Solo credit bureau first party data – Solo credit bureau first-party data is a powerful tool that’s changing the landscape of financial services. These bureaus, operating independently of the big three, collect a wealth of information about individuals’ financial behavior, offering a more nuanced and comprehensive picture than traditional credit scores. This data can be a game-changer for lenders, helping them assess risk and make smarter lending decisions, while also empowering consumers with greater financial transparency and control.

Think of it as a detailed financial portrait, capturing not just your credit history but also your spending patterns, debt levels, and even how you manage your finances. This rich information can help lenders offer more personalized and competitive financial products, while also helping consumers understand their financial standing and make informed decisions.

What is Solo Credit Bureau First-Party Data?

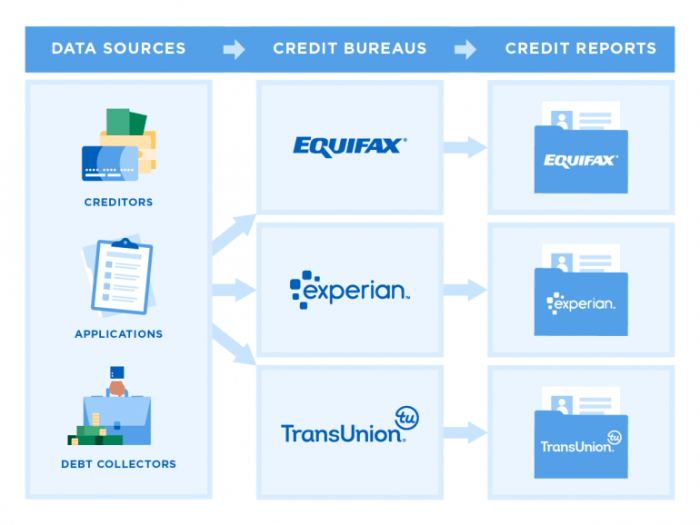

Solo credit bureaus are non-traditional credit reporting agencies that collect and analyze financial data from a limited range of sources, often focusing on specific segments of the population or niche markets. Unlike the three major credit bureaus (Experian, Equifax, and TransUnion), solo credit bureaus typically operate independently and have smaller data sets. Their role in the financial ecosystem is to provide alternative credit assessments and insights, particularly for individuals who may have limited or no credit history with traditional bureaus.

First-party data is information that a company collects directly from its customers or users. It’s considered the most valuable type of data because it’s directly related to the company’s own customers and their interactions with the business. In contrast, second-party data is obtained from another company that has collected it directly from its own customers, and third-party data is collected and aggregated by data brokers or other third-party organizations. Solo credit bureaus collect first-party data from their users, providing a more granular and specific view of their financial behavior.

Data Points Collected by Solo Credit Bureaus

Solo credit bureaus collect a variety of data points to create a comprehensive picture of their users’ financial health. These data points can include:

- Payment history: This data reflects the user’s track record of making payments on time, including loan payments, credit card bills, and utility bills. It’s a crucial indicator of their financial responsibility.

- Credit utilization: This refers to the amount of available credit the user is currently using. A high credit utilization ratio can negatively impact their credit score, indicating potential overspending.

- Account balances: This data includes the outstanding balances on the user’s credit accounts, such as credit cards, loans, and lines of credit. It provides insights into their overall debt levels.

- Debt-to-income ratio: This ratio represents the proportion of the user’s monthly income that goes towards debt payments. A high debt-to-income ratio can signal financial strain and make it difficult to obtain new credit.

- Credit inquiries: This data reflects the number of times lenders have accessed the user’s credit report recently. A high number of inquiries can negatively impact their credit score, suggesting they may be applying for too much credit.

Data Collection and Privacy Considerations

Solo credit bureaus play a crucial role in building individual credit profiles, but their data collection practices raise important privacy concerns. Understanding how these bureaus collect and use first-party data is essential for both consumers and businesses.

