Uber’s $10 Billion Investment Deal

Uber, the ride-hailing giant, secured a massive $10 billion investment deal in 2023, marking a significant milestone in its journey to profitability. This deal not only provided a much-needed financial boost but also signaled a shift in Uber’s strategic direction.

The Investors and Investment Amount

The investment was led by a consortium of investors, including the Abu Dhabi Investment Authority (ADIA), the sovereign wealth fund of the United Arab Emirates, and a group of private equity firms. The $10 billion investment was a mix of equity and debt financing, providing Uber with a substantial cash injection to support its growth plans.

The Purpose of the Funding

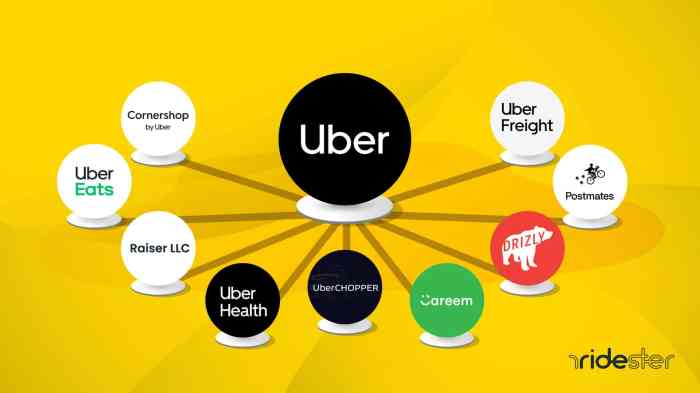

The primary purpose of the investment was to fuel Uber’s expansion efforts, particularly in emerging markets where ride-hailing is still in its nascent stages. The funds were also allocated to bolster Uber’s core businesses, including ride-hailing, food delivery, and freight transportation.

Timeline of the Deal

The deal was finalized in the second quarter of 2023, following months of negotiations. Initial discussions between Uber and potential investors began in early 2023, with the deal structure and terms being finalized in the following months. The investment was announced publicly in April 2023, marking a significant event in the ride-hailing industry.

Strategic Motivations

Uber’s decision to secure this substantial investment was driven by several strategic motivations:

* Accelerated Growth: The investment allowed Uber to expedite its expansion into new markets, particularly in regions with high growth potential, such as Asia and Latin America.

* Market Leadership: The influx of capital strengthened Uber’s position as a dominant player in the ride-hailing and mobility space, allowing it to invest in technology, infrastructure, and talent acquisition.

* Profitability Focus: The investment provided Uber with the resources to focus on profitability, a key priority for the company as it sought to move beyond its early growth phase.

* Technological Innovation: The investment enabled Uber to invest in research and development, further strengthening its technological edge in areas such as autonomous driving and artificial intelligence.

Impact on Uber’s Operations and Growth

Uber’s $10 billion investment deal signifies a significant boost to its financial resources, impacting its core business operations and propelling its growth strategy. This injection of capital will empower Uber to expand its existing services and venture into new markets, solidifying its position as a leading player in the mobility and delivery landscape.

Enhanced Operations and Efficiency

The substantial investment will empower Uber to optimize its core business operations across its ride-hailing, food delivery, and freight services. This could involve investing in technology infrastructure to improve platform efficiency, streamlining logistics and delivery processes, and enhancing customer support systems. For instance, Uber Eats could leverage the investment to develop advanced algorithms for optimizing delivery routes, reducing delivery times, and minimizing costs.

Expansion into New Markets and Product Offerings

The investment will fuel Uber’s expansion into new markets and product offerings. Uber could leverage this capital to enter emerging markets with high growth potential, like developing economies with a rapidly expanding middle class and increasing demand for mobility solutions. Additionally, the investment could facilitate Uber’s foray into new service verticals, such as last-mile delivery, micro-mobility solutions like e-scooters and e-bikes, or even urban air mobility.

The investment is expected to accelerate Uber’s growth trajectory and market share. By strengthening its existing services and expanding into new markets and product offerings, Uber can capture a larger share of the global mobility and delivery market. For example, Uber’s expansion into urban air mobility could create a new revenue stream and disrupt the traditional transportation sector.

