One click checkout bolt another round of layoffs – One-Click Checkout Bolt: Another Round of Layoffs sets the stage for a story about the turbulent world of e-commerce and the ever-shifting landscape of the tech industry. In a world where convenience reigns supreme, Bolt, the company that promised to revolutionize online checkout, has found itself facing the harsh realities of a changing market. As layoffs ripple through the tech sector, Bolt joins a growing list of companies grappling with economic headwinds, market shifts, and the need to adapt to a new era of digital commerce.

The rise of Bolt’s one-click checkout solution was a beacon of hope for businesses looking to streamline their checkout process and boost conversion rates. But in a world where growth is often measured in exponential terms, the company’s recent layoffs paint a picture of a company struggling to keep pace with the demands of a rapidly evolving industry. This story is a cautionary tale about the fragility of success in the tech world and the challenges of navigating a market that is constantly in flux.

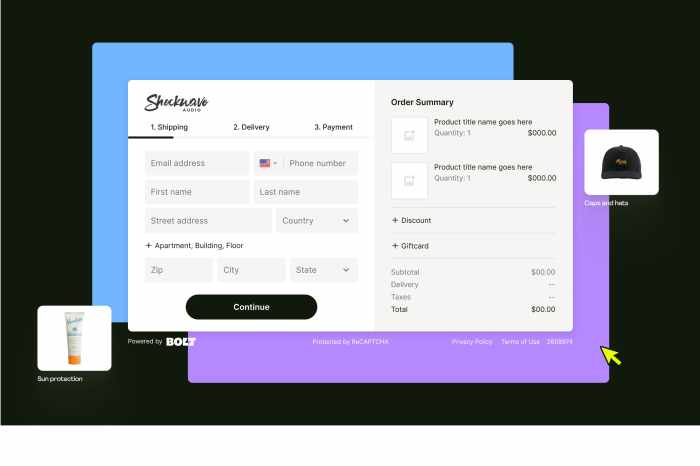

Bolt’s One-Click Checkout

In today’s fast-paced digital world, convenience is king. Consumers demand seamless online experiences, and one-click checkout solutions are emerging as a game-changer in the e-commerce landscape. Bolt, a leading provider of one-click checkout technology, is making waves by simplifying the checkout process and enhancing customer satisfaction.

Impact on Customer Conversion Rates

Bolt’s one-click checkout solution has a significant impact on customer conversion rates. By eliminating the need for customers to enter their payment and shipping information repeatedly, Bolt streamlines the checkout process, making it faster and easier for customers to complete their purchases. Studies have shown that one-click checkout solutions can lead to a substantial increase in conversion rates, often exceeding 20%. This is because they reduce friction and eliminate potential roadblocks that can deter customers from completing their purchases.

Enhancement of Online Shopping Experiences

Bolt’s technology not only improves conversion rates but also enhances the overall online shopping experience. Customers appreciate the convenience and speed of one-click checkout, which allows them to purchase items quickly and effortlessly. This streamlined experience reduces shopping cart abandonment rates, as customers are less likely to leave their carts unfinished if the checkout process is simple and efficient.

Bolt has experienced significant growth in recent years, solidifying its position as a leader in the payments industry. The company has attracted a large customer base, including major retailers and e-commerce platforms. This growth can be attributed to the increasing demand for one-click checkout solutions and the effectiveness of Bolt’s technology. The company’s market share is expected to continue expanding as more businesses adopt its innovative solution.

Layoffs in the Tech Industry

The tech industry has been hit hard by a wave of layoffs in recent months, with companies like Bolt joining a growing list of those cutting jobs. While these layoffs may seem like isolated incidents, they reflect broader trends and challenges facing the sector.

Reasons for Layoffs

Layoffs in the tech industry are driven by a complex interplay of factors, including economic conditions, market shifts, and company-specific strategies.

- Economic Downturn: The global economic slowdown has led to reduced consumer spending and business investment, impacting tech companies’ revenue streams. The Federal Reserve’s aggressive interest rate hikes have also contributed to a tighter credit market, making it harder for tech companies to raise capital. For example, Bolt, which relies heavily on venture capital funding, has been impacted by the reduced availability of capital.

- Market Saturation and Competition: The tech sector is characterized by rapid innovation and fierce competition. As markets become saturated, companies are forced to cut costs and streamline operations to stay ahead of the curve. Bolt, for instance, faces competition from established players like Amazon and PayPal in the payments space, necessitating a focus on efficiency and cost optimization.

- Overhiring during the Pandemic: Many tech companies aggressively hired during the pandemic, fueled by a surge in demand for digital services. However, as the pandemic subsided and growth slowed, some companies found themselves with bloated workforces and had to adjust their headcount. This is a factor that has contributed to layoffs at Bolt and other tech companies.

Bolt’s Layoffs

The recent round of layoffs at Bolt, a leading fintech company, has sent shockwaves through the tech industry, highlighting the ongoing challenges and uncertainties faced by businesses in the current economic climate. These layoffs, while unfortunate for the affected employees, are a reflection of the broader industry trends and the need for companies to adapt and optimize their operations for long-term sustainability.

Factors Contributing to Bolt’s Layoffs

Bolt’s decision to conduct layoffs can be attributed to a confluence of factors, including:

- Economic Downturn: The global economic landscape has been marked by rising inflation, interest rate hikes, and a potential recession, leading to a slowdown in consumer spending and a cautious approach to investments. This has impacted the fintech sector, forcing companies to reassess their growth strategies and prioritize profitability.

