India EV Market 2024 is a dynamic landscape, characterized by rapid growth, ambitious government policies, and a burgeoning consumer interest in sustainable transportation. This burgeoning market is fueled by a confluence of factors, including rising fuel prices, environmental concerns, and a growing awareness of the benefits of electric vehicles. While the Indian EV market faces challenges like infrastructure limitations, high costs, and range anxiety, the potential for growth is immense, with the government playing a pivotal role in shaping its trajectory.

From the bustling streets of Delhi to the serene backroads of Kerala, electric vehicles are making their mark on the Indian landscape. The country’s commitment to clean energy, coupled with the growing demand for affordable and eco-friendly transportation options, has created a fertile ground for the EV market to flourish. As the EV industry continues to evolve, India is poised to become a global leader in electric mobility, showcasing a compelling blend of innovation, government support, and consumer enthusiasm.

India’s EV Market Landscape in 2024

India’s electric vehicle (EV) market is experiencing a surge in growth, driven by a combination of government initiatives, increasing consumer demand, and technological advancements. In 2024, the market is poised for continued expansion, with several key players shaping the landscape.

Key Players in India’s EV Market

The Indian EV market is characterized by a diverse range of players, including established automotive giants, emerging startups, and international companies. Some of the key players in the market include:

- Tata Motors: A leading Indian automaker, Tata Motors has a strong presence in the EV segment with its Nexon EV and Tigor EV models.

- Mahindra & Mahindra: Mahindra & Mahindra is another prominent player in the Indian EV market, offering a range of electric SUVs and commercial vehicles.

- Hyundai: The South Korean automaker Hyundai has made significant inroads into the Indian EV market with its Kona Electric and Ioniq 5 models.

- MG Motor: MG Motor, a subsidiary of SAIC Motor, has gained popularity in India with its ZS EV and Hector EV models.

- Bajaj Auto: Bajaj Auto, a leading motorcycle manufacturer, is expanding its presence in the EV space with its Chetak electric scooter.

- Ola Electric: Ola Electric, a subsidiary of ride-hailing giant Ola, has emerged as a major player in the electric two-wheeler segment with its S1 and S1 Pro scooters.

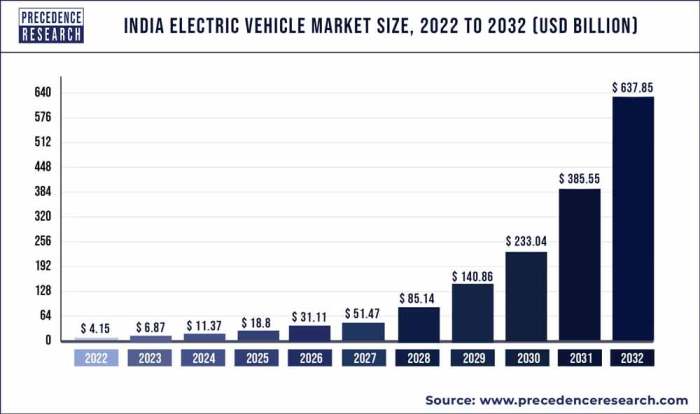

Market Size and Growth Trends

The Indian EV market is expected to witness significant growth in the coming years. According to a report by MarketsandMarkets, the Indian EV market is projected to reach USD 47.8 billion by 2027, growing at a CAGR of 49.1% during the forecast period.

- Electric Two-Wheelers: The electric two-wheeler segment is currently the largest segment of the Indian EV market, driven by factors such as affordability, ease of use, and government incentives.

- Electric Cars: The electric car segment is expected to grow rapidly in the coming years, as more models become available and charging infrastructure improves.

- Electric Buses: The electric bus segment is also experiencing significant growth, driven by government initiatives to promote public transportation and reduce emissions.

Factors Driving Growth

Several factors are driving the growth of the Indian EV market, including:

- Government Policies: The Indian government has introduced several policies to promote the adoption of EVs, such as subsidies, tax benefits, and charging infrastructure development. The Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) India scheme, launched in 2015, has played a significant role in incentivizing EV adoption. The scheme provides financial assistance to manufacturers and buyers of electric vehicles, including cars, buses, and two-wheelers.

- Consumer Demand: There is a growing awareness among Indian consumers about the benefits of EVs, such as lower running costs, reduced emissions, and a quieter driving experience. The increasing availability of affordable and stylish EV models is further driving demand.

