Turo car rental ipo profitable growth – Turo Car Rental IPO: Profitable Growth Ahead? The world of car rentals is changing, and Turo is leading the charge. This peer-to-peer car rental platform has disrupted the traditional model by connecting car owners with renters directly, creating a more flexible and affordable option for everyone. Turo’s IPO signifies a pivotal moment in the company’s journey, raising questions about its future growth potential and the impact on the broader car rental industry.

Turo’s business model relies on technology to connect car owners and renters seamlessly. Their mobile app allows users to easily search, book, and manage rentals, while their data analytics platform helps them optimize pricing and availability. This innovative approach has fueled Turo’s rapid growth, attracting a large user base and generating substantial revenue.

Turo’s Business Model and Growth Strategy

Turo, the world’s largest peer-to-peer car sharing marketplace, has disrupted the traditional car rental industry with its innovative business model and ambitious growth strategy. By connecting car owners with renters, Turo offers a more affordable and flexible alternative to traditional rental companies.

Turo’s Peer-to-Peer Car Rental Model

Turo’s model operates on a peer-to-peer basis, allowing car owners to list their vehicles for rent on the platform. Renters can browse available cars, filter by location, vehicle type, and price, and book their desired vehicle directly through the Turo app. Turo facilitates the entire process, from booking and payment to insurance and customer support.

Key Differences from Traditional Rental Companies:

- Variety of Vehicles: Turo offers a wide range of vehicles, including classic cars, luxury cars, SUVs, and even RVs, providing renters with greater choice and flexibility. Traditional rental companies often have limited selections and focus on standard car models.

- Lower Prices: Turo’s peer-to-peer model eliminates the overhead costs associated with traditional rental companies, resulting in lower rental prices for customers. Owners set their own rates, and competition within the platform drives prices down.

- Flexibility and Convenience: Turo offers greater flexibility than traditional rentals. Renters can pick up and drop off vehicles at convenient locations, and rental periods can be customized to suit individual needs. Turo also allows for one-way rentals, providing additional flexibility.

Turo’s Growth Strategy

Turo’s growth strategy focuses on expanding its market reach, forging strategic partnerships, and investing in technology to enhance its platform and user experience.

Market Expansion:

Turo has expanded its operations to over 5,000 cities across the United States, Canada, and the United Kingdom, and is actively exploring new markets globally. The company’s expansion strategy leverages data analytics and market research to identify areas with high demand for car rentals and strong potential for growth.

Strategic Partnerships:

Turo has formed partnerships with major companies and organizations to enhance its offerings and reach new customers. For example, Turo has partnered with airlines, hotels, and travel agencies to offer seamless car rental options to travelers. The company also collaborates with car manufacturers to provide incentives for owners to list their vehicles on the platform.

Technology Investments:

Turo invests heavily in technology to improve its platform’s functionality and user experience. The company has developed advanced algorithms to optimize pricing, match renters with suitable vehicles, and ensure the safety and security of transactions. Turo is also exploring new technologies, such as artificial intelligence and machine learning, to enhance its platform’s capabilities and provide a more personalized experience for users.

Turo’s Competitive Landscape

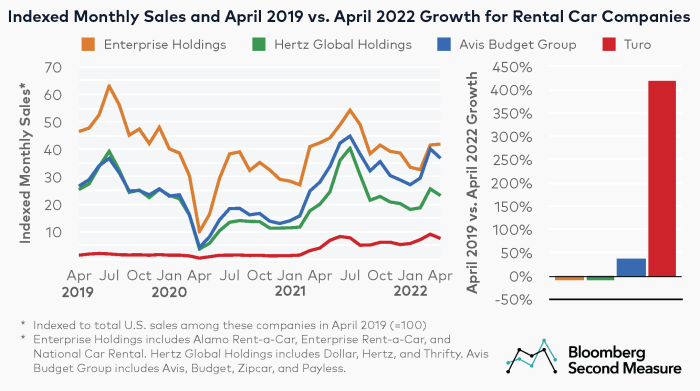

Turo faces competition from traditional rental companies like Enterprise, Avis, and Hertz, as well as other peer-to-peer car sharing platforms like Getaround and Zipcar.

Strengths:

- Strong Brand Recognition: Turo has established a strong brand reputation for its innovative peer-to-peer model and wide selection of vehicles.

- Large User Base: Turo boasts a large and growing user base, with millions of registered users globally, providing a strong network effect for both owners and renters.

- Technology and Innovation: Turo’s platform is powered by advanced technology, enabling efficient operations, seamless transactions, and a user-friendly experience.

- Strong Partnerships: Turo’s strategic partnerships with major companies and organizations enhance its market reach and provide access to new customer segments.

Weaknesses:

- Regulatory Challenges: The peer-to-peer car sharing industry faces regulatory challenges in some jurisdictions, which can limit Turo’s growth and expansion.

