The Appeal of Bitcoin: Taking Out Mortgages Buy Bitcoin

Bitcoin, the first decentralized cryptocurrency, has captivated investors and enthusiasts worldwide. Its potential for growth and the allure of a decentralized financial system have fueled its rise in popularity. Understanding the factors driving Bitcoin’s appeal is crucial for anyone considering investing in this digital asset.

Bitcoin’s Potential for Growth

Bitcoin’s price has experienced significant volatility, but its long-term growth potential has attracted investors seeking high returns. This potential is fueled by several factors:

- Limited Supply: Bitcoin’s supply is capped at 21 million coins, making it a scarce asset. This scarcity is expected to drive its value higher as demand increases.

- Growing Adoption: Increasing acceptance of Bitcoin as a payment method and investment vehicle is driving demand. More businesses and individuals are embracing Bitcoin, leading to increased use and value.

- Decentralization: Bitcoin operates on a decentralized network, removing reliance on intermediaries like banks. This fosters trust and transparency, attracting investors seeking alternatives to traditional financial systems.

- Inflation Hedge: Bitcoin’s limited supply and lack of control by governments make it an attractive hedge against inflation. As traditional currencies lose value, Bitcoin’s value may increase.

Bitcoin’s Price Fluctuations

Bitcoin’s price is highly volatile, experiencing sharp rises and falls. These fluctuations are driven by various factors, including:

- Market Sentiment: News, events, and investor sentiment can significantly impact Bitcoin’s price. Positive news often leads to price increases, while negative news can trigger sell-offs.

- Regulatory Uncertainty: Government regulations and policies regarding cryptocurrencies can influence Bitcoin’s price. Clarity and favorable regulations tend to boost confidence and price, while uncertainty can create volatility.

- Supply and Demand: Like any asset, Bitcoin’s price is influenced by supply and demand. Increased demand from investors and businesses can drive prices up, while decreased demand can lead to price drops.

- Technological Developments: Advancements in Bitcoin technology and infrastructure can affect its value. New applications, improved scalability, and security enhancements can influence investor confidence and price.

Bitcoin Volatility and Risk Tolerance

Bitcoin’s volatility is significantly higher than traditional investments like stocks or bonds. This high volatility presents both opportunities and risks for investors.

- High Potential Returns: Bitcoin’s volatility can lead to significant price increases, offering the potential for substantial returns.

- High Risk of Losses: The same volatility that drives potential gains can also lead to significant losses. Investors must be prepared for sharp price drops and potential capital loss.

Bitcoin is suitable for investors with a high risk tolerance and a long-term investment horizon.

Mortgages as a Funding Source

Mortgages, traditionally used to finance real estate purchases, are increasingly being explored as a funding source for Bitcoin investments. This approach involves using the equity in your home to borrow funds, which can then be used to buy Bitcoin. While it might seem appealing, it’s crucial to understand the risks and complexities associated with this strategy.

Pros and Cons of Using a Mortgage for Bitcoin Investment

Using a mortgage for Bitcoin investment presents both potential benefits and drawbacks. Here’s a breakdown of the pros and cons:

- Pros:

- Leverage: Mortgages allow you to leverage your home equity, enabling you to invest in a larger amount of Bitcoin than you could with your own cash.

- Potential for Higher Returns: If Bitcoin’s value appreciates significantly, the potential returns on your investment could outweigh the cost of mortgage interest.

- Tax Advantages: In some jurisdictions, mortgage interest payments may be tax-deductible, potentially reducing your overall tax burden.

- Cons:

- High Risk: Bitcoin is a volatile asset, and its price can fluctuate drastically. If the price drops, you could lose a significant portion of your investment, potentially exceeding the value of your home.

- Mortgage Interest: Mortgages come with interest charges, which can eat into your potential profits, especially if Bitcoin’s value doesn’t rise as expected.

- Foreclosure Risk: If you fail to make your mortgage payments, you could face foreclosure, losing your home and your Bitcoin investment.

- Limited Liquidity: Bitcoin is not as liquid as traditional assets, meaning it may be difficult to sell quickly if you need to access your funds.