- Technological Advancements: Advancements in battery technology, charging infrastructure, and vehicle design are making EVs more practical and appealing to consumers. The development of fast-charging technologies, which can charge EVs in a matter of minutes, is addressing the range anxiety issue.

Challenges Faced by the Indian EV Market

Despite the growth, the Indian EV market faces several challenges, including:

- Infrastructure Limitations: The lack of adequate charging infrastructure remains a major barrier to EV adoption. The number of charging stations in India is still limited, particularly in rural areas. This makes it difficult for EV owners to charge their vehicles conveniently and reliably.

- High Cost of EVs: The high cost of EVs compared to conventional vehicles is another significant challenge. While the cost of EVs is decreasing, they are still more expensive than their petrol or diesel counterparts. Government subsidies are helping to bridge the price gap, but more needs to be done to make EVs more affordable for the average Indian consumer.

- Range Anxiety: Range anxiety, the fear of running out of battery power before reaching a charging station, is a concern for many potential EV buyers. While the range of EVs has improved significantly in recent years, it is still a factor that discourages some consumers from making the switch.

Government Policies and Incentives

The Indian government has played a pivotal role in accelerating the adoption of electric vehicles (EVs) by implementing a series of supportive policies and incentives. These initiatives aim to create a conducive ecosystem for EVs, address range anxiety, and make them more affordable for consumers.

The FAME India Scheme, India ev market 2024

The Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) scheme is a flagship program launched by the Ministry of Heavy Industries and Public Enterprises in 2015. This scheme provides financial incentives to buyers of EVs, as well as to manufacturers for developing and manufacturing EVs and charging infrastructure.

The scheme has been instrumental in boosting EV adoption in India. FAME India I, launched in 2015, focused on promoting electric two-wheelers, three-wheelers, and four-wheelers. FAME India II, launched in 2019, expanded the scope to include electric buses and commercial vehicles.

Impact of FAME India on the EV Market

- Increased EV Sales: The FAME India scheme has significantly contributed to the growth of the EV market in India. The scheme provides subsidies to buyers, making EVs more affordable. This has led to a surge in demand, especially for electric two-wheelers and three-wheelers.

- Boost to Domestic Manufacturing: The scheme also incentivizes domestic manufacturers to invest in the development and production of EVs. This has led to the emergence of several Indian EV companies, contributing to job creation and technological advancements.

- Charging Infrastructure Development: FAME India has played a crucial role in promoting the development of charging infrastructure across the country. The scheme provides subsidies for setting up charging stations, making it easier for EV owners to charge their vehicles.

Other Government Initiatives

Apart from the FAME India scheme, the government has implemented various other policies and initiatives to promote EV adoption.

Tax Breaks and Subsidies

- Tax Exemptions: The government has introduced tax exemptions on the purchase of EVs. For example, the Goods and Services Tax (GST) on EVs is lower than that on conventional vehicles.

- Subsidies for Charging Infrastructure: The government provides subsidies for setting up public charging stations, including fast charging infrastructure, to address range anxiety and encourage EV adoption.

- Financial Assistance for Battery Manufacturing: The government is providing financial assistance to companies involved in the manufacturing of lithium-ion batteries, a key component of EVs. This initiative aims to boost domestic battery production and reduce dependence on imports.

Charging Infrastructure Development

- National Electric Mobility Mission Plan (NEMMP) 2020: The NEMMP aims to create a robust charging infrastructure network across India, with a focus on public charging stations and private charging solutions. The plan also includes initiatives for promoting the use of renewable energy sources for charging EVs.

- Public-Private Partnerships (PPPs): The government is encouraging PPPs for the development of charging infrastructure. This allows private companies to invest in setting up charging stations, while the government provides policy support and financial incentives.

- Smart Cities Mission: The Smart Cities Mission includes initiatives for promoting EV adoption and developing charging infrastructure in smart cities. This will help to create a more EV-friendly environment in urban areas.

EV Technology and Innovation

India’s EV market is experiencing rapid technological advancements, driving innovation across various aspects of the electric vehicle ecosystem. This section delves into the latest developments in EV technology, highlighting key areas of innovation and the role of startups and research institutions in shaping India’s EV future.

Battery Range and Charging Speed

The range and charging speed of electric vehicles are crucial factors influencing consumer adoption. Significant advancements in battery technology are improving EV range, while faster charging infrastructure is making it more convenient to refuel.

