Kinterra Capitals debut 565m fund to support mining for battery metals takes center stage, marking a significant shift in the landscape of battery metal exploration and development. As the world transitions towards a cleaner, more sustainable future, the demand for critical battery metals like lithium, nickel, and cobalt is skyrocketing. This fund, a testament to the growing investment appetite in this sector, aims to accelerate the mining of these essential resources, ensuring a steady supply to meet the burgeoning needs of the electric vehicle (EV) industry.

The fund’s investment strategy is meticulously crafted, focusing on projects that adhere to stringent environmental and social standards. Kinterra Capitals recognizes the importance of responsible mining practices, ensuring that the pursuit of battery metal extraction aligns with sustainability principles. This commitment to ethical sourcing is crucial in addressing concerns surrounding the environmental and social impacts of mining activities.

Battery Metals: Kinterra Capitals Debut 565m Fund To Support Mining For Battery Metals

The transition to electric vehicles (EVs) is a pivotal step in addressing climate change and reducing our reliance on fossil fuels. At the heart of this transition lie battery metals, crucial components that power the EV revolution. These metals are essential for the production of EV batteries, which store energy and enable EVs to operate.

Critical Battery Metals and Their Roles in EV Technology, Kinterra capitals debut 565m fund to support mining for battery metals

Battery metals are a diverse group, each playing a distinct role in EV battery technology. Here are some of the most critical battery metals and their functions:

- Lithium: Lithium is a lightweight and highly reactive alkali metal that serves as the anode material in most EV batteries. It is responsible for storing and releasing energy during charging and discharging.

- Nickel: Nickel is a transition metal that enhances the energy density and lifespan of EV batteries. It is often combined with lithium and cobalt to create cathode materials.

- Cobalt: Cobalt is a transition metal known for its high electrical conductivity and stability. It is a key component in the cathode materials of many EV batteries, improving their performance and durability.

- Manganese: Manganese is a transition metal that acts as a stabilizing agent in cathode materials. It contributes to the battery’s safety and overall performance.

- Graphite: Graphite is a form of carbon that is used as the anode material in many EV batteries. It has excellent electrical conductivity and is relatively inexpensive.

Supply and Demand Dynamics of Battery Metals

The demand for battery metals is expected to soar in the coming years, driven by the rapid growth of the EV market. This surge in demand poses significant challenges for the supply chain, as the current production levels may not be sufficient to meet the projected needs.

- Lithium: The demand for lithium is expected to grow exponentially, with estimates suggesting a tenfold increase by 2035. This projected growth is primarily driven by the increasing demand for EV batteries. However, the supply of lithium is concentrated in a few countries, including Australia, Chile, and China, creating concerns about potential supply chain disruptions.

- Nickel: The demand for nickel is also expected to increase significantly, driven by its use in EV batteries. While nickel reserves are relatively abundant, the production of high-quality nickel suitable for EV batteries is limited. This has led to concerns about potential price volatility and supply shortages.

- Cobalt: The demand for cobalt is projected to rise due to its use in EV batteries, but the supply of cobalt is concentrated in the Democratic Republic of Congo, which has raised ethical concerns about mining practices and human rights.

Sources of Battery Metals

Securing a sustainable supply of battery metals is crucial for the success of the EV transition. Various sources are being explored to meet the growing demand, including:

- Primary Mining: Primary mining involves extracting battery metals from ore deposits. This is currently the dominant source of battery metals, but it has environmental and social impacts.

- Recycling: Recycling EV batteries is a critical strategy for reducing reliance on primary mining. It involves recovering valuable metals from end-of-life batteries. The recycling rate for EV batteries is currently low, but it is expected to improve as technologies and infrastructure develop.

- Alternative Extraction Methods: Researchers are exploring alternative extraction methods, such as deep-sea mining and hydrometallurgical processes, to access battery metals. These methods have their own environmental and economic challenges and require careful consideration.