- Competition: Turo faces intense competition from traditional rental companies and other peer-to-peer car sharing platforms.

- Insurance and Liability: Ensuring adequate insurance coverage for both owners and renters is a critical aspect of Turo’s business model, and managing liability issues can be complex.

Turo’s Financial Performance and IPO

Turo, the peer-to-peer car-sharing platform, has been making waves in the automotive industry, disrupting traditional car rental models with its innovative approach. Its success is reflected in its impressive financial performance and its decision to go public. This section delves into Turo’s financial performance, the rationale behind its IPO, and the key factors that investors will consider when evaluating the company’s public offering.

Turo’s Financial Performance, Turo car rental ipo profitable growth

Turo’s financial performance has been marked by strong revenue growth, increasing profitability, and a commitment to scaling its operations.

Revenue Growth

Turo has experienced significant revenue growth, driven by the increasing adoption of its platform and the expansion of its services. The company’s revenue has grown consistently over the past few years, indicating a strong demand for its car-sharing services.

Profitability

While Turo is still a relatively young company, it has demonstrated a clear path to profitability. The company has been able to effectively manage its costs and optimize its operations, leading to improved profitability.

Key Financial Metrics

Investors will closely examine Turo’s key financial metrics to gauge its financial health and future growth potential. Some of the key metrics to consider include:

- Revenue per user: This metric reflects the average amount of revenue generated per Turo user, providing insights into the company’s ability to attract and retain customers.

- Customer acquisition cost (CAC): CAC measures the cost of acquiring a new customer, indicating the efficiency of Turo’s marketing and sales efforts.

- Net income margin: This metric reflects Turo’s profitability, showcasing its ability to generate profits from its operations.

- Operating expenses: Investors will examine Turo’s operating expenses to understand its cost structure and identify potential areas for optimization.

Rationale Behind Turo’s IPO

Turo’s decision to go public is a strategic move designed to accelerate its growth and expand its reach.

Access to Capital

Going public allows Turo to access a significant amount of capital, which can be used to fund its expansion plans, invest in new technologies, and acquire strategic assets.

Enhanced Brand Visibility

An IPO can significantly enhance Turo’s brand visibility and recognition, attracting new customers and investors.

Increased Liquidity

A public listing provides Turo’s existing shareholders with an opportunity to liquidate their investments and realize their returns.

Factors Investors Will Consider

Investors will carefully evaluate Turo’s IPO, considering various factors that will influence their investment decisions.

Market Size and Growth Potential

Investors will assess the size and growth potential of the peer-to-peer car-sharing market. The market is expected to experience significant growth in the coming years, driven by increasing demand for alternative transportation options and the rise of the sharing economy.

Competitive Landscape

Investors will analyze Turo’s competitive landscape, considering the presence of established players and emerging startups. Turo will need to demonstrate its competitive advantage and its ability to differentiate itself from competitors.

Management Team

Investors will scrutinize Turo’s management team, assessing their experience, expertise, and track record in the automotive and technology industries.

Technology and Innovation

Investors will evaluate Turo’s technology platform, its innovation capabilities, and its ability to adapt to evolving market trends.

Regulatory Environment

The regulatory environment surrounding peer-to-peer car-sharing services is evolving. Investors will consider the potential impact of regulations on Turo’s operations and its ability to navigate the regulatory landscape.

The Impact of Turo’s IPO on the Car Rental Industry

Turo’s IPO marks a significant milestone in the car rental industry, signaling a potential shift in the landscape of this traditional market. The company’s success in disrupting the traditional car rental model has raised questions about the future of established players and the potential for further disruption.

Increased Competition and Disruption

Turo’s entry into the public market has the potential to intensify competition within the car rental industry. The company’s peer-to-peer platform, which connects car owners with renters, offers a more flexible and often more affordable alternative to traditional car rental companies. This could force established players to adapt their strategies to remain competitive.

“Turo’s IPO is a wake-up call for traditional car rental companies. They need to innovate and find ways to compete with this new model,” said [expert name], a leading analyst in the car rental industry.

- Price Competition: Turo’s platform often offers lower rental rates than traditional car rental companies, particularly for shorter rental periods. This price advantage could attract price-sensitive customers and put pressure on traditional companies to lower their rates.

- Flexibility and Choice: Turo’s platform offers a wider range of vehicles and rental options, including unique and specialty vehicles that may not be available from traditional companies. This flexibility can attract customers seeking specific types of vehicles or customized rental experiences.

- Technology and Innovation: Turo has invested heavily in technology to create a seamless and user-friendly platform. This includes features like online booking, mobile app integration, and automated communication. Traditional car rental companies may need to invest more in technology to keep up with Turo’s advancements.

Turo’s Future Growth Prospects: Turo Car Rental Ipo Profitable Growth

Turo’s IPO marks a significant milestone in the company’s journey, and it opens up exciting possibilities for future growth. The company’s innovative business model and strong market position provide a solid foundation for continued success. Turo is poised to capitalize on the evolving car rental landscape and expand its reach, solidifying its position as a leading player in the industry.

