Why did twitter xs valuation tank 56 in one year – Why Did Twitter’s Valuation Tank 56% in One Year? The once-mighty social media platform, known for its real-time news and conversations, experienced a dramatic decline in value over a tumultuous 12 months. This plunge, fueled by internal struggles, external pressures, and the controversial acquisition by Elon Musk, sent shockwaves through the tech industry.

The decline started in early 2022, with Twitter’s stock price steadily slipping. The platform faced criticism for its handling of misinformation, its slow user growth, and its struggle to compete with other social media giants like Facebook and Instagram. This decline was further exacerbated by the volatile market conditions and the looming threat of regulatory scrutiny.

Twitter’s Valuation Decline: Why Did Twitter Xs Valuation Tank 56 In One Year

The drastic drop in Twitter’s stock price, plummeting by a staggering 56% within a year, is a stark indicator of the company’s struggles in the face of fierce competition and evolving market dynamics. This significant decline has raised concerns about Twitter’s future and its ability to compete effectively in the ever-changing social media landscape.

The Timeline of Twitter’s Valuation Decline, Why did twitter xs valuation tank 56 in one year

The dramatic fall in Twitter’s stock price occurred between October 2021 and October 2022. During this period, Twitter’s stock performance exhibited a consistent downward trend, culminating in a significant loss in value. The company’s stock price reached its peak in October 2021, trading at around $70 per share. However, by October 2022, it had plummeted to below $30 per share, marking a steep decline of over 56%.

Factors Contributing to Twitter’s Valuation Decline

The decline in Twitter’s valuation can be attributed to a combination of factors, including:

- Competition from Other Social Media Platforms: The emergence of new social media platforms like TikTok and Instagram has posed significant competition to Twitter, attracting users and advertisers alike. This intensified competition has led to a decline in Twitter’s user growth and advertising revenue, negatively impacting its valuation.

- Slow User Growth: Twitter has struggled to attract and retain users, particularly compared to its competitors. The platform’s user base has grown at a slower pace than its rivals, indicating a lack of appeal and engagement among potential users.

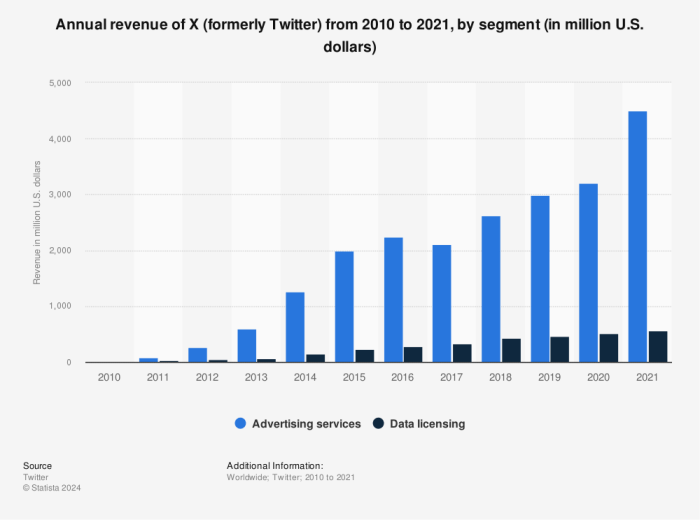

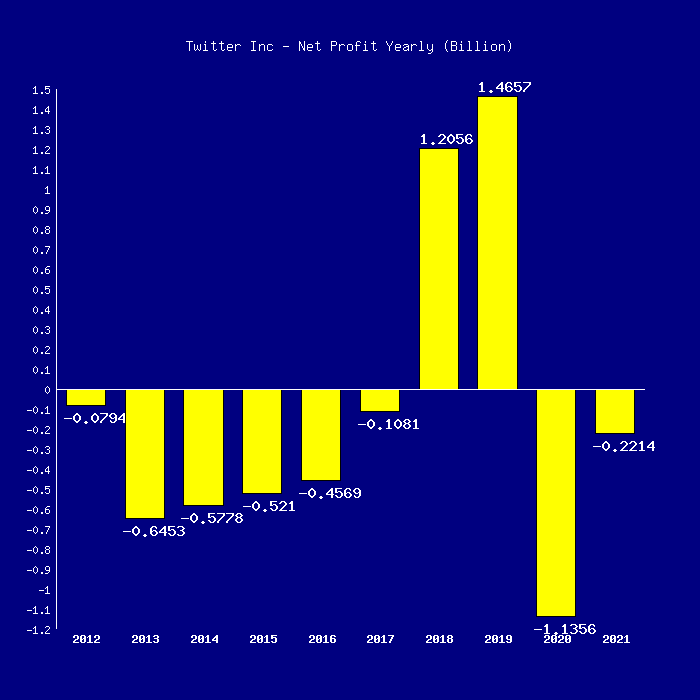

- Challenges in Monetizing User Base: Twitter has faced difficulties in effectively monetizing its user base, particularly compared to other social media platforms like Facebook and Google. The company’s revenue growth has lagged behind its competitors, contributing to the decline in its valuation.

