Raising Series A funding is a pivotal moment for any startup. It’s the point where you’ve proven your initial concept, built a solid team, and are ready to scale your business to the next level. But securing this crucial funding isn’t a walk in the park. It requires a well-crafted pitch, a compelling financial model, and a deep understanding of the investor landscape. Think of it as a high-stakes poker game where your cards are your product, your team, and your market opportunity.

This article will guide you through the intricacies of raising Series A funding, from understanding the process to navigating the challenges and maximizing your chances of success. We’ll delve into the key milestones, the investor landscape, and the crucial steps involved in securing the capital you need to take your startup to the next level.

Understanding Series A Funding: Raising Series A Funding

Series A funding is a crucial milestone for startups, representing a significant investment that propels them toward sustainable growth and market dominance. It signifies a vote of confidence from investors who believe in the company’s potential to disrupt existing markets or create new ones.

Characteristics of a Company Seeking Series A Funding

A company seeking Series A funding typically exhibits a set of key characteristics that demonstrate its readiness for this next stage of growth.

- Product-Market Fit: The company has validated its product or service through initial customer traction and feedback, demonstrating a strong understanding of its target market and the value proposition it offers.

- Proven Business Model: The company has a clear and demonstrable business model, outlining its revenue streams, cost structure, and overall profitability potential.

- Strong Team: The company boasts a talented and experienced team with a proven track record in their respective fields, capable of executing the company’s vision and navigating the challenges of rapid growth.

- Growth Potential: The company demonstrates significant potential for scalability and market expansion, with a clear roadmap for achieving future milestones and increasing market share.

Key Milestones Before Seeking Series A Funding

Before seeking Series A funding, startups should achieve a set of critical milestones to demonstrate their readiness for investment.

- Minimum Viable Product (MVP): The company has developed and launched a working version of its product or service, gathering initial user feedback and validating its core value proposition.

- Early Customer Acquisition: The company has secured a base of early adopters or customers, generating initial revenue and demonstrating product-market fit.

- Financial Projections: The company has developed robust financial projections outlining its revenue, expenses, and profitability over the next few years.

- Team Building: The company has assembled a core team with the skills and experience necessary to execute its growth strategy and navigate the challenges of scaling the business.

- Legal and Regulatory Compliance: The company has established the necessary legal and regulatory framework to operate its business, including intellectual property protection, data privacy compliance, and other relevant regulations.

The Series A Funding Process

Raising Series A funding is a significant milestone for any startup, marking a transition from early-stage development to a more mature and scalable business. It involves a structured process that requires careful planning, execution, and a deep understanding of the investor landscape.

The Series A Funding Process Steps

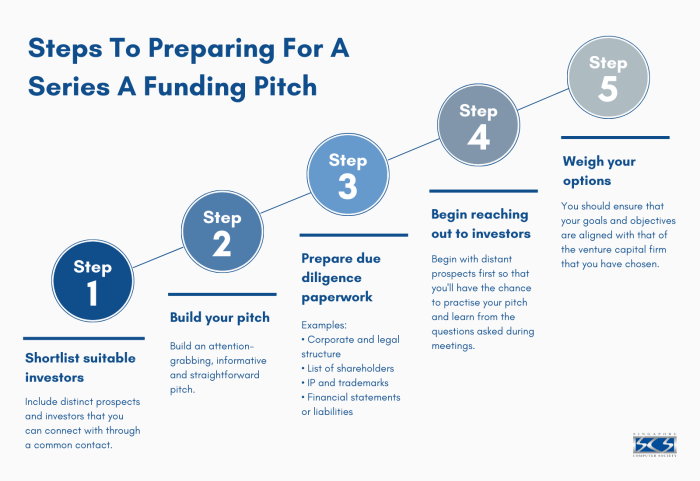

The Series A funding process is a structured journey that involves several key steps, each requiring careful attention and execution.

- Preparation: This stage involves defining your company’s goals, outlining your fundraising strategy, and creating a compelling pitch deck. You should also ensure your financial statements are up-to-date and accurate.

- Investor Outreach: Once your preparation is complete, you can begin reaching out to potential investors. This can be done through networking, attending industry events, and utilizing online platforms. Building relationships with investors is crucial, as it can lead to introductions and potential funding opportunities.

- Pitching and Due Diligence: Once you’ve secured a meeting with an interested investor, you’ll need to deliver a compelling pitch. This should highlight your company’s vision, market opportunity, team, and financial projections. If the investor is interested, they will conduct due diligence, which involves a thorough review of your company’s financials, business model, and legal documents.

