Kapital 165m fintech latin america small business – Kapital’s $165M fintech investment in Latin America sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This investment is not just about financial gains; it’s about fueling the growth of an entire ecosystem. Kapital’s focus on specific areas of fintech, like payments, lending, and financial management, is strategically designed to empower Latin American small businesses. These companies are the backbone of the region’s economy, and Kapital’s investment is poised to unlock their potential by providing them with the tools and resources they need to thrive.

The Latin American fintech landscape is booming, with innovation driving the development of new solutions that cater to the specific needs of the region. Fintech companies are tackling challenges like financial exclusion, limited access to credit, and outdated banking infrastructure. By bridging the gap between traditional financial services and the needs of small businesses, these companies are creating a more inclusive and equitable financial system.

Kapital’s Investment

Kapital’s $165 million investment in Latin American fintech is a significant move that highlights the growing potential of the region’s financial technology sector. This investment signals a strong belief in the future of fintech in Latin America and its ability to drive financial inclusion and innovation.

Kapital’s investment aims to support the development of a robust and accessible financial ecosystem in Latin America.

Focus Areas

Kapital’s investment focuses on specific areas of fintech that address key challenges in the region. These areas include:

* Financial Inclusion: Kapital invests in companies that provide financial services to underserved populations, such as micro, small, and medium-sized enterprises (MSMEs) and individuals without access to traditional banking.

* Digital Payments: The investment supports companies developing innovative digital payment solutions that cater to the growing demand for convenient and secure payment methods in Latin America.

* Lending: Kapital focuses on fintech companies that offer alternative lending solutions, providing access to credit for individuals and businesses that may not qualify for traditional loans.

* Insurtech: The investment supports companies that are transforming the insurance industry in Latin America through technology-driven solutions, improving efficiency and accessibility.

Contribution to Growth

Kapital’s investment plays a crucial role in fostering the growth of the Latin American fintech ecosystem by:

* Providing Funding: The investment provides much-needed capital for fintech startups and companies to scale their operations, develop new products, and expand their reach.

* Supporting Innovation: Kapital’s investment encourages innovation by supporting companies that are developing cutting-edge financial technologies.

* Creating Jobs: The growth of the fintech sector driven by Kapital’s investment creates new jobs and opportunities for skilled professionals in the region.

* Promoting Financial Inclusion: Kapital’s investment in fintech companies that focus on financial inclusion empowers underserved populations with access to essential financial services.

The Latin American Fintech Landscape

Latin America is experiencing a fintech boom, with a rapidly growing number of startups and established companies disrupting traditional financial services. The region’s unique demographics, economic conditions, and technological advancements are driving this surge, creating a dynamic and exciting ecosystem for fintech innovation.

Key Trends Shaping the Fintech Landscape

The Latin American fintech landscape is characterized by several key trends that are shaping its growth and evolution.

- Mobile-first approach: With high mobile penetration and a large unbanked population, Latin American fintech companies are focusing on developing mobile-first solutions to provide financial services to a wider audience. This includes mobile banking, payments, and lending platforms designed for smartphone users.

- Focus on financial inclusion: Fintech companies are playing a crucial role in promoting financial inclusion by providing access to financial services for underserved populations. This includes offering microloans, microinsurance, and other products tailored to the needs of low-income individuals and small businesses.

- Rise of open banking: Open banking initiatives are gaining traction in Latin America, enabling consumers to share their financial data with third-party applications. This is fostering innovation and competition in the financial services sector, leading to the development of new and personalized financial products and services.

- Regulatory support: Governments in Latin America are increasingly supportive of fintech innovation. Many countries have introduced regulatory frameworks to encourage the development of fintech companies and promote financial inclusion.

- Investment surge: Fintech startups in Latin America are attracting significant investments from venture capitalists and other investors. This influx of capital is fueling the growth of the fintech sector and supporting the development of new technologies and solutions.

Challenges Faced by Fintech Companies

Despite the promising outlook, fintech companies in Latin America face several challenges.

- Limited access to funding: While investment in Latin American fintech is increasing, access to funding remains a significant hurdle for many startups. This can limit their ability to scale their operations and compete with established players.

- Regulatory uncertainty: While some governments are supportive of fintech, regulatory frameworks can be complex and evolving. This can create uncertainty for fintech companies and hinder their growth.

- Competition from traditional players: Traditional financial institutions are increasingly adopting digital technologies and launching their own fintech solutions. This creates intense competition for fintech startups.

- Lack of financial literacy: A significant portion of the population in Latin America lacks financial literacy, which can make it challenging for fintech companies to reach and educate their target audience.

Opportunities for Fintech Companies

The Latin American fintech landscape presents numerous opportunities for companies to thrive.

