Prevu Hopes Cash Back Rebates Will Help Sell Homes Online. In a market where online real estate platforms are vying for attention, Prevu is making a bold move with its new cash back rebate program. This program aims to incentivize homebuyers by offering a portion of their commission back to them, making the homebuying process more financially attractive. But is this strategy enough to stand out in a crowded market?

The program works by connecting buyers with agents who are willing to share their commission. Buyers receive a cash back rebate directly from Prevu after closing, essentially reducing the overall cost of purchasing a home. While this might seem like a simple concept, it has the potential to reshape the online real estate landscape. Prevu believes that by offering this financial incentive, they can attract more buyers to their platform and make the homebuying process more accessible for a wider audience.

Prevu’s Cash Back Rebates

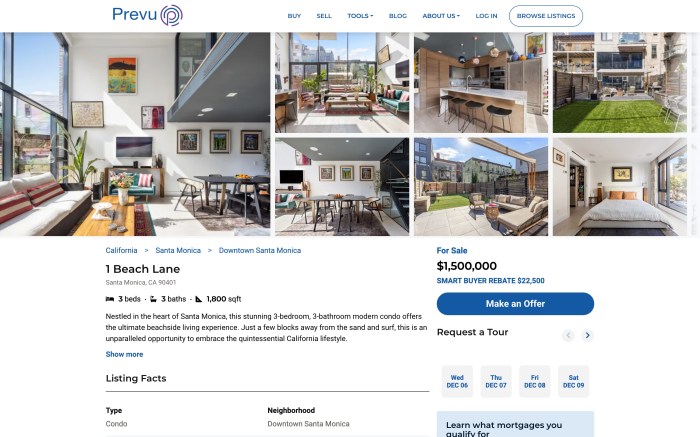

In the ever-evolving landscape of real estate, where online platforms are gaining traction, Prevu stands out with its innovative approach to incentivizing homebuyers. The company offers cash back rebates to buyers, effectively reducing their overall costs and making the homebuying process more appealing.

Prevu’s Cash Back Rebates Explained

Prevu’s cash back rebate program works by returning a percentage of the buyer’s commission back to them. This rebate is typically a fixed percentage, such as 1% or 2%, of the final purchase price. For example, on a $500,000 home, a 1% rebate would equate to $5,000 back in the buyer’s pocket.

Benefits for Homebuyers

Prevu’s cash back rebates offer several advantages for homebuyers, including:

* Reduced Costs: The most significant benefit is the direct financial savings. By receiving a portion of the commission back, buyers can effectively lower their overall homebuying expenses. This can be particularly helpful in competitive markets where buyers may need to make larger down payments or cover closing costs.

* Enhanced Affordability: The cash back rebates can make homeownership more attainable for buyers, especially those with limited financial resources. The extra money can be used to cover other expenses, such as renovations or furniture.

* Simplified Process: Prevu’s online platform streamlines the homebuying process, eliminating the need for traditional real estate agents. Buyers can search for properties, schedule showings, and make offers directly through the platform.

Benefits for Sellers

While the program primarily benefits buyers, sellers also gain advantages:

* Wider Reach: Prevu’s platform connects sellers with a larger pool of potential buyers, as the cash back incentives attract more interested parties. This can lead to faster sales and potentially higher offers.

* Reduced Marketing Costs: By using Prevu’s platform, sellers can save on marketing expenses that they would typically incur with traditional real estate agents.

* Streamlined Transactions: Prevu’s platform simplifies the selling process, allowing sellers to manage their listings and communicate with potential buyers easily.

Comparison with Other Real Estate Platforms

While other real estate platforms offer cash back or similar incentives, Prevu’s approach stands out in several ways:

* Transparency: Prevu is upfront about its fees and rebate structure, providing buyers with clear information about the program’s terms and conditions.

* User-Friendly Platform: Prevu’s online platform is designed for ease of use, allowing buyers and sellers to navigate the process efficiently.

* Strong Customer Support: Prevu offers dedicated customer support to assist users with any questions or concerns they may have throughout the homebuying process.

The Impact of Cash Back Rebates on Online Homebuying Behavior

Cash back rebates, particularly in the online real estate market, can significantly influence buyer decision-making. These rebates act as a financial incentive, potentially tipping the scales in favor of a particular platform or agent offering them.

Potential Influence on Buyer Decision-Making

Cash back rebates can directly impact a buyer’s decision-making process in the online real estate market. They offer a tangible financial benefit, making a platform or agent more attractive compared to those without such programs.

- Increased Affordability: Cash back rebates can effectively reduce the overall cost of buying a home, making it more accessible to a wider range of buyers. For instance, a buyer receiving a rebate of $5,000 on a $500,000 home effectively reduces their upfront costs by 1%, potentially allowing them to qualify for a larger mortgage or afford a more expensive property.

- Enhanced Value Perception: Buyers often perceive cash back rebates as an added value proposition, making the platform or agent offering them seem more competitive. This perception can influence their decision, even if the difference in price or service is minimal compared to other options.

- Incentivized Exploration: Cash back rebates can encourage buyers to explore platforms or agents they might not have considered otherwise. The financial incentive acts as a catalyst, prompting them to investigate and compare different options, potentially leading to a wider selection of properties and a more informed decision.

Potential Concerns and Drawbacks

While cash back rebates offer attractive benefits, buyers might have concerns or perceive drawbacks associated with them.

