Sample series a pitch deck equals – Sample Series A pitch decks equal investor success, but crafting one that truly resonates requires more than just a template. It’s about understanding the investor’s perspective, aligning your story with their needs, and showcasing your company’s potential for growth. Think of it like a compelling movie trailer, except the audience is a group of discerning investors with a keen eye for potential.

A well-structured Series A pitch deck is a roadmap to securing funding. It’s a concise yet impactful presentation of your company’s vision, market opportunity, team, and financial projections. It’s a chance to make a lasting impression and convince investors that your startup is worth their investment.

The Essence of a Series A Pitch Deck

A Series A pitch deck is the cornerstone of a startup’s quest for funding. It’s not just a collection of slides; it’s a carefully crafted narrative that aims to captivate investors and convince them to invest in your company’s future. This document serves as a compelling introduction to your business, showcasing its potential and outlining the path to success.

The Purpose of a Series A Pitch Deck

The primary goal of a Series A pitch deck is to secure investment from venture capitalists or angel investors. It’s designed to persuade these individuals or firms to part with their capital and become stakeholders in your company’s journey. This involves painting a compelling picture of your startup’s vision, market opportunity, team, and financial projections.

Key Elements of a Compelling Series A Pitch Deck

The effectiveness of a Series A pitch deck hinges on its ability to resonate with investors. To achieve this, it must incorporate the following key elements:

- Problem: Clearly define the problem your startup addresses. This should be a pain point that resonates with investors and demonstrates a real need in the market.

- Solution: Present your solution as a unique and innovative approach to tackling the identified problem. Explain how your product or service solves the issue effectively and provides value to customers.

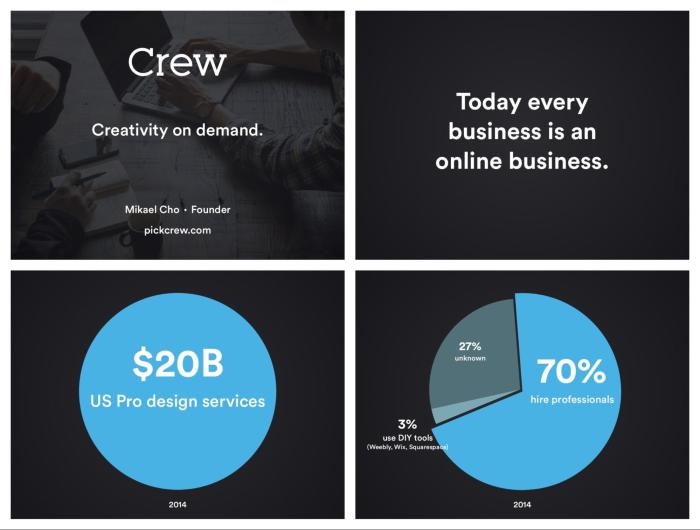

- Market Opportunity: Demonstrate the size and growth potential of the market you’re targeting. Back up your claims with market research data and projections to show the potential for substantial returns on investment.

- Competitive Landscape: Analyze your competitors and highlight your company’s competitive advantage. This could be based on technology, product features, pricing, or any other factors that set you apart.

- Team: Showcase the experience, expertise, and passion of your founding team. Investors want to see a team that is capable of executing the vision and navigating the challenges ahead.

- Financial Projections: Provide a clear and realistic financial model that Artikels your revenue projections, key metrics, and funding requirements. This helps investors understand the financial viability of your business and potential for growth.

- Investment Ask: Clearly state the amount of funding you’re seeking and how you plan to use the capital. Investors need to understand how their investment will contribute to your company’s success.

Examples of Successful Series A Pitch Decks

Several successful startups have employed compelling Series A pitch decks to attract investors. These decks often share common characteristics, such as:

- Airbnb: The Airbnb pitch deck famously used a simple yet powerful narrative to convey its vision of creating a global community of travelers. It focused on the problem of expensive hotel rooms, presented Airbnb as a unique solution, and showcased the growing market opportunity.

- Spotify: Spotify’s pitch deck highlighted the problem of traditional music subscription services being expensive and inconvenient. It then presented Spotify as a user-friendly and affordable alternative, emphasizing its vast music library and personalized recommendations.

