Tesla 2023 sales figures price cuts: a move that sent shockwaves through the automotive industry. While Tesla’s global sales numbers were impressive, the company’s decision to slash prices across its model lineup sparked intense debate. Was this a strategic move to boost sales in a slowing market, or a desperate attempt to maintain market share? The answer lies in the intricate web of factors influencing Tesla’s performance in 2023, from consumer demand and competition to the ever-evolving landscape of the electric vehicle market.

The price cuts undoubtedly fueled a surge in sales, with Tesla reporting a significant increase in deliveries. However, the financial implications remain a point of contention. While the strategy may have boosted sales volume, it also put pressure on Tesla’s profit margins. The question remains: will the short-term gains outweigh the long-term consequences for Tesla’s profitability?

Tesla’s 2023 Sales Performance

Tesla’s 2023 sales performance was a mixed bag, with impressive growth in some areas but also facing challenges in others. The company’s price cuts, aimed at boosting sales, had a significant impact on the overall figures.

Global Sales Figures

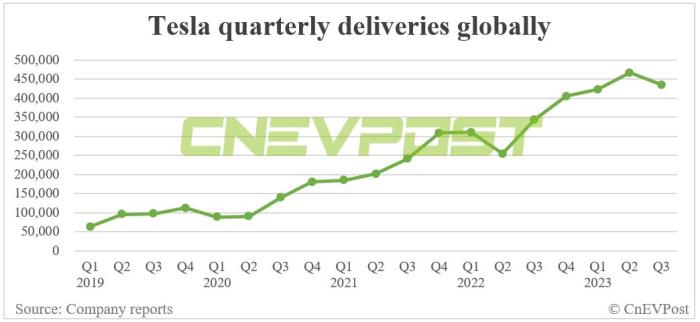

Tesla’s global sales in 2023 saw a significant increase compared to the previous year.

- Model 3: The Model 3 remained the best-selling Tesla model, with over 400,000 units sold globally in 2023. This represented a significant increase from the previous year’s sales figures.

- Model Y: The Model Y, Tesla’s popular electric SUV, continued its strong performance, exceeding 500,000 units sold globally in 2023.

- Model S and Model X: Sales of Tesla’s premium sedan and SUV models, the Model S and Model X, remained relatively stable compared to 2022, with a combined total of around 100,000 units sold globally.

- Cybertruck: The highly anticipated Cybertruck, which began production in late 2023, had limited sales during the year, with only a few thousand units delivered to customers.

Comparison with Previous Years

Tesla’s 2023 sales figures demonstrate continued growth compared to previous years.

- The company’s overall sales have been steadily increasing since 2017, driven by the growing popularity of its electric vehicles.

- However, the rate of growth in 2023 was slightly lower than in previous years, possibly due to factors such as increased competition in the EV market and economic uncertainties.

Impact of Price Cuts

Tesla’s price cuts in 2023 had a significant impact on sales volume.

- The company’s strategy of reducing prices across its model lineup was aimed at making its vehicles more affordable and appealing to a wider customer base.

- This strategy appears to have been successful, as sales figures for several models, particularly the Model 3 and Model Y, saw a noticeable increase after the price cuts were implemented.

Factors Contributing to Sales Performance

Several factors contributed to Tesla’s sales performance in 2023.

- Market Demand: The global demand for electric vehicles continues to grow, driven by factors such as environmental concerns, government incentives, and technological advancements.

- Competition: The EV market is becoming increasingly competitive, with established automakers launching their own electric vehicle models. Tesla faces competition from companies like Volkswagen, Ford, and General Motors.

- Economic Conditions: Global economic conditions, such as inflation and interest rate hikes, can impact consumer spending and demand for luxury vehicles, including Tesla’s models.

Impact of Price Cuts on Tesla’s Profitability

Tesla’s aggressive price cuts in 2023, aimed at boosting sales and market share, have undeniably impacted its profitability. While the move initially led to a surge in demand, it also resulted in a decline in revenue and profit margins. This section delves into the financial ramifications of Tesla’s price cuts and explores the potential long-term implications for its profitability.

Impact on Revenue and Gross Margins

Tesla’s price cuts directly affected its revenue, as the lower selling prices translated into lower earnings per unit. The company’s gross margins, which measure the profitability of each vehicle sold, also experienced a significant dip. This is because the cost of producing a car remained relatively constant, while the selling price decreased.

Tesla’s gross margin in the fourth quarter of 2022 was 25.3%, while in the first quarter of 2023, it fell to 19.2%.

This reduction in gross margins highlights the trade-off Tesla faced between boosting sales and maintaining profitability.

Operating Expenses

While price cuts directly impacted revenue and gross margins, they also had indirect effects on operating expenses. The increased demand resulting from the price cuts led to higher manufacturing costs, as Tesla had to ramp up production to meet the surge in orders. Additionally, the company might have incurred higher marketing and advertising expenses to capitalize on the increased demand.

