Japanese bankers get robot suits to help lift stacks of money – it sounds like something out of a sci-fi movie, but it’s actually happening in real life. In a world where automation is rapidly changing the way we work, the banking industry is no exception. Japan, known for its traditional approach to banking, is embracing the future by equipping its bankers with robotic exoskeletons to handle the physically demanding task of lifting and moving heavy stacks of cash. This innovative approach is not only making the job easier for bankers but also improving efficiency and safety in the workplace.

This move highlights the increasing reliance on technology in the banking sector. Robotic exoskeletons, also known as robotic suits, are designed to augment human strength and endurance, allowing individuals to perform tasks that would otherwise be difficult or impossible. The use of these suits in banking is just one example of how technology is transforming various industries, from manufacturing to healthcare.

The Rise of Robotic Assistance in Banking

The banking industry is undergoing a significant transformation, driven by technological advancements and the need for increased efficiency. Japan, known for its technological prowess, is at the forefront of this revolution, embracing automation and robotics to streamline operations and enhance customer experience. One such innovation is the use of robotic suits for tasks like lifting heavy stacks of money, highlighting the potential of this technology to revolutionize the industry.

Robotic Exoskeletons in Banking

Robotic exoskeletons, or robotic suits, are wearable devices that augment human strength and endurance, enabling workers to perform tasks that would otherwise be physically demanding or impossible. In the banking industry, these suits can significantly enhance efficiency and safety, particularly in tasks involving the handling of heavy cash.

- Reduced Physical Strain: Lifting and carrying stacks of money can be physically demanding, leading to fatigue, injuries, and potential health issues. Robotic suits can significantly reduce the strain on workers’ bodies, allowing them to perform tasks for extended periods without fatigue.

- Improved Accuracy and Efficiency: Robotic suits can provide enhanced precision and control, reducing the risk of errors and ensuring accurate handling of cash. This can significantly improve the efficiency of tasks like counting and sorting money.

- Enhanced Safety: Heavy lifting can pose safety risks for workers, especially when dealing with large sums of money. Robotic suits can provide additional support and stability, minimizing the risk of accidents and injuries.

Applications of Robotic Exoskeletons in Other Industries

The use of robotic exoskeletons is not limited to the banking industry. They are finding applications in various sectors, demonstrating their versatility and potential to enhance human capabilities.

- Manufacturing: In manufacturing, robotic exoskeletons are used to assist workers in performing repetitive and physically demanding tasks, reducing fatigue and improving productivity. For example, they can be used to support workers in assembly lines, helping them lift heavy parts or perform precise movements.

- Construction: Construction workers often face physically demanding tasks, such as lifting heavy materials and working in awkward positions. Robotic exoskeletons can help them perform these tasks with greater ease and safety, reducing the risk of injuries.

- Healthcare: In healthcare, robotic exoskeletons are used for rehabilitation purposes, helping patients regain mobility after injuries or illnesses. They are also being explored for assisting elderly individuals with mobility challenges.

- Military: Robotic exoskeletons are used in the military to enhance soldiers’ strength and endurance, allowing them to carry heavier loads and perform tasks for extended periods.

The Japanese Banking Landscape

The Japanese banking industry has long been known for its traditional practices, including a strong emphasis on cash transactions. This has resulted in a unique landscape where cash management plays a significant role in the daily operations of banks.

Cash Handling Practices in Japanese Banks, Japanese bankers get robot suits to help lift stacks of money

Japanese banks have traditionally relied on manual methods for handling cash. This involves a meticulous process that starts with the physical collection of cash from customers and ends with its secure storage and transportation to central locations.

- Branch-Level Cash Management: Branch employees are responsible for receiving deposits, processing withdrawals, and managing the cash flow within their respective branches. This involves counting, sorting, and securing cash in vaults or designated areas.

- Centralized Cash Processing: Banks often have dedicated cash processing centers where large volumes of cash are received, sorted, and prepared for circulation. This includes tasks like currency verification, counterfeit detection, and cash reconciliation.

- Cash Transportation: Secure transportation of cash between branches and central processing centers is a crucial aspect of cash management. This often involves armored vehicles and trained security personnel to ensure the safety and integrity of cash during transit.

Challenges of Managing Large Amounts of Cash

Managing large amounts of cash in a traditional manner presents numerous challenges for Japanese banks. These challenges are compounded by the increasing volume of cash transactions in the country, driven by factors such as the popularity of cash payments and the aging population.