Turo’s Potential for Continued Growth in the Car Rental Market

The global car rental market is projected to grow significantly in the coming years, driven by factors such as increasing tourism, rising disposable incomes, and the growing popularity of car sharing. Turo is well-positioned to benefit from this growth. Its peer-to-peer platform offers a unique value proposition to both car owners and renters, catering to diverse needs and preferences. Turo’s platform provides flexibility and affordability compared to traditional car rental companies, making it an attractive option for a wide range of users.

Turo’s Plans for Future Expansion and Innovation

Turo has ambitious plans for future expansion and innovation. The company is focused on expanding its geographic reach and diversifying its product offerings. Turo is exploring new markets both domestically and internationally, targeting regions with high growth potential. The company is also investing in new technologies to enhance the user experience, such as automated vehicle inspections and digital key access. Turo is exploring the potential of electric vehicles and autonomous driving, positioning itself at the forefront of the evolving automotive landscape.

Potential Risks and Challenges that Could Impact Turo’s Future Growth

Despite its strong growth prospects, Turo faces several potential risks and challenges. One significant risk is the potential for increased competition from traditional car rental companies and other peer-to-peer car sharing platforms. As the market matures, competition is likely to intensify, putting pressure on Turo to maintain its competitive edge. Another challenge is the need to manage regulatory compliance and ensure the safety of its platform. Turo must navigate evolving regulations and ensure that its platform operates in a safe and responsible manner.

The Impact of Technology on Turo’s Business

Turo, the peer-to-peer car-sharing platform, has been built upon a foundation of technology, leveraging it to disrupt the traditional car rental industry. From its user-friendly mobile app to its data-driven platform, technology plays a crucial role in every aspect of Turo’s operations, enabling its growth and shaping its future.

The Role of Technology in Turo’s Business Model

Turo’s success is intrinsically linked to its technological prowess. The platform relies heavily on technology to facilitate seamless interactions between car owners and renters.

- Mobile App: Turo’s mobile app is the primary interface for both car owners and renters. It allows users to browse available cars, book rentals, communicate with each other, and manage payments. The app’s intuitive design and user-friendly features have been key to Turo’s rapid adoption.

- Online Platform: Turo’s online platform serves as the central hub for its operations. It connects car owners and renters, handles bookings, manages payments, and provides customer support. The platform’s robust infrastructure ensures smooth and efficient operations, supporting Turo’s rapid growth.

- Data Analytics: Turo leverages data analytics to gain insights into user behavior, market trends, and operational efficiency. This data helps Turo optimize its pricing strategies, personalize the user experience, and improve its overall service.

The Impact of Emerging Technologies on Turo’s Future

Emerging technologies, such as autonomous vehicles and artificial intelligence, have the potential to significantly impact Turo’s business model and future growth prospects.

- Autonomous Vehicles: The rise of autonomous vehicles could lead to a significant shift in the car rental industry. Turo could capitalize on this trend by integrating autonomous vehicles into its platform, offering renters access to self-driving cars. This could open up new revenue streams and attract a wider range of customers.

- Artificial Intelligence: AI can be used to enhance Turo’s platform in several ways. For example, AI-powered chatbots could provide 24/7 customer support, while machine learning algorithms could be used to optimize pricing and identify potential fraud.

Leveraging Technology to Enhance Customer Experience and Drive Growth

Turo can leverage technology to further enhance its customer experience and drive growth.

- Personalized Recommendations: Turo can utilize data analytics to provide personalized car recommendations to renters based on their preferences, location, and past rental history. This can enhance the customer experience and lead to higher conversion rates.

- Improved Communication: Turo can utilize AI-powered chatbots to provide 24/7 customer support, ensuring quick and efficient responses to inquiries. This can improve customer satisfaction and reduce support costs.

- Enhanced Security: Turo can leverage technology to improve security features, such as real-time vehicle tracking, remote vehicle locking, and advanced fraud detection systems. This can provide peace of mind to both car owners and renters.

Turo’s IPO is a testament to its disruptive potential and the growing demand for alternative car rental solutions. The company’s focus on technology, its expanding market reach, and its commitment to innovation position it for continued success in the years to come. As Turo navigates the complexities of the public market, it will face new challenges and opportunities, shaping the future of car rentals and potentially disrupting the traditional industry landscape.

Turo’s IPO was a huge success, and the company is poised for even more profitable growth. It’s interesting to see how companies are taking inspiration from pop culture to create unique and engaging workspaces, like the Chinese game developer who modeled their offices after the iconic Starship Enterprise. This innovative approach to office design could be a key factor in attracting top talent and boosting employee morale, which in turn could contribute to even greater success for Turo.

Standi Techno News

Standi Techno News