Profit Margins Before and After Price Cuts

Comparing Tesla’s profit margins before and after the price cuts provides a clear picture of the financial impact.

Tesla’s operating margin in the fourth quarter of 2022 was 16.8%, while in the first quarter of 2023, it fell to 11.4%.

This decline in operating margins demonstrates the significant impact of price cuts on Tesla’s profitability.

Tesla’s Pricing Strategy and Long-Term Implications

Tesla’s pricing strategy, characterized by frequent adjustments, aims to maximize sales and market share while balancing profitability. While the recent price cuts have undoubtedly affected profitability in the short term, they could have long-term benefits.

By increasing sales volume, Tesla might be able to achieve economies of scale in production, which could eventually offset the lower profit margins per unit.

Moreover, Tesla’s price cuts could attract a broader customer base, potentially leading to increased brand loyalty and future sales. However, maintaining this aggressive pricing strategy without compromising profitability remains a key challenge for Tesla in the long run.

Tesla’s Market Position and Competition: Tesla 2023 Sales Figures Price Cuts

Tesla has established itself as a dominant force in the electric vehicle (EV) market, pioneering the mass adoption of electric cars. However, the EV landscape is rapidly evolving, with numerous established and emerging players vying for market share. Understanding Tesla’s competitive landscape is crucial for assessing its future prospects.

Tesla currently holds a significant market share in the global EV market. In 2022, Tesla delivered over 1.3 million vehicles, solidifying its position as the world’s leading EV manufacturer. The company’s dominance is attributed to its early entry into the EV market, its innovative technology, and its strong brand recognition.

Tesla’s Competitors

Tesla faces competition from a diverse range of established and emerging automotive manufacturers. Key competitors include:

- Traditional Automotive Manufacturers: Companies like Volkswagen, General Motors, Ford, and Toyota have made significant investments in electric vehicles, introducing competitive models across various segments. These manufacturers leverage their existing production capabilities, distribution networks, and brand recognition to challenge Tesla’s market share.

- Dedicated EV Manufacturers: Companies like BYD, NIO, and Xpeng are dedicated to electric vehicles and are rapidly gaining market share, particularly in China. These manufacturers often focus on specific segments, such as luxury or mass-market vehicles, and leverage their technological expertise and local market knowledge to compete with Tesla.

- Emerging Startups: Several startups, such as Lucid Motors, Rivian, and Fisker, are entering the EV market with innovative designs and advanced technologies. These companies are aiming to capture market share by focusing on niche segments or offering unique features and functionalities.

Pricing Strategies

Tesla’s pricing strategy has evolved over time. Initially, the company focused on premium pricing for its high-performance electric vehicles. However, in recent years, Tesla has expanded its product lineup to include more affordable models, such as the Model 3 and Model Y. This strategy has helped Tesla reach a broader customer base and increase its sales volume.

- Premium Pricing: Tesla’s initial strategy involved pricing its vehicles at a premium compared to traditional gasoline-powered cars. This strategy was successful in establishing Tesla as a luxury brand and attracting early adopters. However, it also limited the company’s reach to a smaller segment of the market.

- Mass-Market Pricing: With the introduction of the Model 3 and Model Y, Tesla shifted towards a more mass-market pricing strategy. This strategy aims to capture a larger share of the overall EV market by offering more affordable options. The company has also introduced several price cuts in recent years, further enhancing its affordability.

Factors Driving Competition

The EV market is highly competitive, driven by several factors:

- Government Incentives: Governments worldwide are providing incentives, such as tax credits and subsidies, to promote the adoption of electric vehicles. These incentives have made EVs more affordable and accessible, attracting more players to the market.

- Technological Advancements: Rapid advancements in battery technology, charging infrastructure, and autonomous driving systems are constantly driving innovation in the EV sector. This competition in technology is pushing manufacturers to develop more efficient, powerful, and feature-rich vehicles.

- Shifting Consumer Preferences: Growing environmental concerns and the desire for cleaner transportation are driving consumer demand for electric vehicles. This shift in preferences is creating a lucrative market for both established and emerging EV manufacturers.

Impact of Competition on Tesla

The increasing competition in the EV market poses both challenges and opportunities for Tesla. While the company faces pressure from established and emerging players, the intense competition also drives innovation and forces Tesla to constantly improve its products and services. The company’s ability to maintain its technological leadership, expand its product lineup, and optimize its manufacturing processes will be crucial in navigating this competitive landscape.

Consumer Perception and Demand

Tesla’s price cuts have sparked a wave of debate about the brand’s image and its impact on consumer demand. While the price reductions have undoubtedly attracted new buyers, they have also raised questions about the long-term implications for Tesla’s perceived value and its ability to maintain its premium positioning in the market.