- Large unbanked population: Latin America has a large unbanked population, representing a significant market opportunity for fintech companies to provide financial services to underserved individuals and businesses.

- Growing middle class: The region’s growing middle class is driving demand for new and innovative financial products and services.

- Technological advancements: Latin America is rapidly adopting new technologies, creating a favorable environment for fintech innovation.

- Government support: Governments in Latin America are increasingly supportive of fintech innovation, creating a favorable regulatory environment for fintech companies to operate and grow.

Small Businesses in Latin America

Small businesses are the backbone of Latin American economies, contributing significantly to job creation, economic growth, and innovation. However, they face unique challenges that hinder their growth and prosperity. These challenges include limited access to financing, complex regulatory environments, and a lack of digital infrastructure.

Fintech Solutions for Small Businesses

Fintech solutions are emerging as a powerful force to address the specific needs and challenges of small businesses in Latin America. These solutions leverage technology to provide innovative and efficient financial services, enabling businesses to access capital, manage finances, and expand their operations.

- Access to Finance: Fintech companies are providing alternative lending options, such as peer-to-peer lending and crowdfunding platforms, which offer faster and more flexible financing solutions for small businesses that may not qualify for traditional bank loans.

- Payment Processing: Fintech solutions are streamlining payment processing for small businesses, enabling them to accept various payment methods, including mobile wallets, online payments, and contactless transactions. This simplifies transactions and improves customer experience.

- Financial Management: Fintech platforms are providing intuitive and user-friendly tools for small businesses to manage their finances, track expenses, generate reports, and make informed decisions. These tools empower businesses to gain better control over their finances and optimize their operations.

- Digital Marketing and Sales: Fintech companies are offering solutions that help small businesses leverage digital channels for marketing and sales, reaching a wider customer base and enhancing their online presence. This includes tools for social media marketing, online advertising, and e-commerce integration.

Examples of Fintech Companies Serving Small Businesses

Several fintech companies are making a significant impact on the Latin American small business landscape. These companies are developing innovative solutions that address specific needs and challenges, empowering businesses to grow and thrive.

- Konfío (Mexico): Konfío is an online lending platform that provides small businesses with access to working capital loans, leveraging data analytics to assess creditworthiness and offer personalized financing options.

- Stash (Brazil): Stash offers a mobile-first platform that enables small businesses to manage their finances, receive payments, and access financial products, providing a comprehensive financial solution for entrepreneurs.

- Clip (Mexico): Clip provides a mobile point-of-sale (POS) system that allows small businesses to accept card payments, manage inventory, and track sales, simplifying operations and improving customer service.

Kapital’s Impact on Small Businesses

Kapital’s $165 million investment in Latin American fintech is poised to have a significant impact on small businesses in the region, providing them with access to much-needed financial resources and tools to thrive. This injection of capital is expected to fuel innovation and growth, ultimately contributing to the economic development of Latin America.

The Benefits of Kapital’s Investment

Kapital’s investment is expected to benefit small businesses in Latin America in several ways.

- Increased Access to Funding: Kapital’s investment will help fintech companies in Latin America expand their lending operations, making it easier for small businesses to secure loans and other forms of financing. This will be particularly beneficial for businesses that have traditionally struggled to obtain loans from traditional banks due to a lack of credit history or collateral.

- Improved Financial Services: Kapital’s investment will also support the development of innovative financial products and services tailored to the needs of small businesses. This could include solutions for managing cash flow, automating payments, and accessing digital banking services.

- Enhanced Financial Inclusion: Kapital’s investment will contribute to financial inclusion by providing access to financial services for previously underserved populations, including women and entrepreneurs in rural areas. This will empower small businesses to participate more fully in the economy and contribute to economic growth.

Fostering Innovation and Growth

Kapital’s investment will not only provide financial resources but also support the development of innovative solutions that can help small businesses grow and thrive.

- Technology Adoption: Kapital’s investment will encourage fintech companies to develop and implement cutting-edge technologies that can help small businesses streamline operations, improve efficiency, and reach new markets. This could include solutions for online payments, inventory management, and customer relationship management (CRM).

- Business Development Support: Kapital’s investment will also support the development of business development programs and resources for small businesses. This could include training programs, mentorship opportunities, and access to networks of investors and industry experts.

- Data-Driven Decision Making: Kapital’s investment will encourage fintech companies to leverage data analytics to provide small businesses with insights that can help them make better decisions about their operations, marketing, and growth strategies.

