Texture seed round, a term that’s been buzzing in the venture capital world, signifies a unique approach to funding early-stage startups. It’s not your typical seed round, offering a blend of traditional funding with a dash of something different. Imagine a startup that’s already gained some traction, perhaps even a bit of revenue, but still needs that extra push to scale. Enter the texture seed round, a strategic move for investors and startups alike.

This round focuses on startups that have already established a solid foundation, showing promise in their market and a clear path to growth. Investors, looking for more than just potential, seek startups with a proven track record and a clear vision for the future. Texture seed rounds, in essence, bridge the gap between the traditional seed round and the more established Series A, offering a unique opportunity for startups to accelerate their journey.

Understanding Texture Seed Rounds

In the dynamic world of venture capital funding, the term “texture seed round” has emerged as a distinct approach to early-stage financing. This type of round, often characterized by its unique structure and investor profile, offers a compelling alternative to traditional seed funding for startups.

Characteristics of a Texture Seed Round

Texture seed rounds, also known as “pre-seed” or “micro-seed” rounds, are characterized by their focus on early-stage startups with a strong vision and a well-defined product-market fit. The funding amount is typically smaller than traditional seed rounds, ranging from $100,000 to $500,000. This allows startups to validate their initial product and gain traction before seeking larger investments.

- Early-Stage Startups: Texture seed rounds target startups that are still in their early stages of development, often with a minimum viable product (MVP) or a proof of concept. They are typically pre-revenue or have limited revenue.

- Smaller Funding Amounts: The funding amount in a texture seed round is significantly smaller than a traditional seed round, typically ranging from $100,000 to $500,000. This smaller investment allows startups to test their product, acquire early users, and validate their business model.

- Investor Profile: Texture seed rounds are often led by angel investors, seed-stage venture capitalists, or micro-VCs. These investors are typically experienced entrepreneurs, industry experts, or individuals with a strong network and a passion for supporting early-stage startups.

Comparison with Traditional Seed Rounds

While texture seed rounds share some similarities with traditional seed rounds, there are key differences.

| Feature | Texture Seed Round | Traditional Seed Round |

|---|---|---|

| Stage of Startup | Very early-stage, pre-revenue or limited revenue | Early-stage, with a proven product-market fit and some traction |

| Funding Amount | Smaller, typically $100,000 to $500,000 | Larger, typically $1 million to $5 million |

| Investor Profile | Angel investors, seed-stage VCs, micro-VCs | Seed-stage VCs, institutional investors, strategic partners |

| Valuation | Lower, reflecting the early stage of the startup | Higher, reflecting the startup’s progress and potential |

| Focus | Product validation, market testing, building a team | Scaling the business, expanding the market, building a strong team |

Rationale for Texture Seed Rounds

Texture seed rounds, also known as “pre-seed” or “bridge” rounds, are becoming increasingly popular in the startup world. These rounds offer a unique blend of early-stage funding and strategic support, catering to the specific needs of startups navigating the initial phases of growth.

Benefits for Startups

The benefits of texture seed rounds for startups are multifaceted. These rounds provide a valuable bridge between initial bootstrapping and traditional seed funding.

- Access to Early Capital: Texture seed rounds allow startups to secure initial funding before reaching the traditional seed stage, enabling them to build a strong foundation, validate their product-market fit, and attract further investment.

- Strategic Guidance: Investors in texture seed rounds often bring valuable expertise and connections to the table. They can provide mentorship, strategic advice, and access to their networks, helping startups navigate the early stages of growth.

- Reduced Dilution: By raising smaller amounts in a texture seed round, startups can minimize dilution of their equity, preserving ownership and control for founders.

- Improved Valuation: A successful texture seed round can demonstrate traction and validate the startup’s potential, leading to a higher valuation in subsequent funding rounds.

Benefits for Investors

Texture seed rounds offer investors an opportunity to participate in high-potential startups at an early stage.

