When startups fail these startups clean up – When startups fail, these startups clean up. The world of entrepreneurship is filled with both thrilling success stories and heartbreaking failures. While many dream of building the next billion-dollar company, the reality is that a significant percentage of startups fail. But amidst the wreckage of these failed ventures, a new breed of entrepreneurs is emerging: “cleanup” startups. These companies specialize in helping failed startups navigate the aftermath, minimizing losses, and maximizing recovery.

From managing legal and financial complexities to handling sensitive data and intellectual property, cleanup startups offer a range of services that can help failed ventures transition into a new chapter. These startups are playing a crucial role in the startup ecosystem, offering valuable services that can benefit investors, entrepreneurs, and the industry as a whole.

The Startup Ecosystem and Failure

The startup ecosystem is a dynamic and complex environment, characterized by rapid innovation, fierce competition, and a high rate of failure. While many startups dream of achieving exponential growth and disrupting established industries, the reality is that a significant portion of them don’t survive. Understanding the factors that contribute to startup failure is crucial for both aspiring entrepreneurs and investors, as it allows for informed decision-making and a better understanding of the risks involved.

Common Reasons for Startup Failure

Several factors contribute to the high failure rate among startups.

- Lack of Market Demand: A common reason for failure is the lack of a viable market for the startup’s product or service. Even if a product is innovative, it needs to address a real need or solve a problem that customers are willing to pay for. Startups that fail to identify a substantial market or adequately validate their assumptions about customer demand are at a high risk of failure.

- Poor Execution: Even with a great idea, poor execution can lead to a startup’s demise. This includes factors like ineffective marketing, inadequate product development, and a lack of operational efficiency. Without a strong team and a clear plan for execution, a startup may struggle to gain traction and compete effectively.

- Insufficient Funding: Startups often require significant funding to get off the ground and scale their operations. Insufficient funding can lead to a shortage of resources, hindering growth and ultimately leading to failure. Many startups fail because they run out of money before achieving profitability, making financial planning and fundraising crucial for survival.

- Competition: The startup ecosystem is highly competitive, and many startups fail to differentiate themselves from their rivals. Intense competition can make it challenging to acquire customers, secure funding, and build a sustainable business model. Startups need to offer a unique value proposition that sets them apart from competitors and attracts customers.

The Role of Funding and Investment

Funding and investment play a critical role in the success or failure of startups.

- Early-Stage Funding: Seed funding and angel investments are essential for startups to develop their product, validate their market, and build a team. However, securing these early-stage investments can be challenging, as investors often require a strong pitch and a clear vision for the future. Startups that fail to attract sufficient early-stage funding may struggle to gain momentum and progress.

- Growth Funding: As startups grow, they may require additional funding to expand their operations, hire more employees, and invest in marketing and sales. Venture capital firms and other institutional investors play a significant role in providing this growth funding. However, securing these investments often involves giving up equity in the company, which can dilute the founders’ ownership stake and potentially lead to conflicts with investors.

- Impact of Investment on Success: While funding is crucial for startup success, it’s important to note that it’s not a guarantee. Many startups fail despite receiving significant funding. This highlights the importance of effective management, a sound business model, and a strong team. Investment alone is not enough to ensure success; it’s a necessary but not sufficient condition. Startups that misuse or mismanage funds may still face failure.

Impact of Market Conditions and Competition

The startup ecosystem is not static; it’s constantly evolving, influenced by factors such as economic conditions, technological advancements, and consumer preferences.

- Economic Cycles: Economic downturns can have a significant impact on startups, as they may face reduced funding, lower consumer spending, and increased competition. Startups that are reliant on venture capital or consumer spending may struggle to survive during economic recessions.

- Technological Disruptions: Technological advancements can create opportunities for new startups but also disrupt established industries. Startups that fail to adapt to these disruptions or compete with new technologies may find themselves struggling to remain relevant. For example, the rise of mobile technology disrupted traditional industries like retail and media, creating opportunities for new startups while challenging existing players.