- Battery Range: Lithium-ion battery technology is continuously evolving, leading to increased energy density and improved range. Some Indian EV manufacturers are developing and deploying advanced battery packs, enabling their vehicles to travel longer distances on a single charge. For instance, Tata Motors’ Nexon EV Max boasts a range of over 437 kilometers, while Hyundai’s Kona Electric offers a range of around 450 kilometers.

- Charging Speed: The development of fast-charging technologies, such as DC fast charging, is accelerating the adoption of EVs. DC fast chargers can replenish a significant portion of an EV’s battery in a relatively short time, making it more convenient for long-distance travel. The Indian government is actively promoting the installation of fast-charging infrastructure across the country, with a focus on highways and major cities.

Battery Manufacturing

The Indian government has recognized the importance of domestic battery manufacturing for the growth of the EV sector. Several initiatives are underway to establish a robust battery manufacturing ecosystem in India.

- Government Incentives: The government is providing financial incentives and subsidies to encourage domestic battery manufacturing. The Production Linked Incentive (PLI) scheme for advanced chemistry cell (ACC) battery manufacturing aims to attract investments and boost domestic production.

- Private Investments: Private companies are also investing heavily in battery manufacturing facilities. Companies like Reliance Industries, Mahindra & Mahindra, and Ola Electric are establishing large-scale battery manufacturing plants in India.

- Research and Development: Indian research institutions and startups are actively involved in developing advanced battery technologies, focusing on improving battery performance, reducing costs, and enhancing sustainability.

Charging Infrastructure

A robust charging infrastructure is essential for widespread EV adoption. India is rapidly expanding its charging network, with both public and private players investing in charging stations.

- Public-Private Partnerships: The government is collaborating with private companies to establish charging stations across the country. This includes setting up charging infrastructure at public places, highways, and commercial buildings.

- Smart Charging Solutions: Innovative charging solutions, such as smart charging and vehicle-to-grid (V2G) technology, are being explored to optimize charging efficiency and enhance grid stability. Smart charging systems can adjust charging times based on electricity prices and grid demand, while V2G technology allows EVs to provide energy back to the grid.

Smart Mobility Solutions

India is embracing smart mobility solutions to enhance the efficiency and sustainability of its transportation system.

- Connected Vehicle Technology: Connected vehicle technology enables communication between vehicles, infrastructure, and other devices, leading to improved traffic flow, safety, and reduced congestion.

- Mobility-as-a-Service (MaaS): MaaS platforms integrate various transportation options, such as EVs, public transport, and ride-sharing services, into a single platform, providing seamless and convenient travel experiences.

Role of Startups and Research Institutions

Indian startups and research institutions are playing a pivotal role in driving innovation in the EV sector.

- Startups: Numerous startups are developing innovative solutions for the EV ecosystem, ranging from battery management systems and charging technologies to smart mobility platforms and electric vehicle design.

- Research Institutions: Indian research institutions, such as the Indian Institute of Technology (IITs) and the Council of Scientific and Industrial Research (CSIR), are conducting research on advanced battery technologies, charging infrastructure, and smart mobility solutions.

Consumer Adoption and Market Trends

The Indian EV market is experiencing a surge in consumer adoption, driven by a confluence of factors. While the initial adoption was largely driven by government incentives and environmental consciousness, several other factors are now influencing consumer decisions.

Factors Influencing Consumer Adoption

The adoption of EVs in India is influenced by a combination of factors, including price, range, charging infrastructure, and brand perception.

- Price: One of the primary barriers to EV adoption is the higher upfront cost compared to traditional gasoline-powered vehicles. While the cost of EVs has been decreasing, it remains a significant concern for many consumers. Government subsidies and incentives are playing a crucial role in making EVs more affordable, but further price reductions are needed to accelerate mass adoption.

- Range: The range of an EV, or the distance it can travel on a single charge, is a major consideration for potential buyers. Consumers are concerned about the availability of charging infrastructure and the potential inconvenience of running out of charge on long journeys. As battery technology improves and charging infrastructure expands, range anxiety is gradually diminishing.

- Charging Infrastructure: The availability of charging infrastructure is a critical factor for EV adoption. While charging infrastructure is expanding in major cities, rural areas still lack adequate facilities. The government is actively promoting the development of public and private charging stations, but more investment is needed to ensure widespread access.

