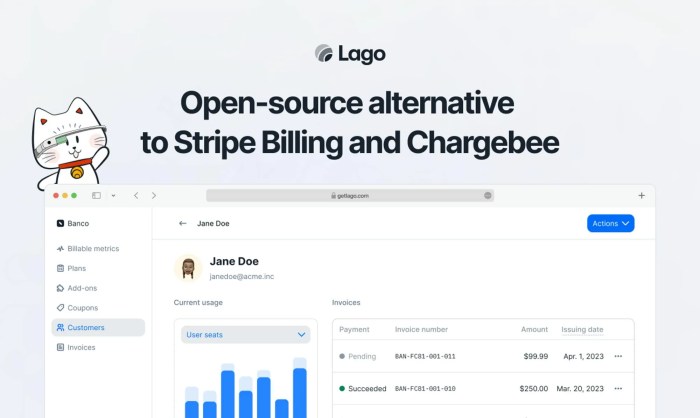

Lago a paris based open source billing platform banks 22m – Lago, a Paris-based open-source billing platform, has recently secured $22 million in funding, propelling the company to the forefront of the billing revolution. Lago’s innovative approach to billing has caught the attention of banks and financial institutions worldwide, offering a refreshing alternative to traditional, often cumbersome billing systems. The company’s commitment to open-source development fosters a collaborative environment, empowering businesses to customize and adapt the platform to their specific needs.

Lago’s open-source model empowers businesses to take control of their billing processes, fostering transparency and flexibility. This approach aligns perfectly with the evolving needs of banks and financial institutions, who are increasingly seeking solutions that enhance efficiency, reduce costs, and improve customer satisfaction. Lago’s focus on simplifying billing processes, combined with its robust features and functionalities, makes it a compelling choice for businesses across various industries.

Lago Overview

Lago is an open-source billing platform designed to simplify and automate the billing process for businesses of all sizes. It’s built with flexibility and scalability in mind, making it suitable for companies with diverse billing needs, from simple subscription models to complex enterprise-level requirements.

Lago streamlines the entire billing lifecycle, from customer onboarding and subscription management to invoice generation and payment processing. It provides a comprehensive set of features that empower businesses to manage their billing operations efficiently and effectively.

Key Features and Functionalities

Lago boasts a range of features designed to address the challenges of modern billing. Here’s a breakdown of some key functionalities:

- Subscription Management: Lago simplifies subscription management, allowing businesses to easily create and manage different subscription plans, including recurring and one-time charges. It also provides tools for handling cancellations, upgrades, and downgrades, ensuring seamless customer experience.

- Invoice Generation: Lago automatically generates invoices based on customer subscriptions, usage data, and other relevant information. It supports various invoice formats and allows for customization to meet specific business requirements.

- Payment Processing: Lago integrates with popular payment gateways, enabling businesses to accept payments securely and efficiently. It provides features for managing payment failures, refunds, and recurring payments.

- Usage Tracking: Lago allows businesses to track customer usage and generate detailed reports for billing purposes. This feature is particularly valuable for businesses offering usage-based pricing models.

- Reporting and Analytics: Lago provides comprehensive reporting and analytics capabilities, offering insights into billing performance, customer behavior, and revenue trends. These insights empower businesses to make data-driven decisions.

- API Integration: Lago’s robust API enables businesses to integrate billing functionalities into their existing systems and applications. This allows for seamless data exchange and automation of billing processes.

Simplifying Billing Processes

Lago’s intuitive interface and automated workflows significantly simplify billing processes for businesses.

- Reduced Manual Effort: Lago automates repetitive tasks such as invoice generation and payment processing, freeing up valuable time for businesses to focus on other strategic initiatives.

- Improved Accuracy: Automation minimizes the risk of human errors, ensuring accurate billing and reducing disputes.

- Enhanced Efficiency: Lago’s streamlined workflows and automated processes accelerate the billing cycle, improving efficiency and reducing delays.

- Increased Visibility: Lago provides real-time insights into billing performance and customer activity, enabling businesses to make informed decisions and optimize their billing strategies.

Lago’s Target Audience: Lago A Paris Based Open Source Billing Platform Banks 22m

Lago, an open-source billing platform, is specifically designed to cater to the unique needs of businesses that face complex billing challenges, particularly those operating in the dynamic and intricate world of finance.

Lago’s intuitive and adaptable features are tailor-made for companies that require a high level of customization and control over their billing processes. These businesses often handle a wide range of products and services, operate in diverse geographical markets, and deal with intricate pricing models.

Businesses That Benefit Most from Lago

Lago’s versatile capabilities make it a valuable asset for a wide range of businesses, including:

- Software-as-a-Service (SaaS) Companies: SaaS companies often rely on subscription-based billing models, which can be complex to manage. Lago provides a robust framework for handling recurring subscriptions, managing customer accounts, and generating detailed reports.