Data Collection Methods

Solo credit bureaus employ various methods to gather first-party data, ensuring comprehensive and accurate credit histories. These methods include:

- Direct reporting from lenders and creditors: The primary source of data for solo credit bureaus is direct reporting from lenders and creditors. These entities provide information about borrowers’ loan and credit card accounts, including payment history, credit limits, and outstanding balances. This method ensures that the data is accurate and up-to-date, as it comes directly from the source.

- Consumer self-reporting: Consumers can directly report their credit information to solo credit bureaus, providing details about their financial accounts and other relevant information. This method allows individuals to proactively manage their credit history and correct any inaccuracies. It also helps individuals who may have limited credit history build their credit profile.

- Data aggregation from other sources: Solo credit bureaus may also gather data from other sources, such as public records, utility companies, and telecommunications providers. This data can provide additional insights into an individual’s financial behavior and creditworthiness. However, it’s crucial to ensure that data aggregation practices comply with privacy regulations and consumer consent.

Legal and Ethical Implications

The collection and utilization of first-party data by solo credit bureaus have significant legal and ethical implications. Ensuring responsible data handling is crucial to protect consumer privacy and maintain public trust.

- Compliance with data privacy regulations: Solo credit bureaus must comply with data privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. These regulations set stringent standards for data collection, storage, and usage, including obtaining informed consent from individuals and providing transparency about data processing activities. Failure to comply with these regulations can result in substantial fines and legal repercussions.

- Transparency and consumer consent: Transparency and consumer consent are fundamental principles of ethical data handling. Solo credit bureaus must be transparent about their data collection practices and obtain explicit consent from individuals before using their data. This means clearly informing consumers about what data is being collected, how it will be used, and for how long it will be stored. Consumers should have the right to access, correct, or delete their personal data, ensuring control over their information.

- Data security and protection: Solo credit bureaus are responsible for safeguarding the personal data they collect. This includes implementing robust security measures to protect against unauthorized access, use, disclosure, alteration, or destruction of data. They must also have appropriate data breach response plans in place to mitigate the risks associated with data breaches. Failing to protect consumer data can lead to significant financial and reputational damage, as well as legal liability.

Potential Risks Associated with Data Breaches and Misuse

Data breaches and misuse of first-party data pose significant risks to individuals and society as a whole.

- Identity theft and fraud: If sensitive financial data is compromised, individuals are vulnerable to identity theft and fraud. Criminals can use stolen data to open new credit accounts, make unauthorized purchases, or access financial resources. This can have severe consequences for victims, including financial losses, damaged credit scores, and reputational harm.

- Discrimination and unfair treatment: The misuse of credit data can lead to discrimination and unfair treatment. For example, if credit bureaus use data in a biased or discriminatory manner, it can result in individuals being denied access to credit, employment, or other opportunities. This can perpetuate existing inequalities and hinder social mobility.

- Erosion of trust and privacy: Data breaches and misuse of data can erode public trust in institutions and undermine individual privacy. When individuals feel that their personal information is not being protected, they may become less willing to share data with organizations, hindering the development of innovative services and technologies.

Applications of Solo Credit Bureau First-Party Data: Solo Credit Bureau First Party Data

Solo credit bureau first-party data, derived directly from consumers and their credit activities, offers a unique and valuable resource for various industries. This data provides insights into individual creditworthiness, financial behavior, and risk profiles, enabling businesses to make more informed decisions and enhance their operations.

Lending and Credit Scoring

Solo credit bureau data plays a crucial role in lending and credit scoring. It provides a comprehensive view of a borrower’s credit history, including payment patterns, credit utilization, and debt levels. This information allows lenders to assess credit risk more accurately and make informed decisions about loan approvals, interest rates, and credit limits.

- Improved Credit Risk Assessment: Solo credit bureau data helps lenders develop more accurate credit risk models by incorporating a wider range of credit information, including alternative data sources like utility payments and rent history. This leads to more precise risk assessments, enabling lenders to extend credit to a broader range of borrowers while mitigating potential losses.