- Negotiation and Term Sheet: If due diligence is successful, you will enter into negotiations with the investor to finalize the terms of the funding agreement. This will be documented in a term sheet, which Artikels the amount of funding, valuation, equity stake, and other key terms.

- Closing the Round: Once the term sheet is agreed upon, the final step is to close the round. This involves legal documentation, shareholder agreements, and the transfer of funds.

The Role of Investors and Venture Capitalists

Investors play a crucial role in the Series A funding process, providing capital to help startups grow and scale their businesses. They also bring valuable expertise, industry connections, and strategic guidance. Venture capitalists are a common type of investor in Series A rounds.

- Venture capitalists typically invest in early-stage companies with high growth potential. They often have a deep understanding of the startup ecosystem and can provide valuable insights and connections.

- Angel investors are individuals who invest their own money in startups. They are often entrepreneurs or experienced business professionals with a strong network and a desire to support early-stage innovation.

- Corporate venture capitalists are venture capital funds established by large corporations. They are interested in investing in companies that complement their existing business or provide access to new technologies.

- Family offices are private wealth management firms that invest on behalf of high-net-worth individuals and families. They often have a long-term investment horizon and can provide significant capital.

Preparing for Series A Funding

The journey to secure Series A funding is a crucial step for any startup aiming to scale. It requires meticulous preparation, ensuring your company is ready to impress investors and secure the necessary capital. This involves crafting a compelling pitch deck, demonstrating a robust financial model, and developing a compelling narrative that highlights your unique value proposition.

Creating a Comprehensive Pitch Deck

A pitch deck is your opportunity to showcase your company’s vision, market opportunity, and financial projections to potential investors. It should be concise, visually appealing, and tell a compelling story.

- Start with a strong opening slide: This should capture attention and clearly define your company’s mission and value proposition. Think of it as your elevator pitch in a single slide.

- Present your market opportunity: Highlight the size and growth potential of your target market. Demonstrate your understanding of the market dynamics and how your company fits within the landscape.

- Showcase your product or service: Clearly explain what you offer, its key features, and how it solves a specific problem or meets a specific need.

- Present your team: Investors want to see a strong team with relevant experience and expertise. Highlight the skills and backgrounds of your key personnel.

- Demonstrate traction and early success: Showcase any milestones, customer acquisition, or revenue generated to date. This provides evidence of your company’s progress and potential.

- Artikel your financial projections: Present realistic and well-supported financial projections, including revenue, expenses, and profitability. Investors need to see a clear path to profitability and potential for strong returns.

- Conclude with a call to action: Clearly state what you are seeking from investors, the amount of funding, and how they can participate in your company’s growth story.

Developing a Strong Financial Model

A robust financial model is essential to demonstrate the company’s growth potential and profitability. It provides investors with a clear picture of your financial health and future projections.

- Start with a detailed revenue model: Artikel how you plan to generate revenue, including your pricing strategy, customer acquisition costs, and sales projections.

- Map out your expenses: Include all operating expenses, such as salaries, marketing, rent, and technology.

- Project your profitability: Develop a clear picture of your company’s expected profitability over time, including key metrics like gross margin and net income.

- Show sensitivity analysis: Demonstrate how your projections might change under different scenarios, such as varying market conditions or changes in customer acquisition costs. This shows investors that you have considered potential risks and contingencies.

Building a Compelling Narrative

Beyond the numbers, investors want to hear a compelling narrative that showcases your company’s unique value proposition and competitive advantage.

- Highlight your unique selling proposition: What makes your company different and better than the competition?

- Demonstrate your competitive advantage: What are your key differentiators? Why should investors choose to invest in your company over others in the same space?

- Tell a story that resonates: Use your pitch deck to weave a compelling narrative that captures the attention of investors and inspires them to believe in your vision.

- Be authentic and passionate: Investors can sense genuine enthusiasm and belief in your product or service.

Securing Series A Funding

Securing Series A funding is a crucial step for any startup looking to scale its operations and achieve significant growth. This stage involves convincing investors to provide the necessary capital to expand your business, but it also requires careful negotiation and strategic planning. Here’s a breakdown of the key elements involved in securing Series A funding.

Identifying Potential Investors and Building Relationships

Identifying potential investors is a crucial step in the Series A fundraising process. It involves researching and understanding the investor landscape, identifying investors who align with your company’s vision and goals, and building relationships with them.

- Researching the Investor Landscape: Start by identifying investors who have a history of investing in companies similar to yours. Explore venture capital firms, angel investors, and other potential sources of funding. Utilize online resources, industry publications, and network with other entrepreneurs to gather information about potential investors.