- Operational Efficiency: Manual cash handling is time-consuming and labor-intensive, impacting the overall efficiency of banking operations. This can lead to delays in processing transactions and higher operational costs.

- Security Risks: Handling large amounts of cash poses significant security risks. The possibility of theft, fraud, or counterfeit money necessitates robust security measures, which can be costly and complex.

- Space Constraints: Storing and managing large amounts of cash require significant physical space, which can be a challenge in urban areas with limited real estate.

Robotic Suits as a Solution

The introduction of robotic suits addresses these challenges by automating the physically demanding tasks associated with cash handling. These suits provide enhanced strength and endurance, allowing employees to lift and move heavy stacks of cash with ease.

- Increased Efficiency: Robotic suits enable faster and more efficient cash handling, reducing the time required for tasks like counting, sorting, and transporting cash.

- Reduced Labor Costs: By automating manual tasks, robotic suits reduce the need for large numbers of employees, leading to potential cost savings for banks.

- Improved Safety: Robotic suits minimize the risk of injuries to employees by reducing the physical strain associated with handling heavy loads.

- Enhanced Security: The use of robotic suits can enhance security by providing employees with additional strength and agility to handle situations that require physical intervention.

The Technology Behind the Suits

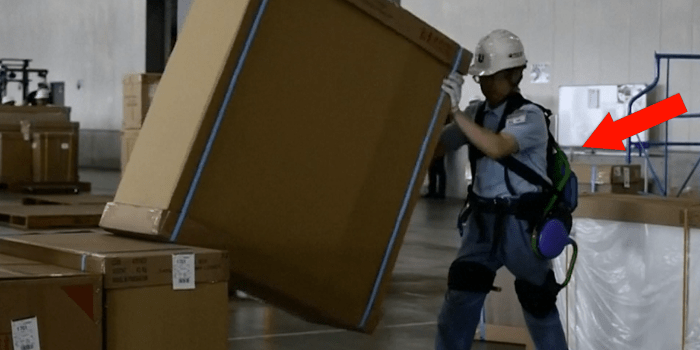

The robotic suits employed by Japanese bankers are not your typical sci-fi exoskeletons. They are more akin to sophisticated, wearable lifting devices designed to augment human strength and reduce the risk of injuries. These suits are engineered to support heavy lifting tasks, specifically those involving stacks of money, a common sight in the bustling banking world.

Suit Features and Capabilities

These suits are typically made of lightweight yet durable materials like aluminum and carbon fiber, ensuring both strength and maneuverability. They feature a combination of hydraulics, pneumatics, and sensors that work in unison to provide assistance. The suits are designed to distribute the weight of heavy objects across the user’s body, reducing strain on the back, legs, and arms.

The suits are equipped with advanced sensors that detect the user’s movements and adjust their assistance accordingly. This dynamic adaptation allows the suits to provide the optimal level of support, ensuring smooth and efficient lifting. Some suits also incorporate haptic feedback systems that provide the user with real-time information about the weight and movement of the object being lifted.

Safety Considerations and Training

While these suits offer significant advantages in terms of safety and efficiency, they are not without their safety considerations. The suits require extensive training to ensure proper operation and prevent potential accidents. Training programs typically cover aspects like:

- Understanding the suit’s controls and functionalities.

- Proper lifting techniques to avoid strain and injury.

- Emergency procedures and safety protocols.

Operators must be trained to use the suits safely and responsibly, recognizing potential hazards and taking appropriate precautions. The suits also come with safety features such as emergency stop buttons and sensors that detect potential overloads, ensuring the user’s well-being.

Cost and Efficiency

The cost of robotic suits varies depending on the specific features and capabilities. While the initial investment can be substantial, the long-term benefits can outweigh the cost. The suits can significantly improve efficiency by allowing employees to lift heavier loads and work for longer periods without fatigue.

“The use of robotic suits has been shown to reduce workplace injuries by up to 50% and increase productivity by 20% in certain industries.” – [Source: Industry Research Report]

Furthermore, the suits can reduce the need for manual labor, freeing up employees to focus on more complex tasks. This shift towards automation can lead to significant cost savings in the long run, as it reduces the need for additional personnel and overtime hours.

The Impact on Bankers and Customers: Japanese Bankers Get Robot Suits To Help Lift Stacks Of Money

The introduction of robotic suits into the banking industry promises a significant shift in the way banks operate, affecting both bankers and customers. These suits, designed to assist with physically demanding tasks, could lead to a transformation in the workload and working conditions of bankers, while also potentially influencing customer experience and perception of the banking sector.