- Slack: Slack’s pitch deck effectively addressed the problem of inefficient communication in the workplace. It showcased Slack’s innovative platform for team collaboration, highlighting its features and benefits for businesses.

Analyzing the Strengths of Successful Pitch Decks

The success of these pitch decks can be attributed to several key factors:

- Clear and Concise Storytelling: They present a compelling narrative that is easy to understand and resonates with investors.

- Data-Driven Approach: They use data and market research to support their claims and demonstrate the potential for growth.

- Focus on Value Proposition: They clearly articulate the value proposition of the startup and how it solves a real problem for customers.

- Team Credibility: They highlight the experience and expertise of the founding team, inspiring confidence in their ability to execute the vision.

- Investment Ask and Use of Funds: They clearly define the investment ask and how the funds will be used to drive growth and achieve milestones.

Understanding the Investor Perspective

Series A funding is a significant milestone for any startup, and securing it requires a compelling pitch deck that resonates with investors. Investors at this stage are not just looking for a good idea; they are seeking businesses with the potential for substantial growth and returns. To craft a successful Series A pitch deck, it’s crucial to understand the key concerns and expectations of investors.

Investor Concerns and Expectations

Investors at the Series A stage are looking for companies that have demonstrated product-market fit, have a solid team, and are ready to scale. They want to see a clear path to profitability and a strong competitive advantage. Investors are also mindful of the risks involved in early-stage companies and want to see evidence of mitigation strategies.

- Traction and Market Validation: Investors want to see concrete evidence that your product or service is in demand and that you have a growing customer base. This could include metrics such as revenue, user growth, and customer acquisition cost (CAC).

- Team and Execution: Investors invest in people as much as they invest in ideas. They want to see a team with a proven track record of success, a clear understanding of the market, and the ability to execute on their vision. This could include highlighting the experience and expertise of the founding team, as well as any key hires.

- Financial Projections and Growth Strategy: Investors want to see a well-defined financial plan that Artikels your revenue model, unit economics, and path to profitability. They also want to understand your strategy for scaling your business and capturing market share. This could include a detailed financial model, a go-to-market strategy, and a clear understanding of your key performance indicators (KPIs).

- Competitive Landscape: Investors want to understand your competitive landscape and how you differentiate yourself from your rivals. They want to see a clear competitive advantage that gives you a sustainable edge in the market. This could include an analysis of your competitors, your unique selling proposition (USP), and your strategy for staying ahead of the curve.

- Risk Mitigation: Investors are aware of the risks involved in early-stage companies. They want to see that you have a plan to mitigate these risks and build a sustainable business. This could include addressing potential challenges, outlining your risk management strategies, and demonstrating your ability to adapt to changing market conditions.

Investor Evaluation Criteria

Investors use a variety of criteria to evaluate Series A investment opportunities. These criteria can vary depending on the investor’s investment thesis, industry expertise, and risk appetite. However, some common criteria include:

- Market Size and Growth Potential: Investors want to see a large and growing market for your product or service. This ensures that there is sufficient opportunity for your business to scale and generate significant returns.

- Product-Market Fit: Investors want to see evidence that your product or service meets a real need in the market and that customers are willing to pay for it. This could include customer testimonials, user reviews, and data on customer engagement.

- Team and Experience: Investors want to see a team with the skills, experience, and passion to execute on their vision. They look for founders with relevant industry experience, a strong network, and a track record of success.

- Financial Performance: Investors want to see strong financial performance, including metrics such as revenue growth, profitability, and unit economics. They also want to understand your financial projections and your path to profitability.

- Valuation and Investment Terms: Investors carefully evaluate the valuation of the company and the investment terms offered. They want to ensure that the investment aligns with their return expectations and that the terms are fair and reasonable.

Aligning the Pitch Deck with Investor Needs

To maximize your chances of securing Series A funding, it’s crucial to align your pitch deck with the needs and expectations of investors. This means:

- Focus on Key Metrics: Highlight the key metrics that demonstrate your traction, growth, and financial performance. Investors are looking for data-driven evidence of your success.

