Lynk Forges Ahead with Public Market Debut Despite SPACs Dwindling Reserves – a bold move in a shrinking landscape. While the SPAC market struggles with dwindling reserves, Lynk, a company revolutionizing satellite-based communication, takes a leap of faith, launching its public market debut. This move, amidst a shrinking pool of SPAC funding, signals a new era of innovation and underscores Lynk’s unwavering commitment to its unique business model.

Lynk’s satellite-based communication services offer a unique solution to the ever-growing demand for connectivity. The company leverages its technology to provide reliable communication services in remote areas and during emergencies, offering a lifeline to underserved communities. But Lynk faces a formidable challenge: a fiercely competitive telecommunications market. Its success hinges on its ability to carve out a niche and demonstrate the value proposition of its unique offering.

Lynk’s Public Market Debut

Lynk’s public market debut marks a significant milestone for the company and the broader SPAC landscape. Despite the dwindling reserves of SPACs, Lynk’s successful listing demonstrates the continued interest in innovative technologies, particularly those with the potential to disrupt traditional industries. This move also signifies a shift in investor focus toward companies with a clear path to profitability, as Lynk has already established a strong foundation with its satellite-based communication services.

Lynk’s Business Model

Lynk’s business model revolves around providing satellite-based communication services, offering connectivity to underserved areas and regions where traditional terrestrial networks are unavailable or unreliable. The company leverages a network of low-earth orbit (LEO) satellites to establish direct connections with standard mobile phones, effectively extending cellular coverage to remote locations. This approach allows Lynk to cater to a wide range of customers, including individuals, businesses, and governments, who require reliable communication in areas with limited infrastructure.

Challenges and Opportunities

Lynk faces several challenges in the competitive telecommunications market. The company must contend with established players like SpaceX’s Starlink, which also offers satellite-based internet services. Lynk’s focus on mobile phone connectivity sets it apart, but it still needs to navigate the complexities of regulatory approvals and network infrastructure development. However, the company also enjoys several opportunities. The growing demand for reliable communication in remote areas presents a significant market opportunity, particularly in developing countries. Lynk’s ability to provide affordable and accessible communication solutions can create a substantial impact in these regions. Moreover, the company’s focus on mobile phone connectivity offers a unique advantage, as it can leverage existing infrastructure and user base without requiring new hardware or software installations.

SPAC Landscape and Dwindling Reserves

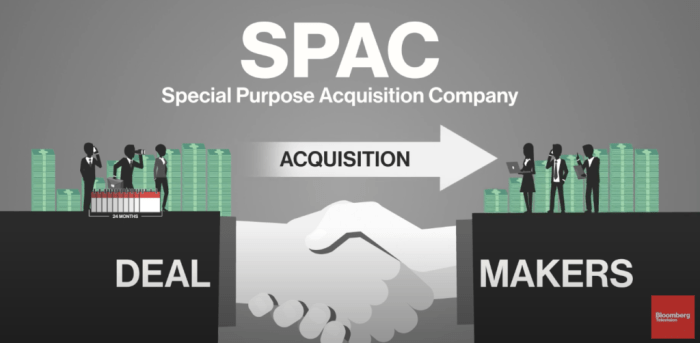

The SPAC market, once a hotbed of activity, is facing a cooling period, with a decline in available capital impacting future deals. This shift is largely attributed to the dwindling reserves of SPACs, which are special purpose acquisition companies, that were formed during the SPAC boom.

SPACs’ Dwindling Reserves

The SPAC boom of 2020 and 2021 saw a surge in the formation of SPACs, which raised billions of dollars to acquire private companies and take them public. However, many of these SPACs failed to find suitable targets within the two-year timeframe allotted to complete a merger. As a result, they are now facing a shortage of capital, with their trust accounts dwindling. This has led to a significant slowdown in SPAC activity, as fewer companies are willing to merge with SPACs that have limited funds.

Lynk’s SPAC Transaction Compared to Other Deals, Lynk forges ahead with public market debut despite spacs dwindling reserves

Lynk’s SPAC transaction is an example of a deal that has gone through despite the challenging market conditions. While the company managed to secure a merger with a SPAC, it’s important to note that the terms of the deal might have been more favorable to the SPAC than in the past. The declining reserves of SPACs have put them in a less advantageous position, leading to more favorable terms for companies like Lynk.

Implications for Innovation and Investment

The dwindling reserves of SPACs have significant implications for the future of innovation and investment in emerging technologies. While SPACs have been instrumental in providing a path to market for many startups, the current market conditions make it more difficult for them to raise capital. This could hinder the development of innovative companies and technologies, as they may face challenges in securing funding.

Lynk’s Growth Strategy and Future Prospects: Lynk Forges Ahead With Public Market Debut Despite Spacs Dwindling Reserves

Lynk, the company that provides satellite-based cellular communication, has set its sights on a rapidly expanding market, driven by the increasing demand for reliable connectivity in remote and underserved areas. To achieve its ambitious growth goals, Lynk has developed a multifaceted strategy encompassing market expansion, technological innovation, and strategic partnerships.

Market Expansion Strategies

Lynk’s primary growth strategy revolves around expanding its market reach and customer base. This includes:

- Geographic Expansion: Lynk is actively expanding its satellite network coverage to encompass new regions and countries, particularly in emerging markets with high growth potential and limited terrestrial infrastructure. The company is aiming to provide affordable and accessible communication services to regions previously considered “off-grid.” For example, Lynk has secured licenses to operate in several African countries, where the demand for reliable mobile communication is particularly high.