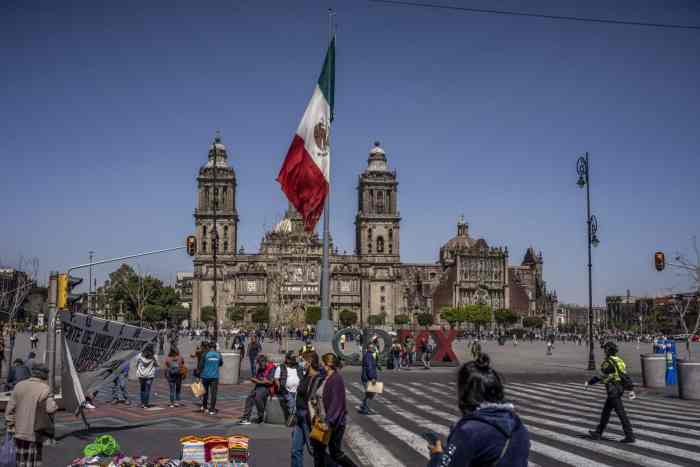

A Hypothetical Scenario

Imagine a small clothing boutique in Mexico City that has been struggling to expand its business due to limited access to financing. With Kapital’s investment, a local fintech company could offer the boutique a loan with flexible terms and competitive interest rates. This loan would allow the boutique to invest in new inventory, hire additional staff, and open a second location. The fintech company could also provide the boutique with access to digital payment solutions, helping them reach a wider customer base online. Through these resources, the boutique could significantly grow its business, creating jobs and contributing to the local economy.

The Future of Fintech in Latin America: Kapital 165m Fintech Latin America Small Business

Kapital’s investment in the Latin American fintech sector signifies a pivotal moment, poised to reshape the financial landscape of the region. The infusion of capital will empower startups and established players to innovate and expand, accelerating the adoption of financial technology and driving financial inclusion for millions.

The Impact of Kapital’s Investment

Kapital’s investment will catalyze growth within the Latin American fintech sector, fostering innovation and competition. This influx of capital will enable fintech companies to:

- Develop cutting-edge technologies: Fintech companies can leverage the investment to develop advanced technologies like artificial intelligence (AI), machine learning, and blockchain, creating more efficient and personalized financial services.

- Expand their reach: The investment will enable fintech companies to expand their geographic reach, bringing financial services to underserved populations in rural areas and remote communities.

- Enhance customer experience: Fintech companies can use the investment to improve their user interfaces, streamline processes, and offer a more seamless and intuitive customer experience.

Emerging Trends and Technologies

The Latin American fintech landscape is characterized by rapid innovation and the emergence of new technologies. Some of the key trends shaping the future of fintech in the region include:

- Open banking: Open banking allows consumers to share their financial data with third-party applications, leading to the development of innovative financial products and services. In Brazil, for instance, the open banking framework has spurred the creation of new fintech solutions for personal finance management, credit scoring, and investment.

- Mobile payments: Mobile payments are becoming increasingly popular in Latin America, driven by the high smartphone penetration and the desire for convenient and secure payment methods. In Mexico, the adoption of mobile wallets like Mercado Pago has significantly reduced the reliance on cash transactions.

- Financial inclusion: Fintech companies are playing a crucial role in promoting financial inclusion by providing access to financial services for underserved populations, including those in rural areas and those who lack traditional banking access. In Colombia, fintech platforms like “RappiPay” have enabled individuals without bank accounts to make and receive payments, contributing to a more inclusive financial system.

Key Factors for Continued Growth, Kapital 165m fintech latin america small business

Several factors will contribute to the continued growth of the Latin American fintech market:

- Growing middle class: The expanding middle class in Latin America is driving demand for financial services, creating opportunities for fintech companies to cater to their needs. This trend is particularly evident in countries like Chile and Peru, where the middle class is growing rapidly.

- Favorable regulatory environment: Governments in Latin America are increasingly supportive of fintech innovation, creating a conducive environment for startups and established players. For example, Mexico’s regulatory framework for fintech companies has facilitated the entry of new players and fostered competition in the financial services market.

- Technological infrastructure: The development of robust internet and mobile infrastructure is enabling the widespread adoption of fintech solutions. In Brazil, the expansion of broadband internet access has facilitated the growth of digital banking and online payment platforms.

Kapital’s investment is a testament to the immense potential of the Latin American fintech market. This strategic move not only empowers small businesses but also sets the stage for a future where financial innovation thrives. As the fintech landscape continues to evolve, we can expect to see even more cutting-edge solutions emerge, further enhancing the financial lives of individuals and businesses across Latin America.

Kapital, a fintech company focused on empowering small businesses in Latin America, recently secured a $165 million investment. This news comes at a time when the music industry is experiencing its own shakeup, with Taylor Swift’s music returning to TikTok despite ongoing disputes between the platform and Universal Music Group. Both situations highlight the evolving landscape of digital platforms and their impact on various sectors, including finance and entertainment.

Standi Techno News

Standi Techno News