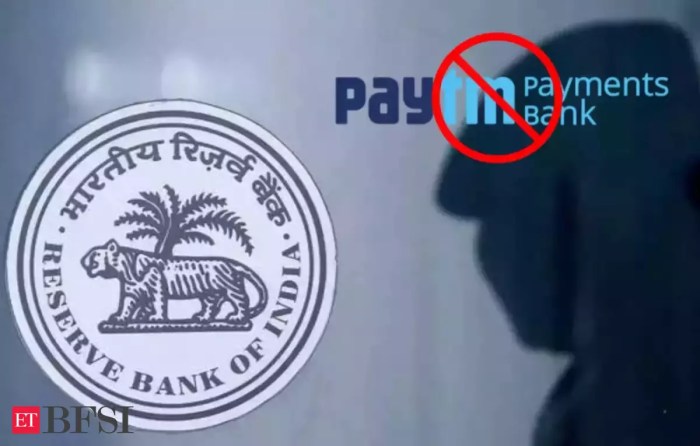

India central bank extends some paytm payments bank restrictions deadline to march 15 – India Central Bank Extends Paytm Payments Bank Deadline to March 15, giving the digital payments giant some breathing room to address concerns raised by the Reserve Bank of India (RBI). This move comes after the RBI imposed restrictions on Paytm Payments Bank in 2021, citing concerns about its compliance with regulations. The deadline extension, however, doesn’t mean the RBI is completely satisfied with Paytm’s progress. It’s a chance for the company to show that it’s taking the necessary steps to ensure its operations meet the regulatory standards.

The RBI’s initial restrictions on Paytm Payments Bank were a significant blow to the company’s growth plans. Paytm, which is known for its popular e-commerce platform and mobile wallet, had ambitious plans to expand its payments bank operations. However, the RBI’s concerns forced the company to hit the brakes and re-evaluate its strategy. The deadline extension provides Paytm with a valuable opportunity to demonstrate its commitment to regulatory compliance and to rebuild trust with the RBI.

Background of Paytm Payments Bank and RBI Restrictions

Paytm Payments Bank, a subsidiary of the popular e-commerce platform Paytm, entered the Indian financial landscape in 2017. Its launch marked a significant step towards promoting financial inclusion, offering basic banking services to a vast population, particularly those who were unbanked. However, the journey of Paytm Payments Bank has been marked by regulatory scrutiny and restrictions imposed by the Reserve Bank of India (RBI).

The RBI’s initial restrictions on Paytm Payments Bank stemmed from concerns about its operational practices and compliance with regulatory guidelines. These restrictions were aimed at ensuring the stability and integrity of the Indian financial system.

The Restrictions Imposed by the RBI

The RBI’s restrictions on Paytm Payments Bank were primarily focused on limiting its ability to onboard new customers and expand its operations. These restrictions included:

- A cap on the number of new customers Paytm Payments Bank could acquire.

- Restrictions on the types of deposits it could accept.

- Limits on the amount of money customers could hold in their accounts.

These restrictions were imposed to ensure that Paytm Payments Bank complied with the regulatory requirements for payments banks, which included maintaining a certain level of capital adequacy and liquidity. The RBI also expressed concerns about Paytm Payments Bank’s KYC (Know Your Customer) practices, which are crucial for preventing money laundering and other financial crimes.

Reasons Behind the RBI’s Initial Restrictions

The RBI’s actions were driven by a desire to protect the interests of customers and maintain the integrity of the financial system. The central bank’s concerns included:

- Paytm Payments Bank’s rapid growth and potential for systemic risk.

- Concerns about its ability to manage its risk profile effectively.

- Potential for money laundering and other financial crimes.

The RBI’s restrictions were aimed at ensuring that Paytm Payments Bank operated within a safe and sound framework, mitigating potential risks to the financial system. The central bank’s actions were also seen as a move to establish clear regulatory boundaries for the burgeoning payments bank sector in India.

The Extension of the Deadline

The Reserve Bank of India (RBI) has extended the deadline for certain restrictions imposed on Paytm Payments Bank until March 15, 2023. This extension provides Paytm Payments Bank with more time to comply with the RBI’s directives and address concerns related to its operations.

Significance of the Extension

This extension is crucial for Paytm Payments Bank, as it allows the company to continue its operations and address the concerns raised by the RBI without facing immediate penalties. It provides a much-needed window for Paytm Payments Bank to strengthen its compliance framework and ensure its operations meet the regulatory standards set by the RBI.