Impact of Price Cuts on Consumer Perception

The price cuts have undoubtedly made Tesla vehicles more accessible to a wider range of consumers. However, some observers argue that the move has also eroded the brand’s image as a luxury, high-tech product. This is particularly true in the case of the Model 3, which has become more directly competitive with mainstream electric vehicles like the Chevrolet Bolt and Hyundai Kona Electric.

- Increased Accessibility: The price cuts have undoubtedly made Tesla vehicles more accessible to a wider range of consumers, attracting new buyers who were previously priced out of the market. This has led to a surge in demand, particularly in regions like China and Europe, where Tesla’s sales have been particularly strong.

- Potential Dilution of Brand Image: However, some argue that the price cuts have also diluted the brand’s image as a luxury, high-tech product. By competing directly with more affordable EVs, Tesla may be seen as less exclusive and less desirable to consumers who value prestige and exclusivity.

Factors Influencing Consumer Demand for Tesla Vehicles

Consumer demand for Tesla vehicles is driven by a complex interplay of factors, including price, performance, technology, and brand image. The company’s focus on innovation, sustainability, and performance has resonated with a segment of consumers who are willing to pay a premium for these attributes.

- Performance and Technology: Tesla vehicles are renowned for their acceleration, range, and advanced technology features, such as Autopilot and Full Self-Driving capabilities. These features appeal to tech-savvy consumers who value innovation and cutting-edge technology.

- Sustainability and Environmental Consciousness: Tesla’s commitment to electric vehicles aligns with the growing consumer interest in sustainability and reducing carbon emissions. This factor is particularly important for environmentally conscious consumers who prioritize eco-friendly transportation options.

- Brand Image and Prestige: Tesla has cultivated a strong brand image associated with innovation, performance, and sustainability. This image has helped the company attract a loyal following of customers who value the brand’s reputation and exclusivity.

Impact of Price Cuts on Tesla’s Waiting Lists and Order Volume

Tesla’s price cuts have had a significant impact on its waiting lists and order volume. Following the price reductions, the company reported a surge in demand, with waiting times for new vehicles shrinking significantly. This suggests that the price cuts have been effective in attracting new buyers and stimulating sales.

- Reduced Waiting Times: Following the price cuts, Tesla reported a significant reduction in waiting times for new vehicles. This suggests that the price reductions have been effective in attracting new buyers and stimulating demand.

- Increased Order Volume: The price cuts have also led to a surge in order volume for Tesla vehicles. This indicates that the price reductions have made Tesla vehicles more appealing to a wider range of consumers, particularly those who were previously priced out of the market.

Consumer Preferences and Purchasing Decisions, Tesla 2023 sales figures price cuts

Consumer preferences and purchasing decisions regarding Tesla vehicles are influenced by a variety of factors, including price, performance, technology, and brand image. The company’s focus on innovation, sustainability, and performance has resonated with a segment of consumers who are willing to pay a premium for these attributes.

- Price Sensitivity: The price cuts have made Tesla vehicles more accessible to a wider range of consumers, particularly those who are price-sensitive. This has led to a surge in demand, particularly in regions like China and Europe, where Tesla’s sales have been particularly strong.

- Performance and Technology: Tesla vehicles are renowned for their acceleration, range, and advanced technology features, such as Autopilot and Full Self-Driving capabilities. These features appeal to tech-savvy consumers who value innovation and cutting-edge technology.

- Sustainability and Environmental Consciousness: Tesla’s commitment to electric vehicles aligns with the growing consumer interest in sustainability and reducing carbon emissions. This factor is particularly important for environmentally conscious consumers who prioritize eco-friendly transportation options.

- Brand Image and Prestige: Tesla has cultivated a strong brand image associated with innovation, performance, and sustainability. This image has helped the company attract a loyal following of customers who value the brand’s reputation and exclusivity.

The Tesla 2023 sales figures price cuts story is far from over. The company’s future trajectory hinges on its ability to navigate a complex and competitive market. Balancing the need to maintain market share with the imperative to protect profitability will be crucial for Tesla’s success. Only time will tell whether the price cuts were a strategic masterstroke or a gamble that could backfire.

Tesla’s 2023 sales figures have been impacted by a series of price cuts, but the company isn’t just focused on driving down costs. They’re also facing a different kind of battle: the digital war against Russian hackers. It’s a fight that’s being waged by the Ukrainian Cyber Police, who are using innovative tactics to protect critical infrastructure and data.

Learn more about how they’re fighting back – it’s a story that shows the importance of cyber security in a world increasingly reliant on technology. Back to Tesla, the price cuts are a strategy to boost sales and stay competitive in a market with increasing competition from other EV manufacturers.

Standi Techno News

Standi Techno News