- Brand Perception: Brand perception and consumer trust are important factors in the EV market. Consumers are increasingly looking for established brands with a proven track record in the automotive industry. New EV manufacturers need to build trust and establish their brand reputation to attract customers.

Types of EVs Gaining Popularity

Electric two-wheelers, cars, and buses are the most popular types of EVs in India.

- Electric Two-Wheelers: Electric two-wheelers are experiencing the highest growth in the Indian EV market. Their affordability, ease of use, and low running costs are making them attractive to a wide range of consumers, including commuters and delivery personnel. Leading players like Ola Electric, Ather Energy, and Bajaj Auto are driving this segment with innovative models and expanding charging networks.

- Electric Cars: Electric cars are gaining traction in the Indian market, particularly in major cities. Consumers are drawn to their performance, efficiency, and environmental benefits. Leading car manufacturers like Tata Motors, Hyundai, and MG Motor are offering a range of electric cars to cater to different segments of the market. The government’s focus on promoting electric cars, along with the increasing availability of charging infrastructure, is expected to further boost their adoption.

- Electric Buses: Electric buses are being increasingly adopted by state governments and private operators for public transportation. They offer significant cost savings, reduced emissions, and improved passenger comfort. Companies like JBM Auto, Ashok Leyland, and Tata Motors are leading the electric bus market, supplying buses to various cities across India. The government’s focus on electrifying public transportation is expected to drive further growth in this segment.

Emerging Trends in the Indian EV Market

The Indian EV market is characterized by several emerging trends, including the rise of electric ride-hailing services and the growing demand for commercial EVs.

- Electric Ride-Hailing Services: Electric ride-hailing services are gaining popularity in India, offering a cleaner and more sustainable alternative to traditional taxi services. Companies like Ola and Uber are increasingly incorporating electric vehicles into their fleets, driven by government incentives and consumer demand for eco-friendly transportation options.

- Commercial EVs: The demand for commercial EVs, such as electric trucks, vans, and delivery vehicles, is growing rapidly in India. Businesses are recognizing the cost savings, environmental benefits, and operational efficiency offered by electric commercial vehicles. Companies like Mahindra & Mahindra, Tata Motors, and Eicher Motors are leading the way in developing and supplying electric commercial vehicles to various industries.

Infrastructure Development: India Ev Market 2024

The growth of India’s EV market hinges on a robust charging infrastructure. While the government has taken steps to promote EV charging, significant challenges remain in building a network that can cater to the increasing number of EVs on the road.

Current State of EV Charging Infrastructure

India’s EV charging infrastructure is still in its nascent stages. As of 2023, there are approximately 1,500 public charging stations across the country, with a majority concentrated in major cities. However, this number is far from sufficient to meet the needs of a growing EV fleet. The distribution of charging stations is uneven, with limited availability in rural areas and smaller towns.

Challenges and Opportunities in Developing EV Charging Infrastructure

- Limited Investment: The development of EV charging infrastructure requires significant capital investment, which has been a major hurdle for private companies.

- Lack of Standardization: The absence of standardized charging protocols and connectors creates compatibility issues and hinders the interoperability of charging stations.

- Land Acquisition and Permitting: Obtaining land for charging stations and navigating the complex permitting process can be time-consuming and expensive.

- Grid Capacity Constraints: The existing power grid infrastructure may not be sufficient to handle the increased demand from a large number of EV charging stations.

- Safety and Security Concerns: Ensuring the safety and security of charging stations, including protection against vandalism and cyberattacks, is crucial.

Despite these challenges, there are also opportunities for developing a robust EV charging infrastructure in India:

- Government Support: The Indian government is committed to promoting EVs and has announced various policies and incentives to encourage the development of charging infrastructure.

- Private Sector Participation: Private companies are increasingly investing in EV charging infrastructure, recognizing the potential of this growing market.

- Technological Advancements: Advancements in battery technology, charging speed, and smart grid integration are paving the way for more efficient and reliable charging solutions.

- Public-Private Partnerships: Collaborative efforts between the government and private companies can leverage resources and expertise to accelerate the development of EV charging infrastructure.

Role of Private Companies and Government Agencies

Private companies play a crucial role in building and operating EV charging infrastructure. Several companies are developing charging networks across India, offering various charging options, including fast charging, AC charging, and home charging. These companies are also working on innovative solutions to improve charging infrastructure, such as smart charging technologies and mobile charging units.