Potential Impact on the Indian Digital Payments Landscape

The extension of the deadline for Paytm Payments Bank could have a significant impact on the Indian digital payments landscape.

- Continued Growth of Paytm Payments Bank: The extension provides Paytm Payments Bank with a chance to continue its growth and expansion in the Indian digital payments market. This could lead to increased competition in the sector and benefit consumers with more options and choices.

- Strengthening Regulatory Oversight: The extension also highlights the RBI’s commitment to ensuring the stability and security of the Indian digital payments ecosystem. The RBI’s actions demonstrate its focus on strengthening regulatory oversight and ensuring that all payment service providers comply with its guidelines.

- Enhanced Consumer Confidence: By extending the deadline, the RBI is demonstrating its confidence in Paytm Payments Bank’s ability to address the concerns and comply with its directives. This could boost consumer confidence in Paytm Payments Bank and encourage more users to adopt its services.

Paytm Payments Bank’s Response

Paytm Payments Bank, in its official statement, welcomed the RBI’s decision to extend the deadline for addressing the regulatory concerns. The company emphasized its commitment to complying with all regulatory requirements and expressed its ongoing cooperation with the central bank.

Paytm Payments Bank’s strategy for addressing the RBI’s concerns revolves around strengthening its internal controls, enhancing risk management frameworks, and ensuring compliance with all applicable regulations. The company has been actively working to implement the necessary changes and improvements to meet the RBI’s expectations.

Potential Implications of the Extension for Paytm Payments Bank’s Future Growth

The extension of the deadline provides Paytm Payments Bank with valuable time to complete the necessary changes and demonstrate its commitment to regulatory compliance. This can be crucial for its future growth as it allows the company to focus on strengthening its operations and building trust with regulators.

However, the extension also comes with potential risks. If Paytm Payments Bank fails to address the RBI’s concerns within the extended timeframe, it could face further regulatory scrutiny or even sanctions. This could negatively impact the company’s reputation and hinder its growth prospects.

The extension offers Paytm Payments Bank a chance to demonstrate its commitment to good governance and regulatory compliance. By successfully addressing the RBI’s concerns, the company can regain the trust of regulators and pave the way for future growth. However, failure to meet the deadline could lead to further regulatory scrutiny and potentially hinder the company’s growth prospects.

Impact on the Indian Digital Payments Industry: India Central Bank Extends Some Paytm Payments Bank Restrictions Deadline To March 15

The RBI’s extension of the deadline for Paytm Payments Bank to comply with certain regulations has far-reaching implications for the burgeoning Indian digital payments industry. This decision signifies a crucial juncture, potentially influencing the trajectory of this sector and impacting other digital payment providers.

The Broader Implications of the Deadline Extension

The deadline extension provides Paytm Payments Bank with more time to address the regulatory concerns. This respite allows the company to strengthen its compliance framework, enhance its risk management systems, and improve its overall operational efficiency. The extension also offers Paytm Payments Bank the opportunity to solidify its position in the market and further its growth ambitions.

Impact on Other Digital Payment Providers

The extension of the deadline for Paytm Payments Bank has sparked a ripple effect across the Indian digital payments landscape. Other digital payment providers are closely monitoring the situation, analyzing the implications for their own operations.

- Increased Scrutiny: The RBI’s scrutiny of Paytm Payments Bank has heightened the focus on compliance and risk management practices across the digital payments sector. Other providers are likely to review their own procedures and strengthen their systems to avoid similar issues.

- Competitive Landscape: The extension provides Paytm Payments Bank with a competitive advantage, allowing it to continue its growth trajectory while other providers may face stricter scrutiny. This could lead to a more competitive landscape, with providers vying for market share and user base.

- Regulatory Landscape: The RBI’s actions underscore its commitment to ensuring a robust and secure digital payments ecosystem. This could lead to stricter regulations and greater oversight for the industry, potentially impacting the operating models of other providers.

Potential Future Trends in the Indian Digital Payments Landscape, India central bank extends some paytm payments bank restrictions deadline to march 15

The Paytm Payments Bank case highlights the dynamic and evolving nature of the Indian digital payments industry.

