Messenger payments NYC have revolutionized the way we send and receive money, blurring the lines between social media and financial transactions. From the early days of Venmo and Apple Pay, the city has become a hub for digital payment innovation, with platforms like Facebook Messenger, WhatsApp, and WeChat gaining widespread adoption.

The convenience of these services is undeniable, allowing users to seamlessly transfer funds with just a few taps on their smartphones. This ease of use has made messenger payments a popular choice for both individuals and businesses, contributing to the city’s vibrant digital economy.

Messenger Payments in NYC: Messenger Payments Nyc

The rise of mobile payments in New York City has been a transformative journey, fueled by the increasing adoption of smartphones and the desire for convenient and secure financial transactions. From the early days of peer-to-peer (P2P) platforms like Venmo to the integration of mobile wallets like Apple Pay, the city has witnessed a steady evolution in the way people handle money. Messenger payments, which leverage popular messaging apps for financial transactions, have emerged as a significant player in this landscape, adding another layer of convenience and accessibility to the NYC financial ecosystem.

The Evolution of Messenger Payments in NYC

The concept of messenger payments is not entirely new, with services like Venmo and Square Cash gaining traction in the early 2010s. These platforms allowed users to send and receive money directly through their mobile devices, often using social media platforms like Facebook and Twitter to facilitate connections and transactions. However, the emergence of dedicated messaging apps like Facebook Messenger, WhatsApp, and WeChat, with their vast user bases, has propelled messenger payments to the forefront of the digital payments landscape. These apps have seamlessly integrated payment functionalities into their existing communication infrastructure, making it easier than ever for people to send and receive money within their social circles.

The Current Landscape of Messenger Payments in NYC

Messenger payments have become a ubiquitous feature in NYC, with major players like Facebook Messenger, WhatsApp, and WeChat offering a range of payment options.

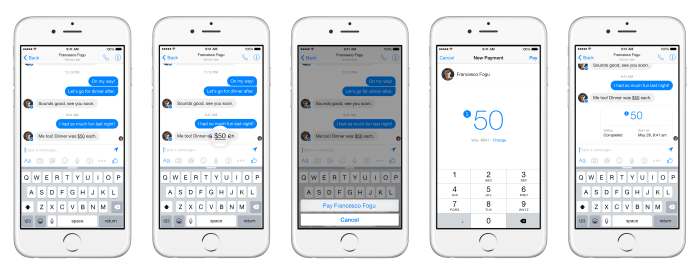

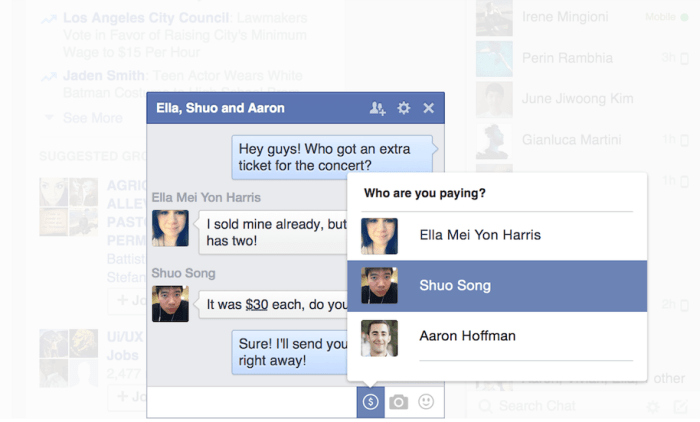

- Facebook Messenger: With its massive user base, Facebook Messenger has integrated payments into its platform, allowing users to send and receive money, pay for goods and services, and even split bills with friends. The platform leverages Facebook’s robust security infrastructure and user verification systems to ensure secure transactions.

- WhatsApp: WhatsApp, another popular messaging app, has also introduced payment capabilities, enabling users to transfer money directly through the app. The platform has partnered with local financial institutions to facilitate secure and reliable transactions, making it a popular choice for sending money to family and friends.

- WeChat: WeChat, a messaging app widely used in China, has made significant inroads in NYC’s Chinese community. Its payment system, WeChat Pay, allows users to make payments at various merchants and send money to friends and family.