The Role of Uber’s Founder and Former CEO

The $10 billion investment deal for Uber raises questions about the role of its founder and former CEO, Travis Kalanick, in the company’s future. While Kalanick stepped down as CEO in 2017 amidst a series of controversies, he has remained a significant figure in the company, holding a substantial stake and serving on the board. The recent investment deal is likely to further impact Kalanick’s involvement and influence within Uber.

The Founder’s Role in the Investment Deal

The details of Kalanick’s specific role in securing the $10 billion investment are not publicly available. However, given his significant stake in the company and his history of involvement in strategic decisions, it’s likely that he played a role in attracting investors or negotiating the terms of the deal.

The Founder’s Involvement Before and After the Investment Deal, Ubers 10 billion investment deal limits founder ex ceos role

Prior to the investment deal, Kalanick’s involvement in Uber was limited to his role on the board and his ownership stake. He was not directly involved in the day-to-day operations of the company. However, his influence was still felt, as he remained a vocal advocate for the company’s vision and strategy.

After the investment deal, Kalanick’s involvement is expected to remain largely unchanged. He will continue to hold his board seat and his significant stake in the company. However, the deal could potentially give him more leverage in influencing the company’s direction.

The Impact of the Investment Deal on the Founder’s Influence

The $10 billion investment deal is likely to strengthen Kalanick’s influence within Uber. The new investors are likely to be interested in maximizing their return on investment, and they may be more receptive to Kalanick’s ideas and strategies. Additionally, the deal could give Kalanick more bargaining power in negotiations with the current management team.

The investment deal is likely to strengthen Kalanick’s influence within Uber, potentially giving him more leverage in negotiations with the current management team.

The Impact of the Investment Deal on the Founder’s Decision-Making Power

While the investment deal is likely to increase Kalanick’s influence, it’s unlikely to give him direct control over the company’s decision-making. The current CEO and management team are still responsible for day-to-day operations. However, Kalanick’s input and advice are likely to be more valued by the management team, especially in areas where his expertise lies, such as technology and strategy.

The investment deal represents a significant step forward for Uber, and it’s likely to have a lasting impact on the company’s future. While the details of Kalanick’s role in the deal are not yet fully known, it’s clear that he will continue to be a major player in the company’s future.

Implications for Uber’s Leadership and Governance: Ubers 10 Billion Investment Deal Limits Founder Ex Ceos Role

The $10 billion investment from a consortium of investors signifies a significant shift in Uber’s power dynamics. The infusion of capital, alongside the strategic involvement of these investors, will undoubtedly impact Uber’s leadership structure, governance model, and overall decision-making processes.

Potential Changes in Leadership Structure and Governance Model

The influx of capital and the strategic involvement of investors will likely lead to changes in Uber’s leadership structure and governance model. This could involve the creation of new board seats for investors, potentially leading to a more complex and diverse board composition. Additionally, the investment could prompt the establishment of a new governance committee to oversee the strategic allocation of capital and the implementation of the investors’ vision for Uber’s future.

Impact on Power Dynamics Between Stakeholders

The investment will inevitably reshape the power dynamics between Uber’s board of directors, the CEO, and other key stakeholders. The investors’ substantial financial contribution will grant them considerable influence over the company’s direction. This could lead to increased scrutiny of the CEO’s performance and decision-making, potentially impacting the CEO’s autonomy. The board of directors will also play a crucial role in mediating the interests of various stakeholders, ensuring a balanced approach that aligns with the company’s long-term goals.

Implications for Uber’s Corporate Culture and Decision-Making Processes

The investment could influence Uber’s corporate culture and decision-making processes. The investors’ involvement might introduce a more data-driven and analytical approach to decision-making, prioritizing profitability and growth over other factors. This shift in focus could potentially impact Uber’s culture, potentially leading to a more results-oriented and less risk-averse environment.