- Identifying Investors Who Align with Your Vision: Look for investors who understand your industry, your target market, and your company’s long-term goals. Their expertise and connections can be invaluable to your growth.

- Building Relationships: Building relationships with potential investors takes time and effort. Attend industry events, reach out to investors through networking platforms, and actively engage with them.

Negotiating the Terms of the Funding Agreement

Once you have identified potential investors, it’s time to negotiate the terms of the funding agreement. This involves determining the valuation of your company, the equity stake investors will receive, and the level of control they will have.

- Valuation: The valuation of your company is a critical factor in determining the terms of the funding agreement. It reflects the perceived value of your business and the potential for future growth.

- Equity: Investors will typically receive equity in your company in exchange for their investment. This represents a portion of ownership in your business.

- Control: The level of control investors have in your company can vary depending on the terms of the agreement. This can include voting rights, board representation, and other aspects of decision-making.

Closing the Funding Round and Securing the Capital

Once the terms of the funding agreement have been negotiated, it’s time to close the funding round and secure the necessary capital for growth. This involves legal documentation, due diligence, and finalizing the investment.

- Legal Documentation: A legal team will draft and review all necessary documents, including the term sheet, the investment agreement, and any other relevant documents.

- Due Diligence: Investors will conduct due diligence to verify the information you have provided about your company. This includes reviewing financial statements, examining your business model, and assessing your team’s capabilities.

- Finalizing the Investment: Once due diligence is complete, investors will finalize the investment and provide the agreed-upon capital.

Post-Series A Funding

Securing Series A funding is a major milestone for any startup. But it’s just the beginning. The real work starts after you’ve closed the deal. This is when you need to focus on using the funds wisely to scale your business, build a strong team, and achieve sustainable growth.

Strategic Fund Allocation

The first step after securing Series A funding is to allocate the funds strategically. This means identifying the key areas where the money will have the biggest impact on your company’s growth.

- Product Development: Investing in product development is crucial for enhancing features, improving user experience, and expanding your product offerings. This could involve hiring additional engineers, investing in research and development, or scaling your infrastructure to handle increased demand.

- Marketing and Sales: With Series A funding, you can ramp up your marketing and sales efforts to reach a wider audience and drive customer acquisition. This could include launching targeted advertising campaigns, expanding your sales team, or investing in content marketing initiatives.

- Team Expansion: Building a strong team is essential for scaling your business. Series A funding allows you to hire key personnel in areas like engineering, product management, marketing, and sales.

- Operational Efficiency: Investing in operational efficiency can help streamline your processes, reduce costs, and improve overall productivity. This could involve implementing new software tools, automating tasks, or optimizing your supply chain.

Establishing Key Performance Indicators

Once you’ve allocated your funds, it’s essential to establish key performance indicators (KPIs) to track your progress and measure success. KPIs provide tangible metrics that help you assess the effectiveness of your strategies and make data-driven decisions.

- Customer Acquisition Cost (CAC): This metric tracks how much you spend to acquire a new customer. By analyzing your CAC, you can identify areas for improvement in your marketing and sales efforts.

- Customer Lifetime Value (CLTV): This metric measures the total revenue you generate from a single customer over their relationship with your company. A high CLTV indicates that your customers are satisfied and loyal, which is essential for sustainable growth.

- Monthly Recurring Revenue (MRR): This metric tracks the recurring revenue generated from your subscriptions or recurring services. A consistent increase in MRR signifies a healthy and growing business.

- Burn Rate: This metric measures the rate at which your company is spending cash. Monitoring your burn rate is crucial for ensuring you have enough runway to achieve profitability.

Building a Strong Team and Culture

A strong team is the backbone of any successful company. After securing Series A funding, you have the opportunity to build a talented and motivated team that can drive your business forward.

- Hiring: Invest in hiring the right people with the skills and experience needed to execute your growth plans. Focus on finding individuals who are passionate about your mission and who are a good cultural fit.

- Culture: Cultivate a positive and supportive work environment that encourages collaboration, innovation, and continuous learning. This will help attract and retain top talent.

- Leadership: Develop strong leadership within your team. This includes empowering your managers to lead effectively and fostering a culture of accountability and ownership.

Common Challenges in Raising Series A Funding

The journey to securing Series A funding can be a challenging one for startups. While a compelling idea and a strong team are crucial, numerous obstacles can stand in the way of securing investment. Understanding these challenges and developing strategies to overcome them is vital for increasing the likelihood of success.

The Competitive Landscape

The Series A funding landscape is highly competitive. Investors receive numerous pitches from startups vying for their capital. To stand out, startups need to demonstrate a compelling value proposition, a strong track record, and a clear path to profitability. Investors are looking for startups with a proven market fit, a differentiated product or service, and a team with the experience and expertise to execute their vision.