- Address Investor Concerns: Be proactive in addressing potential investor concerns, such as competition, market risks, and execution challenges. This shows that you have a clear understanding of your business and are prepared for potential obstacles.

- Showcase Your Competitive Advantage: Clearly articulate your unique selling proposition and how you differentiate yourself from your competitors. This helps investors understand why your business is worth investing in.

- Communicate a Clear Vision: Investors want to see a clear vision for the future of your company. This includes your growth strategy, your long-term goals, and your plans for scaling your business.

- Demonstrate Your Passion: Investors want to see that you are passionate about your business and believe in its potential. Your enthusiasm and conviction will be contagious and can help you build a strong relationship with investors.

The Anatomy of a Series A Pitch Deck

A Series A pitch deck is a crucial document that helps startups secure funding from investors. It’s a visual representation of your company’s story, highlighting your progress, future plans, and the potential for growth.

Sections of a Series A Pitch Deck

A typical Series A pitch deck includes several key sections, each designed to address specific investor concerns and showcase your company’s value proposition.

| Section | Purpose | Content |

|---|---|---|

| Cover Slide | To introduce your company and grab attention. | Company name, logo, tagline, brief description of your business, and key metrics (e.g., traction, funding, team). |

| Problem | To establish the problem your company solves and its market size. | Define the problem you are addressing, quantify its impact, and provide data or research to support your claims. |

| Solution | To present your solution and demonstrate its effectiveness. | Describe your product or service, highlight its unique features and benefits, and showcase how it solves the identified problem. |

| Market | To illustrate the market opportunity and your company’s position within it. | Analyze the target market size, growth potential, and competitive landscape. Provide evidence of market demand and your company’s competitive advantage. |

| Business Model | To explain how your company generates revenue and achieves profitability. | Artikel your revenue model, pricing strategy, and key cost drivers. Provide projections for revenue and profitability based on realistic assumptions. |

| Team | To showcase the experience and expertise of your team. | Introduce your key team members, highlight their relevant experience and skills, and demonstrate their passion for the company’s mission. |

| Traction | To demonstrate the progress and success of your company. | Present key metrics that showcase your company’s growth, customer acquisition, and product adoption. Include relevant data, charts, and graphs to illustrate your traction. |

| Financial Projections | To project future financial performance and demonstrate the potential for return on investment. | Provide clear and realistic financial projections for revenue, expenses, and profitability. Highlight key financial milestones and the potential for growth. |

| Funding Request | To clearly state your funding needs and how you plan to use the funds. | Specify the amount of funding you are seeking, the intended use of the funds, and the expected impact on your business. |

| Exit Strategy | To provide investors with a clear vision of the potential return on their investment. | Artikel your long-term vision for the company, including potential exit strategies such as acquisition or IPO. |

Crafting a Compelling Narrative

A Series A pitch deck is more than just a presentation of numbers and facts; it’s a story that paints a compelling picture of your company’s future. Investors are not just looking for a good return on their investment; they are searching for a story that resonates with them, a vision they can believe in.

A compelling narrative in your pitch deck will not only help you capture the attention of investors but also build trust and credibility. It allows you to connect with them on an emotional level, making them feel like they are part of your journey.

A sample Series A pitch deck is like a roadmap for your startup’s future, showcasing your vision and potential. But sometimes, unexpected roadblocks can throw a wrench in your plans. Just like how bumble lost a third of its Texas workforce after the state passed a restrictive abortion bill , a pitch deck needs to be adaptable and responsive to unforeseen circumstances.

It’s about showing investors that you’re not just building a product, but a company that can navigate challenges and thrive in the long run.

Examples of Compelling Narratives

Here are some examples of compelling narratives used in successful Series A pitch decks:

- The “David vs. Goliath” story: This narrative highlights how a small startup is taking on a large, established competitor and winning. It appeals to investors’ desire to support the underdog and be part of a disruptive force.

- The “Mission-Driven” story: This narrative focuses on the company’s social impact and its mission to solve a significant problem. It attracts investors who are looking for investments that align with their values and make a positive difference in the world.