Government agencies are also actively involved in promoting the development of EV charging infrastructure. The Ministry of Power has launched several initiatives to encourage the installation of charging stations, including financial incentives and simplified permitting processes. The Bureau of Energy Efficiency (BEE) has also set standards for EV charging equipment and is working to ensure interoperability between different charging stations.

Future Outlook and Projections

The Indian EV market is poised for significant growth in the coming years, driven by a confluence of factors including government support, technological advancements, and evolving consumer preferences. This section delves into the anticipated trajectory of the market, highlighting the key drivers and potential challenges that will shape its future.

Market Growth Projections

The Indian EV market is expected to experience substantial growth in the coming years, driven by a combination of government policies, technological advancements, and increasing consumer awareness. Several research firms have projected optimistic growth figures:

- Frost & Sullivan predicts that the Indian EV market will reach 10 million units by 2026.

- NITI Aayog, a government think tank, forecasts that EVs will account for 30% of all vehicle sales in India by 2030.

- The Society of Indian Automobile Manufacturers (SIAM) estimates that the EV market could reach 20 million units by 2030.

These projections suggest a robust growth trajectory for the Indian EV market, indicating a shift towards electric mobility.

Key Factors Shaping the Future of the Indian EV Market

Several key factors will play a pivotal role in shaping the future of the Indian EV market, influencing its growth and adoption:

- Technological Advancements: Ongoing advancements in battery technology, such as increased range, faster charging times, and reduced costs, will be crucial for widespread EV adoption. Advancements in electric powertrains and autonomous driving technologies will also contribute to the growth of the market.

- Government Policies and Incentives: The Indian government has implemented several policies and incentives to promote EV adoption, including subsidies, tax benefits, and infrastructure development. The continuation and strengthening of these policies will be essential for sustained market growth.

- Consumer Preferences: Growing consumer awareness of environmental concerns, rising fuel prices, and the availability of affordable EVs are driving demand for electric vehicles. The perception of EVs as a cleaner and more sustainable mode of transportation is further fueling their adoption.

- Infrastructure Development: The expansion of charging infrastructure is critical for the widespread adoption of EVs. The government is actively promoting the installation of charging stations across the country, and private players are also investing in this space.

These factors will collectively shape the future of the Indian EV market, driving its growth and influencing its trajectory.

Potential Challenges and Opportunities

While the Indian EV market presents immense potential, it also faces several challenges and opportunities:

- Cost of EVs: The initial cost of EVs remains higher compared to traditional vehicles, which can be a barrier for some consumers. Continued advancements in battery technology and economies of scale are expected to bring down prices in the future.

- Range Anxiety: The limited range of EVs compared to gasoline-powered vehicles is a concern for many consumers. The development of faster charging infrastructure and advancements in battery technology are addressing this issue.

- Lack of Awareness: There is a need to increase consumer awareness about the benefits of EVs and address misconceptions. Public awareness campaigns and educational initiatives can play a significant role in this regard.

- Limited Charging Infrastructure: The availability of charging infrastructure is crucial for widespread EV adoption. The government and private players need to accelerate the development of a robust charging network.

- Job Creation and Skill Development: The transition to electric mobility will create new job opportunities in the EV industry. The government needs to invest in skill development programs to prepare the workforce for these emerging roles.

The Indian EV market presents both challenges and opportunities, and addressing these factors will be crucial for its sustainable growth.

The Indian EV market is on a journey of transformation, navigating a complex interplay of technological advancements, government policies, and consumer preferences. The future holds immense potential for growth, but it’s crucial to address the challenges of infrastructure development, cost reduction, and range anxiety. With the right blend of innovation, investment, and strategic planning, India can truly become a global leader in the electric vehicle revolution, paving the way for a cleaner, more sustainable future for transportation.

India’s EV market is poised for explosive growth in 2024, driven by government incentives and increasing consumer demand for sustainable mobility. This surge in interest aligns with the evolving entertainment landscape, where platforms like TikTok are leveraging their massive reach to create unique experiences. In a recent move, TikTok partnered with Tickets.com tiktok partners with tickets com to sell tickets for its first live music event to manage ticket sales for its inaugural live music event, further demonstrating the potential for cross-industry collaboration and the impact of technology on consumer behavior in the EV market.

Standi Techno News

Standi Techno News