- Competition: The startup ecosystem is characterized by fierce competition, as new players emerge constantly. Startups that fail to differentiate themselves from competitors or establish a strong brand identity may find it difficult to attract customers and secure funding. Competition can also lead to price wars, making it challenging for startups to maintain profitability.

The Rise of “Cleanup” Startups

The startup ecosystem is a dynamic environment characterized by innovation and constant change. While many startups succeed, a significant number fail. This failure, however, creates opportunities for a new breed of startups: “cleanup” startups. These startups specialize in cleaning up the mess left behind by failed ventures, offering essential services that help recover assets, manage liabilities, and mitigate the negative consequences of failure.

Types of Cleanup Startups

Cleanup startups offer a diverse range of services tailored to address specific needs arising from failed ventures. Here are some common types:

- Asset Recovery: These startups specialize in recovering valuable assets from failed ventures, such as inventory, equipment, and intellectual property. They often work with liquidators, auctioneers, and other professionals to maximize the value of assets.

- Debt Management: These startups help failed ventures manage their outstanding debts, negotiate with creditors, and explore options for debt restructuring or forgiveness. They can also assist with legal proceedings related to debt recovery.

- Data Recovery and Security: These startups focus on recovering and securing data from failed ventures. This is crucial to prevent data breaches, protect sensitive information, and ensure compliance with regulations.

- Brand Reputation Management: These startups help failed ventures manage their online and offline reputation, mitigate negative publicity, and restore public trust. They often use public relations, social media management, and online reputation repair strategies.

- Legal and Regulatory Compliance: These startups provide legal and regulatory support to failed ventures, ensuring they comply with all relevant laws and regulations during the closure process. This includes handling legal disputes, tax obligations, and other legal matters.

Examples of Successful Cleanup Startups

Several cleanup startups have emerged as successful players in the ecosystem, providing valuable services to failed ventures:

- Liquidation.com: This startup offers a comprehensive platform for online asset liquidation, connecting businesses with buyers and facilitating the sale of assets from failed ventures.

- Debt.com: This startup provides debt management services to individuals and businesses, including debt consolidation, negotiation, and legal support. They also offer resources and advice on managing debt effectively.

- Kroll: This global risk consulting firm offers a range of services, including data recovery, cybersecurity, and investigations. They assist businesses with managing risks and mitigating potential losses in the event of failure.

- Reputation.com: This startup specializes in online reputation management, helping businesses monitor their online presence, manage reviews, and respond to negative feedback. They can also assist with crisis communication and reputation repair.

Market Demand for Cleanup Services

The demand for cleanup services in the startup ecosystem is steadily increasing. This is driven by several factors:

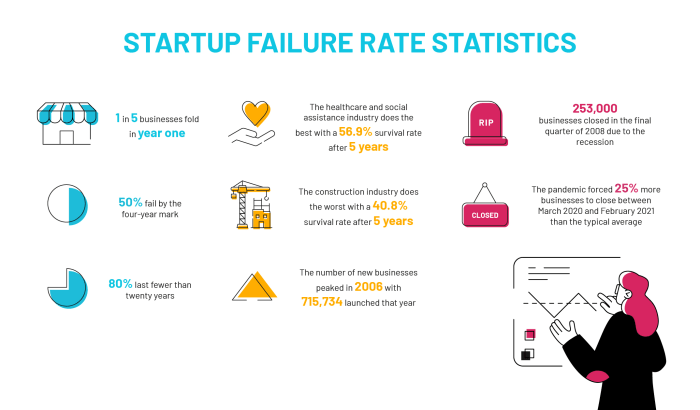

- High Startup Failure Rate: The failure rate for startups is high, with estimates ranging from 70% to 90%. This creates a significant market for cleanup services as businesses seek to minimize losses and manage the consequences of failure.

- Increased Complexity of Startups: Modern startups are often more complex and involve sophisticated technologies, data management, and legal structures. This complexity increases the potential for failure and the need for specialized cleanup services.

