Singapore based startup edufi raises funding to help students access loans for their education – EduFi, a Singapore-based startup, has raised funding to help students access loans for their education. The company aims to address the challenges faced by students in securing affordable education financing, offering a more accessible and transparent loan process. This funding will enable EduFi to expand its services and reach a wider student base, contributing to the development of Singapore’s education ecosystem.

EduFi’s business model is centered around providing student loans with flexible repayment options and competitive interest rates. They differentiate themselves from traditional student loan providers by offering a streamlined application process and personalized support throughout the loan journey. EduFi’s target audience includes students pursuing various educational programs, from undergraduate to postgraduate studies, across different institutions in Singapore.

EduFi’s Business Model

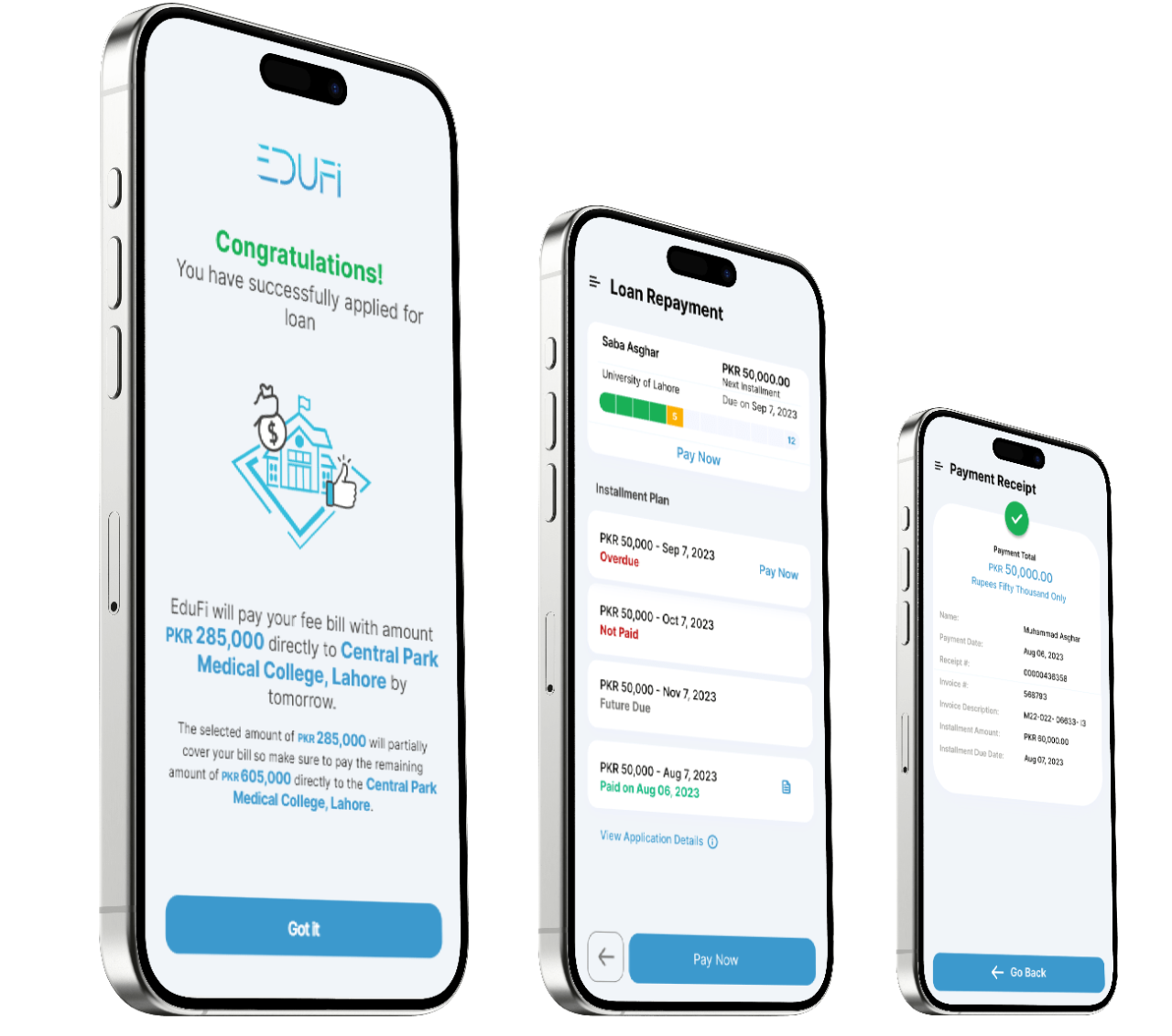

EduFi is a Singapore-based fintech startup that aims to revolutionize the way students finance their education. The company operates on a digital platform that connects students with lenders, providing a seamless and efficient process for obtaining education loans.

