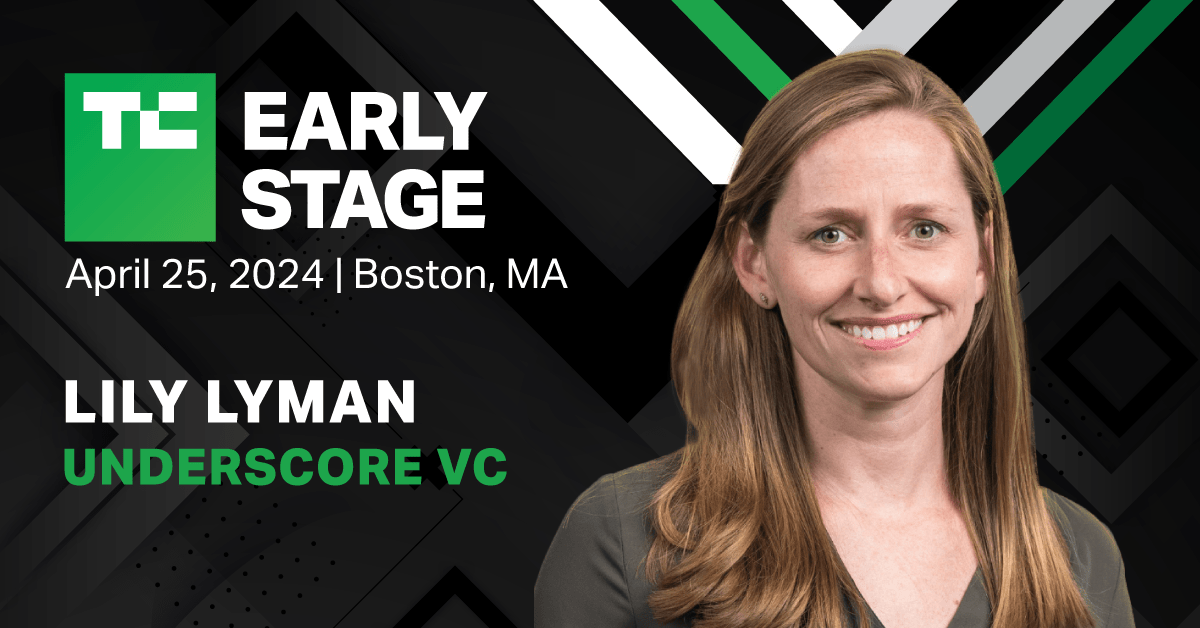

Underscores lily lyman will break down venture relationships at techcrunch early stage 2024 – Lily Lyman: Breaking Down Venture Relationships at TechCrunch Early Stage 2024, is a session that promises to be a game-changer for startups looking to navigate the complex world of venture capital. Lily Lyman, a leading expert in venture relationships at TechCrunch, will share her insights on building and nurturing successful partnerships with investors.

Drawing on her extensive experience in the tech industry, Lyman will delve into the crucial role that strong venture relationships play in the early stages of a startup’s journey. She’ll explore the benefits of these relationships, including access to funding, mentorship, and valuable industry connections. Lyman will also address the challenges that startups face in establishing and maintaining robust relationships with investors.

Lily Lyman’s Role at TechCrunch

Lily Lyman is a prominent figure in the tech industry, holding the position of Venture Editor at TechCrunch. Her expertise lies in the realm of venture relationships, where she plays a pivotal role in connecting startups with investors and fostering a vibrant ecosystem for early-stage companies.

Lily’s deep understanding of the tech landscape stems from her extensive experience in the industry. She has a keen eye for identifying promising startups and possesses a strong network of investors and entrepreneurs. Her role at TechCrunch allows her to leverage this expertise to provide valuable insights and guidance to early-stage ventures.

Lily Lyman’s Background and Expertise

Lily’s journey in the tech industry has been marked by several key roles that have shaped her approach to venture relationships. Prior to joining TechCrunch, she held positions at notable companies like Google and Salesforce, where she gained invaluable experience in the areas of product development, marketing, and business development. These experiences provided her with a comprehensive understanding of the challenges and opportunities faced by startups.

Lily’s work at TechCrunch has been instrumental in establishing the platform as a leading voice in the venture capital space. She has spearheaded initiatives that have helped to connect startups with investors, including the TechCrunch Disrupt event, which has become a renowned platform for showcasing innovative technologies and attracting investment.

Lily Lyman’s Contributions to the Venture Ecosystem

Lily’s contributions to the venture ecosystem extend beyond her work at TechCrunch. She is an active member of the Silicon Valley startup community, frequently participating in events and mentoring early-stage entrepreneurs. Her insights and guidance have helped numerous startups navigate the complexities of fundraising and scaling their businesses.

Lily’s deep understanding of the venture landscape, coupled with her extensive network and passion for supporting early-stage companies, make her a valuable asset to the tech industry. Her role at TechCrunch allows her to leverage her expertise to connect startups with investors, fostering a vibrant and thriving ecosystem for innovation.