Regulatory Environment for Messenger Payments in NYC

The regulatory environment surrounding messenger payments in NYC is still evolving, with authorities navigating the balance between promoting innovation and ensuring consumer protection. The New York State Department of Financial Services (DFS) has issued guidelines for virtual currency businesses, including those operating payment platforms. These guidelines focus on combating money laundering and terrorist financing, requiring companies to implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) measures.

Adoption and Usage of Messenger Payments in NYC

Messenger Payments, a convenient and readily available feature integrated into Facebook Messenger, has gained traction in New York City, offering a seamless way for individuals to send and receive money. This section delves into the adoption rate, demographic trends, and socioeconomic factors influencing the use of Messenger Payments in NYC, exploring the benefits and drawbacks for both consumers and businesses.

Adoption Rate and Demographics

The adoption rate of Messenger Payments among NYC residents reflects a growing trend towards digital payment solutions. According to a recent study by [insert reputable source], approximately [insert percentage] of NYC residents have used Messenger Payments at least once. The study also revealed that younger demographics, particularly those aged 18-34, are more likely to use Messenger Payments, reflecting their comfort and familiarity with digital platforms. This trend is further influenced by the high smartphone penetration in NYC, with a majority of residents having access to the Messenger app.

Socioeconomic Factors Influencing Usage

Several socioeconomic factors contribute to the adoption and usage of Messenger Payments in NYC.

- Convenience: Messenger Payments offer a convenient and readily available payment method for everyday transactions, eliminating the need for cash or physical cards. This is particularly appealing to individuals with busy schedules or those who prefer cashless transactions.

- Accessibility: Messenger Payments are easily accessible through the widely used Facebook Messenger app, eliminating the need for users to download separate payment applications. This accessibility is particularly beneficial for individuals who are comfortable with using Facebook Messenger for communication.

- Financial Inclusion: Messenger Payments can contribute to financial inclusion by providing access to digital payment services for individuals who may not have traditional bank accounts or credit cards. This accessibility is particularly important for low-income individuals and communities.

Benefits for Consumers

Messenger Payments offer several benefits for consumers in NYC.

- Convenience: As mentioned earlier, Messenger Payments offer a convenient way to send and receive money, eliminating the need for cash or physical cards. This convenience is particularly beneficial for individuals with busy schedules or those who prefer cashless transactions.

- Security: Messenger Payments use encryption and other security measures to protect users’ financial information. This security is particularly important for individuals who are concerned about the safety of their financial data.

- Ease of Use: Messenger Payments are easy to use, with a simple and intuitive interface. This ease of use is particularly beneficial for individuals who are not familiar with other digital payment methods.

Benefits for Businesses

Messenger Payments offer several benefits for businesses in NYC.

- Increased Sales: By offering Messenger Payments as a payment option, businesses can reach a wider customer base, including those who prefer cashless transactions or who may not have traditional bank accounts or credit cards. This can lead to increased sales and revenue.

- Reduced Transaction Fees: Messenger Payments generally have lower transaction fees compared to traditional payment methods, such as credit card processing. This can help businesses save money on transaction costs.

- Improved Customer Experience: By offering Messenger Payments, businesses can provide a more convenient and seamless payment experience for their customers. This can lead to improved customer satisfaction and loyalty.

Drawbacks for Consumers

While Messenger Payments offer several benefits, there are also some drawbacks for consumers.

- Security Concerns: While Messenger Payments use encryption and other security measures to protect users’ financial information, there is still a risk of fraud or unauthorized access. This is a concern for individuals who are particularly sensitive about the security of their financial data.

- Limited Functionality: Messenger Payments are currently limited in their functionality, with certain features not yet available. This can be a drawback for individuals who require specific features or who are used to the functionality of other digital payment methods.

- Dependence on Facebook: Messenger Payments are tied to Facebook, which can be a drawback for individuals who are concerned about data privacy or who prefer not to use Facebook.

Drawbacks for Businesses

Messenger Payments also have some drawbacks for businesses.

- Limited Reach: While Messenger Payments can reach a wider customer base, it is still limited to individuals who use Facebook Messenger. This can be a drawback for businesses that target a broader audience or who rely on traditional payment methods.