- Regulatory Scrutiny and Content Moderation Issues: Twitter has faced increasing regulatory scrutiny and challenges in content moderation, impacting its user experience and attracting criticism. These issues have contributed to a decline in investor confidence and negatively affected the company’s valuation.

- Elon Musk’s Acquisition and Subsequent Restructuring: Elon Musk’s acquisition of Twitter in 2022 and subsequent restructuring efforts, including mass layoffs and policy changes, have created uncertainty and volatility in the company’s stock price. The impact of these changes on Twitter’s future remains uncertain, contributing to the decline in its valuation.

Internal Factors Contributing to the Decline

Twitter’s plummeting valuation wasn’t solely a result of external forces. A confluence of internal factors played a significant role in eroding investor confidence and driving down the stock price.

The internal factors contributing to Twitter’s valuation decline can be broadly categorized into user growth and engagement, internal changes and decisions, and leadership issues. These factors, often intertwined, ultimately painted a picture of a company struggling to maintain its relevance and profitability in a rapidly evolving digital landscape.

User Growth and Engagement

User growth and engagement are crucial metrics for any social media platform, as they directly impact revenue potential and advertising appeal. Twitter’s struggles in this area were a major contributing factor to its valuation decline.

- Twitter’s user base, while significant, has remained relatively stagnant in recent years. This lack of growth has raised concerns among investors about the platform’s long-term viability and ability to attract new users.

- User engagement, measured by metrics like tweets per user and time spent on the platform, has also shown signs of decline. This suggests that users are spending less time on Twitter and interacting less with the platform’s content, which can negatively impact advertising revenue.

Internal Changes and Decisions

Internal changes and decisions made by Twitter’s leadership also played a role in the valuation decline. These decisions, often aimed at improving the platform’s user experience or boosting revenue, were met with mixed reactions from investors and users alike.

- The introduction of new features, such as the “Super Follow” feature, was met with skepticism by some users and failed to gain widespread adoption. These features, designed to increase user engagement and generate revenue, ultimately fell short of expectations.

- Twitter’s decision to prioritize content moderation and combat misinformation, while commendable from a social responsibility standpoint, has been criticized by some users for being overly restrictive. These policies, aimed at fostering a healthier and more inclusive platform, have been accused of stifling free speech and discouraging engagement.

External Factors Influencing the Decline

The decline in Twitter’s valuation wasn’t solely driven by internal factors. The broader economic landscape, market trends, and external pressures also played a significant role in shaping the company’s fortunes.

Impact of the Broader Market Conditions

The year 2022 witnessed a tumultuous period for the tech sector, marked by rising inflation, increasing interest rates, and concerns about a potential recession. These macroeconomic factors created a challenging environment for growth-oriented companies like Twitter. As investors sought safety in more stable investments, valuations for tech companies, including Twitter, were significantly impacted.

Comparison with Other Social Media Companies

During this period, Twitter’s performance lagged behind other social media giants like Facebook (Meta) and Instagram. While these platforms continued to grow their user base and revenue, Twitter struggled to maintain its growth trajectory. This relative underperformance contributed to the decline in its valuation, as investors sought opportunities in companies with stronger growth prospects.

Regulatory and Legal Challenges

Twitter faced several regulatory and legal challenges during this period. These challenges, including investigations into data privacy, content moderation policies, and potential antitrust concerns, created uncertainty and weighed on the company’s valuation. The scrutiny from regulators and policymakers increased the risk associated with investing in Twitter, leading to a decline in its market value.

Elon Musk’s Acquisition and its Impact

Elon Musk’s acquisition of Twitter in October 2022 marked a significant turning point in the company’s history. The deal, valued at $44 billion, sent shockwaves through the tech industry and raised questions about the future of the social media platform. The acquisition brought about a series of changes that had a profound impact on Twitter’s valuation.