Factors Influencing Investor Decisions

Investors make decisions based on a combination of factors, including:

- Market Size and Growth: Investors seek startups operating in large and rapidly growing markets with significant potential for expansion.

- Product-Market Fit: A strong product-market fit demonstrates that the startup’s product or service addresses a real customer need and has a proven market demand.

- Team Experience and Expertise: Investors look for founders with relevant industry experience, a strong track record of success, and a team with complementary skills.

- Financial Projections and Metrics: Startups need to present realistic financial projections and key performance indicators (KPIs) that demonstrate their growth potential and profitability.

- Competitive Landscape: Investors assess the competitive landscape to understand the startup’s competitive advantages and its ability to differentiate itself from rivals.

- Exit Strategy: Investors want to see a clear path to liquidity, such as an IPO or acquisition, that will allow them to realize a return on their investment.

Overcoming Common Obstacles

- Lack of Traction: Startups often struggle to secure funding without significant traction or early customer adoption. To overcome this, consider building a minimum viable product (MVP) and focusing on acquiring early customers to demonstrate product-market fit.

- Weak Financial Projections: Realistic and well-supported financial projections are crucial for investors. Engage with financial advisors to develop accurate forecasts and demonstrate a clear path to profitability.

- Inadequate Team Experience: Investors prioritize startups with experienced founders and a strong team. Consider adding experienced advisors or mentors to your team to enhance credibility and expertise.

- Unclear Value Proposition: A clear and concise value proposition is essential for investors. Craft a compelling message that highlights the unique benefits of your product or service and resonates with your target audience.

- Limited Networking: Building a strong network of investors and advisors is vital for securing funding. Attend industry events, engage with angel investors, and leverage online platforms to connect with potential investors.

Case Studies of Successful Series A Funding Rounds

Successful Series A funding rounds are not just about luck. They are the result of careful planning, strategic execution, and a compelling story that resonates with investors. Understanding the factors that contributed to the success of other companies can provide valuable insights for your own fundraising journey.

Examples of Companies That Successfully Raised Series A Funding

The following companies are just a few examples of companies that have successfully raised Series A funding.

- Airbnb: The company raised $11 million in Series A funding in 2011, led by Sequoia Capital. Airbnb’s success was driven by its innovative business model, strong traction, and a clear vision for the future of travel. Airbnb’s founders had a strong understanding of the market and were able to articulate a compelling vision for how their platform would revolutionize the way people travel.

- Spotify: Spotify raised $100 million in Series A funding in 2008, led by Sequoia Capital. Spotify’s success was driven by its focus on user experience, its ability to build a strong brand, and its commitment to innovation. Spotify’s founders were able to create a product that was both user-friendly and engaging, which helped them to attract a large and loyal user base.

- Slack: Slack raised $25 million in Series A funding in 2014, led by Accel Partners. Slack’s success was driven by its ability to identify a clear market need, its rapid product development, and its strong team. Slack’s founders were able to build a product that solved a real problem for businesses, and they were able to execute quickly to capture market share.

Factors That Contributed to Their Success

Several key factors contributed to the success of these Series A funding rounds.

- Strong Team: Investors are looking for teams with a proven track record of success, a clear vision for the future, and a strong commitment to execution. The founders of these companies had the right mix of skills and experience to build successful businesses.

- Compelling Story: Investors want to invest in companies that have a clear vision and a compelling story. The founders of these companies were able to articulate their vision and their strategy for achieving it in a way that resonated with investors.

- Market Validation: Investors want to invest in companies that have a proven market need and a strong customer base. The founders of these companies were able to demonstrate that their products or services were in demand and that they had the potential to grow quickly.

- Strong Traction: Investors want to see evidence of progress and growth. The founders of these companies were able to demonstrate that they were making significant progress towards their goals and that they had the potential to scale their businesses quickly.

Strategies They Employed

The companies discussed above employed several strategies to secure Series A funding.

- Networking: The founders of these companies built strong relationships with investors and other key stakeholders in the industry. They attended industry events, met with potential investors, and cultivated a network of supporters.

- Pitching: The founders of these companies developed a compelling pitch that resonated with investors. They were able to articulate their vision, their strategy, and their traction in a clear and concise way.

- Due Diligence: The founders of these companies were prepared to answer questions from investors and provide them with the information they needed to make a decision. They were transparent about their business and their plans for the future.

- Negotiation: The founders of these companies were able to negotiate favorable terms with investors. They understood the market and they were able to secure funding that was aligned with their goals.

