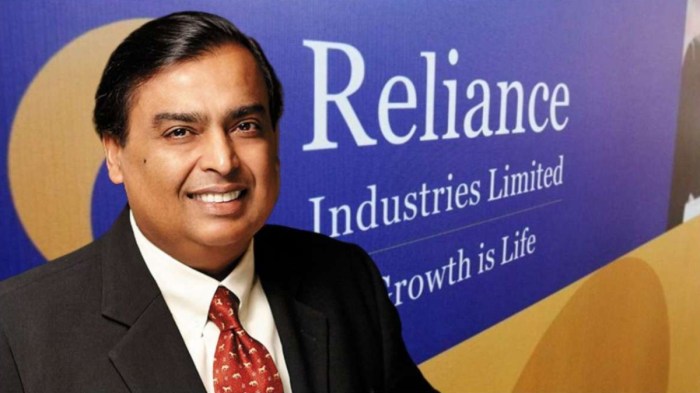

Reliance backed viacom18 agrees to buy 60 of disney india unit report says – Reliance-backed Viacom18 agrees to buy 60 of Disney India unit report says – a deal that’s shaking up the Indian media and entertainment landscape. This acquisition, if confirmed, would mark a significant shift in the industry, potentially leading to a wave of consolidation and competition among streaming platforms. The deal, reportedly worth billions of dollars, signals a major bet by Reliance on the future of the Indian media market.

The deal could see Viacom18, a joint venture between Reliance Industries and ViacomCBS, acquire a controlling stake in Disney Star India, the Indian subsidiary of The Walt Disney Company. This move would create a media powerhouse, combining Viacom18’s strong presence in television and digital with Disney’s vast content library and popular streaming platform, Disney+ Hotstar.

The Acquisition Deal

The Indian media and entertainment industry is witnessing a major shift with Reliance-backed Viacom18 acquiring a 60% stake in Disney India. This deal marks a significant move in the industry, with implications for both the companies involved and the broader landscape.

Financial Implications

The acquisition of Disney India by Viacom18 is a substantial financial transaction. For Reliance, this deal represents a significant investment in the media and entertainment sector, reinforcing their position as a major player in the Indian market. On the other hand, Disney’s decision to divest its stake in India aligns with their global strategy of focusing on core businesses and markets.

This deal signifies a strategic shift for both Reliance and Disney, reflecting their respective priorities and ambitions in the Indian media landscape.

Impact on the Indian Media and Entertainment Landscape

The acquisition of Disney India by Viacom18 is likely to have a significant impact on the Indian media and entertainment landscape. The combined entity will be a dominant force in the market, controlling a vast portfolio of assets, including popular streaming platforms, television channels, and production houses. This consolidation is expected to lead to increased competition in the market, as Viacom18 will have a larger reach and more resources to invest in content creation and distribution.

The acquisition is also likely to impact the Indian media and entertainment ecosystem. The combined entity will have a significant influence on content production and distribution, potentially impacting the careers of artists and creators.

This acquisition has the potential to reshape the Indian media and entertainment landscape, influencing content creation, distribution, and consumer choices.

The acquisition of Disney India by Reliance-backed Viacom18 is a significant event in the Indian media and entertainment landscape, potentially reshaping the competitive dynamics of the sector. Understanding the market share and competitive landscape before and after the acquisition is crucial to analyzing the potential impact of this deal.

The Indian media and entertainment sector is a diverse and dynamic market with various players competing for market share across different segments. Before the acquisition, Disney India and Viacom18 were already significant players in the market.

- Disney India, a subsidiary of The Walt Disney Company, held a substantial market share in the television broadcasting and film production segments. Its popular channels include Star Plus, Star Bharat, and Disney Channel, while its film production arm has produced successful films like “Dangal” and “Simmba.”

- Viacom18, a joint venture between Reliance Industries and ViacomCBS, was also a major player in the Indian media and entertainment sector, with a strong presence in television broadcasting, film production, and digital content. Its channels include Colors, MTV India, and Nickelodeon India, and it has produced successful films like “Bajirao Mastani” and “Tanhaji: The Unsung Warrior.”

Competitive Landscape Before the Acquisition

The Indian media and entertainment sector was already highly competitive before the acquisition, with several key players vying for market share.

- The primary competitors to Disney India and Viacom18 included Zee Entertainment Enterprises, Sony Pictures Networks India, and the Network18 Group.

- These companies competed across various segments, including television broadcasting, film production, and digital content.

- The competition was fierce, with companies constantly innovating and expanding their offerings to attract audiences.

Potential Challenges and Opportunities

The acquisition of Disney India by Viacom18 presents both challenges and opportunities for the combined entity.

- One potential challenge is the integration of the two companies’ operations and cultures.

- Another challenge is the potential for regulatory scrutiny, as the deal could raise concerns about market dominance.

- However, the acquisition also presents significant opportunities. The combined entity will have a larger market share, a wider range of content, and a stronger platform for distribution.

- This could enable the combined entity to compete more effectively against its rivals and expand its reach in the Indian market.

