PulseWallet Technology

PulseWallet is a revolutionary payment system that allows users to pay for goods and services by simply scanning their wrist. This innovative approach eliminates the need for traditional payment methods like credit cards or mobile wallets, providing a seamless and secure payment experience.

PulseWallet’s Wrist-Scanning Technology

PulseWallet utilizes advanced biometric technology to identify users and process payments. The wrist-scanning system employs a combination of near-field communication (NFC) and biometrics to ensure secure and accurate transactions.

- Near-Field Communication (NFC): NFC technology enables wireless communication between two devices that are in close proximity. PulseWallet’s wrist-scanning device utilizes NFC to communicate with payment terminals, allowing for contactless transactions.

- Biometrics: PulseWallet incorporates biometrics to authenticate users and prevent unauthorized access. The system uses a combination of fingerprint and vein pattern recognition to verify the user’s identity. This unique combination of biometric features makes it highly difficult for unauthorized individuals to access the user’s account.

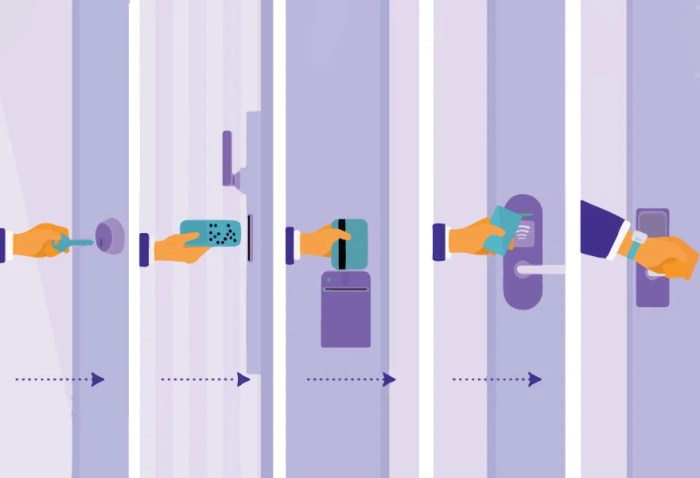

PulseWallet’s Technology Compared to Other Contactless Payment Methods

PulseWallet’s wrist-scanning technology offers several advantages over other contactless payment methods, such as:

- Enhanced Security: Biometric authentication provides a higher level of security compared to traditional PIN-based authentication or contactless cards.

- Convenience: Users can easily make payments without having to carry their wallets or phones.

- Hygienic: PulseWallet’s wrist-scanning system eliminates the need to touch payment terminals, reducing the risk of spreading germs.

Examples of PulseWallet’s Applications

PulseWallet’s technology can be integrated into various scenarios, such as:

- Retail Stores: Customers can pay for their purchases by simply scanning their wrists at the checkout counter.

- Public Transportation: Users can use PulseWallet to pay for bus, train, and subway fares.

- Event Ticketing: Event organizers can use PulseWallet to streamline ticket purchases and access control.

User Experience: Pulsewallet Lets You Pay For Items By Scanning Your Wrist

PulseWallet offers a unique and potentially convenient way to pay for goods and services by simply scanning your wrist. But how does it actually work, and what are the benefits and drawbacks of using this technology? Let’s delve into the user experience of PulseWallet.

Setting Up and Using PulseWallet

Setting up PulseWallet involves a few simple steps. First, you need to download the PulseWallet app on your smartphone. Then, you’ll be required to link your bank account or a preferred payment method to the app. Next, you’ll need to pair your wristband with the app, which typically involves scanning a QR code on the band. Once paired, you can add funds to your PulseWallet account, and you’re ready to make payments.

To make a payment, you simply need to scan your wrist at the point of sale. The PulseWallet app will then communicate with the merchant’s system, deducting the payment amount from your PulseWallet account. This process is designed to be fast and seamless, eliminating the need for cash, cards, or even your phone.

Advantages of Paying with PulseWallet

- Convenience: PulseWallet offers a hands-free payment experience, eliminating the need to fumble for cash or cards. It’s especially useful in situations where your hands are full, like carrying groceries or holding a baby.

- Security: PulseWallet utilizes advanced encryption and authentication measures to protect your payment information. The wristband itself doesn’t store any sensitive data, and payments are only authorized with your smartphone’s approval.

- Speed: PulseWallet payments are typically processed quickly, potentially faster than traditional card payments, reducing waiting times at checkout.

- Contactless: PulseWallet promotes contactless payments, which is especially beneficial during times of heightened hygiene concerns, such as pandemics.

Disadvantages of Paying with PulseWallet

- Limited Acceptance: PulseWallet is a relatively new technology, and not all merchants currently accept it. This means you might encounter situations where you can’t use PulseWallet to pay.