- First-mover Advantage: Investors in texture seed rounds can secure a stake in promising startups before they gain significant traction, potentially leading to substantial returns in later rounds.

- Influence and Impact: Texture seed round investors can actively shape the direction of the startup, providing guidance and mentorship, which can lead to greater success.

- Diversification: Texture seed rounds allow investors to diversify their portfolio by investing in a wider range of early-stage companies, potentially mitigating risk.

- Valuation Uncertainty: Early-stage startups often face challenges in determining a fair valuation for their company, potentially leading to a lower valuation than they could achieve later.

- Investor Expectations: Investors in texture seed rounds may have higher expectations for rapid growth and traction, which can put pressure on startups to achieve milestones quickly.

- Lack of Funding Security: Texture seed rounds typically involve smaller amounts of funding, which may not be sufficient to cover all expenses and unforeseen challenges.

- Higher Risk: Early-stage startups are inherently riskier investments, and texture seed rounds are particularly susceptible to failure due to the early stage of development.

- Limited Exit Opportunities: Early-stage startups may take longer to achieve liquidity events such as an IPO or acquisition, potentially delaying returns for investors.

- Dilution: Investors in texture seed rounds may experience significant dilution of their equity as the startup raises further funding in subsequent rounds.

- Valuation: The valuation of the company is typically lower than in a traditional seed round. This is because the company is still in its early stages of development and has not yet proven its business model.

- Equity: The amount of equity that investors receive in exchange for their investment is typically small, usually between 5% and 10% of the company.

- Conversion: The investors’ equity may be convertible into equity in a future round, such as a seed round or Series A round.

- Liquidation preference: Investors may have a liquidation preference, which means they are entitled to receive a certain amount of money back before other shareholders in the event of a sale or liquidation of the company.

- Anti-dilution protection: Investors may have anti-dilution protection, which protects them from being diluted in the event of future financing rounds.

- Convertible notes: Convertible notes are debt instruments that can be converted into equity at a future date. This is a popular option for texture seed rounds because it allows investors to receive a return on their investment even if the company does not raise a larger seed round.

- Simple agreements for future equity (SAFE): SAFEs are a type of convertible security that is similar to convertible notes. However, SAFEs are typically simpler and more streamlined than convertible notes.

- Preferred stock: Preferred stock is a type of equity that gives investors certain rights and preferences over common stockholders. This is a less common option for texture seed rounds, but it can be used in some cases.

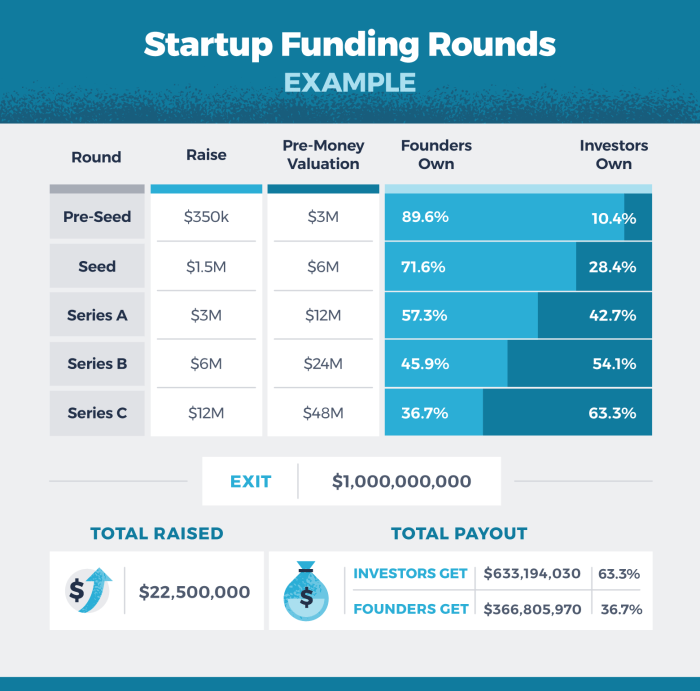

- Pre-money valuation: The pre-money valuation is the value of the company before the investment is made. This is typically based on the company’s potential, the size of the market, and the team’s experience.