- The “Growth Hacking” story: This narrative showcases the company’s impressive growth trajectory and its innovative approach to acquiring customers. It appeals to investors who are seeking high-growth potential and a strong track record of success.

Crafting a Narrative Flow Chart, Sample series a pitch deck equals

A well-structured narrative follows a logical progression that keeps investors engaged and informed. Here’s a flow chart illustrating the typical structure of a compelling Series A pitch deck narrative:

- The Problem: Begin by clearly defining the problem your company is solving. Explain the market need and why it’s important.

- The Solution: Introduce your company and its unique solution to the problem. Explain how your product or service addresses the need and provides value.

- The Market: Demonstrate the size and growth potential of the market. Show that there is a significant opportunity for your company to succeed.

- The Team: Highlight the expertise and experience of your team. Investors want to see that you have the right people in place to execute your vision.

- The Traction: Showcase your company’s progress and achievements. This includes metrics like customer acquisition, revenue growth, and user engagement.

- The Future: Paint a clear picture of your company’s future vision and roadmap. Explain how you plan to scale your business and achieve long-term success.

- The Ask: Finally, clearly state your funding request and how you will use the funds to achieve your goals.

Data and Metrics

Investors crave tangible proof of your company’s success and future potential. This is where data and metrics step onto the stage, transforming your pitch from a hopeful narrative to a compelling story backed by hard evidence.

Data and metrics provide the foundation for credibility and allow investors to objectively assess your company’s performance, growth trajectory, and overall value proposition. They serve as a powerful tool to demonstrate your understanding of your business, its key drivers, and your ability to measure and track progress.

Examples of Relevant Metrics

A well-structured Series A pitch deck should include a curated selection of metrics that paint a clear picture of your company’s current state and future potential.

These metrics should be tailored to your specific industry and business model, but some common examples include:

- Financial Metrics:

- Revenue: Track your revenue growth over time, highlighting key milestones and projected future performance. Include revenue per customer, average transaction value, and customer lifetime value (CLTV) to showcase the financial health of your business.

- Profitability: Present your gross profit margin, operating profit margin, and net profit margin to demonstrate your ability to generate profits and manage expenses effectively.

- Customer Acquisition Cost (CAC): This metric measures the cost of acquiring a new customer, allowing investors to assess the efficiency of your marketing and sales efforts. Compare your CAC to your customer lifetime value (CLTV) to demonstrate the long-term value of each customer.

- Burn Rate: Investors will want to understand your monthly expenses and how long your current cash reserves will last. A clear and concise presentation of your burn rate helps them assess your financial sustainability and funding needs.

- Operational Metrics:

- Customer Growth: Showcase your growth in customer base, including monthly active users (MAU), daily active users (DAU), and new customer acquisition rates. This demonstrates your ability to attract and retain customers.

- Engagement Metrics: For SaaS businesses, track key metrics like average revenue per user (ARPU), churn rate, and customer satisfaction scores to demonstrate the stickiness of your product and the value you provide to your customers.

- Conversion Rates: Track conversion rates at various stages of your customer journey, such as website conversion rates, lead-to-customer conversion rates, and trial-to-paid conversion rates. This provides insights into the effectiveness of your marketing and sales funnel.

- Market Metrics:

- Market Size: Demonstrate the potential of your target market by presenting market size data, including total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM).

- Market Share: Illustrate your current market share and projected growth in market share. This shows investors your competitive position and potential for future dominance.

- Competitive Landscape: Provide a brief overview of your key competitors, their strengths and weaknesses, and how you differentiate your offering. This demonstrates your understanding of the competitive landscape and your ability to compete effectively.

Presenting Data and Metrics

Data and metrics are powerful tools, but their effectiveness hinges on clear and concise presentation.

- Visualize Your Data: Use charts, graphs, and tables to present data in a visually appealing and easily digestible format. Keep your visualizations simple and avoid overwhelming investors with too much information.

- Focus on Key Metrics: Don’t try to cram every metric into your pitch deck. Instead, focus on the key metrics that tell the most compelling story about your business and its potential. Prioritize metrics that demonstrate your progress towards achieving your goals and achieving a positive return on investment for investors.