- Transparency and Complexity: Buyers may be concerned about the transparency and complexity of the rebate program. They might question how the rebate is calculated, what conditions apply, and how it is ultimately received. A lack of clarity or complicated terms can deter buyers from participating.

- Potential for Hidden Costs: Some buyers might be skeptical about the true cost of the service, suspecting that the rebate is offset by higher fees or commissions elsewhere. This skepticism can arise from past experiences with hidden fees or unclear pricing structures in other industries.

- Impact on Service Quality: Buyers might worry that the focus on cash back rebates might compromise the quality of service provided. They may fear that the agent’s primary motivation is to close deals quickly, potentially neglecting personalized attention and expert advice.

Prevu’s cash back rebate program can effectively attract new customers and increase market share in the online real estate market. The program’s structure and benefits can appeal to a wider audience, potentially driving significant growth.

- Targeting Budget-Conscious Buyers: Prevu’s program directly targets budget-conscious buyers who are seeking ways to maximize their savings. By offering a tangible financial benefit, Prevu positions itself as a cost-effective and attractive option compared to traditional real estate agents.

- Enhancing Brand Recognition: The cash back rebate program can act as a powerful marketing tool, increasing brand recognition and attracting new customers. The program’s unique selling proposition can differentiate Prevu from competitors, generating buzz and attracting attention in the online real estate space.

- Building Customer Loyalty: By providing a valuable financial incentive, Prevu can foster customer loyalty. Buyers who have experienced the benefits of the program are more likely to recommend it to friends and family, generating organic growth and positive word-of-mouth marketing.

Prevu’s Business Strategy and Future Prospects: Prevu Hopes Cash Back Rebates Will Help Sell Homes Online

Prevu’s business model is built on disrupting the traditional real estate industry by offering a more transparent and cost-effective approach to home buying and selling. The company targets tech-savvy and cost-conscious consumers, particularly millennials and Gen Z, who are comfortable with online transactions and appreciate the potential for significant savings.

Prevu’s Cash Back Rebates and Its Business Strategy, Prevu hopes cash back rebates will help sell homes online

Prevu’s cash back rebates are a key component of its overall strategy for online real estate. By offering cash back to buyers, Prevu incentivizes them to use its platform, attracting a larger customer base and generating more revenue. The rebates also differentiate Prevu from traditional real estate agents, positioning it as a more affordable and consumer-friendly option. This approach aligns with Prevu’s mission to make the homebuying process more accessible and transparent for everyone.

The Potential Impact of Prevu’s Cash Back Program on the Industry

Prevu’s cash back program has the potential to significantly impact the real estate industry in the long term. The program could:

- Increase competition: Traditional real estate agents may face pressure to adapt their pricing models and services to compete with Prevu’s value proposition.

- Shift consumer behavior: More homebuyers may choose to work with online platforms like Prevu, leading to a decrease in reliance on traditional agents.

- Drive innovation: The success of Prevu’s cash back program could encourage other real estate companies to explore similar strategies, leading to greater innovation in the industry.

The Future of Online Real Estate

The online real estate market is evolving rapidly, driven by technological advancements and changing consumer preferences. The integration of technology is streamlining the homebuying process, making it more accessible and efficient for buyers and sellers alike. Prevu’s cash back program plays a significant role in this evolving landscape, offering a unique incentive that further empowers online homebuyers.

Virtual Tours and 3D Modeling

Virtual tours and 3D modeling are revolutionizing how people experience properties online. They allow potential buyers to virtually walk through a property from the comfort of their own homes, getting a realistic sense of its layout, features, and overall feel. This technology eliminates the need for multiple in-person viewings, saving time and effort for both buyers and sellers.

AI-Powered Property Search

Artificial intelligence (AI) is transforming the way people search for properties. AI-powered platforms can analyze vast amounts of data to understand individual preferences and match buyers with properties that align with their specific needs and criteria. This personalized approach helps streamline the search process, ensuring that buyers only see properties that are relevant to their interests.

Streamlining the Homebuying Process

Technology is simplifying various aspects of the homebuying process, making it more efficient and less stressful. Online platforms offer tools for managing offers, scheduling inspections, and handling paperwork, reducing the need for manual processes and face-to-face interactions. This digital transformation allows buyers and sellers to complete transactions more efficiently and with greater transparency.

Prevu’s Cash Back Program: A Catalyst for Change

Prevu’s cash back program is a unique offering that is shaping the online real estate market. By providing buyers with a financial incentive to purchase homes online, Prevu is encouraging the adoption of digital platforms and driving the shift towards a more efficient and accessible homebuying experience. This program is not only beneficial for buyers but also for real estate agents, who can reach a wider audience and attract more clients through Prevu’s platform.

Prevu’s cash back rebate program is a clever strategy that could potentially disrupt the online real estate market. It addresses a key concern for many homebuyers: the cost of buying a home. By offering a financial incentive, Prevu is aiming to attract a larger customer base and increase their market share. Whether this strategy will be successful in the long run remains to be seen, but it certainly presents an interesting approach to a rapidly evolving industry.

Prevu hopes their cash back rebates will entice buyers to take the plunge into the online home buying world. It’s a smart move, considering the increasing popularity of remote work, which is being facilitated by companies like RemotePass, a platform that helps companies onboard, manage pay, and retain remote workers. RemotePass recently raised $5.5 million to further develop their platform, highlighting the growing demand for tools that support remote workforces.

This trend could lead to more people relocating and potentially buying homes online, making Prevu’s strategy even more relevant.

Standi Techno News

Standi Techno News