Personal Finance Monarch Intuit Mint: these three names represent a significant shift in how we manage our money. The personal finance landscape has been revolutionized by tools like Mint, empowering individuals to take control of their financial lives. But how does Mint stack up against newer players like Monarch? This article delves into the world of personal finance management, comparing these two platforms and exploring their impact on financial literacy and behavior.

The rise of fintech has given birth to a plethora of personal finance tools, each vying for a piece of the market. Mint, a popular choice for years, faces competition from newcomers like Monarch, which boasts advanced features and a more modern approach. This article explores the strengths and weaknesses of both platforms, examining their user interfaces, data security, and impact on financial literacy. We’ll also discuss how these tools are shaping the way people think about money and influencing their financial decisions.

Personal Finance Landscape: Personal Finance Monarch Intuit Mint

The way we manage our money has undergone a dramatic transformation, fueled by the rise of technology and changing consumer behaviors. From the days of paper-based checkbooks and manual budgeting to the digital age of online banking, mobile apps, and AI-powered financial advisors, the personal finance landscape has evolved significantly.

Evolution of Personal Finance Management Tools

The evolution of personal finance management tools has been a journey from basic calculators and spreadsheets to sophisticated software platforms that offer a wide range of features.

- Early Days: In the pre-digital era, personal finance management relied heavily on manual methods, such as pen and paper, calculators, and simple spreadsheets. These tools were often limited in functionality and required significant manual effort.

- The Rise of Personal Finance Software: The introduction of personal finance software in the late 20th century marked a turning point. Programs like Quicken and Microsoft Money provided automated features for tracking expenses, managing budgets, and analyzing financial data. These programs helped users gain better control over their finances and make more informed financial decisions.

- The Fintech Revolution: The emergence of fintech companies in the 21st century further revolutionized personal finance management. Fintech apps like Mint, Personal Capital, and YNAB leveraged technology to offer innovative solutions for budgeting, investing, and debt management. These apps are typically user-friendly, accessible on mobile devices, and integrate with financial institutions to provide real-time data.

These advancements in personal finance management tools have significantly impacted consumer behavior. Users are now more empowered to track their finances, set financial goals, and make informed decisions about their money. The accessibility and convenience of these tools have led to increased financial awareness and engagement among consumers.

Key Trends Shaping the Personal Finance Landscape

The personal finance landscape is constantly evolving, driven by technological advancements, changing consumer preferences, and regulatory shifts. Here are some key trends shaping the industry:

- The Rise of Fintech: Fintech companies are disrupting traditional financial institutions by offering innovative and user-friendly solutions for managing money. These companies are leveraging technology to provide services like budgeting, investing, lending, and insurance, often at lower costs and with greater convenience than traditional banks.

- Mobile Banking: The widespread adoption of smartphones and tablets has fueled the growth of mobile banking. Mobile banking apps offer a wide range of features, including account management, bill pay, money transfers, and investment management. This convenience and accessibility have made mobile banking the preferred method for many consumers.

- Financial Literacy Initiatives: There is a growing emphasis on improving financial literacy among consumers. Governments, financial institutions, and non-profit organizations are launching initiatives to educate people about personal finance topics, such as budgeting, saving, investing, and debt management. These initiatives aim to empower consumers to make informed financial decisions and achieve their financial goals.

Competitive Landscape of Personal Finance Software

The personal finance software market is highly competitive, with a wide range of players offering different features and pricing models. Some of the leading players in the market include:

- Mint: Mint is a popular free personal finance app that provides budgeting, expense tracking, and financial insights. It is known for its user-friendly interface and integration with various financial institutions.

- Personal Capital: Personal Capital offers a free financial management platform that provides investment tracking, budgeting, and retirement planning tools. It also offers premium services, including financial advisory and wealth management.

- YNAB (You Need a Budget): YNAB is a subscription-based budgeting app that emphasizes a zero-based budgeting approach. It helps users track their income and expenses, plan for future spending, and achieve their financial goals.