Content Strategy and Programming

The acquisition of Disney India’s unit by Reliance-backed Viacom18 is poised to significantly reshape the Indian media landscape, impacting both companies’ content strategies and programming. The combined entity will have a formidable content library and distribution network, allowing for greater reach and diverse offerings.

Content Synergies and Diversification

The deal promises a diverse range of content, merging Disney’s iconic franchises and family-friendly entertainment with Viacom18’s strong presence in local language content and youth-oriented programming. This strategic alliance will create a powerful force in the Indian entertainment industry.

- Expanded Content Library: The combined entity will boast a vast library of content, including Disney’s beloved characters like Mickey Mouse, Marvel superheroes, and Pixar animations. This will be complemented by Viacom18’s strong portfolio of local language content, popular reality shows, and youth-centric entertainment. This diverse content library will cater to a wider audience, strengthening both companies’ positions in the market.

- Enhanced Distribution Network: The acquisition will create a wider distribution network, encompassing television channels, digital streaming platforms, and theatrical releases. Viacom18’s strong presence in regional markets will benefit from Disney’s global reach, while Disney’s digital streaming platforms will gain access to Viacom18’s established local audience. This synergy will allow for greater reach and audience engagement.

- Cross-Promotional Opportunities: The combined entity will have significant opportunities for cross-promotion. Disney’s global franchises can be leveraged to promote Viacom18’s local content, while Viacom18’s established audience can be introduced to Disney’s popular characters and stories. This cross-promotion will drive viewership and generate revenue for both companies.

Digital Streaming and OTT Platforms

The Reliance-backed Viacom18’s acquisition of Disney India’s operations is a significant move in the Indian digital streaming and OTT landscape. This deal has the potential to reshape the competitive dynamics of the market, with implications for consumer choices, subscription models, and the overall content ecosystem.

Consolidation and Competition

The acquisition signifies a trend of consolidation in the Indian OTT market, where major players are seeking to expand their reach and market share. With Disney+ Hotstar joining Viacom18’s portfolio of streaming platforms, including JioCinema, Voot, and others, the combined entity will be a formidable force in the industry. This consolidation could lead to increased competition among streaming giants like Netflix, Amazon Prime Video, and others, pushing them to offer more compelling content and services to retain subscribers.

Impact on Consumer Choices and Subscription Models

The acquisition could lead to changes in consumer choices and subscription models. The combined platform will offer a wider range of content, including movies, TV shows, live sports, and regional language programming, attracting a broader audience. The bundling of multiple streaming services into one subscription package could also become a trend, offering value for money and simplifying consumer choices. This move could also influence subscription pricing strategies, with the potential for more affordable options or tiered subscription models that cater to different consumption patterns.

Regulatory and Legal Considerations: Reliance Backed Viacom18 Agrees To Buy 60 Of Disney India Unit Report Says

The acquisition of Disney India by Reliance-backed Viacom18 is a significant deal that will have far-reaching implications for the Indian media landscape. The transaction will likely face regulatory scrutiny and legal hurdles, and the potential impact on existing contracts and partnerships must be carefully considered.

Antitrust Scrutiny and Government Approvals

The deal will likely be subject to antitrust scrutiny from the Competition Commission of India (CCI). The CCI will assess whether the merger will create a dominant player in the Indian media market and potentially harm competition. The CCI’s approval will be crucial for the deal to proceed. The government will also need to approve the acquisition, particularly if it involves foreign investment.

Impact on Existing Contracts and Partnerships

The acquisition could potentially impact existing contracts and partnerships for both Viacom18 and Disney India. For example, Viacom18 may need to renegotiate contracts with advertisers and content providers. Disney India may also need to address its existing distribution agreements and partnerships with cable operators and streaming platforms.

Legal Framework for Media Mergers and Acquisitions in India

The legal framework surrounding media mergers and acquisitions in India is governed by the Competition Act, 2002, and the Foreign Exchange Management Act, 1999. The Competition Act regulates mergers and acquisitions to prevent anti-competitive practices, while the Foreign Exchange Management Act governs foreign investment in India.

The potential acquisition of Disney India by Reliance-backed Viacom18 has the potential to reshape the Indian media landscape, creating a new industry leader with a combined reach across television, digital, and streaming. The deal could trigger further consolidation in the market as other players look to compete with the combined entity. With its vast content library, strong distribution network, and growing digital presence, the new entity could become a dominant force in the Indian media and entertainment sector, offering consumers a wider range of content choices and subscription models. This deal will be closely watched by industry experts and investors alike as it could set the stage for the future of the Indian media market.

The media landscape is heating up with Reliance-backed Viacom18’s reported bid to acquire 60% of Disney India, a move that could reshape the Indian entertainment industry. Meanwhile, in the world of climate tech, Clairity Carbon Capture has secured seed funding to develop its innovative carbon capture technology. This investment signals a growing focus on sustainable solutions, while the media merger highlights the ongoing consolidation in the entertainment sector.

Standi Techno News

Standi Techno News