- Enhanced Loan Approval Decisions: By leveraging solo credit bureau data, lenders can make more informed loan approval decisions. This data helps identify borrowers with a strong credit history and responsible financial behavior, reducing the risk of defaults and improving loan portfolio performance.

- Tailored Loan Products: Solo credit bureau data allows lenders to offer personalized loan products tailored to individual borrowers’ needs and creditworthiness. For instance, borrowers with excellent credit history may qualify for lower interest rates or higher credit limits, while those with limited credit history may be offered smaller loans with more flexible terms.

Fraud Detection and Prevention

Solo credit bureau data is instrumental in combating fraud and preventing financial losses. It provides insights into suspicious credit activities, helping businesses identify potential fraudsters and take proactive measures to mitigate risks.

- Early Detection of Fraudulent Activity: By analyzing patterns in credit behavior, solo credit bureau data can identify unusual or suspicious transactions, such as multiple applications for credit cards or loans within a short period, large balance transfers, or sudden changes in spending patterns. This early detection allows businesses to investigate potential fraud cases and take appropriate action.

- Improved Fraud Risk Scoring: Solo credit bureau data helps develop more sophisticated fraud risk scoring models, enabling businesses to prioritize investigations and allocate resources effectively. This data can identify individuals with a higher likelihood of engaging in fraudulent activities, allowing businesses to take proactive steps to prevent fraud.

- Real-Time Fraud Monitoring: Solo credit bureau data can be integrated into real-time fraud monitoring systems, providing immediate alerts when suspicious activity is detected. This allows businesses to respond quickly to potential fraud cases and minimize financial losses.

Risk Management

Solo credit bureau data empowers businesses to manage risk effectively across various operations. It provides insights into customer behavior, financial stability, and potential liabilities, enabling businesses to make informed decisions and minimize exposure to risk.

- Credit Risk Management: By analyzing solo credit bureau data, businesses can assess the creditworthiness of their customers and manage their credit risk exposure. This data helps identify customers with a higher risk of defaulting on payments, allowing businesses to take appropriate actions, such as setting stricter credit limits or requiring collateral.

- Operational Risk Management: Solo credit bureau data can be used to identify potential operational risks, such as fraud, money laundering, or identity theft. This data helps businesses implement effective risk mitigation strategies and minimize potential losses.

- Regulatory Compliance: Solo credit bureau data helps businesses comply with regulatory requirements related to credit reporting and risk management. This data provides evidence of due diligence and supports compliance with anti-money laundering and know-your-customer (KYC) regulations.

Customer Segmentation and Targeting, Solo credit bureau first party data

Solo credit bureau data enables businesses to segment their customer base and target specific groups with personalized offers and services. By understanding customer creditworthiness and financial behavior, businesses can tailor their marketing campaigns and product offerings to meet the unique needs of different customer segments.

- Identify High-Value Customers: Solo credit bureau data helps businesses identify high-value customers with a strong credit history and high spending potential. These customers can be targeted with exclusive offers, premium services, and personalized marketing campaigns.

- Develop Targeted Marketing Strategies: By segmenting customers based on their creditworthiness and financial behavior, businesses can develop targeted marketing strategies that resonate with specific customer groups. This approach maximizes the effectiveness of marketing campaigns and improves customer engagement.

- Optimize Product Development: Solo credit bureau data provides insights into customer needs and preferences, enabling businesses to develop products and services tailored to specific customer segments. This approach ensures that products and services meet the needs of target customers, leading to higher customer satisfaction and increased sales.

Personalized Financial Products and Services

Solo credit bureau data is essential for developing personalized financial products and services that cater to individual needs and preferences. By understanding a customer’s credit history, financial behavior, and risk profile, businesses can offer tailored solutions that meet their specific financial goals.

- Personalized Credit Cards: Solo credit bureau data enables financial institutions to offer personalized credit cards with tailored credit limits, rewards programs, and interest rates based on a customer’s creditworthiness and spending patterns. This approach ensures that credit cards meet the specific needs of individual customers, enhancing customer satisfaction and loyalty.