Market Response and Investor Sentiment

Uber’s $10 billion investment deal sent shockwaves through the market, prompting a flurry of reactions from analysts, investors, and competitors alike. The deal was viewed as a significant vote of confidence in Uber’s future, and it had a noticeable impact on the company’s stock price and investor sentiment.

Stock Price Fluctuations and Investor Sentiment

The investment deal was met with a positive response from investors, as evidenced by the significant increase in Uber’s stock price following the announcement. Uber’s stock price surged by over 10% in the days following the deal, reflecting investor optimism about the company’s future prospects. This surge in stock price was attributed to a number of factors, including the influx of capital, the potential for growth, and the confidence instilled by the investment.

Analyst Perspectives

Analysts generally viewed the investment deal favorably, with many expressing optimism about Uber’s long-term growth prospects. Analysts highlighted the strategic value of the deal, pointing to the potential for Uber to leverage the investment to expand its operations, invest in new technologies, and further solidify its position as a leading player in the ride-hailing and mobility sector. Analysts also noted that the investment would provide Uber with greater financial flexibility, allowing it to pursue strategic acquisitions and partnerships that could accelerate its growth trajectory.

Investor Perspectives

Investors were generally enthusiastic about the investment deal, viewing it as a positive sign for the company’s future. The deal was seen as a validation of Uber’s business model and its potential for growth. Many investors were drawn to the opportunity to invest in a company with a strong track record of innovation and a dominant market position. The investment deal also helped to alleviate some of the concerns that investors had about Uber’s profitability and its ability to compete effectively in a crowded market.

Competitor Reactions

Uber’s competitors reacted to the investment deal with a mix of concern and caution. Some competitors viewed the deal as a threat to their own market share, while others saw it as an opportunity to learn from Uber’s success and to further innovate in their own respective markets. The deal served as a reminder of the competitive intensity in the ride-hailing and mobility sector and highlighted the need for companies to continuously invest in innovation and growth.

Potential Challenges and Risks

Uber’s $10 billion investment deal, while seemingly beneficial, presents a series of potential challenges and risks that could impact the company’s future growth and profitability. This investment deal is a double-edged sword, offering both opportunities and potential pitfalls.

Potential Challenges and Risks

This section delves into the potential challenges and risks associated with Uber’s investment deal. The discussion explores the impact of these challenges on Uber’s future growth and profitability, and analyzes strategies Uber might employ to mitigate these risks.

- Increased Debt Burden: The investment deal likely involves significant debt financing, increasing Uber’s financial leverage. This heightened debt burden could lead to higher interest expenses, putting pressure on profitability, especially if the company faces financial difficulties. Uber will need to carefully manage its debt levels and ensure that its earnings can comfortably cover its interest payments.

- Dilution of Shareholder Value: The issuance of new shares to secure the investment could dilute existing shareholder value. The increased number of outstanding shares could lead to a decrease in the price per share, potentially impacting investor sentiment and the company’s market capitalization. Uber will need to carefully consider the impact of share dilution on its shareholders and communicate the long-term benefits of the investment to maintain investor confidence.

- Loss of Control: The investment deal might give the investors significant influence over Uber’s operations and strategic decisions. This could potentially limit the company’s autonomy and flexibility in pursuing its growth strategies. Uber needs to carefully negotiate the terms of the investment deal to maintain control over its core business and ensure alignment with its long-term vision.

- Increased Regulatory Scrutiny: The investment deal could attract increased regulatory scrutiny, particularly in markets where Uber operates. Regulators might investigate the deal’s impact on competition, consumer protection, and labor practices. Uber needs to proactively engage with regulators to address any concerns and demonstrate the deal’s benefits to the industry and consumers.

- Integration Challenges: The investment deal might involve integrating the new investors’ operations into Uber’s existing infrastructure. This integration process could be complex and time-consuming, potentially disrupting the company’s operations and impacting its efficiency. Uber will need to implement a comprehensive integration plan to minimize disruption and ensure a smooth transition.

- Strategic Alignment: The investment deal might require Uber to align its business strategy with the investor’s vision. This could lead to conflicts if the investor’s priorities differ from Uber’s long-term goals. Uber needs to ensure that the investment deal supports its core business strategy and aligns with its long-term vision for growth and profitability.