Kinterra Capitals’ Fund

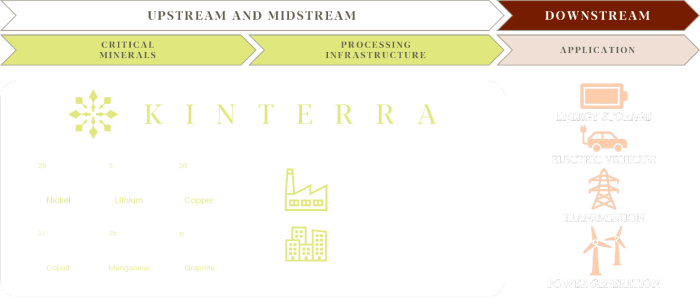

Kinterra Capitals’ debut fund, with a target size of $565 million, is a significant player in the burgeoning battery metals sector. The fund aims to capitalize on the rapidly growing demand for critical minerals, driven by the global shift towards electric vehicles, renewable energy, and other clean technologies. This fund represents a strategic investment in the future of a sustainable energy landscape.

Investment Criteria and Selection Process

Kinterra Capitals employs a rigorous investment criteria and selection process to identify promising battery metal mining projects. The fund focuses on projects with a high probability of success, considering factors such as:

- Proven Mineral Reserves: Projects with well-defined and substantial mineral reserves, ensuring a long-term supply of battery metals.

- Strong Project Economics: Projects with robust financial models, demonstrating a clear path to profitability and strong returns on investment.

- Experienced Management Teams: Projects led by experienced and proven mining professionals with a track record of success.

- Environmental and Social Responsibility: Projects that prioritize sustainable practices and adhere to strict environmental and social standards.

- Favorable Regulatory Environment: Projects located in jurisdictions with supportive mining regulations and a stable political climate.

The fund utilizes a multi-step selection process, including:

- Initial Screening: Identifying potential projects based on publicly available data and industry research.

- Due Diligence: Conducting in-depth technical, financial, and environmental assessments of shortlisted projects.

- Investment Committee Review: Evaluating the project’s potential and aligning it with the fund’s investment strategy.

- Investment Decision: Making a final decision on whether to invest in the project, based on a thorough analysis of all factors.

Geographic Focus

Kinterra Capitals’ fund prioritizes projects in regions with significant battery metal resources and supportive mining policies. The fund’s geographic focus includes:

- North America: Regions in Canada and the United States, known for their established mining infrastructure and regulatory frameworks.

- Australia: A major producer of lithium, nickel, and cobalt, with a well-developed mining industry and a favorable investment environment.

- South America: Countries like Chile and Argentina, rich in lithium and copper reserves, and actively promoting the development of their battery metal sectors.

- Africa: Regions in the Democratic Republic of Congo and Zambia, with abundant cobalt reserves, but facing challenges related to governance and environmental sustainability.

Management Team

Kinterra Capitals boasts a seasoned management team with extensive experience in the mining and investment sectors. The team’s expertise spans various areas, including:

- Mining Geology and Exploration: Identifying and evaluating promising mineral deposits.

- Project Development and Engineering: Designing and constructing efficient and sustainable mining operations.

- Financial Management: Managing the fund’s investments and ensuring strong financial performance.

- ESG (Environmental, Social, and Governance): Integrating sustainability principles into all aspects of the fund’s operations.

The management team’s deep understanding of the battery metal industry and its proven track record of success positions Kinterra Capitals’ fund as a leading player in the sector.

Implications for the Mining Industry and the Environment

The influx of capital into battery metal mining promises to reshape the industry and its environmental footprint. While this investment presents opportunities for economic growth and technological advancements, it also necessitates a careful consideration of potential challenges and the development of sustainable practices.

Environmental and Social Impact of Battery Metal Mining

The extraction of battery metals, including lithium, cobalt, nickel, and manganese, can have significant environmental and social consequences. These include:

* Land Use: Mining operations require vast tracts of land for extraction, processing, and infrastructure development, potentially leading to habitat loss and fragmentation.

* Water Consumption: Battery metal mining is water-intensive, requiring large volumes for extraction, processing, and dust suppression. This can strain water resources in arid regions and impact local communities.

* Waste Management: Mining activities generate significant amounts of waste, including tailings, overburden, and mine water. Improper management of these wastes can lead to pollution of soil and water resources.

* Social Impacts: Mining operations can displace local communities, disrupt traditional livelihoods, and contribute to social unrest if not managed responsibly.

