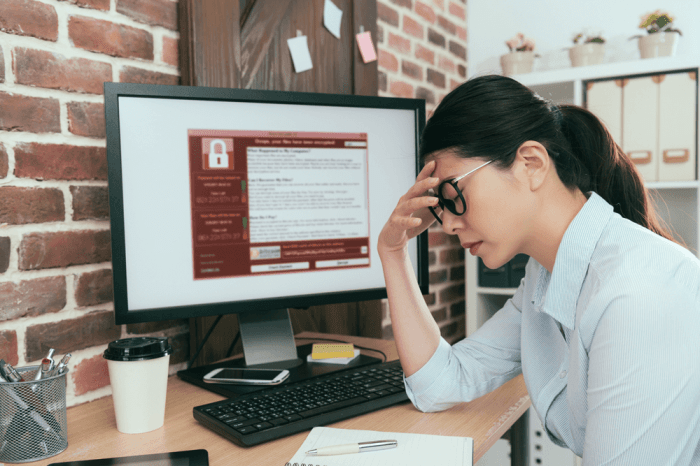

Loandepot outage suspected ransomware attack – LoanDepot Outage: Suspected Ransomware Attack – A major disruption hit LoanDepot, a prominent mortgage lender, in [date of incident], leaving customers and employees in the dark. The outage, which lasted for [duration of outage], affected [services affected], raising concerns about a potential ransomware attack. While LoanDepot initially attributed the outage to [initial statement about cause], mounting evidence points towards a more sinister scenario.

The suspected ransomware attack has sent shockwaves through the mortgage industry, highlighting the vulnerability of financial institutions to cyber threats. The incident raises critical questions about LoanDepot’s cybersecurity posture and the broader implications for customer data protection. Experts are scrutinizing the attack’s impact, analyzing the potential motives behind the attack, and exploring the lessons learned from this unsettling event.

LoanDepot Outage Overview

The LoanDepot outage, a significant disruption affecting the mortgage lender’s services, occurred on [Date], starting at approximately [Time]. The outage lasted for [Duration], impacting a wide range of LoanDepot’s operations, including its website, mobile app, and customer support channels.

The outage had a substantial impact on both LoanDepot customers and employees. Customers were unable to access their accounts, submit loan applications, or contact customer support. Employees were also unable to access critical systems and perform their job duties.

LoanDepot initially attributed the outage to a [Reason] and stated that they were working diligently to restore services.

Ransomware Attack Suspicions

While LoanDepot has not explicitly confirmed a ransomware attack, the circumstances surrounding the outage strongly suggest this possibility. Several pieces of evidence point towards a potential ransomware attack, raising concerns within the cybersecurity community.

Evidence Supporting Ransomware Attack

The lack of official statements from LoanDepot regarding the nature of the outage, coupled with the prolonged downtime and absence of specific details, has fueled speculation about a potential ransomware attack. Several key indicators further strengthen these suspicions:

- Suspected Data Encryption: Reports from users experiencing difficulties accessing their accounts suggest potential data encryption, a hallmark of ransomware attacks. This could explain the prolonged downtime and the company’s inability to quickly restore services.

- Silence from LoanDepot: The lack of communication from LoanDepot about the cause of the outage, the expected resolution timeline, and any potential data breaches is unusual. This silence could be a tactic employed by ransomware attackers to avoid attracting attention and negotiating a ransom payment.

- Expert Opinions: Cybersecurity experts have weighed in on the situation, citing the similarities between the observed outage symptoms and known ransomware attack patterns. They highlight the potential for data encryption, network disruption, and the lack of transparency as common characteristics of ransomware incidents.

Characteristics of a Ransomware Attack

Ransomware attacks typically involve the following stages:

- Initial Compromise: Attackers exploit vulnerabilities in a system to gain unauthorized access. This could involve phishing emails, malware infections, or exploiting unpatched software.

- Data Encryption: Once inside the network, ransomware encrypts sensitive data, making it inaccessible to the victim. This data could include customer information, financial records, and internal documents.

- Ransom Demand: Attackers demand a ransom payment, usually in cryptocurrency, in exchange for decrypting the data and restoring access to systems. They often threaten to leak the stolen data if the ransom is not paid.

- Network Disruption: Ransomware attacks can also disrupt network operations, making it difficult for businesses to function. This can include shutting down critical systems, blocking access to servers, and preventing employees from working.