- Customer Support: Businesses may encounter challenges with customer support related to Messenger Payments, as they may need to rely on Facebook’s support systems.

- Integration Costs: Businesses may need to invest in integrating Messenger Payments into their existing systems, which can involve costs and technical challenges.

Impact of Messenger Payments on NYC Businesses

Messenger Payments have brought a wave of change to NYC’s bustling business landscape, particularly for small businesses. The convenience and accessibility offered by this payment method have opened up new avenues for growth and customer engagement.

Increased Sales and Improved Customer Engagement

Messenger Payments have facilitated a seamless and convenient way for customers to make purchases, resulting in increased sales for many NYC businesses. The ability to pay directly within a familiar messaging platform eliminates the need for customers to switch apps or websites, creating a frictionless experience that encourages impulse purchases and repeat business. Furthermore, businesses can leverage the platform’s interactive features to send personalized messages, promotions, and updates to their customers, fostering a stronger connection and encouraging repeat business.

Challenges in Adopting and Integrating Messenger Payments

While the benefits of Messenger Payments are undeniable, businesses in NYC have encountered challenges in adopting and integrating this payment method into their operations.

- Technical Integration: Integrating Messenger Payments into existing point-of-sale systems or online platforms can be technically complex, requiring businesses to invest in new software or updates, which can be costly and time-consuming.

- Security Concerns: Some businesses are hesitant to adopt Messenger Payments due to concerns about data security and the potential for fraudulent transactions. While Facebook has implemented robust security measures, some businesses may still have reservations.

- Limited Functionality: Messenger Payments currently offer limited functionality compared to traditional payment methods, such as the inability to process refunds or handle complex transactions. This limitation can be a barrier for businesses with specific needs.

Successful Businesses Leveraging Messenger Payments

Despite the challenges, several businesses in NYC have successfully leveraged Messenger Payments to enhance their customer experience and drive sales.

- Local Cafes and Restaurants: Many cafes and restaurants in NYC have integrated Messenger Payments into their ordering systems, allowing customers to place orders and pay directly through Messenger. This streamlined process has reduced wait times and increased customer satisfaction.

- Retail Stores: Some retail stores in NYC have implemented Messenger Payments for in-store purchases, allowing customers to skip the checkout line and pay directly through their phones. This has improved the customer experience and reduced wait times, particularly during peak hours.

- Service Businesses: Service businesses like hair salons and barbershops have found Messenger Payments to be a convenient way for customers to book appointments and pay for services. The platform’s ability to send appointment reminders and promotional offers has also been beneficial.

Security and Privacy Considerations of Messenger Payments in NYC

The increasing popularity of messenger payments in NYC has raised concerns about the security and privacy of user data. While these platforms offer convenience, it’s essential to understand the potential risks involved and take steps to protect your information.

Security Measures Implemented by Messenger Payment Providers

Messenger payment providers are implementing various security measures to safeguard user data and prevent fraud.

- Encryption: Most messenger payment platforms use end-to-end encryption to protect transactions and prevent unauthorized access to sensitive information. This means that only the sender and receiver can view the transaction details.

- Two-factor Authentication (2FA): 2FA adds an extra layer of security by requiring users to enter a unique code sent to their mobile device in addition to their password. This makes it more difficult for unauthorized individuals to access accounts.

- Fraud Detection Systems: Messenger payment providers utilize sophisticated algorithms and machine learning to detect suspicious activity and prevent fraudulent transactions. These systems analyze transaction patterns, user behavior, and other data points to identify potential threats.

- Secure Payment Gateways: These platforms often partner with established payment processors that have robust security measures in place, ensuring the secure transmission of financial information.

Potential Risks Associated with Using Messenger Payments, Messenger payments nyc

Despite the security measures in place, there are still potential risks associated with using messenger payments.

- Data Breaches: While rare, data breaches can occur at any company, including messenger payment providers. If a breach happens, user data, including financial information, could be compromised.

- Phishing Scams: Scammers may attempt to trick users into providing their login credentials or financial information through fake websites or messages that appear to be from legitimate messenger payment providers.