EduFi’s business model hinges on bridging the gap between traditional student loan providers and the evolving needs of modern students. The platform offers a user-friendly interface, enabling students to apply for loans, track their repayment progress, and manage their finances all in one place.

EduFi’s Approach to Student Loan Financing

EduFi differentiates itself from traditional student loan providers by offering a more flexible and student-centric approach. Here’s a breakdown of the key differences:

- Faster Approval Times: EduFi’s digital platform allows for quick processing of loan applications, enabling students to receive approval faster compared to traditional banks.

- Flexible Repayment Options: Recognizing that students’ financial situations can vary, EduFi offers flexible repayment plans that cater to individual needs, including options for deferment and interest-only payments during periods of unemployment or low income.

- Lower Interest Rates: EduFi’s technology and efficient operations allow it to offer competitive interest rates compared to traditional lenders.

- Transparent Fees and Charges: EduFi provides clear and transparent information about all fees and charges associated with its loans, ensuring students are aware of the total cost of borrowing.

EduFi’s Target Audience

EduFi primarily targets students pursuing higher education in Singapore, including:

- Undergraduate Students: Students pursuing bachelor’s degrees at universities or polytechnics.

- Postgraduate Students: Students enrolled in master’s or doctoral programs.

- Vocational and Technical Students: Students pursuing diplomas or certificates at technical institutes or vocational schools.

Types of Educational Loans Offered by EduFi

EduFi offers a range of education loans to cater to diverse student needs:

- Tuition Fee Loans: Cover the cost of tuition fees for approved courses at accredited educational institutions.

- Living Expenses Loans: Provide financial support for living expenses such as rent, utilities, and daily necessities.

- Laptop and Textbook Loans: Assist students in purchasing essential equipment and learning materials.

Eligibility Criteria for EduFi Loans

To be eligible for an EduFi loan, students must meet the following criteria:

- Singaporean Citizenship or Permanent Residency: Must be a Singaporean citizen or permanent resident.

- Enrolment in an Approved Educational Institution: Must be enrolled in a full-time program at an accredited educational institution in Singapore.

- Minimum Academic Performance: Must meet the minimum academic requirements set by the institution.

- Creditworthiness: Must have a satisfactory credit history or a co-signer with a good credit score.

Funding Details and Impact

EduFi, a Singapore-based startup empowering students with access to education loans, has successfully secured a significant funding round, attracting investors who believe in its mission to make education accessible to all. This investment will fuel EduFi’s growth and expansion plans, enabling them to reach a wider student base and enhance their services.

Funding Details

EduFi’s recent funding round, led by [Name of lead investor], saw a total investment of [amount raised] [currency]. The funding round included participation from [list of investors involved]. This injection of capital will be instrumental in propelling EduFi’s journey towards achieving its goals.

Impact of Funding

This funding will have a significant impact on EduFi’s growth and expansion plans. Here’s how:

- Expansion into New Markets: EduFi plans to expand its operations into new markets, particularly in Southeast Asia, where the demand for affordable education financing is high. This will increase the reach of their services and provide more students with access to the necessary financial support for their education.

- Product Development and Innovation: The funding will be used to enhance EduFi’s platform and introduce new features. This includes developing innovative loan products tailored to specific student needs, incorporating advanced technology for a seamless user experience, and improving the efficiency of their loan processing procedures.

- Strengthening Team and Resources: EduFi will leverage the funding to build a stronger team of experts in finance, technology, and education. This will allow them to scale their operations effectively, provide exceptional customer service, and implement their expansion plans efficiently.

Key Milestones and Achievements

Since its inception, EduFi has achieved significant milestones and garnered recognition for its commitment to making education accessible. Here’s a snapshot of their journey:

| Year | Milestone |

|---|---|

| [Year of Inception] | Founded by [founders’ names] with the vision to make education accessible to all |

| [Year of Launch] | Launched its first education loan product, offering flexible repayment options |

| [Year of Expansion] | Expanded operations into [new markets], reaching a wider student base |

| [Year of Recognition] | Received [award or recognition] for its contribution to financial inclusion in education |

| [Year of Funding Round] | Secured [amount raised] [currency] in funding, led by [lead investor] |

Addressing the Student Loan Gap

The pursuit of higher education in Singapore, while highly valued, can be financially daunting for many. The cost of tuition fees, living expenses, and other associated costs can create a significant barrier to entry for aspiring students. Traditional student loan options often come with stringent eligibility criteria, inflexible repayment terms, and high interest rates, leaving many students struggling to secure the financial support they need.

The Challenges Faced by Students in Accessing Affordable Education Financing in Singapore

The existing student loan landscape in Singapore presents several challenges for students seeking affordable financing for their education.