Sustainable Mining Practices for Mitigating Environmental Impact

To minimize the environmental impact of battery metal mining, several sustainable practices are crucial:

* Minimizing Land Disturbance: Implementing techniques such as selective mining, underground extraction, and reclamation can reduce the area of land impacted by mining operations.

* Water Conservation: Employing water-efficient technologies, such as closed-loop systems and water recycling, can reduce water consumption and minimize the impact on local water resources.

* Waste Management and Recycling: Investing in advanced waste management systems and promoting the recycling of battery metals can reduce the volume of waste generated and minimize environmental pollution.

* Community Engagement: Engaging with local communities and addressing their concerns through transparent communication, social impact assessments, and benefit-sharing agreements can foster a more sustainable and equitable mining environment.

The Future of Battery Metal Mining

The future of battery metal mining is poised for significant transformation, driven by the growing demand for electric vehicles, renewable energy technologies, and other applications reliant on battery metals. This evolution will be shaped by a confluence of technological advancements, policy changes, and market dynamics, presenting both challenges and opportunities for the industry.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the future of battery metal mining. These innovations are enabling more efficient extraction, processing, and recycling of battery metals, while also reducing the environmental footprint of mining operations.

- Improved Exploration Techniques: Advancements in remote sensing, geophysical surveys, and data analytics are enhancing exploration efforts, allowing for the identification of new deposits and the optimization of existing mines. For instance, companies like Rio Tinto are employing artificial intelligence (AI) and machine learning to analyze geological data, leading to faster and more accurate identification of mineral deposits.

- Enhanced Extraction Methods: Innovative extraction methods, such as in-situ leaching and biomining, are being developed to minimize the environmental impact of traditional mining practices. In-situ leaching, for example, involves dissolving minerals underground using a chemical solution, reducing the need for large-scale excavation.

- Advanced Processing Technologies: Technological advancements in processing are improving the efficiency and sustainability of battery metal extraction. For instance, hydrometallurgical processing techniques are being refined to reduce energy consumption and minimize waste generation.

- Recycling and Circular Economy: Recycling technologies are becoming increasingly sophisticated, enabling the recovery of valuable battery metals from end-of-life batteries and electronic waste. This is crucial for closing the loop on battery metal supply chains and reducing reliance on virgin materials.

Policy Changes

Government policies are playing a crucial role in shaping the future of battery metal mining by promoting responsible sourcing, sustainable practices, and the development of domestic supply chains.

- Stricter Environmental Regulations: Governments worldwide are enacting stricter environmental regulations to mitigate the potential impacts of mining operations on ecosystems and communities. This includes regulations on waste management, water usage, and air emissions.

- Support for Battery Metal Mining: Governments are providing financial incentives and policy support to encourage the development of battery metal mining projects, particularly in countries with abundant resources. This includes tax breaks, subsidies, and streamlined permitting processes.

- Supply Chain Security Measures: Governments are increasingly focused on ensuring the security and resilience of battery metal supply chains. This involves diversifying sourcing, promoting domestic production, and reducing reliance on critical mineral imports from politically unstable regions.

Kinterra Capitals’ $565 million fund represents a pivotal moment in the battery metal mining industry. By providing a much-needed injection of capital, this fund will play a vital role in driving innovation, accelerating exploration, and promoting responsible mining practices. As the demand for battery metals continues to climb, the fund’s commitment to supporting sustainable projects will be instrumental in ensuring a secure and responsible supply chain for the burgeoning EV market. The future of battery metal mining is intertwined with the future of sustainable transportation, and this fund is poised to shape that future in a positive and impactful way.

Kinterra Capital’s debut $565 million fund is a major boost for the battery metal mining industry, which is crucial for powering the future of technology. This investment comes at a time when the demand for battery metals is soaring, fueled by the rapid adoption of electric vehicles and other green technologies. The fund will be used to support companies developing and operating mines in North America, with a focus on environmentally sustainable practices.

Meanwhile, in the world of gaming, Sony’s PS VR2 is getting compatibility with older PS VR games, possibly by the end of the year , which could be a huge boon for virtual reality enthusiasts. This focus on sustainability and technological advancement is a sign that the future is bright for both the mining and gaming industries.

Standi Techno News

Standi Techno News