties to the Chinese government. These concerns were amplified by the US government’s scrutiny of Huawei’s operations.

- Brand Recognition: Huawei’s brand recognition in the US was relatively low compared to established players like Samsung and Apple. This made it difficult for Huawei to attract customers and compete in the crowded smartphone market.

- Competition from Established Players: Huawei faced intense competition from established smartphone brands like Samsung and Apple, which already enjoyed strong brand loyalty and established distribution channels.

The 2018 Trade Dispute and Its Impact

The year 2018 witnessed a significant escalation in trade tensions between the United States and China, culminating in a trade war that had profound implications for Huawei’s smartphone business in the US. This trade dispute, fueled by concerns over intellectual property theft, unfair trade practices, and national security, led to a series of actions by the US government that directly impacted Huawei’s operations.

US Government Actions Against Huawei

The US government took a series of actions that significantly hampered Huawei’s smartphone business in the US. These actions were driven by concerns about national security and intellectual property theft, with the US government alleging that Huawei posed a risk to US national security due to its ties to the Chinese government. The US government’s actions included:

- Imposing export restrictions: The US Commerce Department placed Huawei on its Entity List in May 2019, effectively restricting US companies from selling components and software to Huawei without a special license. This restriction severely impacted Huawei’s supply chain, making it difficult to source essential components for its smartphones.

- Lobbying against Huawei: The US government actively lobbied against Huawei, urging allies to restrict Huawei’s access to their 5G networks. This campaign aimed to isolate Huawei from global markets, further impacting its smartphone business.

- Security concerns: The US government raised concerns about Huawei’s smartphones posing a security risk, citing potential backdoors that could be used for espionage or data theft. These concerns were fueled by allegations that Huawei was required by Chinese law to cooperate with intelligence agencies, raising suspicions about the security of its devices.

The trade dispute and subsequent actions by the US government had a significant impact on Huawei’s smartphone business in the US. Huawei’s sales declined sharply, and its market share dwindled as consumers became hesitant to purchase Huawei devices due to concerns about security and the availability of future updates. The following points illustrate the impact:

- Sales decline: Huawei’s smartphone sales in the US plummeted after the trade dispute began. According to IDC, Huawei’s US market share fell from 2.8% in Q1 2018 to just 0.4% in Q1 2019, highlighting the dramatic impact of the trade dispute.

- Loss of carrier partnerships: US carriers, including AT&T and Verizon, stopped selling Huawei smartphones due to pressure from the US government and concerns about security. This loss of carrier partnerships significantly hampered Huawei’s ability to reach consumers in the US market.

- Limited availability: The export restrictions imposed by the US government made it challenging for Huawei to source components for its smartphones, leading to limited availability of its devices in the US market.

Consumer Perception and Brand Image

Prior to 2018, Huawei smartphones held a relatively strong position in the US market, garnering a loyal following among tech-savvy consumers. This positive perception was built on a foundation of innovation, competitive pricing, and a focus on features that appealed to a specific segment of the market.

Pre-2018 Perception of Huawei Smartphones

Huawei’s brand image in the US prior to 2018 was characterized by a combination of factors, including:

- Innovation: Huawei was known for its focus on cutting-edge technology, particularly in areas like camera capabilities, battery life, and fast charging. This emphasis on innovation attracted tech enthusiasts and early adopters.

- Value for Money: Huawei smartphones often offered premium features at a more affordable price point compared to flagship models from other leading brands. This value proposition appealed to budget-conscious consumers.

- Strong Features: Huawei smartphones were known for their powerful processors, high-quality displays, and attractive designs. These features contributed to their appeal among consumers seeking a balance of performance and aesthetics.

- Customer Loyalty: Huawei cultivated a loyal customer base by providing excellent after-sales support and consistently delivering on its promises of innovation and value. This loyalty was evident in online forums and user reviews, where many customers expressed positive experiences with Huawei devices.

Impact of the Trade Dispute on Consumer Perception

The trade dispute between the US and China in 2018 had a significant impact on consumer perception of Huawei in the US. The US government’s accusations of national security risks associated with Huawei’s equipment, coupled with media coverage of the dispute, led to a decline in consumer trust and a negative perception of the brand.

- Security Concerns: The US government’s allegations that Huawei’s equipment could be used for espionage and surveillance raised serious security concerns among US consumers. This perception of potential risks made many hesitant to purchase Huawei devices.

- Negative Media Coverage: The trade dispute received widespread media attention, with many news outlets highlighting the US government’s concerns about Huawei’s security practices. This negative media coverage further fueled consumer anxiety and contributed to a decline in brand trust.

- Uncertainty and Fear: The ongoing trade dispute created an atmosphere of uncertainty and fear among US consumers, leading some to avoid Huawei products due to concerns about potential future restrictions or sanctions.

