India weighs delaying caps on upi market share in win for phonepe google pay – India Delays UPI Market Share Caps: Win for PhonePe, Google Pay. This headline, while seemingly technical, actually reveals a brewing battle within India’s booming digital economy. The Unified Payments Interface (UPI), a revolutionary payment system, has become the backbone of digital transactions in India, with players like PhonePe and Google Pay dominating the scene. But concerns about market dominance have led to proposed caps on market share, raising questions about the future of this crucial system.

The proposed caps, which would limit the market share of any single UPI player, aimed to create a more level playing field for smaller players and foster competition. However, the move faced strong opposition from PhonePe and Google Pay, who argued that such caps would stifle innovation and hinder their ability to scale their services. The government, recognizing the potential impact of these caps, has now decided to delay their implementation, offering a reprieve to the dominant players and creating a window for further discussions and deliberations.

The Unified Payments Interface (UPI) has revolutionized India’s digital economy, transforming the way people make payments and transact. It is a game-changer, bringing financial inclusion to millions and making digital payments seamless and accessible.

The Significance of UPI

UPI is a real-time mobile-based payments system that allows users to transfer funds between bank accounts instantly. It is a significant development in India’s digital economy, driving financial inclusion and boosting digital transactions. The UPI ecosystem has facilitated a surge in digital payments, reducing reliance on cash and promoting financial inclusion.

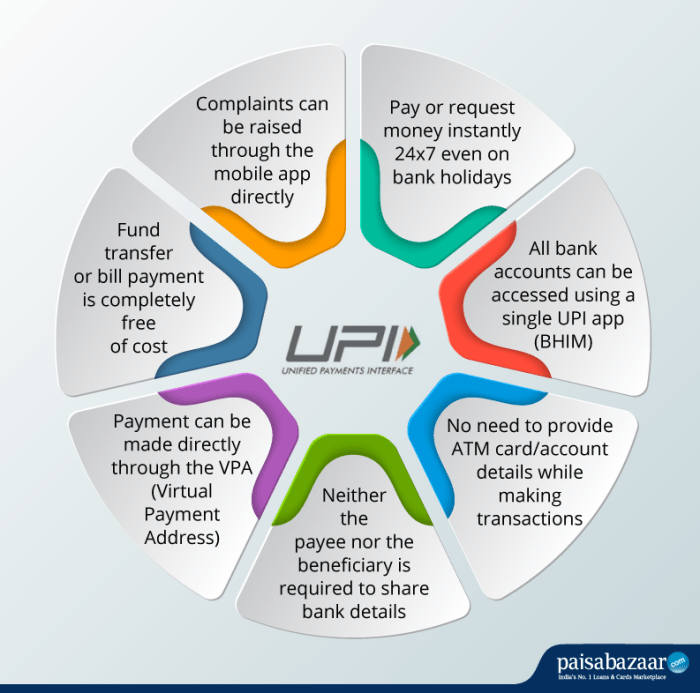

Key Features of UPI

UPI offers a range of features that have contributed to its widespread adoption. These features include:

- Real-time Payments: UPI enables instant money transfers, making it a convenient and efficient payment method.

- Virtual Payment Addresses (VPAs): UPI uses virtual payment addresses (VPAs), such as mobile numbers or email addresses, to simplify payments and make them more secure.

- Multiple Bank Accounts: Users can link multiple bank accounts to their UPI app, providing flexibility and convenience.

- Interoperability: UPI is interoperable, allowing users to send and receive money across different banks and payment apps.

- Security Features: UPI employs robust security measures, including two-factor authentication and transaction limits, to protect user funds.

Impact on Financial Inclusion

UPI has played a pivotal role in promoting financial inclusion in India. By providing a convenient and accessible payment system, UPI has empowered individuals, especially those in rural areas and underserved communities, to participate in the formal financial system.

- Increased Financial Literacy: UPI has encouraged financial literacy by familiarizing users with digital payments and financial services.