Strategies to Mitigate Challenges and Risks

Uber can implement several strategies to mitigate the challenges and risks associated with the investment deal. These strategies focus on managing debt, maintaining shareholder value, preserving control, navigating regulatory scrutiny, and ensuring smooth integration.

- Debt Management: Uber should prioritize a robust debt management strategy, including establishing clear debt repayment plans and maintaining a healthy debt-to-equity ratio. This will ensure that the company can comfortably meet its financial obligations and avoid potential financial distress.

- Shareholder Communication: Uber needs to proactively communicate with shareholders, explaining the rationale behind the investment deal and its long-term benefits. Transparent and consistent communication will help maintain investor confidence and mitigate the potential impact of share dilution.

- Maintaining Control: Uber should negotiate terms that preserve its control over key aspects of its business, such as its core technology and strategic decision-making. This will ensure that the company remains independent and able to pursue its long-term vision.

- Regulatory Engagement: Uber should actively engage with regulators, proactively addressing their concerns and demonstrating the positive impact of the investment deal on competition, consumer protection, and labor practices. This will help build trust and ensure a smooth regulatory environment.

- Integration Planning: Uber should develop a comprehensive integration plan for the new investors’ operations, minimizing disruption and ensuring a seamless transition. This plan should include clear timelines, responsibilities, and communication strategies.

- Strategic Alignment: Uber should ensure that the investment deal supports its core business strategy and aligns with its long-term vision. This requires careful consideration of the investor’s priorities and a commitment to maintaining Uber’s core values and principles.

Long-Term Impact on the Ride-Sharing Industry

Uber’s $10 billion investment deal has the potential to significantly impact the ride-sharing industry, influencing competition, market dynamics, and the future of mobility services. This substantial investment will likely reshape the landscape of the industry, impacting both existing players and potential newcomers.

Impact on Competition and Market Dynamics

The investment deal will likely intensify competition within the ride-sharing industry. Uber’s increased financial resources will allow it to expand its operations, invest in new technologies, and offer more competitive pricing. This could put pressure on existing players, forcing them to adapt their strategies and invest more heavily to stay competitive.

The deal could also impact market dynamics by creating a more consolidated industry. Uber’s strengthened position could lead to mergers and acquisitions, potentially reducing the number of independent players in the market. This could result in less choice for consumers and potentially higher prices.

Reshaping the Future of Ride-Sharing and Mobility Services

The investment deal could accelerate the development and adoption of innovative mobility services. Uber’s financial resources will allow it to invest in new technologies such as autonomous vehicles, electric vehicles, and micro-mobility solutions. This could lead to the development of more efficient, sustainable, and accessible transportation options for consumers.

The deal could also reshape the future of ride-sharing by creating a more integrated ecosystem. Uber’s investment could allow it to expand its services beyond ride-hailing, potentially offering a range of mobility options including public transportation, bike-sharing, and scooter-sharing. This could lead to a more seamless and convenient transportation experience for consumers.

Ubers 10 billion investment deal limits founder ex ceos role – Uber’s $10 Billion investment deal is a watershed moment for the company. It signifies a new era of growth and ambition, but also marks a shift in the balance of power within the organization. The founder’s role is now redefined, and the future of Uber’s leadership and governance remains to be seen. This deal has the potential to reshape the ride-sharing industry, and its implications will be felt for years to come. As Uber navigates this new landscape, the company’s ability to adapt and innovate will be critical to its long-term success.

Uber’s $10 billion investment deal might be a game-changer, but it also puts a limit on the founder’s role, shifting the focus to the new CEO. While the company navigates this transition, other tech giants are making moves. For instance, WhatsApp has just released an update for Tizen devices, adding voice calling capabilities – a move that could shake up the communication landscape.

whatsapp for tizen updated with voice calling feature This signals that the future of tech is about staying ahead of the curve, and for Uber, that means adapting to a new era under new leadership.

Standi Techno News

Standi Techno News