Strategies to Mitigate Negative Perceptions

Despite the challenges posed by the trade dispute, Huawei implemented several strategies to mitigate negative perceptions and maintain its brand image in the US. These efforts included:

- Public Relations Campaigns: Huawei launched public relations campaigns to address security concerns and reassure consumers about the safety of its devices. These campaigns involved issuing statements, engaging with media outlets, and collaborating with security experts to demonstrate its commitment to transparency and security.

- Focus on Innovation: Huawei continued to invest heavily in research and development, releasing new smartphones with innovative features and technologies. This focus on innovation aimed to showcase Huawei’s technological capabilities and reinforce its position as a leader in the mobile industry.

- Partnership with US Carriers: Huawei maintained its partnerships with major US carriers, ensuring the availability of its devices through established distribution channels. This strategy aimed to provide consumers with convenient access to Huawei smartphones and build trust through existing relationships.

Industry Analysis and Future Implications

The 2018 trade dispute between the US and China had a profound impact on Huawei’s smartphone business in the US, and the long-term implications are still unfolding. While the dispute has significantly hindered Huawei’s ability to compete in the US market, the company’s future prospects remain uncertain.

The Long-Term Impact of the Trade Dispute

The trade dispute, fueled by national security concerns, led to the US government imposing restrictions on Huawei, effectively barring it from accessing key technologies and collaborating with US companies. This resulted in Huawei being unable to sell its smartphones through major US carriers, limiting its reach to a small segment of consumers. The impact was multi-faceted:

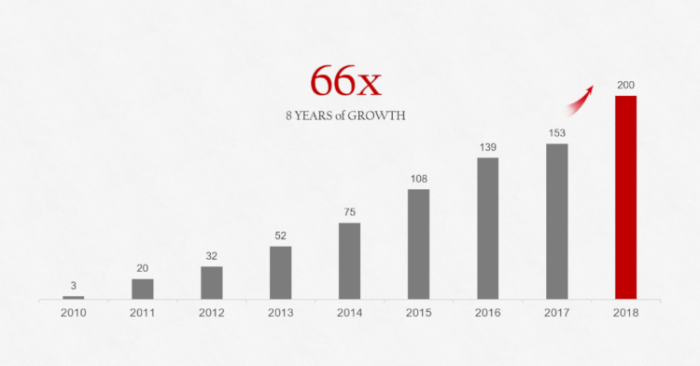

* Market Share Decline: Huawei’s market share in the US plummeted from a peak of 10% in 2017 to almost zero within a few years.

* Loss of Revenue: Huawei’s revenue from US smartphone sales dwindled significantly, impacting its overall financial performance.

* Brand Perception: The trade dispute negatively affected Huawei’s brand image in the US, creating an air of uncertainty and distrust among consumers.

Huawei’s Potential Re-Entry into the US Market

The possibility of Huawei re-entering the US market remains a subject of debate. While the US government has eased some restrictions, the path to a full return is uncertain. A few factors influence this potential:

* Political Climate: The political climate between the US and China plays a significant role. Any easing of tensions could create opportunities for Huawei.

* Security Concerns: Addressing US security concerns regarding Huawei’s technology will be crucial.

* Consumer Trust: Rebuilding trust with US consumers will be a long and arduous process, requiring Huawei to demonstrate its commitment to transparency and security.

The Future of the US Smartphone Market

The absence of Huawei has impacted the US smartphone market in several ways:

* Increased Competition: Samsung and Apple have benefited from Huawei’s absence, further solidifying their dominance in the market.

* Emergence of New Players: The void left by Huawei has opened doors for other players, such as OnePlus and Xiaomi, to gain a foothold in the US.

* Focus on Innovation: The intense competition has spurred innovation, with companies pushing the boundaries of smartphone technology.

The future of the US smartphone market is likely to be characterized by:

* Continued Innovation: The focus on innovation is expected to remain a driving force, with companies constantly introducing new features and functionalities.

* 5G Adoption: The widespread adoption of 5G technology will transform the smartphone landscape, offering faster speeds and enhanced connectivity.

* Emerging Technologies: Advancements in areas like artificial intelligence, augmented reality, and foldable displays will shape the future of smartphones.

The US smartphone market is dynamic and constantly evolving, with new players emerging and existing players adapting to changing consumer demands.

Huawei sell smartphones us carriers 2018 – The 2018 trade dispute significantly impacted Huawei’s US smartphone journey, creating a scenario where its ambitions were met with unexpected obstacles. The future of Huawei’s presence in the US market remains uncertain, with the company facing a complex and ever-evolving landscape. While Huawei continues to innovate and expand its global reach, its experience in the US serves as a reminder of the delicate balance between technological progress and geopolitical realities. The story of Huawei’s US smartphone journey is far from over, and the future holds both opportunities and challenges for this tech giant.

Remember when Huawei was all over US carrier shelves in 2018? Well, things have changed, and now you’re more likely to find them selling VR tech than smartphones. If you’re looking to get into the world of virtual reality, check out htc vive tracker bundles for some awesome options. But hey, who knows, maybe Huawei will make a comeback in the US smartphone market someday.

For now, they’re busy making waves in other tech fields.

Standi Techno News

Standi Techno News