- Quicken: Quicken is a long-established personal finance software that offers a wide range of features, including budgeting, bill pay, investment tracking, and tax preparation. It is available as a subscription-based service.

The competitive landscape is constantly evolving, with new players entering the market and existing players introducing new features and services. This competition is driving innovation and pushing the boundaries of what personal finance software can do.

Monarch and Intuit: A Comparative Analysis

Both Monarch and Intuit Mint are popular personal finance management tools that offer a range of features to help users track their spending, manage their budgets, and achieve their financial goals. However, they differ in their approaches, target audiences, and capabilities. This comparative analysis will delve into the strengths and weaknesses of each platform, examining their target audiences, pricing models, user interfaces, feature sets, and integration capabilities.

Target Audience and Pricing

Monarch and Mint cater to different segments of the personal finance market, with distinct pricing models reflecting their target audience. Monarch, with its premium features and comprehensive financial planning tools, targets individuals seeking sophisticated financial management solutions. Mint, on the other hand, caters to a broader audience, offering a free, user-friendly platform for basic budgeting and expense tracking.

- Monarch: Monarch’s target audience includes individuals with complex financial situations, such as those with multiple investment accounts, real estate holdings, or significant debt. Its subscription-based model, with a monthly fee, reflects the value it provides through advanced features and personalized financial advice.

- Mint: Mint’s free, ad-supported model makes it accessible to a wide range of users, including those new to personal finance management. Its focus on simplicity and ease of use makes it an attractive option for individuals looking for basic budgeting and expense tracking tools.

User Interface and Features

Monarch and Mint offer distinct user interfaces and feature sets, reflecting their target audience and pricing models. Monarch’s interface is designed for users seeking a comprehensive and customizable experience, while Mint’s interface prioritizes simplicity and ease of use.

- Monarch: Monarch’s user interface is designed for users seeking a comprehensive and customizable experience. It offers a wide range of features, including budgeting, expense tracking, investment management, debt management, and financial planning tools. Its advanced features include personalized financial advice, goal setting, and portfolio analysis.

- Mint: Mint’s user interface is designed for simplicity and ease of use. Its focus on basic budgeting and expense tracking makes it an attractive option for users new to personal finance management. While it offers a range of features, it lacks the depth and sophistication of Monarch’s offerings.

Integration Capabilities

Both Monarch and Mint offer integration capabilities with other financial institutions and services, allowing users to connect their accounts and consolidate their financial data. However, the scope and depth of their integrations differ, reflecting their target audience and pricing models.

- Monarch: Monarch offers a wider range of integrations, including support for a variety of financial institutions, investment platforms, and credit card providers. Its comprehensive integrations allow users to connect all their accounts and gain a complete picture of their financial situation.

- Mint: Mint’s integration capabilities are more limited than Monarch’s, with a focus on supporting common financial institutions and services. Its integrations are sufficient for basic budgeting and expense tracking but may not meet the needs of users with complex financial situations.

Key Features and Benefits of Mint

Mint is a popular personal finance management tool that helps users track their spending, budget, and investments. It offers a wide range of features, designed to simplify financial management and promote financial well-being.

Core Features of Mint

Mint provides a comprehensive suite of tools for managing personal finances. Its core features include:

- Budgeting: Mint allows users to create personalized budgets based on their income and expenses. Users can set spending limits for various categories, such as groceries, dining, and entertainment, and track their progress toward their financial goals.

- Expense Tracking: Mint automatically tracks expenses by connecting to users’ bank accounts, credit cards, and other financial institutions. This provides a detailed overview of spending patterns and helps users identify areas where they can cut back.

- Bill Payment Reminders: Mint sends timely reminders about upcoming bills, helping users avoid late fees and maintain good credit scores.

- Credit Monitoring: Mint offers free credit monitoring, which allows users to track their credit score and identify any potential issues, such as fraudulent activity.

- Investment Tracking: Mint enables users to track their investments, including stocks, mutual funds, and retirement accounts. This provides a centralized view of portfolio performance and helps users make informed investment decisions.