The Importance of Venture Relationships

In the fast-paced world of startups, securing funding is often the first hurdle. However, venture relationships go beyond mere financial support. They play a crucial role in guiding startups through their early stages, providing access to invaluable resources and fostering long-term success.

Benefits of Strong Venture Relationships

Strong venture relationships offer a multitude of benefits to startups, particularly in the early stages of their journey. These relationships can provide access to crucial resources, mentorship, and industry connections, which are essential for growth and success.

- Access to Funding: Venture capitalists (VCs) are the primary source of funding for startups. Building relationships with VCs can open doors to investment opportunities, allowing startups to secure the necessary capital to scale their operations.

- Mentorship and Guidance: VCs often possess extensive experience in the startup ecosystem and can provide valuable mentorship and guidance to entrepreneurs. They can offer insights into various aspects of business, from product development to marketing and sales.

- Industry Connections: VCs have a vast network of industry contacts, including potential customers, partners, and other investors. This network can be instrumental in helping startups secure partnerships, expand their reach, and gain valuable insights into the market.

Challenges in Building and Maintaining Venture Relationships

While the benefits of strong venture relationships are undeniable, startups face several challenges in building and maintaining these relationships.

- Competition: The startup ecosystem is highly competitive, and VCs receive numerous pitches from entrepreneurs seeking funding. Startups need to differentiate themselves and demonstrate a compelling value proposition to attract VC attention.

- Building Trust and Credibility: Building trust with VCs is essential for securing funding and long-term support. Startups need to demonstrate transparency, integrity, and a clear vision for their business.

- Maintaining Communication: Effective communication is crucial for fostering strong venture relationships. Startups need to keep VCs informed about their progress, challenges, and future plans. Regular updates and open dialogue can strengthen the relationship and ensure alignment.

TechCrunch Early Stage 2024

TechCrunch Early Stage is an annual event that brings together the brightest minds in the startup world, providing a platform for emerging companies to showcase their innovations and connect with potential investors. The 2024 edition is expected to be even bigger and more impactful, offering a unique opportunity for startups to gain valuable insights, secure funding, and build crucial relationships.

Significance for Startups and Investors, Underscores lily lyman will break down venture relationships at techcrunch early stage 2024

The event is a vital hub for startups seeking to connect with investors, gain exposure, and secure funding. It offers a platform to pitch their ideas to a diverse audience of venture capitalists, angel investors, and industry experts.

For investors, TechCrunch Early Stage presents a unique opportunity to discover promising startups with high growth potential. They can engage with founders, assess their ideas, and identify potential investment opportunities. The event provides a concentrated environment to source promising companies and gain valuable insights into emerging trends and sectors.

Key Themes and Topics

TechCrunch Early Stage 2024 is expected to focus on key themes shaping the future of the startup ecosystem. These themes will include:

- Emerging Technologies: The event will explore the latest advancements in artificial intelligence, blockchain, Web3, and other disruptive technologies, highlighting their potential impact on various industries.

- Sustainable Innovation: With growing concerns about climate change and environmental sustainability, the event will focus on startups developing solutions for a more sustainable future, including green technology, renewable energy, and circular economy models.

- The Future of Work: The event will delve into the evolving landscape of work, exploring the impact of automation, remote work, and the rise of the gig economy on the future of employment.

- Impact Investing: TechCrunch Early Stage will showcase startups addressing social and environmental challenges, highlighting the growing trend of impact investing and its role in driving positive change.

- The Power of Community: The event will emphasize the importance of building strong communities and fostering collaboration within the startup ecosystem, highlighting the role of mentorship, networking, and shared resources in driving innovation.

Anticipated Audience and Impact

TechCrunch Early Stage 2024 is expected to attract a diverse audience of:

- Startups: Early-stage companies from across various industries, seeking funding, mentorship, and networking opportunities.

- Investors: Venture capitalists, angel investors, and other investors looking to discover promising startups and identify investment opportunities.

- Industry Experts: Leaders and experts from various sectors, sharing their insights and perspectives on the future of technology and innovation.

- Media and Press: Journalists and media representatives covering the latest developments in the startup ecosystem.

The event is anticipated to have a significant impact on the startup ecosystem by:

- Boosting Innovation: By showcasing cutting-edge technologies and ideas, the event will foster innovation and inspire new ventures.

- Facilitating Funding: The event will provide a platform for startups to connect with investors and secure funding to scale their businesses.

- Building Connections: The event will facilitate networking and collaboration among startups, investors, and industry experts, fostering a vibrant and supportive community.

- Driving Awareness: The event will generate significant media attention, raising awareness of emerging technologies and trends within the startup ecosystem.

Strategies for Building Strong Venture Relationships

In the competitive landscape of early-stage startups, building strong relationships with investors and venture capitalists is crucial for securing funding and accelerating growth. This involves more than just pitching your idea; it’s about cultivating genuine connections and demonstrating your commitment to building a successful company.