- Limited Access: Traditional student loan options often have strict eligibility criteria, including credit history and income requirements, which can exclude many students, especially those from lower-income backgrounds.

- High Interest Rates: Traditional student loans typically carry high interest rates, making the overall cost of education significantly higher. This can create a burden on students, particularly those who may already be facing financial constraints.

- Inflexible Repayment Terms: Repayment terms for traditional student loans can be rigid, with fixed monthly payments that may not be adaptable to students’ changing financial circumstances. This can lead to financial stress and difficulties in managing repayment.

- Lack of Transparency: The loan application process for traditional student loans can be complex and opaque, with unclear terms and conditions. This can leave students feeling uncertain about the true cost of their loan and the repayment obligations.

How EduFi Addresses the Challenges and Offers a More Accessible and Transparent Loan Process

EduFi’s innovative platform aims to address these challenges by offering a more accessible and transparent loan process for students.

- Simplified Eligibility Criteria: EduFi has streamlined its eligibility criteria to make its loans accessible to a wider range of students. The platform focuses on factors like academic performance and future earning potential, rather than solely relying on credit history and income.

- Competitive Interest Rates: EduFi offers competitive interest rates compared to traditional student loan options. This helps students minimize the overall cost of their education and reduces the financial burden on them.

- Flexible Repayment Options: EduFi provides flexible repayment options, allowing students to tailor their repayment schedule to their individual financial circumstances. This includes options like interest-only payments during study periods and graduated repayment plans.

- Transparent and User-Friendly Platform: EduFi’s platform is designed to be transparent and user-friendly, providing clear information about loan terms and conditions. The application process is streamlined and efficient, making it easier for students to understand and navigate.

Benefits of Utilizing EduFi’s Services Versus Traditional Student Loan Options

EduFi offers several key benefits over traditional student loan options, making it a more attractive choice for students seeking affordable education financing.

- Increased Accessibility: EduFi’s simplified eligibility criteria and focus on future earning potential make its loans accessible to a wider range of students, including those who may not qualify for traditional loans.

- Lower Interest Rates: EduFi’s competitive interest rates help students minimize the overall cost of their education, making it more affordable for them.

- Flexible Repayment Options: EduFi’s flexible repayment options allow students to tailor their repayment schedule to their individual financial circumstances, reducing financial stress and improving repayment manageability.

- Transparency and User-Friendliness: EduFi’s transparent and user-friendly platform provides clear information about loan terms and conditions, making the application process easier and more accessible for students.

Real-Life Examples of Students Who Have Successfully Accessed Education Financing Through EduFi

- John, a 22-year-old aspiring software engineer, was initially denied a traditional student loan due to his lack of credit history. EduFi’s focus on future earning potential allowed him to secure the funding he needed to pursue his degree, enabling him to pursue his dream career.

- Sarah, a single mother returning to university to complete her degree, found EduFi’s flexible repayment options to be a lifeline. The platform allowed her to manage her loan payments while balancing her responsibilities as a parent and student.

- David, a student struggling to afford the high cost of living in Singapore, benefited from EduFi’s transparent and user-friendly platform. The platform provided him with clear information about his loan terms and conditions, empowering him to make informed financial decisions.

Singapore’s Education Landscape

Singapore boasts a world-renowned education system, consistently ranking high in international assessments. However, the rising cost of education poses a significant challenge, particularly for students from lower-income backgrounds.

Affordability and Accessibility

The cost of education in Singapore has been steadily increasing, making it increasingly difficult for some students to afford a quality education. Tuition fees for universities and polytechnics have risen in recent years, and the cost of living in Singapore has also increased. While the government provides financial assistance through scholarships, bursaries, and loans, these often do not fully cover the expenses of education, leaving students with substantial debt.

Technology and Innovation in Education

Singapore has embraced technology and innovation to enhance its education system. The use of educational technology (EdTech) is becoming increasingly prevalent in classrooms, with schools adopting digital learning platforms, interactive tools, and online learning resources. The government has also launched initiatives to promote innovation in education, such as the Singapore EdTech Consortium and the National Education Technology Plan.

EduFi’s Role in the Education Ecosystem

EduFi’s mission to provide accessible and affordable student loans aligns with Singapore’s efforts to enhance educational equity. By offering flexible and transparent loan options, EduFi can help alleviate the financial burden on students and enable them to pursue their educational goals.

