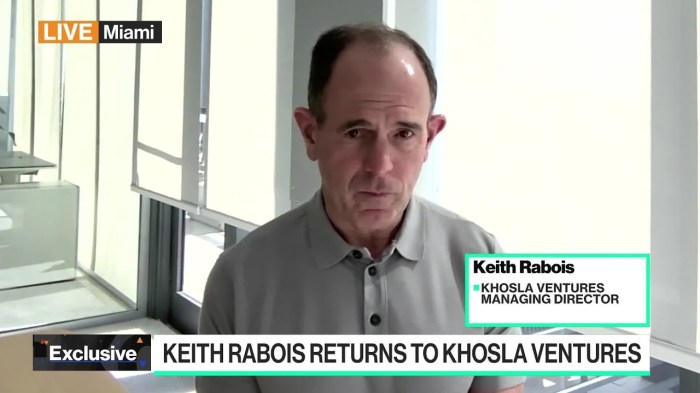

Keith Rabois dishes on his surprising return to Khosla Ventures after leaving the firm in 2019 for Founders Fund, a move that has sent ripples through the tech investment world. Rabois, a prominent figure in Silicon Valley, is known for his successful stints at companies like PayPal and Square, and his departure from Khosla Ventures in 2019 was seen as a significant shift in the landscape of venture capital. So, what brought him back?

The reasons behind Rabois’s return are complex and multifaceted. Some speculate that his time at Founders Fund, a firm known for its focus on early-stage startups, may have led him to reassess his priorities. Others believe that the unique investment strategy and culture of Khosla Ventures, which emphasizes long-term bets on disruptive technologies, may have proven too tempting to resist.

Keith Rabois’s Journey

Keith Rabois is a prominent figure in the tech industry, known for his entrepreneurial spirit and impactful roles in various companies. His journey is marked by a combination of successes and challenges, showcasing his adaptability and strategic thinking.

Keith Rabois’s Career Highlights, Keith rabois dishes on his surprising return to khosla ventures after leaving the firm in 2019 for founders fund

Rabois’s career spans over two decades, starting with his early roles at companies like PayPal and LinkedIn. He played a crucial role in the development of these platforms, contributing to their growth and success.

- PayPal: As one of the early employees at PayPal, Rabois played a significant role in shaping the company’s strategy and operations. He held various positions, including Vice President of Operations and Chief Operating Officer.

- LinkedIn: After PayPal, Rabois joined LinkedIn as Vice President of Product Management, contributing to the development of the platform’s core features. He played a key role in establishing LinkedIn as a leading professional networking platform.

- Khosla Ventures: In 2010, Rabois joined Khosla Ventures, a venture capital firm known for its investments in promising startups. He was a partner at the firm, focusing on identifying and investing in innovative companies across various sectors.

- Founders Fund: In 2019, Rabois left Khosla Ventures to join Founders Fund, another prominent venture capital firm known for its investments in companies like SpaceX and Airbnb. He was a partner at the firm, continuing his work in supporting and guiding early-stage startups.

Rabois’s Departure from Khosla Ventures

Rabois’s decision to leave Khosla Ventures in 2019 was driven by his desire to pursue new opportunities and expand his reach in the venture capital landscape.

- Seeking New Challenges: Rabois sought new challenges and opportunities to leverage his experience and expertise in a broader context. Founders Fund provided him with a platform to invest in a wider range of companies and industries.

- Expanding Network: Joining Founders Fund allowed Rabois to expand his network and connect with a broader range of entrepreneurs and investors. This move provided him with access to a larger pool of promising startups and opportunities.

The Surprising Return

Keith Rabois’s return to Khosla Ventures in 2023 after leaving the firm in 2019 for Founders Fund came as a surprise to many in the tech industry. His departure from Khosla Ventures was seen as a significant move, as he had been a key player in the firm’s success. The reasons behind his return are complex and multifaceted.

Factors Influencing Rabois’s Return

Rabois’s return to Khosla Ventures can be attributed to several factors, including:

- Shifting Priorities: After a few years at Founders Fund, Rabois may have realized that his priorities had changed. He may have been seeking a more hands-on role in investing, something that Khosla Ventures offered. Founders Fund, known for its large-scale bets, may have been less aligned with Rabois’s evolving interests.

- Strong Relationship with Khosla: Rabois’s relationship with Vinod Khosla, the founder of Khosla Ventures, is known to be strong. The mutual respect and understanding between the two may have played a role in Rabois’s decision to return. Khosla Ventures, with its focus on early-stage investments and a hands-on approach, might have been more appealing to Rabois.

- Evolution of Khosla Ventures: Khosla Ventures has evolved significantly since Rabois’s departure. The firm has expanded its investment focus and broadened its reach. Rabois may have been drawn back by the firm’s new direction and its potential for growth.

Rabois’s Impact on Khosla Ventures

Rabois’s return to Khosla Ventures brings a wealth of experience and expertise that could significantly benefit the firm. His previous tenure, combined with his recent experiences at Founders Fund, provides him with a unique perspective on the evolving venture capital landscape.

Rabois’s Expertise and Experience

Rabois’s diverse background encompasses various roles, including entrepreneur, investor, and operator. He co-founded and led multiple successful companies, including Slide, Opendoor, and OpenAI, demonstrating his ability to identify and nurture promising startups. His experience as an operator provides him with invaluable insights into the challenges and opportunities faced by early-stage companies. Additionally, his time at Founders Fund exposed him to a wide range of investment strategies and market trends, further enriching his understanding of the venture capital ecosystem.