Developing a Comprehensive Framework

A well-structured framework can help startups navigate the complex world of venture relationships. This framework should encompass three key phases:

- Pre-Investment: This stage involves identifying and connecting with relevant investors, understanding their investment criteria, and crafting a compelling pitch that resonates with their interests.

- Investment: This phase focuses on building trust and transparency during the due diligence process, negotiating terms, and ensuring alignment between the startup’s vision and the investor’s expectations.

- Post-Investment: This stage emphasizes ongoing communication, consistent performance updates, and proactive engagement with investors to foster a collaborative partnership that drives growth and success.

Making a Lasting Impression

Making a positive first impression is essential in the initial stages of building a venture relationship. Startups can achieve this by:

- Demonstrating Passion and Expertise: Enthusiasm for your idea is contagious, and investors are drawn to founders who deeply understand their industry and possess the expertise to execute their vision.

- Crafting a Concise and Compelling Pitch: Your pitch should be clear, concise, and compelling, highlighting the problem you’re solving, your unique solution, and the potential market opportunity.

- Building a Strong Network: Networking with other entrepreneurs, industry experts, and potential investors can expand your reach and increase your visibility within the startup ecosystem.

The Power of Clear Communication

Clear and consistent communication is the cornerstone of any successful venture relationship. Startups should:

- Articulate a Clear Value Proposition: Investors need to understand the value your startup brings to the market and how it will generate returns on their investment.

- Provide Regular Updates and Transparency: Keep investors informed about your progress, challenges, and key milestones, ensuring transparency and building trust.

- Actively Engage with Investors: Seek feedback, respond to inquiries promptly, and demonstrate a willingness to collaborate and address investor concerns.

The Impact of Venture Relationships on Startup Success: Underscores Lily Lyman Will Break Down Venture Relationships At Techcrunch Early Stage 2024

In the dynamic world of startups, navigating the complex landscape of funding and growth requires more than just a brilliant idea and a passionate team. Strong venture relationships can be the crucial catalyst that propels startups towards sustainable success. These relationships go beyond mere financial backing; they offer invaluable insights, mentorship, and strategic guidance that can shape the trajectory of a startup’s journey.

The Role of Venture Relationships in Securing Funding

Venture capitalists (VCs) are not just investors; they are experienced entrepreneurs, industry experts, and seasoned advisors who bring a wealth of knowledge and connections to the table. A strong relationship with a VC can significantly increase a startup’s chances of securing funding.

- Credibility and Endorsement: VCs act as a stamp of approval, validating a startup’s potential and attracting other investors. A strong relationship with a reputable VC can open doors to a wider pool of investors, boosting the startup’s fundraising efforts.

- Network Access: VCs have extensive networks that extend across various industries, connecting startups with potential customers, partners, and talent. This access can be invaluable for startups looking to expand their reach and build strategic alliances.

- Negotiation Power: A strong relationship built on trust and mutual respect can lead to more favorable funding terms, giving startups greater control over their equity and future growth.

Examples of Successful Startups Leveraging Venture Relationships

Numerous startups have successfully harnessed the power of venture relationships to achieve remarkable growth.

- Airbnb: The home-sharing platform benefited significantly from its relationship with Sequoia Capital, which provided not only funding but also strategic guidance and connections that helped Airbnb navigate its early years and establish its market dominance.

- Spotify: The music streaming service secured early funding from venture capitalists like Sequoia Capital and Kleiner Perkins Caufield & Byers, who played a pivotal role in shaping Spotify’s growth strategy and market expansion.

Insights, Mentorship, and Strategic Guidance

Venture relationships provide startups with a unique advantage: access to valuable insights, mentorship, and strategic guidance.

- Market Expertise: VCs have deep industry knowledge and insights into market trends, allowing them to provide valuable advice on product development, market positioning, and go-to-market strategies.

- Operational Guidance: VCs can offer practical advice on scaling operations, managing finances, building teams, and navigating the complexities of business growth.

- Strategic Partnerships: VCs can connect startups with potential partners, collaborators, and strategic alliances that can accelerate their growth and expand their reach.

TechCrunch Early Stage 2024 is set to be a pivotal event for the startup ecosystem. Lyman’s session on venture relationships is a must-attend for founders and entrepreneurs looking to gain a competitive edge. Her insights and practical advice will equip startups with the tools and strategies they need to navigate the complexities of venture capital and build lasting relationships with investors.

Underscores Lily Lyman will break down venture relationships at TechCrunch Early Stage 2024, offering insights into the complexities of navigating these partnerships. This comes at a time when the industry is seeing major shifts, like the recent acquisition of Foodpanda’s Taiwan unit by Uber for a whopping $950 million in cash, as reported in this article. Lyman’s talk will undoubtedly touch upon the implications of such strategic moves on venture relationships, providing valuable perspectives for both investors and startups.

Standi Techno News

Standi Techno News