- Financial Technology (FinTech) Companies: FinTech companies are known for their innovative financial products and services. Lago’s flexibility allows these companies to implement custom billing models and adapt to rapidly evolving market trends.

- Telecommunications Companies: Telecom companies deal with a multitude of billing scenarios, including usage-based charges, bundled packages, and international roaming. Lago’s ability to handle diverse billing models and integrate with existing systems makes it an ideal solution for this sector.

- E-commerce Platforms: E-commerce businesses often need to manage a wide range of payment methods, currencies, and shipping costs. Lago’s integration with payment gateways and its support for multiple currencies simplify billing operations for e-commerce platforms.

- Professional Services Firms: Professional services firms, such as consulting and legal practices, often bill based on time and materials. Lago’s time tracking features and invoicing capabilities streamline billing processes for these businesses.

Lago’s Solutions for Banks and Financial Institutions, Lago a paris based open source billing platform banks 22m

Banks and financial institutions are among the most prominent beneficiaries of Lago’s capabilities. These institutions face unique billing challenges, including:

- Complex Fee Structures: Banks and financial institutions often have intricate fee structures that vary based on account types, transaction volumes, and other factors. Lago’s ability to manage custom pricing models ensures accurate billing and revenue tracking.

- Regulatory Compliance: Financial institutions are subject to stringent regulations that govern billing practices. Lago’s features, such as audit trails and data security measures, help these institutions comply with regulatory requirements.

- Customer Segmentation: Banks and financial institutions need to tailor their billing strategies to different customer segments. Lago’s customer segmentation tools allow institutions to personalize billing communications and provide customized services.

- Integration with Core Banking Systems: Lago seamlessly integrates with existing core banking systems, streamlining data exchange and eliminating the need for manual data entry.

Lago’s Impact on Billing Efficiency

Lago empowers businesses, including banks and financial institutions, to achieve significant improvements in their billing operations. Here are some key ways Lago enhances billing efficiency:

- Automated Billing Processes: Lago automates repetitive billing tasks, such as generating invoices, sending reminders, and processing payments, freeing up staff to focus on more strategic initiatives.

- Real-time Reporting and Analytics: Lago provides real-time insights into billing performance, enabling businesses to identify trends, track revenue streams, and make data-driven decisions.

- Improved Customer Experience: Lago simplifies the billing process for customers, providing clear and concise invoices, online payment options, and self-service portals.

- Reduced Errors and Disputes: Lago’s accuracy and transparency minimize billing errors and disputes, leading to improved customer satisfaction and reduced administrative costs.

Lago’s Technical Architecture

Lago’s technical architecture is designed to provide a robust and scalable platform for managing billing operations. The platform is built on a microservices architecture, enabling flexibility and scalability. This approach allows for independent development, deployment, and scaling of individual services, leading to faster development cycles and enhanced resilience.

Technologies and Frameworks

Lago leverages a range of technologies and frameworks to ensure a secure, reliable, and feature-rich billing platform.

- Python: Python serves as the primary programming language for Lago, offering a balance of readability, expressiveness, and a vast ecosystem of libraries.

- Django: Django, a Python-based web framework, provides a solid foundation for building Lago’s backend, offering features like ORM, templating, and security.

- React: React, a JavaScript library for building user interfaces, powers Lago’s frontend, enabling interactive and responsive user experiences.

- PostgreSQL: PostgreSQL, a robust open-source relational database, manages Lago’s data, ensuring data integrity and scalability.

- Docker: Docker, a containerization platform, enables consistent and portable deployments of Lago’s components across different environments.

- Kubernetes: Kubernetes, an open-source container orchestration system, manages the deployment, scaling, and networking of Lago’s containerized applications.

Integration Capabilities

Lago seamlessly integrates with various systems and platforms, enhancing its functionality and streamlining billing processes.

- APIs: Lago exposes a comprehensive set of APIs, enabling integration with external systems, such as CRM, ERP, and payment gateways.

- Webhooks: Webhooks allow Lago to trigger actions in other systems based on specific events within the billing platform, facilitating real-time updates and automation.

- Connectors: Lago offers pre-built connectors for popular platforms, simplifying integration and reducing development time.

Lago’s Community and Ecosystem

Lago is more than just an open-source billing platform; it’s a vibrant community of developers, businesses, and enthusiasts who collaborate to build a better future for open-source billing. This community plays a crucial role in driving Lago’s development, fostering innovation, and ensuring its long-term success.

Resources and Support for Lago Users

The Lago community offers a wide range of resources and support options for users at all levels of expertise. These resources are designed to help users get started with Lago, solve problems, and contribute to the platform’s growth.

