Softcard’s Announcement

Softcard, a mobile payments platform, has announced the cessation of its operations. The company, a joint venture between AT&T, Verizon, and T-Mobile, has informed its users that it will be shutting down its services on March 31, 2015.

Reasons for Softcard’s Shutdown

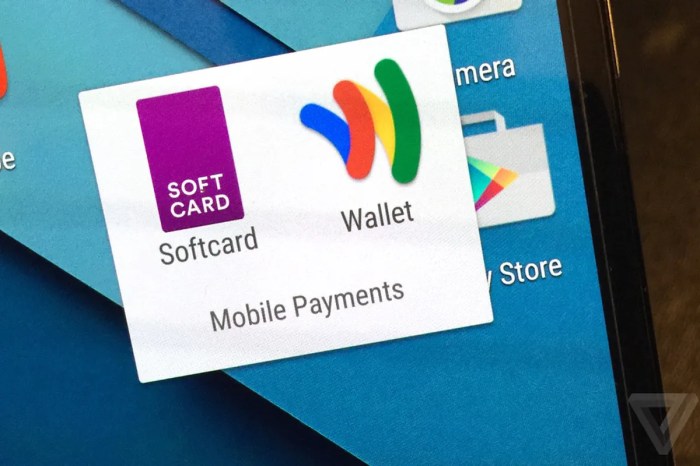

Softcard’s decision to cease operations was primarily driven by the rapidly evolving mobile payments landscape. The company faced stiff competition from established players like Apple Pay and Google Wallet, which had gained significant traction in the market. The rise of these competing platforms, coupled with Softcard’s limited adoption, contributed to the company’s decision to exit the market.

“We believe that the mobile payments market is evolving rapidly and that our current business model is not sustainable in the long term,” said Softcard CEO, Michael Lembeck.

Impact on Users: Softcard To Cease Operations Come 31st Of March

The cessation of Softcard operations on March 31st will have a direct impact on its users. Softcard users will no longer be able to use the service for mobile payments. This means they will need to find alternative payment methods for their everyday transactions.

Accessing Funds and Data

Softcard users can access their funds by linking their Softcard account to a bank account or debit card. They can also access their transaction history and other account information through the Softcard app until the service shuts down.

Alternative Payment Methods

With the closure of Softcard, users have various options for mobile payments. Some popular alternatives include:

- Apple Pay: Apple Pay is a contactless payment system that uses Near Field Communication (NFC) technology. It is compatible with iPhones, iPads, and Apple Watches.

- Google Pay: Google Pay is a similar contactless payment system that works on Android devices. It also allows for online payments and peer-to-peer transfers.

- Samsung Pay: Samsung Pay is a mobile payment service that is available on Samsung Galaxy devices. It supports NFC and Magnetic Secure Transmission (MST) technology, allowing for payments at most point-of-sale terminals.

- Venmo: Venmo is a peer-to-peer payment app that allows users to send and receive money from friends and family. It also allows for payments at select merchants.

- PayPal: PayPal is a widely recognized online payment platform that also offers mobile payment options. It allows for payments at millions of merchants worldwide.

History of Softcard

Softcard was a mobile payment platform that allowed users to make purchases with their smartphones. It was launched in 2011 by a joint venture between AT&T, T-Mobile, and Verizon Wireless.

The company aimed to provide a secure and convenient way for consumers to pay for goods and services using their mobile devices. Softcard was initially available only to customers of the three participating wireless carriers. However, it later expanded its reach to include other mobile operators and financial institutions.

Key Milestones, Softcard to cease operations come 31st of march

Softcard’s journey was marked by several significant milestones, showcasing its evolution and impact on the mobile payment landscape.

- 2011: Softcard was launched as a joint venture between AT&T, T-Mobile, and Verizon Wireless.

- 2012: Softcard partnered with several major retailers, including Walmart, Target, and CVS Pharmacy.

- 2013: Softcard expanded its services to include mobile wallet features, allowing users to store loyalty cards, coupons, and gift cards.

- 2014: Softcard was acquired by Google, which integrated its technology into its own mobile payment platform, Android Pay.

Role in the Mobile Payment Industry

Softcard played a crucial role in the early development of the mobile payment industry. It was one of the first platforms to offer a secure and convenient way for consumers to pay with their smartphones.

Softcard’s focus on NFC technology allowed users to make contactless payments by simply tapping their phones on compatible payment terminals. The platform also incorporated security features, such as tokenization, to protect users’ sensitive payment information.

Partnerships and Acquisitions

Softcard established partnerships with several major companies, including:

- Retailers: Walmart, Target, CVS Pharmacy, Walgreens, and others.

- Financial Institutions: Bank of America, Chase, Wells Fargo, and others.

- Mobile Operators: AT&T, T-Mobile, Verizon Wireless, and others.