- Dependence on Technology: PulseWallet requires a functioning smartphone and a charged wristband. If either fails, you won’t be able to make payments.

- Privacy Concerns: Some users may have privacy concerns about using a technology that tracks their payments and location through the wristband. It’s important to research the company’s privacy policies and data security measures before using PulseWallet.

Real-World Scenarios for PulseWallet

- Grocery Shopping: Imagine effortlessly paying for your groceries with a quick scan of your wrist while juggling bags and children.

- Public Transportation: PulseWallet could be used to pay for bus or train fares, eliminating the need for tickets or separate payment methods.

- Cafes and Restaurants: Order your coffee or meal and pay without fumbling for your wallet, making the process smoother and faster.

- Events and Festivals: PulseWallet could be used to purchase tickets, merchandise, and food and drinks at events, streamlining the experience.

Security and Privacy

PulseWallet is designed to prioritize the security of your financial information and transactions. The platform employs a multi-layered security approach, ensuring that your data is protected from unauthorized access and misuse.

Security Measures Implemented by PulseWallet

PulseWallet utilizes a combination of advanced security measures to safeguard your data and transactions. These include:

- Biometric Authentication: PulseWallet uses your unique wrist scan as your primary authentication method. This provides a highly secure and convenient way to access your account and authorize transactions.

- End-to-End Encryption: All data transmitted between your device and PulseWallet’s servers is encrypted using industry-standard encryption protocols. This prevents unauthorized access to your data during transmission.

- Secure Data Storage: Your personal information and transaction history are stored securely on PulseWallet’s servers, which are protected by multiple layers of security, including firewalls, intrusion detection systems, and regular security audits.

- Two-Factor Authentication: You can further enhance the security of your PulseWallet account by enabling two-factor authentication (2FA). This adds an extra layer of protection by requiring you to enter a unique code sent to your mobile device in addition to your wrist scan.

Potential Privacy Concerns

While PulseWallet prioritizes user privacy, there are potential concerns associated with wrist-scanning payment systems:

- Data Collection: PulseWallet collects data about your transactions, including the date, time, location, and amount of each purchase. This data could be used for marketing purposes or sold to third-party advertisers.

- Privacy of Biometric Data: Your wrist scan is a unique biometric identifier that could be used to track your movements and spending habits. This data could be potentially misused or stolen if the PulseWallet system is compromised.

- Data Breaches: Like any online platform, PulseWallet is susceptible to data breaches. If a breach occurs, your personal information, including your wrist scan, could be compromised.

Best Practices for Users

To ensure the security of your PulseWallet account, follow these best practices:

- Protect Your Wrist Scan: Keep your wrist scan confidential and do not share it with anyone.

- Use Strong Passwords: If you choose to use a password in addition to your wrist scan, create a strong and unique password that is difficult to guess.

- Enable Two-Factor Authentication: Enable 2FA to add an extra layer of security to your account.

- Monitor Your Account Activity: Regularly review your transaction history for any suspicious activity.

- Report Suspicious Activity: If you notice any suspicious activity on your account, contact PulseWallet customer support immediately.

Market Impact and Future Potential

PulseWallet, with its innovative wrist-scanning payment technology, has the potential to significantly disrupt the payments industry and reshape how we interact with commerce. By seamlessly integrating payment functionality into a ubiquitous accessory like a wristwatch, PulseWallet promises a future where transactions are faster, more secure, and more convenient than ever before.

Market Impact and Implications for the Payments Industry

PulseWallet’s potential market impact is far-reaching, impacting both consumers and businesses alike. Its seamless integration with everyday life could lead to a surge in contactless payments, potentially reducing reliance on traditional payment methods like credit cards and cash. This shift could have several implications for the payments industry:

- Increased Adoption of Contactless Payments: PulseWallet’s convenience and security features could drive a significant increase in contactless payments, leading to a more efficient and streamlined payment experience for consumers.

- Reduced Transaction Costs: By eliminating the need for physical cards or cash handling, PulseWallet could reduce transaction costs for both businesses and consumers, leading to greater affordability and accessibility.

- Enhanced Security: The biometrics-based security of PulseWallet could potentially reduce fraud and unauthorized transactions, creating a safer and more secure payment environment.

- New Opportunities for Businesses: PulseWallet’s integration with wearable technology could open up new opportunities for businesses to engage with customers and offer personalized experiences based on real-time data and preferences.

Future Applications and Advancements of Wrist-Scanning Payment Technology

The potential applications of wrist-scanning payment technology extend beyond simple transactions. As the technology evolves, we can expect to see a range of innovative use cases emerge, transforming various aspects of our lives:

- Micropayments and Subscription Services: PulseWallet’s ability to process micropayments could facilitate seamless subscriptions for services like streaming platforms, public transportation, and recurring bills.