Potential Areas of Contribution

Rabois’s expertise and experience could be particularly valuable in several areas:

Identifying Emerging Trends

Rabois’s keen eye for emerging trends, honed through his involvement in various cutting-edge companies, can help Khosla Ventures identify promising investment opportunities in nascent industries. His experience in fields like artificial intelligence, real estate technology, and consumer technology positions him to recognize disruptive technologies and businesses with high growth potential.

Building and Scaling Companies

Rabois’s operational experience allows him to provide valuable guidance to portfolio companies on building and scaling their businesses. His understanding of product development, go-to-market strategies, and team building can help startups navigate the complexities of growth and expansion.

Strategic Partnerships

Rabois’s extensive network of connections in the technology industry can facilitate strategic partnerships for Khosla Ventures’ portfolio companies. He can leverage his relationships to open doors to potential collaborators, customers, and investors, accelerating the growth of startups.

Potential Challenges and Conflicts

While Rabois’s return presents significant opportunities, there are also potential challenges and conflicts to consider:

Potential Conflicts of Interest

Rabois’s past investments and involvement in other companies could create potential conflicts of interest. Khosla Ventures must ensure that his activities do not compromise the firm’s fiduciary responsibilities to its investors and portfolio companies.

Integration with Existing Team

Rabois’s return might necessitate adjustments to Khosla Ventures’ existing team structure and dynamics. Ensuring seamless integration and collaboration between Rabois and existing partners will be crucial for the firm’s success.

Differing Investment Philosophies

Rabois’s investment philosophy and approach may differ from those of Khosla Ventures’ existing partners. Finding common ground and aligning investment strategies will be essential for a successful partnership.

The Future of Khosla Ventures with Rabois: Keith Rabois Dishes On His Surprising Return To Khosla Ventures After Leaving The Firm In 2019 For Founders Fund

Keith Rabois’s return to Khosla Ventures after a four-year stint at Founders Fund has sparked significant curiosity about the firm’s future trajectory. Rabois’s experience and network, coupled with his entrepreneurial spirit, could reshape the firm’s investment strategy and portfolio composition.

The Potential Impact on Investment Strategy

Rabois’s return could significantly influence Khosla Ventures’ investment strategy. He brings a deep understanding of the tech landscape, particularly in areas like fintech, artificial intelligence, and consumer technology. This expertise could lead the firm to explore new investment opportunities in these rapidly evolving sectors.

- Rabois’s focus on early-stage startups, as evident during his time at Founders Fund, could lead Khosla Ventures to invest in more seed and Series A rounds. This shift could enhance the firm’s ability to identify and back disruptive technologies at their nascent stages.

- His strong network within Silicon Valley could also provide Khosla Ventures with access to promising startups that might not be readily apparent to other investors. This could give the firm a competitive edge in identifying future unicorns.

The Influence on Portfolio Composition

Rabois’s presence could influence the composition of Khosla Ventures’ portfolio. His expertise in areas like fintech and artificial intelligence could lead the firm to invest in more startups in these sectors. This could result in a more diversified portfolio, potentially mitigating risk and maximizing returns.

- Rabois’s understanding of consumer technology could also lead Khosla Ventures to invest in startups developing innovative consumer products and services. This could diversify the firm’s portfolio beyond traditional tech investments, potentially attracting a broader range of investors.

- Furthermore, Rabois’s strong track record of building and scaling successful companies could guide Khosla Ventures towards startups with high growth potential. This could result in a portfolio of companies with a higher likelihood of achieving significant exits.

The Potential Impact on Overall Performance

Rabois’s return could potentially enhance Khosla Ventures’ overall performance. His experience, network, and expertise could lead to better investment decisions, resulting in higher returns for the firm’s investors.

- Rabois’s ability to identify promising startups and navigate the complex world of venture capital could lead to a more successful portfolio. This could translate into higher returns for investors, potentially making Khosla Ventures a more attractive investment destination.

- Rabois’s entrepreneurial spirit and passion for innovation could also inspire the firm’s investment team, leading to a more dynamic and successful investment strategy. This could result in Khosla Ventures becoming a leader in the venture capital space.

Rabois’s return to Khosla Ventures marks a significant moment for both the firm and the broader tech investment landscape. His expertise and experience in building successful companies will undoubtedly be invaluable to Khosla Ventures, and his presence is likely to reshape the firm’s investment strategy. This move also highlights the evolving dynamics of venture capital, where talent and expertise are constantly in flux, and the lines between firms are becoming increasingly blurred. As Rabois embarks on this new chapter, it will be fascinating to see how his influence will shape the future of Khosla Ventures and the tech world at large.

Keith Rabois’ return to Khosla Ventures after his stint at Founders Fund is a story of a seasoned investor going back to his roots. This move comes at a time when the tech industry is abuzz with the AMD accusing NVIDIA of sabotaging their performance on The Witcher 3 — a drama that’s shaking up the graphics card market.

Rabois’ insights, honed through his experience at both firms, could prove invaluable as Khosla Ventures navigates this evolving landscape.

Standi Techno News

Standi Techno News