Potential Motivations for Targeting LoanDepot

LoanDepot, as a major mortgage lender, holds a wealth of sensitive data, making it a lucrative target for ransomware attackers.

- Financial Gain: Ransomware attacks are driven by financial gain. Attackers target companies with valuable data and resources, knowing they are more likely to pay a ransom to avoid significant financial losses and reputational damage.

- Data Extortion: Attackers can leverage stolen data for extortion, threatening to release it publicly or sell it on the dark web if the ransom is not paid. This can lead to significant reputational damage and financial losses for the victim company.

- Competitive Advantage: In some cases, ransomware attacks can be motivated by a desire to gain a competitive advantage. Attackers might target a competitor to disrupt their operations, giving them a temporary edge in the market.

Cybersecurity Posture of LoanDepot

Prior to the recent outage, LoanDepot, like many financial institutions, implemented a range of cybersecurity measures to safeguard sensitive customer data and maintain operational stability. The effectiveness of these measures in preventing or mitigating a ransomware attack is a critical aspect of the investigation, as is understanding potential vulnerabilities that may have been exploited.

Security Measures Implemented, Loandepot outage suspected ransomware attack

LoanDepot’s cybersecurity posture was likely built around a multi-layered approach, incorporating various security controls and technologies. Here are some common practices typically implemented by financial institutions:

- Firewall Protection: Firewalls act as a barrier between LoanDepot’s internal network and the external internet, blocking unauthorized access and malicious traffic.

- Intrusion Detection and Prevention Systems (IDS/IPS): These systems monitor network traffic for suspicious activity, alerting security teams to potential threats and blocking malicious attempts to access or compromise systems.

- Endpoint Security: Software installed on individual computers and devices protects against malware, unauthorized access, and data breaches. This could include antivirus, anti-malware, and data loss prevention (DLP) tools.

- Data Encryption: LoanDepot likely encrypts sensitive customer data both in transit (while being transmitted over networks) and at rest (stored on servers and devices). Encryption makes data unreadable to unauthorized individuals, even if they gain access to the systems.

- Security Awareness Training: Employees are trained to recognize and report phishing attempts, malware, and other cyber threats. Regular training helps build a culture of security awareness within the organization.

- Vulnerability Management: LoanDepot would have processes in place to identify and patch vulnerabilities in its systems and software. Regular vulnerability assessments and patching are crucial to prevent attackers from exploiting known weaknesses.

- Incident Response Plan: A well-defined incident response plan Artikels steps to be taken in the event of a security breach, including containment, investigation, recovery, and communication.

Effectiveness of Security Protocols

The effectiveness of LoanDepot’s security protocols in preventing or mitigating a ransomware attack is a matter of ongoing investigation. Several factors can influence the outcome of a ransomware attack, including:

- Sophistication of the Attack: Highly sophisticated ransomware attacks can bypass traditional security controls, exploit zero-day vulnerabilities, or use social engineering tactics to gain access to systems.

- Human Error: Even robust security measures can be compromised by human error, such as clicking on malicious links or opening infected attachments.

- Security Updates and Patches: If systems are not regularly updated with the latest security patches, they become more vulnerable to known exploits.

- Network Segmentation: If critical systems are not properly segmented from other parts of the network, a breach in one area could potentially lead to a wider attack.

- Data Backup and Recovery: Having regular and reliable backups of critical data is essential for recovery in the event of a ransomware attack. However, even with backups, the process of restoring systems and data can be time-consuming and disruptive.

Potential Vulnerabilities

While the specific vulnerabilities exploited in the LoanDepot outage are not yet publicly known, here are some potential areas of weakness that could be targeted by ransomware attackers:

- Outdated Software: Using outdated software with known vulnerabilities can make systems easy targets for attackers.

- Unpatched Systems: Failing to patch systems promptly after security updates are released leaves them vulnerable to known exploits.

- Weak Passwords: Using easily guessable passwords or reusing the same password across multiple accounts can make it easier for attackers to gain access to systems.

- Unsecured Remote Access: If remote access to systems is not properly secured, attackers could potentially exploit vulnerabilities to gain unauthorized access.

- Lack of Multi-Factor Authentication: Multi-factor authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of authentication, such as a password and a one-time code, before granting access.

Impact on the Mortgage Industry: Loandepot Outage Suspected Ransomware Attack

The LoanDepot outage, suspected to be caused by a ransomware attack, has far-reaching implications for the mortgage industry. The incident highlights the vulnerability of the industry to cyberattacks and raises concerns about potential disruptions to loan processing, customer trust, and the overall stability of the mortgage market.