- Integrated Loyalty Programs and Rewards: Wrist-scanning technology could be integrated with loyalty programs, allowing for personalized rewards and discounts based on purchase history and preferences.

- Enhanced Security Features: Future iterations of PulseWallet could incorporate advanced security features like multi-factor authentication and dynamic PIN generation, further enhancing the security of transactions.

- Integration with Smart Homes and Devices: Wrist-scanning technology could be integrated with smart home devices and appliances, enabling seamless payments for utilities, services, and purchases within the home.

Benefits and Challenges of Widespread Adoption, Pulsewallet lets you pay for items by scanning your wrist

The widespread adoption of PulseWallet presents both potential benefits and challenges:

| Benefits | Challenges |

|---|---|

| Increased convenience and speed of payments | Privacy concerns related to biometric data collection and usage |

| Reduced transaction costs and increased affordability | Potential for technical glitches and security vulnerabilities |

| Enhanced security and reduced fraud | Need for widespread infrastructure and device compatibility |

| New opportunities for businesses and personalized experiences | Accessibility for individuals without compatible devices |

Ethical Considerations

The integration of biometrics into payment systems, like PulseWallet, raises several ethical considerations that need careful examination. While the convenience and security of wrist-scanning payments are undeniable, it is crucial to address potential concerns regarding privacy, accessibility, and the potential for social and economic disparities.

Privacy and Data Security

The use of biometrics in payment systems raises significant privacy concerns. PulseWallet, by design, collects and stores sensitive biometric data, specifically wrist scans. The security of this data is paramount, as unauthorized access or breaches could lead to identity theft and financial fraud.

- Data Storage and Encryption: Robust data encryption and secure storage mechanisms are essential to prevent unauthorized access and protect user privacy. This includes ensuring that data is stored securely and only accessible by authorized personnel.

- Data Retention and Deletion: Clear policies regarding data retention and deletion are necessary. Users should have the right to know how long their biometric data is stored and how it is used. They should also have the option to request the deletion of their data.

- Data Sharing and Transparency: PulseWallet should be transparent about how biometric data is used and shared. Users need to understand with whom their data is shared and for what purposes. Clear consent mechanisms should be in place to ensure that users are fully informed before providing their biometric data.

Accessibility and Inclusivity

While PulseWallet aims to create a more convenient and secure payment experience, it is crucial to consider the accessibility and inclusivity of the technology for individuals with disabilities. Not everyone has the same physical capabilities, and a payment system that relies on wrist scanning may inadvertently exclude certain individuals.

- Physical Limitations: Individuals with certain physical limitations, such as limited hand mobility or specific medical conditions, may find it challenging or impossible to use PulseWallet.

- Alternative Payment Methods: PulseWallet should offer alternative payment methods to ensure inclusivity for individuals who cannot utilize wrist-scanning technology. This could include traditional payment methods like cards or mobile wallets.

- Adaptive Design: PulseWallet should consider adaptive design principles to make the technology accessible to individuals with disabilities. This could involve features like voice commands or alternative input methods.

Social and Economic Impacts

The widespread adoption of wrist-scanning payments could have significant social and economic implications. While it offers convenience and security, it is essential to consider potential disparities and the impact on vulnerable populations.

- Digital Divide: Access to technology, including smartphones and wearable devices, is not universal. Individuals without access to these devices may be excluded from using PulseWallet, widening the digital divide and exacerbating existing inequalities.

- Economic Impact on Vulnerable Groups: The adoption of wrist-scanning payments could potentially disadvantage vulnerable groups, such as individuals without bank accounts or those with limited access to technology.

- Job Displacement: The automation of payments through biometrics could lead to job displacement in industries that rely on traditional payment methods. This could have a significant impact on employment opportunities and economic stability.

Pulsewallet lets you pay for items by scanning your wrist – PulseWallet is more than just a convenient way to pay. It’s a glimpse into the future of finance, a future where technology seamlessly integrates with our lives. As the technology continues to evolve, we can expect even more innovative applications of wrist-scanning payment systems. From personalized shopping experiences to enhanced security measures, the possibilities are endless. So, the next time you reach for your wallet, think about the potential of PulseWallet. It might just be the key to unlocking a more convenient, secure, and personalized financial future.

Imagine a world where you can pay for your morning coffee just by scanning your wrist. PulseWallet makes this futuristic vision a reality, and it’s not just for coffee! You can use it to buy everything from groceries to gadgets. It’s like having your wallet strapped to your wrist, but without the bulky wallet. Remember when Nintendo ramped up Switch production in 2018 nintendo ramp up switch production 2018 to meet the overwhelming demand?

That’s the kind of impact PulseWallet could have on the payments industry, making transactions smooth and seamless for everyone.

Standi Techno News

Standi Techno News