Insights From These Case Studies

These case studies provide valuable insights for future fundraising efforts.

- Focus on building a strong team: Investors are looking for teams with a proven track record of success, a clear vision for the future, and a strong commitment to execution.

- Develop a compelling story: Investors want to invest in companies that have a clear vision and a compelling story.

- Validate your market: Investors want to invest in companies that have a proven market need and a strong customer base.

- Demonstrate strong traction: Investors want to see evidence of progress and growth.

- Build relationships with investors: Networking is essential for securing funding.

- Develop a compelling pitch: Investors need to be convinced of your vision and your ability to execute.

- Be prepared for due diligence: Investors will want to see your financials and your business plan.

- Negotiate favorable terms: Make sure you understand the market and that you are getting a fair deal.

Resources for Series A Funding

Navigating the Series A funding landscape can feel like traversing a dense jungle. But with the right tools and guidance, you can chart a course to success. Here’s a breakdown of valuable resources to help you secure your Series A funding.

Industry Events

Attending industry events is crucial for connecting with potential investors, learning about market trends, and gaining valuable insights from experienced entrepreneurs. These events offer a platform to showcase your startup, network with investors, and gather valuable feedback.

- TechCrunch Disrupt: A globally recognized event showcasing the latest in technology and innovation. It offers opportunities to connect with investors, pitch your startup, and learn from industry leaders.

- Web Summit: A major tech conference attracting thousands of startups, investors, and industry experts. It provides a platform to network, learn, and pitch your startup to a global audience.

- SXSW: A renowned festival celebrating film, music, and interactive media, offering opportunities to connect with investors and explore new technologies.

- Startup Grind: A global startup community hosting events featuring entrepreneurs, investors, and mentors. It provides opportunities to connect with fellow entrepreneurs and learn from their experiences.

Mentorship Programs, Raising series a funding

Mentorship programs provide invaluable guidance and support from experienced entrepreneurs and investors. Mentors can offer advice on everything from building your business plan to navigating the fundraising process.

- Y Combinator: A renowned accelerator program providing funding and mentorship to early-stage startups.

- Techstars: A global network of accelerators offering mentorship, funding, and resources to startups.

- 500 Startups: A seed-stage venture capital firm providing funding and mentorship to startups globally.

- AngelList: An online platform connecting startups with investors and mentors. It offers mentorship programs and access to a network of experienced entrepreneurs.

Online Platforms

Online platforms offer a wealth of information, resources, and connections for startups seeking Series A funding. These platforms can provide access to investor databases, funding opportunities, and valuable insights.

- Crunchbase: A comprehensive database of startups, investors, and funding rounds. It provides valuable insights into the funding landscape and helps identify potential investors.

- AngelList: An online platform connecting startups with investors and mentors. It offers access to a database of investors, funding opportunities, and mentorship programs.

- SeedInvest: An equity crowdfunding platform allowing startups to raise capital from accredited investors. It provides access to a network of investors and resources for fundraising.

- Gust: A platform for startups to manage their fundraising process. It offers tools for creating pitch decks, managing investor relations, and tracking progress.

Navigating the Series A fundraising landscape requires strategic planning and execution. Here are some tips to maximize your success:

- Build a strong team: Investors prioritize strong leadership and a team with proven experience. Assemble a team with complementary skills and a shared vision for the future.

- Develop a compelling pitch deck: Your pitch deck is your first impression on potential investors. Create a concise and compelling presentation that highlights your business model, market opportunity, and team.

- Network with investors: Attend industry events, connect with investors online, and leverage your network to build relationships with potential investors.

- Be prepared to answer tough questions: Investors will scrutinize your business model, financials, and market opportunity. Be prepared to answer questions about your traction, competition, and long-term strategy.

- Negotiate effectively: Once you receive a term sheet, be prepared to negotiate the terms of the investment. Seek legal counsel to ensure you understand the implications of each clause.

Raising Series A funding is a critical step in a startup’s journey. It’s not just about getting money; it’s about gaining access to the expertise and networks of seasoned investors. By understanding the process, preparing thoroughly, and approaching the fundraising journey strategically, you can increase your chances of securing the resources needed to turn your vision into reality. Remember, it’s a marathon, not a sprint, and persistence, combined with a clear vision and a strong team, will be your greatest assets.

Raising Series A funding can be a real rollercoaster, but sometimes you just need to remember the basics. It’s all about finding investors who believe in your vision, just like AI models have favorite numbers because they think they’re people ! And once you’ve got that buy-in, it’s time to show them how your startup can truly disrupt the market and become the next big thing.

Standi Techno News

Standi Techno News