- Provide Context: Don’t just present raw numbers. Provide context for your data by explaining what each metric represents, how it was calculated, and what it tells investors about your business. For example, if you’re presenting your revenue growth, explain the factors driving that growth and how it compares to industry averages.

- Highlight Trends and Insights: Use your data to tell a story. Highlight trends and insights that demonstrate the strength of your business, its growth potential, and its ability to overcome challenges. Use data to support your claims and reinforce your key messages.

- Use Data to Answer Investor Questions: Anticipate investor questions and use your data to provide clear and concise answers. This demonstrates your preparedness and your ability to back up your claims with evidence.

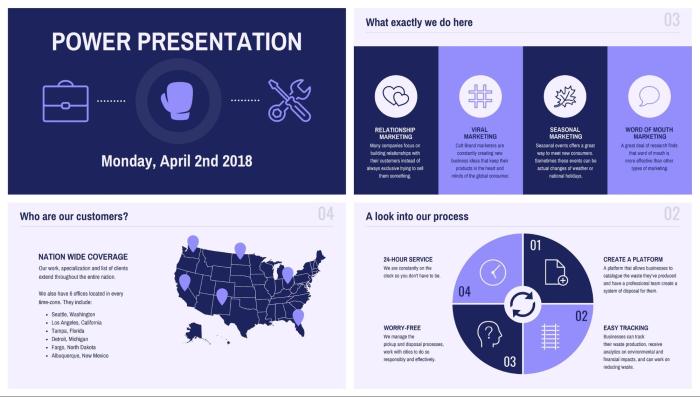

Visual Communication and Design

Your Series A pitch deck isn’t just about the words; it’s about the story you tell through visuals. A compelling visual narrative can make or break your investor engagement, helping them grasp your vision and remember your key points.

Effective Visual Elements

Visual elements are more than just eye candy. They’re strategic tools to convey your message effectively.

“A picture is worth a thousand words.” – Arthur Brisbane

Here are some examples of how visual elements can boost your pitch deck’s impact:

- Charts and Graphs: Present data in a visually appealing and easy-to-understand format. Use bar charts for comparing categories, line graphs for showing trends, and pie charts for illustrating proportions. For example, you could use a line graph to demonstrate your company’s revenue growth over time.

- Infographics: Infographics combine data, visuals, and concise text to explain complex information quickly. For instance, you could use an infographic to showcase your market share or highlight your competitive advantage.

- Images and Photos: High-quality images can evoke emotions and connect with investors on a personal level. For example, a photo of your team working together can convey a sense of collaboration and dedication.

- Illustrations: Custom illustrations can add a unique touch to your pitch deck and help you stand out from the crowd. For example, you could use illustrations to represent your product or service in a visually appealing way.

Best Practices for Visual Design

Here’s a table outlining best practices for visual design in a Series A pitch deck:

| Element | Best Practice | Example |

|---|---|---|

| Color Palette | Use a limited color palette (2-3 primary colors) that reflects your brand and creates visual harmony. | A tech company might use blue and white for a clean, modern look. |

| Typography | Choose legible fonts that are easy to read and consistent with your brand identity. | Use a sans-serif font like Arial or Helvetica for body text and a serif font like Times New Roman for headings. |

| Images and Illustrations | Use high-quality, relevant images and illustrations that enhance your message. | Use a photo of your product in action or an illustration that represents your company’s values. |

| Layout and Spacing | Ensure your deck has a clear and consistent layout with ample white space to prevent visual clutter. | Use a grid system to create a visually appealing and organized layout. |

| Slide Transitions | Use subtle transitions to guide the viewer through your presentation smoothly. | Use a fade-in or slide-in transition for a clean and professional look. |

The Power of the Team

A strong team is the backbone of any successful startup. Investors are not just looking for a great idea; they are looking for a team that can execute it flawlessly. Your team section is your chance to showcase the expertise, experience, and passion that will drive your company’s growth.

Investors want to see that you have the right people in place to navigate the challenges ahead. This section is where you inspire confidence and demonstrate your ability to overcome obstacles.