- Competition in the Fintech Market: The fintech industry is highly competitive, with numerous players vying for market share. The intense competition has put pressure on companies to innovate and deliver compelling value propositions to attract and retain customers. In this environment, companies like Bolt need to streamline their operations and optimize resources to maintain their competitive edge.

- Shifting Consumer Preferences: Consumer preferences are constantly evolving, and fintech companies need to adapt to these changes. The rise of digital-first banking and the growing adoption of alternative payment methods have forced companies to rethink their strategies and invest in new technologies. Bolt’s layoffs may reflect its efforts to align its workforce with these evolving market dynamics.

Impact of Layoffs on Bolt’s Operations

The layoffs are likely to have a significant impact on Bolt’s operations, including:

- Reduced Workforce: The reduction in workforce will inevitably affect the company’s overall capacity and efficiency. It may lead to a decrease in the speed of product development and implementation, as well as a potential slowdown in customer support and service.

- Reorganization and Restructuring: The layoffs are likely to be accompanied by a reorganization and restructuring of Bolt’s operations. This could involve reallocating resources, streamlining processes, and potentially consolidating certain departments. These changes may lead to temporary disruptions in operations, but ultimately aim to optimize efficiency and reduce costs.

- Impact on Product Development: The layoffs may affect Bolt’s product development roadmap, particularly if key personnel involved in innovation and engineering are impacted. The company may need to prioritize its product development efforts and focus on core offerings, potentially delaying or scaling back the development of new features or functionalities.

Consequences for Bolt’s Customers, Partners, and Employees

The layoffs at Bolt will have consequences for various stakeholders:

- Customers: Customers may experience a potential decline in customer support and service levels, as the reduced workforce may result in longer wait times and delayed responses. However, Bolt is expected to prioritize customer satisfaction and maintain its service quality despite the layoffs.

- Partners: Bolt’s partners, including merchants and financial institutions, may be impacted by the layoffs, particularly if key personnel responsible for partnerships are affected. The company will need to ensure continuity in its partnerships and maintain strong relationships with its stakeholders.

- Employees: The layoffs will have a significant impact on the affected employees, who may face job insecurity and financial hardship. Bolt is likely to provide severance packages and support to affected employees during their transition.

The Future of One-Click Checkout and Payments: One Click Checkout Bolt Another Round Of Layoffs

The world of online payments is evolving rapidly, driven by a growing demand for faster, more convenient, and secure checkout experiences. One-click checkout solutions are at the forefront of this evolution, streamlining the purchasing process and offering a seamless experience for consumers.

The Evolving Landscape of Online Payments

The online payments landscape is constantly changing, shaped by factors like technological advancements, evolving consumer preferences, and the rise of new payment methods. Traditional payment methods, like credit cards, are being challenged by newer alternatives, such as mobile wallets, buy now, pay later (BNPL) options, and cryptocurrencies. This shift is driven by a desire for greater convenience, flexibility, and security.

The Competitive Landscape of the Payments Industry

The payments industry is highly competitive, with several key players vying for market share. Some of the major players include:

- PayPal: A leading online payment processor, PayPal offers a wide range of services, including one-click checkout, merchant services, and peer-to-peer payments.

- Stripe: A popular platform for online businesses, Stripe provides tools for managing payments, subscriptions, and fraud prevention.

- Amazon Pay: Amazon’s payment platform allows users to make purchases on websites and apps using their Amazon account information.

- Apple Pay: Apple’s mobile payment service enables users to make purchases using their iPhone, Apple Watch, or iPad.

- Google Pay: Google’s mobile payment service allows users to make purchases using their Android device or Google account.

These companies are continuously innovating and developing new features to enhance the user experience and attract more customers. For example, PayPal has introduced features like Pay Later and Venmo, while Stripe has focused on expanding its international reach and offering new payment options.

Bolt’s Potential Roadmap, One click checkout bolt another round of layoffs

Given the current market dynamics and technological advancements, Bolt’s potential roadmap could focus on:

- Expanding its One-Click Checkout Solution: Bolt can focus on expanding its one-click checkout solution to support more payment methods, including BNPL options and cryptocurrencies. This would provide greater flexibility and convenience for consumers.

- Strengthening its Merchant Partnerships: Bolt can expand its merchant network by partnering with businesses across various industries. This would increase the reach of its one-click checkout solution and generate more revenue.

- Investing in Innovation: Bolt can invest in research and development to explore new technologies and features that could enhance the user experience and improve security. This could include exploring the use of artificial intelligence (AI) for fraud prevention and personalized payment recommendations.

- Focusing on Data Analytics: Bolt can leverage data analytics to gain insights into consumer behavior and preferences. This information can be used to optimize the checkout process and offer personalized recommendations.

By focusing on these areas, Bolt can position itself for continued growth in the evolving online payments landscape.

The story of Bolt’s layoffs is a microcosm of the larger narrative playing out in the tech industry. As companies grapple with economic uncertainties and market shifts, the need for agility and innovation becomes paramount. The future of one-click checkout and the broader payments landscape remains uncertain, but one thing is clear: the companies that can adapt and innovate will be the ones to thrive in this ever-changing digital world.

One-click checkout and Bolt are just the latest casualties in the tech world’s layoff frenzy. But while some companies are cutting back, others are doubling down on innovation, like those developing generative AI copilots to boost productivity. Check out best practices for developing a generative AI copilot for business to see how these tools can help businesses navigate these turbulent times.

Perhaps one-click checkout and Bolt might have survived if they had embraced the power of AI to optimize their operations and anticipate market shifts.

Standi Techno News

Standi Techno News