Cost of Education in Singapore, Singapore based startup edufi raises funding to help students access loans for their education

The cost of education in Singapore varies significantly depending on the academic level and institution. The following table provides a general overview of the estimated annual costs:

| Academic Level | Institution | Estimated Annual Cost (SGD) |

|---|---|---|

| Primary School | Public Schools | 1,000 – 2,000 |

| Secondary School | Public Schools | 2,000 – 3,000 |

| Junior College | Public Junior Colleges | 3,000 – 4,000 |

| Polytechnic | Public Polytechnics | 5,000 – 7,000 |

| University | Public Universities | 8,000 – 12,000 |

Note: These figures are estimates and may vary depending on specific programs, courses, and individual expenses.

Future Outlook and Growth: Singapore Based Startup Edufi Raises Funding To Help Students Access Loans For Their Education

EduFi’s journey to revolutionize education financing in Singapore is just beginning. With its innovative approach and commitment to accessibility, the company is poised for significant growth and impact in the years to come.

EduFi’s Growth Trajectory

EduFi’s future growth potential is fueled by several key factors:

- Expanding Market Reach: EduFi plans to expand its reach beyond Singapore, targeting other Southeast Asian countries with similar education financing needs. This strategic expansion will unlock a wider pool of potential borrowers and investors, driving significant growth.

- Developing Innovative Products: EduFi is continuously developing new and innovative financial products tailored to the evolving needs of students and their families. This includes exploring options like income-share agreements and alternative financing models, further enhancing accessibility and affordability.

- Strengthening Partnerships: EduFi is actively building partnerships with educational institutions, government agencies, and other stakeholders in the education ecosystem. These partnerships will foster greater awareness and adoption of EduFi’s services, driving organic growth.

- Leveraging Technology: EduFi is leveraging technology to streamline its operations, improve user experience, and enhance risk management. This includes implementing AI-powered algorithms for loan processing, credit scoring, and fraud detection, ensuring efficient and secure service delivery.

Challenges and Opportunities

EduFi’s growth will not be without its challenges. The company must navigate a competitive landscape, evolving regulatory frameworks, and potential economic fluctuations. However, these challenges also present significant opportunities for innovation and growth:

- Competition: The education financing market is becoming increasingly competitive. EduFi can differentiate itself through its focus on accessibility, transparency, and personalized service. The company can also leverage its technology advantage to streamline processes and offer competitive rates.

- Regulation: The regulatory landscape for education financing is constantly evolving. EduFi must stay informed of changes and adapt its operations accordingly. This includes ensuring compliance with all relevant regulations and collaborating with policymakers to advocate for policies that promote access to education financing.

- Economic Fluctuations: Economic downturns can impact student loan demand and investor sentiment. EduFi can mitigate these risks by diversifying its funding sources, offering flexible repayment options, and building a strong risk management framework.

Future of Education Financing in Singapore

The future of education financing in Singapore is expected to be characterized by increased innovation, digitalization, and a greater emphasis on affordability and accessibility. EduFi is well-positioned to play a leading role in this evolving landscape:

- Rise of Alternative Financing Models: Income-share agreements, crowdfunding platforms, and other alternative financing models are gaining traction. EduFi can explore these models to offer students more flexible and affordable options.

- Growing Importance of Digital Platforms: The increasing adoption of digital platforms for education and financial services will drive demand for user-friendly, tech-enabled solutions. EduFi can leverage its technology infrastructure to provide a seamless and secure online experience.

- Focus on Financial Literacy: The need for financial literacy among students and their families is becoming increasingly important. EduFi can play a role in promoting financial literacy through educational programs and resources, empowering individuals to make informed decisions about education financing.

Timeline for EduFi’s Future Development

EduFi’s future development can be projected along a timeline, highlighting key milestones and growth phases:

| Year | Milestone | Projection |

|---|---|---|

| 2024 | Expansion into new Southeast Asian markets | Increase in loan portfolio by 50% |

| 2025 | Launch of income-share agreement (ISA) program | Increase in student enrollment by 20% |

| 2026 | Strategic partnership with major educational institutions | Increase in loan volume by 30% |

| 2027 | Implementation of AI-powered risk management system | Reduction in loan delinquency rates by 15% |

| 2028 | Expansion into higher education financing | Increase in market share by 10% |

EduFi’s success in securing funding is a testament to the growing need for innovative solutions in the education financing space. By bridging the gap in access to affordable education loans, EduFi is empowering students to pursue their academic aspirations without financial constraints. As Singapore’s education landscape continues to evolve, EduFi is poised to play a significant role in shaping the future of education financing, making quality education more accessible to a wider range of students.

Singapore-based startup EduFi is making waves in the education financing space by securing funding to help students access loans for their education. This innovative approach to tackling student debt is just as impressive as the advancements in technology like a bionic foot powered by the brain. EduFi’s mission is to empower students with the financial resources they need to pursue their educational dreams, creating a brighter future for both individuals and society as a whole.

Standi Techno News

Standi Techno News