Risks Associated with Using a Mortgage for Bitcoin Investment

Investing in Bitcoin using a mortgage comes with several risks:

- Potential for Loss: Bitcoin’s price is notoriously volatile. If the price drops significantly, you could lose a substantial portion of your investment, potentially exceeding the value of your home. For instance, in 2022, Bitcoin’s price dropped by over 60%, resulting in substantial losses for many investors.

- Interest Rate Fluctuations: Mortgage interest rates can fluctuate, increasing your monthly payments and reducing your potential returns. A rise in interest rates can make it difficult to manage your mortgage payments, especially if Bitcoin’s price doesn’t rise as expected.

- Foreclosure Risk: If you fail to make your mortgage payments due to a decline in Bitcoin’s value or other financial difficulties, you could face foreclosure, losing your home and your investment.

Comparing Potential Returns to Mortgage Interest

The financial viability of using a mortgage to invest in Bitcoin depends on the potential returns from Bitcoin compared to the cost of mortgage interest.

Example: You take out a $100,000 mortgage at a 5% interest rate to invest in Bitcoin. If Bitcoin’s value appreciates by 10% annually, your investment could generate a $10,000 return. However, the mortgage interest would cost you $5,000 annually, leaving you with a net profit of $5,000.

However, this is a simplified example. Bitcoin’s price can fluctuate significantly, and its value could decline, leading to losses that outweigh the potential gains.

Financial Considerations

Taking out a mortgage to buy Bitcoin is a bold move that comes with significant financial implications. It’s essential to thoroughly understand the risks and potential rewards before making such a decision. This section delves into the crucial financial aspects of this strategy, highlighting the importance of responsible financial planning and risk management.

Debt Accumulation and Market Volatility

Using a mortgage to buy Bitcoin means taking on substantial debt. This debt can accumulate over time, especially if Bitcoin’s price fluctuates. If the price drops, you could end up owing more on your mortgage than the value of your Bitcoin holdings. It’s crucial to consider the potential for significant losses and ensure you have a plan to manage this risk.

Financial Planning and Budgeting

Before using a mortgage to invest in Bitcoin, you must have a clear understanding of your financial situation. Develop a comprehensive financial plan that Artikels your income, expenses, and debt obligations. This plan should include a realistic budget that accounts for your mortgage payments and potential losses from Bitcoin price fluctuations.

A well-structured financial plan and budget can help you navigate the complexities of this investment strategy and minimize the risk of financial distress.

Managing Debt and Mitigating Risk

Managing debt and mitigating risk are essential when using a mortgage to buy Bitcoin. Here are some strategies:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments by allocating a portion of your portfolio to other assets, such as stocks, bonds, or real estate, to reduce the impact of Bitcoin price volatility.

- Set Realistic Investment Goals: Establish clear investment goals and timelines, and ensure your Bitcoin investment aligns with your overall financial plan. Don’t invest more than you can afford to lose.

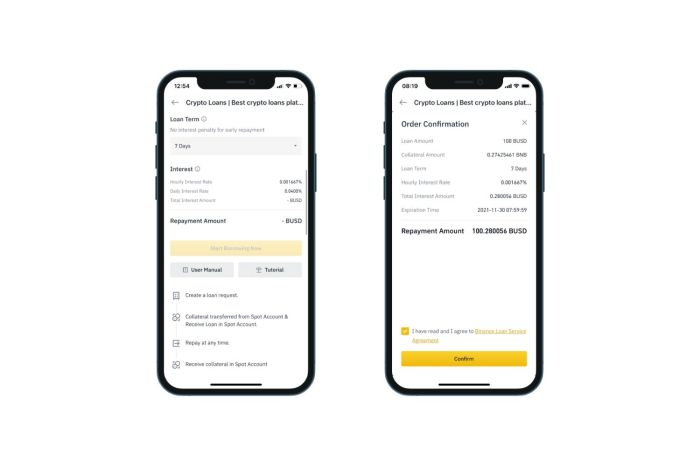

- Consider Short-Term Loans: Instead of a mortgage, consider using a short-term loan with a lower interest rate and shorter repayment period. This can reduce your overall debt burden and limit your exposure to Bitcoin price fluctuations.