In 2014, Google acquired Softcard for an undisclosed amount. This acquisition was a strategic move for Google, as it sought to expand its presence in the mobile payment market. The technology behind Softcard was eventually integrated into Google’s Android Pay platform, which has become one of the leading mobile payment platforms in the world.

Competition and Market Landscape

Softcard, despite its backing from major mobile carriers, faced a fiercely competitive landscape in the mobile payment market. The rise of mobile payments was gaining momentum, with various players vying for market share.

Comparison with Other Mobile Payment Platforms

Softcard’s primary competitors included Apple Pay, Google Wallet (later renamed Google Pay), and Samsung Pay. Each platform offered distinct features and targeted different user bases.

- Apple Pay: Apple Pay, launched in 2014, leveraged Apple’s strong brand recognition and a large user base of iPhone and Apple Watch owners. It offered a seamless user experience and a wide acceptance network.

- Google Wallet/Google Pay: Google Wallet, launched in 2011, aimed to integrate mobile payments with Google’s existing ecosystem. It offered features like peer-to-peer payments and NFC functionality, initially focused on Android devices.

- Samsung Pay: Samsung Pay, launched in 2015, offered a unique feature called Magnetic Secure Transmission (MST), which allowed payments on older payment terminals that didn’t support NFC.

- Softcard: Softcard, launched in 2011, initially targeted AT&T, Verizon, and T-Mobile customers. It offered a relatively simple mobile payment experience but struggled to gain widespread adoption.

Competitive Landscape

The mobile payment market was rapidly evolving during Softcard’s operations. Several factors contributed to the competitive landscape:

- Technology Advancements: NFC technology became more prevalent in smartphones, making mobile payments more accessible.

- Growing Consumer Demand: Consumers increasingly sought convenient and secure payment options, driving the adoption of mobile payment solutions.

- Increased Competition: New players, like Square and PayPal, entered the market, offering alternative mobile payment solutions.

- Strategic Partnerships: Major players like Apple and Google forged strategic partnerships with banks and retailers to expand their acceptance networks.

Factors Contributing to Softcard’s Closure

Softcard’s closure can be attributed to several factors:

- Limited Adoption: Despite its backing from major carriers, Softcard struggled to gain widespread adoption among consumers. This was partly due to its late entry into the market and the lack of a compelling value proposition compared to its competitors.

- Lack of Differentiation: Softcard lacked a distinct advantage over its competitors. It didn’t offer a unique user experience or a compelling feature set to differentiate itself.

- Changing Market Dynamics: The mobile payment market became increasingly competitive, with Apple Pay and Google Pay gaining significant traction.

- Strategic Acquisition: In 2015, Softcard was acquired by Google, which ultimately integrated its technology into Google Wallet/Google Pay. This effectively marked the end of Softcard as a separate entity.

Lessons Learned

Softcard’s journey, though ultimately unsuccessful, offers valuable insights into the mobile payment landscape. Its rise and fall provide a case study for understanding the challenges and opportunities in this rapidly evolving market.

Challenges of Widespread Adoption

The mobile payment market, despite its potential, has faced significant hurdles in achieving widespread adoption. Softcard’s experience highlights several key challenges:

- Consumer Resistance to Change: Consumers are often hesitant to adopt new payment methods, especially when their existing methods are familiar and convenient. The transition from traditional payment methods like credit cards to mobile payments can be a barrier for many users.

- Lack of Interoperability: Mobile payment platforms often operate in silos, lacking compatibility with each other. This fragmentation limits consumer choice and hinders widespread adoption. Softcard, for example, was initially exclusive to certain carriers, hindering its reach.

- Security Concerns: Concerns about data security and privacy remain a major obstacle for mobile payments. Consumers are wary of storing sensitive financial information on their mobile devices, fearing potential breaches or misuse.

- Limited Merchant Acceptance: The widespread adoption of mobile payments requires broad merchant acceptance. This can be challenging, as merchants need to invest in new infrastructure and training to support these payment methods. Softcard faced difficulties in securing widespread merchant adoption, which ultimately hampered its growth.

Softcard to cease operations come 31st of march – Softcard’s story is a testament to the challenges of navigating the ever-evolving world of mobile payments. While it might have failed to reach its full potential, it paved the way for other players to rise to prominence. The lessons learned from Softcard’s journey continue to shape the mobile payment landscape, emphasizing the importance of user experience, strategic partnerships, and a deep understanding of consumer needs. As the industry continues to evolve, we can expect to see more innovative solutions emerge, but the lessons from Softcard’s rise and fall remain valuable reminders of the challenges and opportunities that lie ahead.

So, Softcard is officially shutting down on March 31st. It seems like everyone’s moving on to new things, like Google Allo, which just hit 5 million installs, according to this article. Maybe Softcard just couldn’t keep up with the competition, but hey, at least we’ve got some fresh options to try out.

Standi Techno News

Standi Techno News