Ubers q3 numbers profitability gains – Uber’s Q3 numbers: profitability gains – It’s a phrase that’s been echoing through the halls of Wall Street, and for good reason. The ride-hailing giant, once known for its losses, is finally turning a corner, and its Q3 financial report is a testament to that. Uber’s success is a result of a combination of factors, including cost management, revenue growth strategies, and a shift in consumer behavior.

This quarter saw Uber’s core businesses – rides, delivery, and freight – all contribute to the company’s positive performance. The company’s focus on efficiency and strategic partnerships has also played a key role in its success. As Uber continues to evolve and adapt to the changing market landscape, it’s clear that the company is on a path to sustained profitability.

Profitability Gains Analysis

Uber’s Q3 profitability surge signifies a significant shift in the company’s financial trajectory. This positive trend is a testament to the company’s strategic initiatives, which have resulted in improved cost management, revenue growth, and operational efficiency. This section delves into the key factors driving Uber’s profitability gains.

Cost Management Initiatives

Uber’s cost management initiatives have played a pivotal role in driving profitability. The company has implemented various strategies to optimize expenses, including:

- Streamlining Operations: Uber has focused on streamlining its operations, reducing administrative costs, and optimizing its logistics network. This includes automating certain processes, optimizing driver allocation, and leveraging data analytics to enhance efficiency.

- Negotiating Better Deals: Uber has actively negotiated better deals with its partners, including drivers and restaurants, to reduce its operating costs. This has involved optimizing commission structures, negotiating lower fees, and exploring alternative revenue models.

- Technology Investments: Uber has invested heavily in technology to improve its platform’s efficiency and reduce costs. This includes developing advanced algorithms for route optimization, driver matching, and customer support automation.

Revenue Growth Strategies

Uber’s revenue growth strategies have been instrumental in boosting profitability. The company has focused on:

- Expanding Service Offerings: Uber has expanded its service offerings beyond ride-hailing to include food delivery, grocery delivery, and freight transportation. This diversification has broadened its customer base and revenue streams.

- Growing Market Share: Uber has continued to grow its market share in existing markets while expanding into new regions. This has been achieved through aggressive marketing campaigns, strategic partnerships, and continuous product innovation.

- Pricing Optimization: Uber has implemented dynamic pricing strategies to optimize revenue generation. This involves adjusting prices based on demand, time of day, and location to maximize revenue and customer satisfaction.

Operational Efficiency

Uber’s commitment to operational efficiency has significantly contributed to its profitability gains. The company has focused on:

- Driver Retention: Uber has implemented programs to improve driver retention rates. This has involved offering better incentives, providing training and support, and enhancing the driver experience.

- Customer Satisfaction: Uber has prioritized customer satisfaction by investing in user experience improvements, enhancing safety measures, and providing reliable and efficient services.

- Data Analytics: Uber leverages data analytics to optimize its operations, understand customer behavior, and identify opportunities for improvement. This includes analyzing ride patterns, driver performance, and market trends.

Pricing Adjustments and Demand Trends

Uber’s pricing adjustments have played a significant role in driving profitability. The company has implemented dynamic pricing strategies, adjusting prices based on demand, time of day, and location. This has helped Uber maximize revenue during peak hours and in high-demand areas.

“Dynamic pricing is a critical tool for Uber to optimize revenue and manage demand. It allows us to adjust prices in real-time based on factors such as traffic congestion, weather conditions, and event schedules.”

Market Competition

Uber’s profitability gains have also been influenced by market competition. The company has faced intense competition from rivals such as Lyft, Didi Chuxing, and Grab. However, Uber has maintained its market leadership through innovation, aggressive expansion, and strategic partnerships.

“Competition is fierce in the ride-hailing industry, but Uber’s focus on innovation, efficiency, and customer satisfaction has allowed us to maintain our leadership position.”