- Reduced Reliance on Cash: UPI has facilitated a shift from cash to digital payments, reducing the need for physical currency and promoting financial transparency.

- Empowering Women: UPI has empowered women by providing them with greater control over their finances and enabling them to participate in the workforce and the economy.

- Improved Access to Financial Services: UPI has enabled easier access to financial services, such as microloans and insurance, for individuals who were previously excluded.

Examples of UPI’s Impact

UPI has revolutionized payments and transactions in India, impacting various sectors and industries.

- Retail Payments: UPI has become the preferred payment method for everyday purchases, from groceries to online shopping, simplifying transactions and reducing queues.

- Peer-to-Peer Payments: UPI has made it easy for friends and family to transfer money quickly and securely, replacing traditional methods like cash or bank transfers.

- Bill Payments: UPI has simplified bill payments for utilities, mobile recharges, and other services, providing a convenient and secure alternative to traditional methods.

- Government Services: UPI has been integrated into government services, allowing citizens to pay taxes, fees, and other payments digitally, improving efficiency and transparency.

- Micro-entrepreneurs: UPI has empowered micro-entrepreneurs and small businesses by providing them with a low-cost and convenient way to accept payments from customers.

Arguments for and Against the Caps

The debate over market share caps in India’s Unified Payments Interface (UPI) ecosystem is heating up, with the government weighing the potential benefits and drawbacks of such a move. While some argue that caps are necessary to promote competition and prevent dominance by a few players, others warn of unintended consequences that could stifle innovation and hinder the growth of the digital payments landscape.

The proponents of market share caps argue that they are crucial for ensuring a level playing field and fostering a more inclusive UPI ecosystem.

- Promoting Competition: Caps can encourage existing players to innovate and improve their offerings to attract new users, while also creating space for new entrants to compete effectively. This can lead to a wider range of services and features for consumers.

- Preventing Monopoly: By limiting the market share of dominant players like PhonePe and Google Pay, caps can prevent them from gaining undue influence and potentially abusing their market position. This can safeguard the interests of smaller players and consumers.

- Enhancing Financial Inclusion: Caps can encourage players to focus on reaching underserved segments of the population, such as rural communities and low-income households, by offering tailored solutions and promoting financial literacy. This can contribute to a more inclusive financial system.

Opponents of market share caps argue that they could stifle innovation, hinder the growth of the UPI ecosystem, and ultimately harm consumers.

- Discouraging Innovation: Caps can disincentivize dominant players from investing heavily in research and development, as they face limitations on their potential market share. This could lead to slower innovation and fewer advancements in the UPI ecosystem.

- Restricting Growth: Caps can limit the ability of players to scale their operations and reach a wider audience, potentially hindering the growth of the UPI ecosystem and its ability to serve a larger user base.

- Potential for Fragmentation: Caps could lead to a fragmented UPI ecosystem with multiple players vying for market share, making it difficult for consumers to navigate and utilize different services effectively. This could create confusion and reduce the overall efficiency of the system.

The potential benefits and drawbacks of imposing market share limits in the UPI ecosystem are complex and multifaceted.

- Benefits:

- Increased competition

- Reduced market dominance

- Greater financial inclusion

- Drawbacks:

- Stifled innovation

- Restricted growth

- Potential for fragmentation

Impact on Key Players

The proposed caps on UPI market share could have a significant impact on the operations and strategies of key players like PhonePe and Google Pay, as well as other players in the ecosystem. The changes could reshape the competitive landscape, influencing innovation and market dynamics.

Impact on PhonePe and Google Pay

The caps, if implemented, would likely force PhonePe and Google Pay to adapt their strategies to maintain their dominant positions in the market.

- Focus on Value-Added Services: Both companies could shift their focus towards offering more value-added services beyond basic payments. This could include features like financial products, merchant solutions, and loyalty programs. This diversification would help them retain users even if their transaction volumes are limited by the caps.

- Expansion into New Markets: They might explore expanding into new markets beyond India, leveraging their existing technology and user base. This could help them offset potential losses in the domestic market.