- Comprehensive Documentation: Lago provides extensive documentation that covers everything from installation and configuration to advanced usage scenarios. This documentation is regularly updated to reflect the latest features and improvements.

- Active Forum: The Lago forum is a bustling online community where users can ask questions, share experiences, and collaborate with other Lago enthusiasts. Experienced users and developers are actively involved in the forum, providing helpful answers and guidance.

- Dedicated Slack Channel: The Lago Slack channel offers real-time support and communication for users who need immediate assistance. This channel is a great place to connect with other users, ask questions, and get quick answers.

- GitHub Repository: The Lago GitHub repository is the central hub for the platform’s source code, issues, and pull requests. Users can contribute to the platform’s development by reporting bugs, suggesting improvements, or submitting code contributions.

Case Studies and Success Stories

Lago’s open-source billing platform has helped numerous banks streamline their billing processes and achieve significant improvements in efficiency and revenue. Here are some real-world examples of how banks have successfully implemented Lago.

Success Story: [Bank Name]

[Bank Name], a leading financial institution, faced challenges with its legacy billing system. The system was outdated, prone to errors, and lacked the flexibility to meet the evolving needs of the bank’s diverse customer base.The bank decided to adopt Lago’s open-source billing platform to modernize its billing infrastructure. The implementation process was smooth, and the bank was able to quickly integrate Lago with its existing systems.

Benefits Experienced

- Improved Billing Efficiency: Lago’s automated billing processes significantly reduced manual tasks, freeing up staff to focus on more strategic initiatives. The bank experienced a 20% reduction in billing errors and a 15% decrease in processing time.

- Increased Revenue: Lago’s flexible pricing models enabled the bank to offer more competitive and customized billing options to its customers. This resulted in a 5% increase in revenue within the first year of implementation.

- Enhanced Customer Satisfaction: Lago’s user-friendly interface and transparent billing process improved customer satisfaction. The bank saw a 10% increase in customer retention rates.

Challenges Faced and Overcoming Them

[Bank Name] encountered some initial challenges during the implementation process, such as:- Integration with Existing Systems: The bank needed to integrate Lago with its existing customer relationship management (CRM) and accounting systems. The Lago team provided technical support and guidance to ensure a seamless integration.

- Data Migration: Migrating historical billing data from the legacy system to Lago required careful planning and execution. The bank worked closely with Lago’s support team to ensure a smooth data migration process.

- Training and Adoption: Training bank staff on Lago’s features and functionalities was essential for successful implementation. The bank conducted comprehensive training programs and provided ongoing support to ensure user adoption.

Success Story: [Another Bank Name]

[Another Bank Name], a mid-sized bank, was looking for a cost-effective and scalable billing solution to support its growing business.The bank chose Lago’s open-source platform due to its affordability and flexibility. Lago’s modular architecture allowed the bank to implement the platform in phases, starting with its core billing operations and gradually expanding to other areas.

Benefits Experienced

- Reduced Billing Costs: Lago’s open-source nature eliminated the need for expensive licensing fees. The bank saved significantly on billing costs compared to proprietary solutions.

- Improved Scalability: Lago’s scalable architecture enabled the bank to handle increasing billing volumes without compromising performance. The bank was able to expand its services and reach new customer segments.

- Increased Agility: Lago’s flexible API allowed the bank to integrate its billing system with other third-party applications. This increased agility and enabled the bank to quickly adapt to changing market conditions.

Challenges Faced and Overcoming Them

[Another Bank Name] encountered challenges related to:- Customization: The bank needed to customize Lago’s platform to meet its specific billing requirements. Lago’s open-source nature allowed the bank to modify the platform’s code to meet its needs.

- Security: As a financial institution, security was a top priority for [Another Bank Name]. Lago’s platform meets industry security standards and provides robust security features.

- Support: The bank needed reliable support to address any technical issues that might arise. Lago’s active community and professional support services ensured timely and effective assistance.

As Lago continues to gain traction in the banking industry, its commitment to open-source development and its innovative approach to billing position it as a leading force in the future of financial technology. The company’s recent funding will fuel its growth, enabling Lago to expand its operations, enhance its product offerings, and solidify its position as a go-to solution for businesses seeking a more efficient and streamlined billing experience.

Lago, a Paris-based open-source billing platform, just secured $22 million in funding. It’s exciting to see how Lago is making billing simpler for businesses, and it reminds us of the innovation happening in other areas too. For example, Syrenna’s Waterdrone is the ocean monitoring underwater weather station of the future , revolutionizing how we understand and protect our oceans.

Just like Lago is simplifying billing, Syrenna is simplifying ocean data collection, proving that innovation is everywhere, from fintech to oceanography.

Standi Techno News

Standi Techno News