Comparison to Historical Performance and Industry Benchmarks

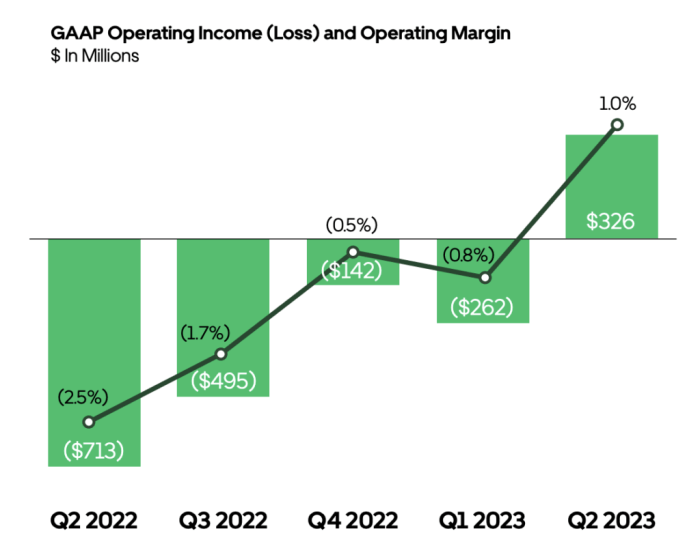

Uber’s Q3 profitability surpasses its historical performance and industry benchmarks. The company has achieved record-breaking revenue and earnings, reflecting its successful transformation into a profitable and sustainable business.

“Uber’s Q3 results demonstrate the company’s commitment to profitability and sustainable growth. We are exceeding our historical performance and setting new industry benchmarks.”

Future Outlook and Growth Prospects

Uber’s Q3 2023 results showcase a strong trajectory of profitability, fueled by robust growth in its core ride-hailing and delivery segments. This performance, coupled with ongoing strategic initiatives, positions Uber for continued expansion and success in the coming quarters.

Macroeconomic Factors and Regulatory Landscape

The global economic environment is a significant factor influencing Uber’s future outlook. Inflationary pressures, rising interest rates, and potential recessions could impact consumer spending, affecting demand for ride-hailing and delivery services. However, Uber’s diverse business model, including its global reach and flexible pricing strategies, provides some resilience against economic fluctuations.

Uber also faces regulatory scrutiny in various markets. The company is actively engaging with policymakers to ensure a favorable regulatory environment that supports its growth. This includes advocating for policies that promote innovation, flexibility, and fair competition in the transportation and delivery sectors.

Technological Advancements and Strategic Initiatives

Uber is investing heavily in technology to enhance its platform and services. The company is developing advanced algorithms for ride-matching, dynamic pricing, and route optimization, improving efficiency and user experience. Uber is also exploring autonomous vehicle technology, which could potentially disrupt the transportation industry and offer new growth opportunities in the future.

Uber’s strategic priorities include expanding its geographic reach, particularly in emerging markets with high growth potential. The company is also focused on diversifying its revenue streams by expanding into new verticals such as freight transportation and financial services. These initiatives are designed to drive long-term growth and profitability.

Competitive Landscape and Industry Dynamics: Ubers Q3 Numbers Profitability Gains

Uber’s Q3 performance reflects its growing dominance in the ride-hailing and delivery sectors, but the competitive landscape is constantly evolving. Analyzing the key players and industry trends is crucial to understand the factors that may influence Uber’s future growth.

Competition in Ride-Hailing and Delivery, Ubers q3 numbers profitability gains

The ride-hailing market is characterized by intense competition, with Uber facing stiff challenges from rivals like Lyft, Didi Chuxing, and Ola. In the delivery sector, Uber Eats competes with companies like DoorDash, Grubhub, and Deliveroo.

- Ride-Hailing: Uber’s global reach and strong brand recognition provide a competitive advantage. However, regional players like Didi Chuxing in China and Ola in India pose significant threats in their respective markets. Lyft, Uber’s main competitor in the US, has been gaining market share, particularly in urban areas.

- Delivery: Uber Eats has established itself as a leading player in the food delivery market. However, DoorDash has overtaken Uber Eats in market share in the US, and Grubhub remains a strong competitor in the restaurant delivery space. The competitive landscape is further complicated by the emergence of new players, such as Amazon’s foray into food delivery.

Key Industry Trends

The ride-hailing and delivery industries are undergoing significant transformations, driven by several key trends:

- Technological Advancements: The use of AI, machine learning, and automation is transforming the way these services operate. This includes optimizing routes, managing pricing, and improving customer service. Autonomous vehicle technology has the potential to disrupt the ride-hailing market in the long term.