- Industry-Specific Solutions: Lynk is tailoring its services to meet the unique needs of various industries. The company is actively exploring partnerships with organizations in sectors such as transportation, logistics, energy, and disaster relief. For example, Lynk is working with transportation companies to provide real-time tracking and communication capabilities for their fleets operating in remote areas.

- Strategic Partnerships: Lynk is forging strategic partnerships with local telecommunications operators, mobile device manufacturers, and technology companies to enhance its market penetration and distribution channels. These collaborations enable Lynk to leverage existing infrastructure and reach a wider audience.

Applications and Benefits of Lynk’s Technology

Lynk’s satellite communication technology offers a wide range of applications across various industries, providing numerous benefits. Here is a table showcasing potential applications and benefits:

| Industry | Applications | Benefits |

|—|—|—|

| Transportation | Fleet management, real-time tracking, communication in remote areas | Improved efficiency, safety, and operational visibility |

| Logistics | Supply chain management, asset tracking, communication in remote locations | Enhanced visibility, reduced downtime, improved logistics coordination |

| Energy | Remote infrastructure monitoring, communication in hazardous environments | Improved safety, remote control, and operational efficiency |

| Disaster Relief | Emergency communication, coordination of relief efforts, access to information | Improved response time, effective communication during emergencies, access to vital information |

| Government & Public Safety | Border security, communication in remote areas, emergency response | Enhanced security, improved communication capabilities in challenging environments |

| Tourism & Hospitality | Communication in remote areas, location-based services | Improved guest experience, enhanced safety and security, access to information |

Impact of Regulatory Changes and Technological Advancements

The future of Lynk’s business is intertwined with the evolving regulatory landscape and technological advancements. Positive regulatory changes, such as the allocation of spectrum for satellite communication, can create opportunities for Lynk to expand its operations and provide more affordable services. However, regulatory hurdles and limitations can hinder its growth.

Similarly, technological advancements, such as the development of more efficient and cost-effective satellite technologies, can create new opportunities for Lynk to improve its service offerings and reduce operational costs. Conversely, competition from emerging technologies, such as high-altitude platforms (HAPs) and terrestrial networks, could pose challenges to Lynk’s market position.

Investor Sentiment and Market Reaction

Lynk’s public market debut sparked a wave of mixed reactions from investors, highlighting the inherent uncertainty surrounding the company’s long-term prospects. The initial stock performance, while positive, fell short of some analysts’ expectations, reflecting a cautious optimism among investors.

Initial Market Reaction and Stock Performance

The initial market reaction to Lynk’s public market debut was a blend of excitement and skepticism. While the stock price experienced an initial surge, it soon settled into a more subdued trading range, suggesting a degree of investor uncertainty. This was likely influenced by a number of factors, including the nascent stage of the satellite communication market, the intense competition from established players, and the inherent risks associated with a young and unproven company.

Factors Influencing Investor Confidence

Investor confidence in Lynk’s long-term growth potential is primarily driven by a few key factors:

- First-mover advantage: Lynk’s early entry into the satellite communication market, particularly in underserved regions, positions it as a potential leader in a rapidly growing sector. The company’s ability to establish a strong foothold in emerging markets could translate into significant market share gains.

- Technological innovation: Lynk’s unique technology, which enables communication via satellites without the need for ground stations, offers a compelling value proposition. This innovation has the potential to disrupt traditional communication networks, particularly in remote areas.

- Growing demand for connectivity: The global demand for affordable and reliable internet access is steadily increasing. Lynk’s ability to provide connectivity to underserved populations could drive significant revenue growth.

Potential Risks and Challenges

Despite its potential, Lynk faces a number of risks and challenges that could impact its future success:

- Competition: The satellite communication market is becoming increasingly competitive, with established players like SpaceX and Amazon investing heavily in their own satellite constellations. Lynk will need to differentiate itself and attract customers in this crowded landscape.

- Regulatory hurdles: Navigating the complex regulatory landscape surrounding satellite communications can be challenging. Lynk’s ability to secure necessary licenses and approvals will be crucial for its growth.

- Financial sustainability: Building and maintaining a satellite constellation requires significant capital investment. Lynk’s ability to generate sufficient revenue to fund its operations and future growth is critical for its long-term viability.

Lynk’s public market debut is a significant milestone in the company’s journey. Despite the headwinds in the SPAC market, Lynk’s bold move signifies a commitment to its vision. The company’s ability to navigate the challenges and capitalize on the opportunities presented by the evolving telecommunications landscape will be key to its future success. Will Lynk be able to overcome the obstacles and solidify its position in the market? Only time will tell.

While SPACs might be facing a rough patch, Lynk is forging ahead with its public market debut. This shows that the tech world is still hungry for innovation, and that’s why it’s exciting to see a restaurant loyalty platform like Blackbird, co-founded by Resy and Eater’s mastermind, securing a hefty $24 million in funding. resy and eater co founder raises 24m for blackbird a restaurant loyalty platform Maybe this signals a new wave of investment in the food and beverage industry, mirroring the tech sector’s continued resilience despite economic headwinds.

Standi Techno News

Standi Techno News