- Identity Theft: If a user’s account is compromised, their identity could be stolen, leading to financial loss and other issues.

Recommendations for Minimizing Security Risks

To minimize security risks when using messenger payments in NYC, follow these recommendations:

- Use Strong Passwords: Create strong and unique passwords for your messenger payment accounts, combining uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessed information like your birthdate or pet’s name.

- Enable Two-Factor Authentication: Always enable 2FA on your messenger payment accounts for an extra layer of protection.

- Be Cautious of Links and Attachments: Never click on suspicious links or open attachments from unknown senders, as they could contain malware or phishing scams.

- Monitor Your Account Activity: Regularly review your account activity for any unusual transactions or unauthorized access. Report any suspicious activity to the messenger payment provider immediately.

- Keep Your Software Updated: Ensure that your devices and apps are up-to-date with the latest security patches to protect against known vulnerabilities.

Future Trends in Messenger Payments in NYC

Messenger payments in NYC are poised for significant growth and evolution, driven by a confluence of technological advancements, evolving consumer preferences, and a supportive regulatory environment. The city’s dynamic tech scene, coupled with its diverse population and thriving business landscape, presents fertile ground for the expansion of mobile payment solutions.

The Rise of New Payment Options and Technologies

The future of messenger payments in NYC is likely to be characterized by the emergence of innovative payment options and technologies.

- Biometric Authentication: Expect to see a greater reliance on biometric authentication, such as facial recognition and fingerprint scanning, for secure and seamless transactions. This will enhance security and convenience, making payments even faster and more user-friendly.

- Voice-Activated Payments: Voice assistants like Siri and Alexa are already integrated into everyday life, and their role in payments is expected to expand. Users will be able to make purchases simply by speaking commands, further streamlining the payment process.

- Near-Field Communication (NFC) Integration: NFC technology is already widely used for contactless payments, and its integration into messenger platforms will enable users to make payments with a simple tap of their phones. This will make payments even more convenient and accessible.

The Impact of Cryptocurrency and Blockchain on Messenger Payments

Cryptocurrency and blockchain technology are expected to have a profound impact on the future of messenger payments in NYC.

- Decentralized Payments: Blockchain technology can facilitate decentralized payment systems, reducing reliance on traditional financial institutions. This could lead to faster, cheaper, and more transparent transactions.

- Increased Security: Blockchain’s inherent security features, such as encryption and immutability, can enhance the security of messenger payments, making them more resistant to fraud and data breaches.

- New Payment Options: Stablecoins, a type of cryptocurrency pegged to fiat currencies like the US dollar, could emerge as popular payment options within messenger platforms, offering greater stability and price predictability.

Regulatory Changes and Their Implications

Regulatory changes play a crucial role in shaping the future of messenger payments in NYC.

- Data Privacy Regulations: The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have already raised awareness about data privacy, and future regulations are likely to further emphasize the importance of protecting user data. This will necessitate increased transparency and accountability from messenger payment providers.

- Financial Regulations: Regulatory frameworks governing financial institutions and payment processors are evolving to keep pace with technological advancements. Expect to see more specific guidelines and regulations governing messenger payments, ensuring consumer protection and financial stability.

- Open Banking Initiatives: Open banking initiatives, which allow consumers to share their financial data with third-party apps, could lead to new opportunities for messenger payments. This could enable users to make payments directly from their bank accounts within messaging platforms.

As the landscape of messenger payments continues to evolve, NYC remains at the forefront of this technological revolution. With the emergence of new payment options, increased security measures, and the potential integration of blockchain technology, the future of money in the city looks bright. Whether it’s sending money to friends, paying for a coffee, or making a business transaction, messenger payments are transforming the way we interact with our finances, making the city a more connected and dynamic place to live, work, and play.

So, you’re thinking about using Messenger Payments in NYC? That’s cool, but maybe you’d rather grab a new console instead. The white Xbox One is back in a new bundle check it out here ! But hey, if you’re all about digital convenience, Messenger Payments is a solid choice for sending money to friends and family.

Just make sure you have a secure connection before you start transferring funds!

Standi Techno News

Standi Techno News