- Focus on Innovation: The startup ecosystem is driven by innovation, which can lead to rapid growth but also increased risk. Cleanup startups provide essential support for businesses navigating these risks and mitigating potential consequences.

The Benefits of “Cleanup” Startups

The rise of “cleanup” startups represents a significant shift in the startup ecosystem. These businesses are not just about salvaging assets; they offer a valuable service that benefits both failed startups and the broader entrepreneurial landscape.

Minimizing Losses and Recovering Assets

“Cleanup” startups play a crucial role in minimizing losses and recovering assets for failed startups. They act as intermediaries, helping to navigate the complexities of liquidation, asset disposal, and debt management.

- Asset Recovery: “Cleanup” startups possess the expertise to identify and recover valuable assets, such as intellectual property, equipment, inventory, and customer data. This can generate revenue for creditors and help mitigate the financial impact of failure.

- Debt Management: These startups can negotiate with creditors, restructure debt obligations, and help failed startups navigate bankruptcy proceedings. This reduces the burden on founders and allows for a more orderly resolution.

- Liquidation Services: “Cleanup” startups provide efficient liquidation services, ensuring that assets are sold at fair market value. This maximizes returns for creditors and minimizes the overall loss incurred by the failed startup.

Providing Data and Insights, When startups fail these startups clean up

Beyond asset recovery, “cleanup” startups can provide valuable data and insights to investors and future entrepreneurs. They gain access to a wealth of information from failed startups, including financial records, customer data, and operational insights.

- Post-Mortem Analysis: “Cleanup” startups can conduct thorough post-mortem analyses of failed startups, identifying the key factors that contributed to their demise. This information can be shared with investors and entrepreneurs to help them avoid similar mistakes in the future.

- Market Research: The data gathered by “cleanup” startups can provide valuable market insights. They can identify trends, customer preferences, and competitor strategies, helping entrepreneurs make more informed decisions.

- Risk Assessment: “Cleanup” startups can use their experience to assess the risks associated with different business models and industries. This information can be shared with investors to help them make more informed investment decisions.

Contributing to a More Sustainable Startup Ecosystem

“Cleanup” startups contribute to a more sustainable startup ecosystem by promoting transparency, accountability, and learning from failures.

- Reducing Moral Hazard: “Cleanup” startups help reduce moral hazard by ensuring that founders and investors are held accountable for their actions. They can identify cases of fraud or mismanagement and help to prevent similar situations from occurring in the future.

- Encouraging Innovation: By providing data and insights from failed startups, “cleanup” startups can help to encourage innovation and entrepreneurship. They create a culture of learning from mistakes, which can lead to better decision-making and more successful ventures.

- Improving Investor Confidence: “Cleanup” startups can improve investor confidence by demonstrating that the startup ecosystem is capable of learning from its failures. This can attract more investment capital and create a more robust and resilient entrepreneurial landscape.

The Challenges of “Cleanup” Startups

While the concept of “cleanup” startups presents a valuable opportunity in the startup ecosystem, it’s not without its challenges. These startups navigate a complex landscape, encountering ethical, legal, and market-related hurdles that require careful consideration and strategic approaches.

Ethical Considerations in Handling Sensitive Data and Assets

The ethical implications of handling sensitive data and assets from failed startups are significant. These “cleanup” startups must grapple with the responsibility of protecting confidential information, ensuring its responsible disposal, and respecting the privacy of individuals involved.

- Data Security and Privacy: Failed startups often hold sensitive data, including customer information, financial records, intellectual property, and employee details. “Cleanup” startups must implement robust security measures to safeguard this data, preventing unauthorized access, breaches, and misuse. This involves adhering to data protection regulations like GDPR and CCPA, encrypting sensitive data, and conducting regular security audits.

- Transparency and Communication: Maintaining transparency with stakeholders, including customers, employees, and investors, is crucial. “Cleanup” startups should clearly communicate their data handling practices, provide options for data deletion or access, and address any concerns promptly.

- Responsible Disposal: The disposal of sensitive data requires careful consideration. “Cleanup” startups should use secure data destruction methods, ensuring that information is permanently erased and cannot be recovered. This helps prevent potential misuse or identity theft.