Demonstrating Expertise and Experience

A compelling team section goes beyond simply listing names and titles. It’s about highlighting the specific skills and experience that make your team uniquely qualified to tackle the problem you’re solving.

Here are some tips for effectively showcasing your team’s expertise:

- Focus on Relevant Experience: Instead of listing every job a team member has held, emphasize the experience that directly relates to your company’s goals. For example, highlight past successes in building similar products, securing funding, or scaling businesses.

- Quantify Achievements: Whenever possible, quantify your team’s achievements with concrete metrics. For example, “Led a team that increased user engagement by 300% in one year.”

- Highlight Complementary Skills: Showcase the diversity of skills within your team and how they complement each other. A well-rounded team with expertise in areas like product development, marketing, finance, and operations is more likely to succeed.

Examples of Compelling Team Introductions

- The Founder with a Proven Track Record: “Jane Doe, our CEO, has a decade of experience in the [Industry] space, having previously led product development at [Previous Company] where she successfully launched [Product] which achieved [Key Metric] within [Timeframe].”

- The Technical Expert with a Passion for Innovation: “John Smith, our Chief Technology Officer, has a PhD in Computer Science and has been building innovative solutions for [Number] years. He’s passionate about [Technology] and is leading the development of our proprietary [Technology/Platform].”

- The Business Development Guru with a Strong Network: “Emily Jones, our Head of Business Development, has a proven track record of securing strategic partnerships and building strong relationships. She has successfully [Specific Achievement] which led to [Positive Outcome] for [Previous Company].”

The Road Ahead

Investors want to know that your company has a clear vision for the future and a solid plan for achieving its goals. They are looking for evidence that your company can continue to grow and generate returns on their investment.

Your future plans and growth strategy should be a compelling narrative that paints a picture of your company’s potential. It should be ambitious, yet realistic, and backed up by data and analysis.

Growth Projections and Market Opportunity

Investors are interested in understanding the market opportunity you are targeting and how your company plans to capture a significant share of that market. They want to see a detailed analysis of your target market, including its size, growth rate, and key trends.

You should also provide a clear and concise roadmap for achieving your growth projections. This roadmap should include key milestones, metrics, and timelines.

Example: “We project that the global market for [your product or service] will reach [market size] by [year]. We are targeting a [percentage] market share, which translates to [revenue target]. We will achieve this growth by [key initiatives, such as expanding into new markets, launching new products, or forming strategic partnerships].”

Key Initiatives and Milestones

A key aspect of your growth strategy is outlining the specific initiatives and milestones you will pursue to achieve your goals. These initiatives should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Expanding into new markets: This could involve entering new geographic regions, targeting new customer segments, or launching new product lines.

- Developing new products or services: This could involve expanding your product portfolio, introducing innovative features, or creating entirely new offerings.

- Building strategic partnerships: This could involve collaborating with other companies to reach new markets, access new technologies, or leverage complementary resources.

- Investing in technology and infrastructure: This could involve upgrading your technology platform, expanding your production capacity, or investing in research and development.

Financial Projections and Exit Strategy

Investors want to understand how your company plans to generate profits and ultimately provide them with a return on their investment. You should provide a clear and concise financial model that projects your company’s revenue, expenses, and profitability over the next few years.

Example: “We project that our revenue will grow at a [percentage] compound annual growth rate (CAGR) over the next five years. This growth will be driven by [key factors, such as new product launches, market expansion, or increased customer acquisition]. We expect to achieve profitability by [year] and to reach a [revenue target] by [year].”

You should also Artikel your exit strategy, which is the plan for how investors will ultimately realize their investment. This could involve an initial public offering (IPO), a sale to another company, or a buyback by existing investors.

Example: “Our long-term goal is to become the leading provider of [your product or service] in the [target market]. We believe that an IPO is the most likely exit strategy for our company, as it will allow us to access the capital needed to continue our growth and expand our reach.”

Financial Projections and Investment Request: Sample Series A Pitch Deck Equals

Investors want to see a clear path to profitability and a return on their investment. Financial projections are crucial for demonstrating your company’s future potential and justifying the investment request.