- Regularly Monitor Your Investments: Keep a close eye on your Bitcoin holdings and adjust your investment strategy based on market conditions. Don’t be afraid to sell if the market turns against you.

Alternative Investment Strategies

Taking out a mortgage to invest in Bitcoin is a bold move that requires careful consideration. It’s essential to weigh the potential rewards against the risks involved and compare this strategy to other investment options.

Comparison with Other Investment Strategies

Understanding the differences between investing in Bitcoin using a mortgage and other popular investment strategies is crucial. Let’s examine how these approaches stack up against each other:

- Stocks: Investing in stocks offers diversification across various sectors and industries, potentially mitigating risk. Stocks can provide long-term growth, but volatility is a factor.

- Bonds: Bonds are considered a safer investment than stocks, offering predictable returns and lower risk. However, their returns may not keep pace with inflation.

- Real Estate: Real estate investments offer tangible assets with potential for appreciation and rental income. However, real estate can be illiquid and requires significant capital investment.

Risk and Reward Analysis

Each investment strategy carries its own set of risks and potential rewards:

- Bitcoin: The cryptocurrency market is known for its high volatility, offering the potential for significant gains but also posing substantial risks of losses. Bitcoin’s price is influenced by factors like regulatory changes, adoption rates, and market sentiment.

- Stocks: Stock investments are subject to market fluctuations, economic conditions, and company performance. While diversification can reduce risk, the potential for losses exists.

- Bonds: Bonds generally carry lower risk than stocks but offer lower returns. Inflation can erode bond returns, and interest rate hikes can impact bond prices.

- Real Estate: Real estate investments can be affected by factors like local market conditions, property taxes, and interest rates. They also require ongoing maintenance and management.

Examples of Successful and Unsuccessful Strategies

- Successful Mortgage-Backed Bitcoin Investment: In 2020, a young entrepreneur named Sarah used a home equity loan to invest in Bitcoin. She researched the market thoroughly and timed her investment well, benefiting from Bitcoin’s surge in value. Sarah’s calculated approach and careful risk management allowed her to generate significant returns.

- Unsuccessful Mortgage-Backed Bitcoin Investment: Mark, a real estate agent, borrowed heavily against his property to invest in Bitcoin in 2017. He was caught off guard by a sudden market downturn and suffered significant losses, jeopardizing his financial stability. Mark’s decision to invest a large portion of his assets in a volatile asset without proper research and risk management proved costly.

Regulatory Landscape

The regulatory environment surrounding Bitcoin investment is constantly evolving, presenting both opportunities and challenges for investors. Understanding the current regulations and potential future changes is crucial for making informed investment decisions.

Impact of Regulations on Bitcoin Investors

Regulations can significantly impact Bitcoin investors by influencing market sentiment, trading activity, and access to investment opportunities.

- Increased Legitimacy and Transparency: Regulatory frameworks can enhance the legitimacy and transparency of the Bitcoin market, attracting institutional investors and fostering greater confidence among retail investors. This can lead to increased market liquidity and price stability.

- Enhanced Investor Protection: Regulations can provide greater investor protection by establishing standards for exchanges, custodians, and other market participants. This can help mitigate risks associated with fraud, theft, and market manipulation.

- Potential for Increased Taxation: Regulations can introduce new tax liabilities for Bitcoin investors, including capital gains tax on profits from trading or holding Bitcoin. This can impact investment returns and necessitate careful tax planning.

- Restrictions on Trading and Investment: Regulations can impose restrictions on trading activities, such as limits on leverage or restrictions on certain types of investors. These restrictions can limit investment opportunities and potentially affect market dynamics.

Risks Associated with Investing in Bitcoin in a Regulated Environment

While regulations can enhance market stability and investor protection, they also introduce new risks that investors need to be aware of.

- Compliance Costs: Complying with regulations can be costly for both exchanges and investors, potentially impacting profitability and investment returns. This includes costs associated with KYC (Know Your Customer) procedures, AML (Anti-Money Laundering) compliance, and reporting requirements.