- Strategic Partnerships: PhonePe and Google Pay could forge strategic partnerships with other players in the ecosystem, such as banks and fintech companies, to gain access to new user segments and expand their reach.

Impact on Other UPI Players

The proposed caps could create opportunities for smaller players in the UPI ecosystem.

- Increased Market Share: Smaller players could potentially gain market share as PhonePe and Google Pay face restrictions. This would allow them to compete more effectively and potentially attract new users.

- Focus on Niche Markets: They could specialize in niche markets, catering to specific customer segments or offering unique value propositions. This could help them differentiate themselves from larger players.

- Innovation and Differentiation: The competitive pressure from the caps could encourage smaller players to innovate and develop new features and services to attract users.

Impact on Competition and Innovation

The caps could have a mixed impact on competition and innovation within the UPI market.

- Reduced Competition: While the caps might encourage smaller players to compete, they could also stifle innovation and limit competition in the long run. The dominance of a few large players could lead to less experimentation and fewer new services.

- Increased Focus on Differentiation: The caps could force all players to focus more on differentiation and offering unique value propositions to attract and retain users. This could lead to more innovation and a wider range of services for consumers.

- Potential for Market Fragmentation: The caps could lead to market fragmentation, with different players specializing in specific segments or regions. This could result in a more diverse and fragmented UPI ecosystem.

Future of UPI and Market Regulation

The proposed caps on UPI market share have sparked a debate about the future of the ecosystem in India. While the government aims to foster a more competitive landscape, the potential impact on innovation and user experience remains a subject of discussion. Understanding the role of government regulation and its potential scenarios is crucial to navigating the evolving UPI landscape.

Government Regulation in the UPI Market

Government regulation plays a crucial role in shaping the UPI ecosystem. By setting guidelines and ensuring fair competition, the government aims to create a sustainable and inclusive market. Here are some key aspects of government regulation:

- Promoting Competition: The proposed caps are intended to prevent dominant players from gaining an unfair advantage, thereby encouraging new entrants and fostering innovation.

- Ensuring Financial Inclusion: Regulation can promote financial inclusion by ensuring that UPI services are accessible to a wider population, including those in rural areas and those with limited financial literacy.

- Protecting Consumer Interests: Regulations can address concerns about data privacy, security, and transparency, ensuring a safe and secure environment for UPI users.

The future of UPI hinges on the government’s regulatory decisions. Here are potential scenarios based on different regulatory approaches:

| Scenario | Regulatory Approach | Impact on UPI Ecosystem |

|---|---|---|

| Scenario 1: Tight Regulation | Stringent caps on market share, strict regulations on data usage and interoperability. | Increased competition, but potential for stifling innovation and slowing down the adoption of new features. |

| Scenario 2: Moderate Regulation | Balanced approach with caps on market share, but flexibility in data usage and interoperability. | Healthy competition, fostering innovation while ensuring user privacy and security. |

| Scenario 3: Minimal Regulation | Limited regulation, allowing market forces to determine the dominant players. | Potential for rapid innovation and growth, but risks of monopolies and lack of consumer protection. |

The decision to delay the UPI market share caps signals a crucial turning point in the evolution of India’s digital payments landscape. It highlights the delicate balance between promoting competition and encouraging innovation. The future of UPI hinges on finding a solution that ensures inclusivity, promotes innovation, and fosters a vibrant and competitive ecosystem. As the debate continues, the focus will be on crafting a regulatory framework that safeguards the interests of all players while ensuring the continued success of UPI as a cornerstone of India’s digital transformation.

India’s decision to delay caps on UPI market share is a win for PhonePe and Google Pay, and it’s a reminder that the fintech landscape is constantly evolving. This dynamic environment is also reflected in the growing AI scene in Latin America, where programs like y combinator latam ai are fostering innovation. The focus on UPI in India highlights the importance of local solutions and the potential for similar breakthroughs in other regions like Latin America, where AI could play a crucial role in shaping the future of finance.

Standi Techno News

Standi Techno News