- Post-money valuation: The post-money valuation is the value of the company after the investment is made. This is calculated by adding the investment amount to the pre-money valuation.

- Network and Industry Expertise: Investors leverage their networks and industry expertise to source potential investment opportunities. They often rely on referrals from other investors, entrepreneurs, and industry experts.

- Market Research and Analysis: Investors conduct thorough market research and analysis to assess the target market size, growth potential, and competitive landscape. They evaluate the company’s product or service, its value proposition, and its potential for differentiation.

- Team Assessment: Investors place a strong emphasis on evaluating the company’s team, including the founders’ experience, expertise, and track record. They assess the team’s ability to execute, adapt to challenges, and build a successful business.

- Financial Projections and Valuation: Investors review the company’s financial projections, including revenue forecasts, profitability estimates, and cash flow analysis. They assess the company’s valuation based on its stage of development, market potential, and competitive landscape.

- Legal and Regulatory Due Diligence: Investors conduct legal and regulatory due diligence to ensure that the company is compliant with all applicable laws and regulations. They review the company’s corporate structure, intellectual property, and other legal documentation.

- Identifying the Right Investors: Texture seed rounds often attract a more specialized investor base, requiring startups to identify investors who understand the nuances of their business model and the value of long-term growth.

- Communicating the Value Proposition: Startups need to clearly articulate their vision and demonstrate how their business model will generate sustainable value over time. This requires a strong narrative that goes beyond short-term metrics and highlights the long-term potential of their venture.

- Building a Strong Team: Texture seed rounds often involve longer-term partnerships with investors, making it crucial for startups to build a strong and experienced team capable of executing their long-term vision.

- Navigating the Investment Landscape: The texture seed funding landscape is evolving, and startups need to stay informed about current trends and best practices to maximize their chances of success.

Risks for Startups

While texture seed rounds offer several advantages, it’s important to acknowledge the potential risks.

Risks for Investors

Investors in texture seed rounds face specific risks as well.

Structure of a Texture Seed Round

A texture seed round is a type of funding round that focuses on providing early-stage startups with a small amount of capital in exchange for a small equity stake. This type of funding round is often used to help startups validate their product-market fit, build a team, and prepare for a larger seed round.

Terms and Conditions

The terms and conditions of a texture seed round can vary depending on the specific circumstances of the deal. However, some common terms include:

Equity Instruments

There are several different types of equity instruments that can be used in texture seed rounds. Some of the most common instruments include:

Valuation Process, Texture seed round

The valuation process for a texture seed round is typically less formal than for a traditional seed round. This is because the company is still in its early stages of development and may not have a lot of historical data to base the valuation on.

For example, if a company raises $100,000 in a texture seed round at a pre-money valuation of $500,000, the post-money valuation would be $600,000.

Investor Perspective

Investors participating in texture seed rounds are motivated by the potential for high returns and the opportunity to be involved in the early stages of promising companies. These investors are typically seeking out companies with innovative products or services, strong teams, and the potential to disrupt established markets.

Investment Strategies and Due Diligence

Investors in texture seed rounds typically employ a variety of strategies and due diligence processes to identify and evaluate promising companies.

Investment Portfolio Strategy

Texture seed rounds typically fit into a broader investment portfolio strategy, where investors allocate capital across different stages of company development and various industries. Investors may use texture seed rounds as a way to diversify their portfolio and gain exposure to high-growth potential companies in emerging markets.

Texture seed rounds can be a key part of a diversified investment portfolio, allowing investors to access high-growth potential companies at an early stage.

Startup Perspective

Seeking texture seed funding is a unique and often challenging endeavor for startups. While traditional seed rounds focus on validating the business model and securing initial traction, texture seed rounds prioritize building a strong foundation for future growth and scaling. Startups navigating this path face a unique set of opportunities and hurdles.