The Impact on Bankers

The introduction of robotic suits could significantly impact the workload and working conditions of bankers.

- Reduced Physical Strain: Robotic suits would alleviate the physical strain associated with tasks such as lifting heavy stacks of cash, reducing the risk of injuries and improving overall worker well-being. This could lead to a decrease in work-related injuries and potentially improve employee retention rates.

- Increased Efficiency: The suits could enhance the efficiency of bankers by allowing them to handle larger volumes of cash more quickly and accurately. This could lead to faster processing times for transactions and potentially increase productivity in banking operations.

- Potential for New Roles: The introduction of robotic suits could create new roles for bankers, focusing on tasks such as programming and monitoring the suits, or managing the integration of this technology into existing workflows. This could open up opportunities for skill development and career advancement within the banking sector.

The Impact on Customers

The use of robotic suits in banking could lead to a more efficient and potentially more engaging customer experience.

- Faster Transaction Times: The increased efficiency brought about by robotic suits could lead to faster transaction times, making banking services more convenient for customers. This could potentially lead to increased customer satisfaction and loyalty.

- Enhanced Security: The use of robotic suits could enhance security measures in banks by providing an additional layer of protection against potential threats. This could lead to a greater sense of security for customers and potentially reduce the risk of theft or fraud.

- Unique Customer Experience: The novelty of seeing robotic suits in action could create a unique and memorable customer experience. This could potentially enhance brand image and create a positive association with the bank.

Ethical Considerations

The introduction of robotic suits into the banking industry raises several ethical considerations.

- Job Displacement: The potential for increased efficiency through robotic suits raises concerns about job displacement. It is crucial to consider the potential impact on the workforce and ensure that appropriate retraining and support programs are in place for affected employees.

- Privacy and Data Security: The use of robotic suits in banking could raise concerns about privacy and data security. It is important to ensure that data collected by the suits is handled securely and in accordance with relevant privacy regulations.

- Social Implications: The widespread adoption of robotic suits in banking could have significant social implications. It is important to consider the potential impact on the human element of banking and ensure that technology is implemented in a way that does not dehumanize the customer experience.

The Future of Robotic Assistance in Banking

The introduction of robotic suits in the banking industry is a significant step towards automation and efficiency. While currently used for lifting heavy stacks of money, the potential for robotic assistance in banking extends far beyond this initial application. As technology continues to advance, robotic suits are likely to evolve and find new applications in various aspects of the banking sector.

Future Developments and Applications

The future of robotic suits in banking holds exciting possibilities. Advancements in artificial intelligence (AI), sensor technology, and human-machine interfaces will enable the development of more sophisticated and versatile suits. These suits could be equipped with AI algorithms that analyze data, predict trends, and provide real-time insights to bankers.

- Enhanced Security: Robotic suits could be integrated with security systems, allowing them to monitor and patrol bank premises, detect suspicious activity, and even intervene in emergencies. For example, a suit equipped with facial recognition technology could be used to verify the identity of customers and employees, reducing the risk of fraud and unauthorized access.

- Improved Customer Service: Robotic suits could be used to provide personalized customer service. Equipped with natural language processing capabilities, these suits could interact with customers, answer their questions, and assist them with transactions. This could lead to faster and more efficient customer service, improving overall customer satisfaction.

- Data Analysis and Insights: Robotic suits could be used to collect and analyze data from various sources within the banking industry. This data could be used to identify trends, predict market movements, and make informed decisions. For instance, a suit equipped with sensors could monitor customer behavior and spending patterns, providing valuable insights into market trends and customer preferences.

The adoption of robotic suits in Japanese banks represents a significant shift in the way we think about work and technology. While some may view this as a sign of the future, others may wonder about the potential impact on jobs and the human element in banking. However, the use of robotic suits in this context is not about replacing human workers but rather enhancing their capabilities and creating a safer and more efficient work environment. As technology continues to advance, it will be interesting to see how robotic assistance evolves and its role in shaping the future of the banking industry.

While Japanese bankers are getting robot suits to help them lift stacks of money, it seems like the tech world is shifting gears. Nvidia, a company known for its powerful GPUs, has announced they’re winding down development of their LTE modems , focusing on other areas like AI and autonomous vehicles. Maybe those robot suits will be the next big thing for the banking industry, who knows?

Standi Techno News

Standi Techno News