Benefits of Using Mint

Using Mint can offer significant benefits for managing personal finances:

- Increased Financial Awareness: By providing a clear picture of income, expenses, and financial goals, Mint helps users become more aware of their financial situation and make informed decisions.

- Improved Budgeting: Mint’s budgeting tools enable users to create realistic budgets and track their progress, leading to better financial control and potentially reducing debt.

- Potential Savings: By identifying areas of overspending and suggesting ways to save money, Mint can help users reduce unnecessary expenses and accumulate wealth.

- Improved Credit Score: Mint’s credit monitoring feature can help users identify and address any issues that may be negatively impacting their credit score, leading to better borrowing terms and lower interest rates.

- Convenience and Time Savings: Mint automates many financial tasks, such as expense tracking and bill payment reminders, saving users time and effort.

Potential Limitations of Mint

While Mint offers numerous benefits, it also has some limitations:

- Data Security Concerns: Like any online financial service, Mint requires users to share sensitive financial information, which raises concerns about data security and potential breaches.

- Reliance on Third-Party Data: Mint relies on data provided by financial institutions, which may not always be accurate or up-to-date. This can lead to discrepancies in expense tracking and other features.

- Limited Customization Options: Mint offers a limited degree of customization for budgeting and other features, which may not suit all users’ needs.

- Lack of Advanced Features: Mint does not offer advanced features such as financial planning, investment advice, or tax preparation, which may be necessary for some users.

User Experience and Interface

Mint’s user interface is designed with simplicity and ease of use in mind. It’s intuitive, accessible, and navigates smoothly, making it an attractive option for users of all technical skill levels.

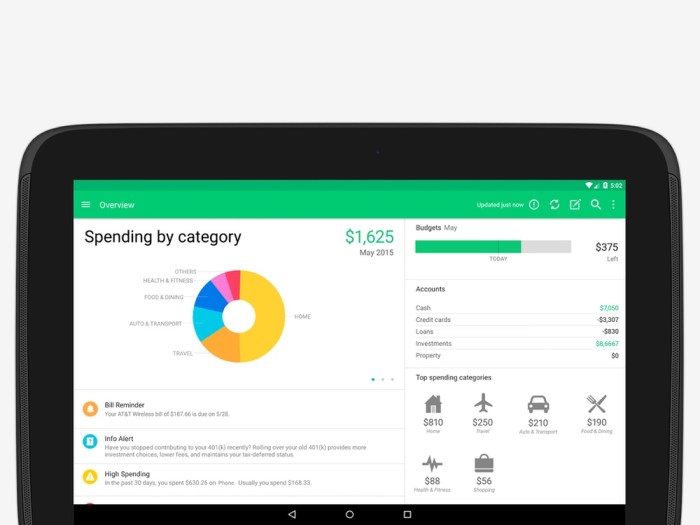

Mint’s user interface is praised for its intuitive design. The platform is organized logically, with clear menus and easy-to-understand icons. Users can quickly find the information they need, whether it’s their account balances, transaction history, or spending insights. This intuitive design makes Mint a user-friendly platform, even for those who are new to personal finance management tools.

Accessibility Features

Mint offers various accessibility features to cater to a wider user base. These features include:

- Screen reader compatibility: Mint’s interface is designed to be compatible with screen readers, allowing visually impaired users to access and manage their finances effectively.

- Keyboard navigation: Users can navigate through the platform using their keyboard, making it accessible to those who may have difficulty using a mouse.

- Adjustable text size: Users can adjust the text size to their preference, enhancing readability for individuals with visual impairments.

Mobile App Functionality

Mint’s mobile app is a key component of its user experience. It provides users with on-the-go access to their finances, allowing them to track spending, manage budgets, and receive alerts. The app is designed to be user-friendly and visually appealing, offering a seamless experience across devices. The app’s functionality includes:

- Real-time transaction updates: Users can view their latest transactions as they occur, providing an up-to-date picture of their financial status.