Your financial projections should be realistic, transparent, and backed by data. They should also be aligned with your company’s overall strategy and growth plans.

Structuring the Financial Section

This section of your Series A pitch deck should include a concise yet informative overview of your company’s financial performance and future projections.

Here are some best practices for structuring the financial section:

* Start with a high-level overview. Begin with a brief summary of your company’s key financial metrics, such as revenue, profitability, and growth rate. This provides investors with a quick snapshot of your company’s financial health.

* Present detailed financial projections. Include a three-to-five-year financial forecast, covering key metrics like revenue, gross profit, operating expenses, and net income.

* Explain your assumptions. Clearly Artikel the key assumptions underlying your financial projections, such as market growth rates, pricing strategies, and cost of goods sold. This helps investors understand the basis for your projections and assess their feasibility.

* Include a sensitivity analysis. A sensitivity analysis demonstrates how your financial projections might change under different scenarios. This shows investors that you have considered potential risks and uncertainties.

Investment Request

The investment request is the heart of your Series A pitch deck. It Artikels the amount of funding you are seeking, the intended use of the funds, and the expected return on investment.

Here are some key elements to include in your investment request:

* Clearly state the amount of funding you are seeking. Be specific about the amount you need to achieve your growth objectives.

* Explain how you will use the funds. Provide a detailed breakdown of how you will allocate the investment, including specific initiatives and projects.

* Artikel your expected return on investment. Present a clear and realistic timeline for achieving profitability and generating a return for investors. This could include metrics like revenue milestones, market share targets, or exit strategies.

* Highlight the potential for significant upside. Emphasize the growth potential of your company and the potential for investors to realize a substantial return on their investment.

Example:

“We are seeking $5 million in Series A funding to accelerate our growth and expand into new markets. This investment will be used to scale our marketing efforts, develop new product features, and hire key personnel. We project that this investment will enable us to achieve $20 million in annual revenue within the next three years, resulting in a significant return for our investors.”

The Art of Refinement and Iteration

Your Series A pitch deck is not a one-and-done creation. It’s a living document that should evolve with your company’s progress and feedback. Refining and iterating on your pitch deck is crucial for maximizing its effectiveness.

Think of it like a sculptor working on a masterpiece. You start with a rough draft, but through careful adjustments and feedback, you refine the form and shape until it becomes a compelling and persuasive work of art.

Identifying Areas for Improvement

A common pitfall is neglecting to gather feedback from potential investors or mentors. This valuable input can highlight areas that need refining. Here are some common areas to focus on:

- Clarity and Conciseness: Is your message clear and concise? Can investors understand your business model and value proposition quickly? A well-structured pitch deck should guide investors through your story with ease.

- Data and Metrics: Are you presenting compelling data that supports your claims? Numbers speak louder than words, so make sure you back up your statements with concrete evidence.

- Visual Communication: Is your deck visually appealing and easy to follow? Use high-quality images, charts, and graphs to enhance your presentation.

- Storytelling: Is your pitch engaging and memorable? Investors are looking for a compelling story that resonates with them. Focus on the “why” behind your business and the impact you’re making.

Seeking and Incorporating Feedback

Don’t be afraid to seek feedback from trusted advisors, mentors, and potential investors. Here are some best practices:

- Engage in Open Dialogue: Ask for specific feedback and be open to constructive criticism. Don’t take feedback personally; use it as an opportunity to improve your pitch.

- Prioritize Key Insights: Focus on the most critical feedback and address those areas first. Prioritize the feedback that aligns with your goals and resonates with your target audience.

- Iterate and Refine: Don’t be afraid to make changes and iterate on your deck based on the feedback you receive. The goal is to create a pitch deck that is both persuasive and informative.

“The best pitch decks are the result of continuous iteration and refinement. Don’t be afraid to experiment and make changes based on feedback.”

Ultimately, a winning Series A pitch deck goes beyond just the content; it’s about the narrative. It’s about weaving together your company’s story, your team’s passion, and your vision for the future, all within a compelling framework that resonates with investors. It’s a call to action, an invitation to join you on a journey of growth and innovation.

Standi Techno News

Standi Techno News