Challenges and Opportunities

Startups seeking texture seed funding must carefully consider the specific challenges and opportunities associated with this approach.

Preparing for a Texture Seed Round

Successful texture seed rounds require meticulous preparation and a strategic approach. Startups should:

- Develop a Comprehensive Business Plan: A detailed business plan outlining the company’s long-term strategy, market analysis, financial projections, and key milestones is essential for attracting investors and securing funding.

- Identify Potential Investors: Startups should research and connect with investors who align with their long-term vision and have a proven track record in supporting companies at their stage of development.

- Craft a Compelling Pitch Deck: A well-structured pitch deck that highlights the company’s value proposition, market opportunity, team, and financial projections is crucial for capturing investor attention and generating interest.

- Practice Pitching: Startups should rehearse their pitch and gather feedback from mentors, advisors, and potential investors to refine their presentation and ensure it resonates with their target audience.

Executing a Texture Seed Round

Executing a texture seed round requires a strategic approach to maximize value for the startup.

- Negotiating Terms: Startups should carefully review and negotiate the terms of the investment agreement, focusing on factors such as valuation, equity dilution, and investor rights.

- Building Relationships: Cultivating strong relationships with investors is essential for long-term success. Startups should proactively communicate progress, address investor concerns, and seek ongoing guidance.

- Utilizing Funding Wisely: Startups should allocate funds strategically to achieve key milestones and build a sustainable foundation for future growth.

- Maintaining Transparency: Transparency and open communication with investors are crucial for building trust and fostering a collaborative partnership.

The Future of Texture Seed Rounds

Texture seed rounds, a novel approach to funding startups, are poised to play a significant role in the evolving venture capital landscape. This innovative funding model, characterized by its flexibility and focus on long-term value creation, is attracting increasing attention from both investors and entrepreneurs.

Impact of Emerging Technologies

The rapid advancement of emerging technologies, such as artificial intelligence, blockchain, and the metaverse, is driving a shift in the startup ecosystem. These technologies are creating new opportunities for innovation and disruption, leading to the emergence of startups with unique business models and growth potential. Texture seed rounds are well-suited to support these startups, providing them with the necessary capital and guidance to navigate the complexities of these emerging sectors.

- AI-powered startups: Texture seed rounds can help AI-powered startups navigate the challenges of developing and scaling their technology, including data acquisition, algorithm optimization, and regulatory compliance. For example, a startup developing an AI-powered medical diagnostic tool might use a texture seed round to secure funding for clinical trials and regulatory approvals, while also receiving mentorship from investors with expertise in the healthcare industry.

- Blockchain startups: Texture seed rounds can support blockchain startups in building decentralized applications (dApps) and infrastructure, which often require significant investment in technology and talent. For instance, a startup developing a blockchain-based supply chain management platform might use a texture seed round to fund the development of its blockchain network and secure partnerships with key players in the supply chain.

- Metaverse startups: Texture seed rounds can provide metaverse startups with the resources to create immersive experiences and develop innovative business models. For example, a startup developing a virtual reality platform for online events might use a texture seed round to fund the development of its platform and secure partnerships with event organizers.

As the venture capital landscape evolves, texture seed rounds are poised to play an increasingly significant role. Startups seeking a strategic edge and investors looking for a blend of potential and proven success will continue to find value in this innovative funding model. The future of texture seed rounds is bright, promising a new era of strategic investment and accelerated growth for the most promising startups.

A texture seed round is like the first layer of paint on a masterpiece – it sets the stage for what’s to come. And speaking of stages, the Russian government is taking a bold step by developing its own smartphone platform, a move that could shake up the global tech scene. Just like a texture seed round, this initiative could be the foundation for a whole new ecosystem, but only time will tell if it’ll be a success.

Standi Techno News

Standi Techno News