Legal and Regulatory Hurdles

“Cleanup” startups face a complex legal and regulatory landscape, navigating various laws and regulations that govern data privacy, intellectual property, and corporate dissolution.

- Data Protection Laws: “Cleanup” startups must comply with data protection laws, such as GDPR and CCPA, which dictate how personal data can be collected, processed, and stored. They must ensure data is handled responsibly and securely, meeting the requirements of these regulations.

- Intellectual Property Rights: Failed startups may have intellectual property assets, including patents, trademarks, and copyrights. “Cleanup” startups need to understand and comply with intellectual property laws, ensuring the proper transfer, licensing, or disposal of these assets.

- Corporate Dissolution: The process of dissolving a failed startup involves legal and regulatory procedures. “Cleanup” startups may need to assist with the liquidation of assets, payment of debts, and closure of accounts, complying with local laws and regulations.

Building Trust and Credibility

In a market where failure is common, “Cleanup” startups face the challenge of building trust and credibility. They must demonstrate their expertise, integrity, and commitment to ethical practices.

- Demonstrating Expertise: “Cleanup” startups need to showcase their knowledge and experience in handling failed startups, data security, legal compliance, and asset disposal. This can be achieved through industry certifications, case studies, and testimonials from previous clients.

- Transparency and Communication: Clear communication and transparency are crucial. “Cleanup” startups should openly discuss their processes, data handling practices, and legal compliance. They should also be responsive to client inquiries and concerns.

- Building a Strong Reputation: Establishing a positive reputation is essential. “Cleanup” startups can achieve this by delivering high-quality services, exceeding client expectations, and building strong relationships with industry stakeholders.

The Future of “Cleanup” Startups: When Startups Fail These Startups Clean Up

The rise of “cleanup” startups signifies a shift in the startup ecosystem, moving beyond just fostering growth to actively addressing the consequences of failure. As the startup landscape continues to evolve, these “cleanup” startups are poised to play an increasingly crucial role, shaping the future of entrepreneurship and innovation.

The Potential for Innovation in “Cleanup” Solutions

The emergence of “cleanup” startups presents an opportunity to develop innovative solutions for addressing startup failure. These startups can leverage technology and data analytics to identify patterns and trends in startup failure, enabling them to create proactive strategies for prevention and mitigation.

For instance, “cleanup” startups can develop predictive models that analyze factors like market trends, competitor activity, and financial performance to identify startups at risk of failure. By providing early warning systems and actionable insights, these startups can help entrepreneurs take corrective measures before it’s too late.

The Impact of Emerging Technologies

Emerging technologies like artificial intelligence (AI), blockchain, and big data are revolutionizing various industries, and the “cleanup” startup landscape is no exception. These technologies can be harnessed to create sophisticated tools and platforms that enhance the efficiency and effectiveness of “cleanup” operations.

AI-powered chatbots can be used to provide automated support and guidance to startups facing challenges, while blockchain technology can be leveraged to create secure and transparent systems for managing assets and liabilities during liquidation processes. Big data analytics can be used to identify valuable insights from failed startups, helping to prevent similar failures in the future.

The rise of cleanup startups signifies a growing awareness of the need for responsible handling of startup failures. These companies are not just cleaning up the mess; they are contributing to a more sustainable and resilient startup ecosystem. By providing valuable services, insights, and support, cleanup startups are helping to turn failures into opportunities for learning and growth, ultimately contributing to a more robust and innovative entrepreneurial landscape.

The world of startups is a rollercoaster ride, with many more failures than successes. But just like a phoenix rising from the ashes, these failed ventures can be reborn into something new and exciting. The knowledge gained from these failed attempts can be a valuable resource, much like the brain-boosting effects of watching 3D movies might offer.

Whether it’s a new product line, a re-imagined business model, or simply a lesson learned, these startups are cleaning up the wreckage and paving the way for future success.

Standi Techno News

Standi Techno News