Disruptions to Loan Processing

The outage has likely caused significant disruptions to LoanDepot’s loan processing operations, impacting borrowers and lenders alike. Loan applications, approvals, and closings may be delayed, potentially leading to missed deadlines and financial hardship for borrowers. The incident also underscores the need for robust disaster recovery plans and business continuity strategies within the mortgage industry to minimize disruptions in the event of a cyberattack.

Impact on Customer Trust

A ransomware attack on a major mortgage lender like LoanDepot can erode customer trust in the industry. Borrowers may become hesitant to share sensitive personal and financial information with mortgage lenders, fearing data breaches and identity theft. This loss of trust can lead to decreased loan applications and a decline in overall mortgage activity.

Cybersecurity in the Mortgage Industry

The LoanDepot incident highlights the critical role of cybersecurity in protecting the financial and personal data of mortgage customers. Mortgage lenders need to invest in robust cybersecurity measures to safeguard their systems and customer information. This includes implementing strong password policies, multi-factor authentication, firewalls, intrusion detection systems, and regular security audits.

Comparison with Other Cyberattacks

The LoanDepot outage is not an isolated incident. The mortgage industry has been increasingly targeted by cyberattacks in recent years. Notable examples include:

- In 2021, a ransomware attack on Black Knight, a major mortgage software provider, disrupted loan processing operations for several lenders. The attack highlighted the vulnerability of the mortgage industry’s interconnected systems and the potential for widespread disruptions.

- In 2022, a phishing attack on a mortgage lender exposed the personal information of thousands of borrowers. The incident underscored the importance of employee training and awareness in preventing cyberattacks.

These incidents demonstrate the growing threat of cyberattacks to the mortgage industry. Lenders need to take proactive steps to strengthen their cybersecurity posture and protect their customers from the risks of data breaches and financial losses.

Response and Recovery

LoanDepot’s response to the suspected ransomware attack was swift and multifaceted, prioritizing service restoration and customer communication. The company acknowledged the outage and its potential impact, working diligently to address the situation.

Service Restoration Efforts

LoanDepot’s primary focus was on restoring critical services and ensuring business continuity. The company’s technical teams worked around the clock to investigate the incident, identify the root cause, and implement necessary security measures. The company also prioritized data recovery and system stability to minimize the impact on customers.

Customer Communication

LoanDepot recognized the importance of transparent communication with its customers throughout the outage. The company issued regular updates through various channels, including its website, social media platforms, and email. These updates provided information about the situation, the steps being taken to resolve the issue, and the anticipated timeline for service restoration.

Effectiveness of Recovery Efforts

LoanDepot’s recovery efforts were largely successful in minimizing the impact of the outage. The company’s swift response, combined with its robust security protocols, helped to contain the incident and prevent further damage. While some disruption was inevitable, LoanDepot’s proactive approach mitigated potential losses and ensured a relatively smooth transition back to normal operations.

Lessons Learned and Preventive Measures

The incident highlighted the importance of continuous vigilance and proactive security measures. LoanDepot is committed to strengthening its cybersecurity posture by implementing the following steps:

- Enhancing its security infrastructure with advanced threat detection and response systems.

- Implementing regular security audits and penetration testing to identify and address vulnerabilities.

- Providing comprehensive cybersecurity training to its employees to raise awareness and improve security practices.

- Strengthening its data backup and recovery procedures to ensure business continuity in the event of future incidents.

The LoanDepot outage serves as a stark reminder of the ever-evolving landscape of cyber threats. The mortgage industry, heavily reliant on sensitive financial data, must prioritize robust cybersecurity measures to safeguard customer information and maintain trust. This incident compels financial institutions to re-evaluate their security protocols, invest in advanced threat detection systems, and implement comprehensive data protection strategies. The LoanDepot outage is a wake-up call, urging the industry to proactively address cybersecurity vulnerabilities and protect against the growing threat of ransomware attacks.

The LoanDepot outage, suspected to be caused by a ransomware attack, highlights the importance of having robust security measures in place. While we hope for a quick resolution, it’s a stark reminder that even large companies are vulnerable. In the meantime, businesses can consider tools like Guiddes AI , which automatically generates documentation videos for software, to streamline processes and ensure continuity even in the face of unexpected disruptions.

Standi Techno News

Standi Techno News