- Budgeting and goal tracking: Users can set budgets and track their progress towards financial goals, such as saving for a house or paying off debt.

- Personalized insights and recommendations: The app analyzes spending patterns and offers personalized recommendations to help users improve their financial habits.

User Feedback and Reviews

Mint’s user interface and overall user experience have received generally positive feedback from users. Many praise the platform’s simplicity, ease of use, and helpful features. Users appreciate the clear visualizations, personalized insights, and mobile app functionality, which contribute to a positive user experience.

“Mint is a great tool for anyone looking to take control of their finances. It’s easy to use, provides helpful insights, and is available on both desktop and mobile.” – A satisfied Mint user

While Mint’s user experience is generally well-received, some users have expressed concerns about certain aspects, such as:

- Occasional glitches and bugs: Some users have reported experiencing occasional glitches or bugs within the platform, which can impact the user experience.

- Limited customization options: While Mint offers some customization options, some users have expressed a desire for more flexibility in tailoring the platform to their specific needs.

- Privacy concerns: As with any financial management tool, there are concerns about the privacy of user data. Mint’s privacy policy should be carefully reviewed before using the platform.

Impact on Financial Literacy and Behavior

Mint and similar personal finance tools are like having a personal financial coach in your pocket. They provide a wealth of information, insights, and tools to help you understand your finances and make better decisions. By tracking your income and expenses, analyzing spending patterns, and offering personalized recommendations, these tools empower you to take control of your financial future.

Financial Literacy Enhancement

Mint and similar tools play a crucial role in enhancing financial literacy by making complex financial concepts accessible and engaging.

- Visualizing spending patterns: Mint’s intuitive dashboards and charts provide a clear visual representation of your spending habits, helping you identify areas where you might be overspending. This visual approach makes it easier to grasp your financial situation and make informed decisions.

- Categorizing expenses: Mint automatically categorizes your transactions, providing a breakdown of where your money is going. This categorization helps you understand your spending habits and identify potential areas for improvement.

- Budgeting and goal setting: Mint allows you to set budgets and financial goals, helping you stay on track and achieve your financial aspirations. By setting clear targets and tracking your progress, you gain a sense of control over your finances and are more likely to achieve your financial goals.

- Financial education resources: Many personal finance tools offer access to educational resources, articles, and videos that provide valuable insights into financial concepts, investment strategies, and debt management techniques.

Future Trends and Innovations

The realm of personal finance management is poised for a dramatic transformation driven by the relentless advancements in artificial intelligence (AI), machine learning (ML), and data analytics. These technologies are set to revolutionize how individuals manage their finances, offering unprecedented levels of automation, personalization, and insights.

AI-Powered Financial Assistants, Personal finance monarch intuit mint

The integration of AI into personal finance platforms will usher in a new era of intelligent financial assistants. These assistants will leverage advanced algorithms to analyze financial data, identify spending patterns, and provide personalized recommendations for budgeting, saving, and investing. They will proactively alert users to potential risks, such as overspending or missed payments, and offer tailored solutions to mitigate these risks. For example, AI-powered assistants could analyze spending patterns and suggest budget adjustments based on individual financial goals and income fluctuations.

In the end, the best personal finance tool is the one that aligns with your individual needs and preferences. Both Mint and Monarch offer valuable features and insights, but they cater to different user demographics. By understanding their strengths and limitations, you can choose the platform that best suits your financial goals and helps you achieve financial freedom.

Mastering personal finance with tools like Mint by Intuit is a game-changer, especially when you’re looking for ways to save money. But sometimes, even the best financial planning can be thrown off by unexpected expenses, like needing to upgrade your phone. Thankfully, the ATT LG G3 getting VoLTE in a new software update might be a good reason to hold off on that upgrade for a while.

That’s because with VoLTE, you’ll be able to enjoy better call quality and faster connection speeds, which means you can save on your monthly phone bill in the long run. So, while Mint can help you stay on top of your finances, a little tech upgrade can help you save money too!

Standi Techno News

Standi Techno News