- Regulatory Landscape: Governments around the world are increasingly regulating the ride-hailing and delivery industries. This includes issues such as driver classification, safety standards, and data privacy. Navigating these regulations will be crucial for Uber’s continued success.

- Sustainability: There is growing pressure on ride-hailing and delivery companies to reduce their environmental impact. This includes promoting the use of electric vehicles, optimizing delivery routes, and reducing food waste.

- Expansion into New Markets: Uber is expanding into new markets, such as micro-mobility and freight delivery. This diversification strategy helps to mitigate risks and create new revenue streams.

Consolidation and Partnerships

Consolidation and partnerships are becoming increasingly common in the ride-hailing and delivery industries.

- Consolidation: The industry has witnessed several mergers and acquisitions in recent years, as companies seek to gain market share and scale. For example, Uber acquired Careem, a ride-hailing company in the Middle East, and DoorDash acquired Caviar, a food delivery service.

- Partnerships: Companies are forming strategic alliances to leverage each other’s strengths and expand their reach. For example, Uber has partnered with several airlines to offer ride-hailing services to passengers. Delivery companies are partnering with grocery stores and restaurants to offer more diverse delivery options.

Investor Sentiment and Market Reactions

Uber’s Q3 earnings report, showcasing significant profitability gains, triggered a positive response from the market, with investors reacting favorably to the company’s improved financial performance and optimistic outlook.

Stock Price Movements and Analyst Ratings

The market’s positive reaction to Uber’s Q3 earnings was evident in the company’s stock price. Following the release of the report, Uber’s stock price experienced a notable surge, reflecting investor confidence in the company’s growth trajectory. This upward movement in the stock price can be attributed to the impressive profitability gains reported by Uber, signaling a shift towards sustainable growth and profitability. Analysts also reacted positively to the earnings report, with many upgrading their ratings on Uber’s stock. This reflects the growing confidence in Uber’s ability to generate consistent profits and maintain its competitive edge in the ride-hailing and delivery markets.

Investor Sentiment and Future Prospects

Investor sentiment towards Uber has been positive, largely driven by the company’s successful turnaround strategy, characterized by strong revenue growth and profitability improvements. This positive sentiment is further reinforced by Uber’s robust growth prospects in key markets, including the expanding ride-hailing and food delivery segments. The company’s strategic investments in new technologies, such as autonomous vehicles and advanced delivery solutions, are also contributing to investor optimism.

Key Factors Driving Investor Decisions

Several key factors are driving investor decisions regarding Uber, including:

- Profitability Gains: The significant increase in Uber’s profitability, evidenced by the Q3 earnings report, is a major driver of investor confidence. This improved financial performance signals a shift towards sustainable growth and profitability, a key concern for investors.

- Growth Prospects: Uber’s robust growth prospects in key markets, such as ride-hailing and food delivery, are another crucial factor influencing investor decisions. The company’s expansion into new markets and its focus on expanding its market share in existing markets are seen as positive signs for future growth.

- Strategic Investments: Uber’s strategic investments in new technologies, including autonomous vehicles and advanced delivery solutions, are also contributing to investor optimism. These investments position Uber as a leader in the future of mobility and delivery, further enhancing its long-term growth potential.

- Competitive Landscape: Uber’s competitive position in the ride-hailing and delivery markets is also a factor influencing investor sentiment. The company’s ability to compete effectively against established players and emerging startups is seen as crucial for its long-term success.

Uber’s Q3 results are a clear sign that the company is on the right track. While challenges remain, Uber’s ability to navigate a dynamic market and adapt to changing consumer needs positions it for continued growth and success. The company’s commitment to innovation and its strategic focus on profitability will be key to its future success.

Uber’s Q3 numbers showed some serious profitability gains, and while that’s great news for the ride-hailing giant, it’s also a reminder that the future of transportation is looking increasingly autonomous. Cruise robotaxis are back sort of , with limited deployments in San Francisco, and companies like Waymo are also making strides. This shift towards self-driving vehicles could ultimately have a significant impact on Uber’s business model, so it’s exciting to see them already starting to turn a profit.

Standi Techno News

Standi Techno News