- Regulatory Uncertainty: The regulatory landscape for Bitcoin is constantly evolving, and uncertainty regarding future regulations can create volatility in the market and impact investment decisions. This uncertainty can make it difficult for investors to plan for the long term.

- Potential for Overregulation: Excessive regulation could stifle innovation and limit the growth of the Bitcoin market. This could discourage investment and hinder the development of new applications and services.

Examples of Regulatory Changes and their Impact on Bitcoin Investors

Several regulatory changes have impacted Bitcoin investors in recent years, highlighting the importance of staying informed about the evolving regulatory landscape.

- The US Securities and Exchange Commission (SEC) has been increasingly scrutinizing cryptocurrency offerings, leading to several enforcement actions against companies that failed to comply with securities laws. This has resulted in increased scrutiny of Initial Coin Offerings (ICOs) and a greater focus on regulatory compliance by cryptocurrency businesses.

- The European Union’s Fifth Anti-Money Laundering Directive (5AMLD) has introduced new regulations for cryptocurrency exchanges and wallet providers, requiring them to comply with KYC and AML requirements. This has led to increased KYC and AML compliance costs for these businesses, which could potentially impact investor access to services and trading opportunities.

Ethical Considerations

Mortgaging your home to invest in Bitcoin is a bold move that comes with significant ethical implications. While the potential for substantial returns is alluring, it’s crucial to weigh the risks against the potential impact on your financial stability and long-term well-being.

The Potential for Financial Instability

Taking out a mortgage to buy Bitcoin involves significant financial risk. Bitcoin’s price is highly volatile, and its value can fluctuate dramatically in a short period. This volatility can lead to substantial losses, potentially jeopardizing your financial security.

- Loss of Home: If the value of Bitcoin plummets and you are unable to repay your mortgage, you could face foreclosure, losing your home and potentially damaging your credit score.

- Increased Debt Burden: Taking out a mortgage for an investment increases your debt burden. If your Bitcoin investment fails to generate returns, you will be left with a mortgage payment, potentially straining your finances and limiting your ability to meet other financial obligations.

The Potential for Exacerbating Social and Economic Inequalities, Taking out mortgages buy bitcoin

Bitcoin’s price has soared in recent years, attracting investors seeking to capitalize on its potential. However, this surge in price has also raised concerns about the potential for Bitcoin investment to exacerbate existing social and economic inequalities.

- Limited Access: Bitcoin investment requires a significant amount of capital, putting it out of reach for many individuals, particularly those from lower socioeconomic backgrounds. This can create a cycle of wealth inequality, where those who can afford to invest in Bitcoin are more likely to benefit from its potential gains, while those who cannot afford to invest are left behind.

- Lack of Regulation: The lack of robust regulation in the cryptocurrency market can create opportunities for fraud and manipulation, which can disproportionately impact vulnerable populations. This can further exacerbate existing social and economic inequalities.

Examples of Bitcoin’s Ethical Implications

Bitcoin has been used for both positive and negative purposes.

- Positive Impact: Bitcoin has been used to facilitate cross-border remittances, enabling people to send money to family and friends in other countries more efficiently and cheaply than traditional methods.

- Negative Impact: Bitcoin has been linked to illicit activities such as money laundering and drug trafficking. The decentralized nature of Bitcoin makes it difficult to track transactions, creating opportunities for criminal activity.

Taking out mortgages buy bitcoin – Ultimately, the decision to use a mortgage to buy Bitcoin is a personal one. It’s crucial to weigh the potential rewards against the risks and ensure you have a solid financial plan in place. Before taking the plunge, consider your financial situation, risk tolerance, and long-term goals. Remember, Bitcoin is a volatile asset, and the market can shift quickly, potentially leaving you with significant losses. Responsible financial practices and careful consideration are key to navigating this complex and exciting world.

Taking out a mortgage to buy Bitcoin might seem like a wild idea, but hey, some people are willing to take risks for potential gains. Maybe those folks could use a little help staying motivated, though. Check out the Lazyboard , a tool designed for those who struggle with procrastination, which might be just what they need to get their finances in order.

After all, even the most daring investors need a bit of organization to keep their dreams from turning into nightmares.

Standi Techno News

Standi Techno News