- Focus on Compliance: The industry is expected to prioritize compliance with regulations and enhance its risk management frameworks to maintain a strong reputation and build user trust. Providers will need to demonstrate robust security measures and transparent operations.

- Innovation and Differentiation: As competition intensifies, providers will need to focus on innovation and differentiation to attract and retain users. This could involve offering new products and services, enhancing user experience, and leveraging technology to create unique value propositions.

- Financial Inclusion: The Indian government has set ambitious goals for financial inclusion, and digital payments play a critical role in achieving these goals. Providers are expected to focus on reaching underserved populations and promoting digital financial literacy.

Regulatory Landscape and Future Prospects

The Paytm Payments Bank saga underscores the evolving regulatory landscape for digital payments in India. The Reserve Bank of India (RBI) is actively shaping this landscape to ensure financial stability and consumer protection, while also fostering innovation and growth in the digital payments sector.

The Regulatory Landscape

India’s digital payments landscape is governed by a comprehensive framework of regulations. The RBI plays a pivotal role in overseeing this sector, with its primary objective being to ensure the safety and security of digital transactions.

- Payment and Settlement Systems Act, 2007: This act provides the legal framework for payment systems in India, including digital payments.

- RBI Guidelines on Payment Banks: These guidelines Artikel the specific regulations for payment banks, which are permitted to accept deposits and offer limited banking services.

- National Payments Corporation of India (NPCI) Guidelines: The NPCI, a not-for-profit organization, operates the Unified Payments Interface (UPI), a real-time mobile payments system. Its guidelines regulate the use of UPI and other payment systems.

The RBI has been actively monitoring the digital payments sector and introducing new regulations to address emerging challenges. This includes:

- Data Security and Privacy: The RBI has implemented strict data security and privacy standards for digital payment providers, requiring them to adhere to robust data protection measures.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: The RBI has implemented stringent AML and KYC regulations to prevent money laundering and financial crimes within the digital payments ecosystem.

- Cybersecurity and Fraud Prevention: The RBI has mandated digital payment providers to implement robust cybersecurity measures and fraud detection systems to safeguard customer data and prevent fraudulent transactions.

Potential Challenges for Digital Payment Providers

While the regulatory landscape is evolving, several challenges remain for Paytm Payments Bank and other digital payment providers:

- Compliance Costs: Meeting the increasingly stringent regulatory requirements can be expensive, particularly for smaller digital payment providers.

- Competition: The digital payments market is highly competitive, with numerous players vying for market share. This can lead to price wars and pressure on margins.

- Technological Advancements: The rapid pace of technological advancements requires digital payment providers to continuously innovate and adapt to stay ahead of the curve.

- Customer Trust: Maintaining customer trust is crucial for digital payment providers, particularly in light of potential security breaches and fraud.

Impact of Regulatory Changes on the Future of Digital Payments in India

Regulatory changes are expected to have a significant impact on the future of digital payments in India.

- Increased Security and Trust: Stringent regulations are likely to enhance the security and trustworthiness of digital payment systems, encouraging greater adoption by consumers and businesses.

- Innovation and Growth: A clear regulatory framework can foster innovation and growth in the digital payments sector, attracting investment and encouraging the development of new products and services.

- Financial Inclusion: Regulations promoting financial inclusion can enable access to digital payments for underserved populations, expanding the reach of financial services.

- Competition and Consumer Choice: A competitive market with clear regulations can lead to greater consumer choice and lower costs for digital payment services.

The extension of the deadline is a positive development for Paytm Payments Bank, but it’s not a free pass. The company still needs to demonstrate its ability to meet the RBI’s requirements. Failure to do so could result in further restrictions or even the revocation of its payments bank license. The pressure is on for Paytm to prove its commitment to compliance and to ensure that its operations are safe and secure. The future of Paytm Payments Bank, and its place in the Indian digital payments landscape, will depend on how it responds to the RBI’s concerns and navigates the regulatory landscape.

The Reserve Bank of India’s extension of the Paytm Payments Bank restrictions deadline to March 15 might seem like a small victory for the company, but it highlights the growing need for automation in the financial sector. Just like sweep aims to automate basic dev tasks using large language models , the future of banking might see AI-powered systems taking over mundane tasks, leaving room for more strategic initiatives.

This could potentially help companies like Paytm navigate regulatory hurdles more efficiently and focus on innovation.

Standi Techno News

Standi Techno News