- Customized Loan Options: Solo credit bureau data allows lenders to offer customized loan options, such as lower interest rates or longer repayment terms, to borrowers with a strong credit history. This approach caters to the unique financial needs of different borrowers, increasing loan approvals and reducing defaults.

- Financial Planning and Advice: Solo credit bureau data can be used to develop personalized financial planning and advice services. By understanding a customer’s financial situation, credit history, and goals, financial advisors can provide tailored recommendations for debt management, savings strategies, and investment opportunities.

Future Trends and Innovations

The landscape of solo credit bureau first-party data is rapidly evolving, driven by advancements in technology and a growing awareness of its potential. Emerging trends are shaping the way this data is collected, analyzed, and utilized, opening doors to new applications and insights.

The Growing Importance of Alternative Data Sources

The traditional credit scoring model, relying heavily on financial history, is being challenged by the emergence of alternative data sources. These non-traditional data points provide a more holistic view of an individual’s creditworthiness, capturing aspects not reflected in traditional credit reports.

- Telecom data: Mobile phone usage patterns, such as call frequency, data consumption, and payment history, can offer insights into an individual’s financial responsibility and stability.

- Utility bills: Consistent payment of utility bills demonstrates financial discipline and responsibility, complementing traditional credit data.

- E-commerce transactions: Regular online purchases and payment history on platforms like Amazon or eBay can reveal spending habits and financial management skills.

- Social media activity: While controversial, social media data can potentially provide insights into an individual’s financial behavior, risk tolerance, and network connections.

These alternative data sources, when combined with traditional credit data, can create a more comprehensive picture of an individual’s creditworthiness, leading to more accurate risk assessments and tailored financial products.

The Development of Advanced Analytics and Machine Learning Techniques

The increasing availability of solo credit bureau first-party data, coupled with advancements in analytics and machine learning, is driving the development of sophisticated models for credit risk assessment. These techniques enable the identification of subtle patterns and relationships within the data, leading to more accurate and nuanced predictions.

- Predictive modeling: Machine learning algorithms can be trained on vast datasets to predict the likelihood of loan defaults, credit card delinquencies, and other financial risks.

- Fraud detection: Advanced analytics can help identify suspicious activity and patterns that may indicate fraudulent behavior, enhancing the security of financial transactions.

- Personalized financial recommendations: By analyzing individual credit data, algorithms can tailor financial products and services, such as loan offers, credit limits, and interest rates, to meet specific needs and risk profiles.

These advancements in analytics are transforming the way credit risk is assessed, paving the way for more personalized and efficient financial services.

The Increasing Focus on Data Privacy and Security

As the use of solo credit bureau first-party data expands, concerns about data privacy and security are growing. Individuals are increasingly aware of the potential risks associated with sharing personal information, and regulators are enacting stricter rules to protect sensitive data.

- Data encryption and anonymization: To mitigate privacy risks, credit bureaus are implementing robust security measures, including data encryption and anonymization techniques.

- Data access controls: Strict access controls are being implemented to ensure that only authorized individuals and organizations have access to sensitive credit data.

- Transparency and consent: Consumers are being given greater transparency and control over their credit data, with the right to access, correct, and delete their information.

The focus on data privacy and security is essential to building trust and ensuring the responsible use of solo credit bureau first-party data.

The rise of solo credit bureaus and the use of first-party data is ushering in a new era of financial transparency and empowerment. By providing a more comprehensive view of individuals’ financial health, these bureaus are paving the way for more personalized financial services and better outcomes for both consumers and lenders. As technology advances and data privacy concerns continue to evolve, the role of solo credit bureaus and first-party data will only become more significant in shaping the future of finance.

Solo credit bureaus are increasingly relying on first-party data to understand their customers’ financial behaviors, just like how the controversial drone company Xtend is leaning into defense contracts to secure its future. This shift towards first-party data is driving innovation in the credit bureau industry, enabling them to offer more personalized and relevant services to their customers.

Standi Techno News

Standi Techno News