The impact of Elon Musk’s acquisition on Twitter’s valuation is multifaceted. While the initial announcement of the acquisition led to a surge in Twitter’s stock price, the subsequent events and changes implemented by Musk have resulted in a significant decline.

Changes Implemented by Musk

The changes implemented by Musk after the acquisition have been controversial and have contributed to the decline in Twitter’s valuation. These changes include:

* Mass Layoffs: Musk initiated a series of mass layoffs, affecting a significant portion of Twitter’s workforce. These layoffs have been criticized for their impact on morale and the company’s ability to operate effectively.

* Changes to Content Moderation Policies: Musk has relaxed content moderation policies, leading to concerns about the spread of misinformation and hate speech on the platform. This has resulted in advertisers pulling back from Twitter, further impacting its revenue.

* Introduction of Twitter Blue: Musk introduced a subscription service called Twitter Blue, which allows users to pay for verification and other features. However, the implementation of Twitter Blue has been plagued by issues, including the proliferation of fake accounts.

Twitter’s Valuation Before and After the Acquisition

Twitter’s valuation has declined significantly since Musk’s acquisition.

* Before the Acquisition: Twitter’s stock price was trading at around $40 per share in the months leading up to the acquisition.

* After the Acquisition: Twitter’s stock price has plummeted, reaching lows of around $10 per share in early 2023. This represents a decline of over 75% from its pre-acquisition price.

The decline in Twitter’s valuation can be attributed to a combination of factors, including the changes implemented by Musk, concerns about the platform’s future, and the broader economic downturn.

Future Outlook and Potential Recovery

Twitter’s plummeting valuation presents a complex scenario, but the future holds potential for recovery. Several factors could contribute to a rebound, while others pose ongoing challenges. Understanding these dynamics is crucial for investors and stakeholders alike.

Factors Contributing to Potential Recovery

The possibility of Twitter’s valuation recovering hinges on several key factors.

- Enhanced User Engagement and Growth: A key driver of recovery lies in attracting and retaining users. Implementing features that foster greater engagement, such as improved content moderation, personalized recommendations, and innovative monetization strategies, could boost user numbers and activity, ultimately driving value.

- Successful Integration of New Features: Introducing features that enhance user experience and expand monetization opportunities is critical. Examples include expanding live streaming capabilities, integrating e-commerce functionalities, and leveraging artificial intelligence (AI) for personalized content delivery.

- Effective Monetization Strategies: Twitter needs to refine its monetization strategies to generate sustainable revenue. Exploring new avenues beyond traditional advertising, such as subscriptions, e-commerce, and data licensing, could prove valuable.

- Improved Brand Reputation and Trust: Rebuilding trust with users and advertisers is essential. Addressing concerns related to content moderation, misinformation, and user privacy will be crucial.

Long-Term Prospects of Twitter’s Business Model

Twitter’s long-term success depends on its ability to adapt its business model to evolving user preferences and market trends.

- Focus on Community Building: Twitter’s strength lies in its ability to foster communities around shared interests. Emphasizing this aspect, through features like topic-specific forums and improved group communication tools, could attract users seeking connection and engagement.

- Leveraging Real-Time Information: Twitter’s real-time information sharing platform is a valuable asset. Developing features that enhance its utility for news dissemination, event coverage, and crisis response could solidify its position as a go-to source for immediate information.

- Exploring New Revenue Streams: Beyond advertising, Twitter needs to diversify its revenue streams. This could involve subscriptions for premium features, e-commerce integrations, and data licensing for insights into user behavior and trends.

Potential Risks and Challenges

Despite the potential for recovery, Twitter faces several risks and challenges that could continue to impact its valuation.

- Competition from Other Platforms: The social media landscape is highly competitive, with platforms like Facebook, Instagram, and TikTok vying for users’ attention. Twitter needs to differentiate itself and offer unique features to remain relevant.

- Content Moderation and Misinformation: Twitter’s struggles with content moderation and the spread of misinformation continue to be a concern. Maintaining a balance between free speech and responsible content control is crucial for regaining user trust.

- Regulatory Scrutiny: Social media platforms face increasing regulatory scrutiny globally. Compliance with evolving privacy laws and regulations will be essential for Twitter’s long-term stability.

- Economic Uncertainty: Global economic conditions can impact advertising revenue, which is a significant source of income for Twitter.

Twitter’s valuation decline serves as a cautionary tale for investors and tech companies alike. The platform’s future remains uncertain, as Musk’s ambitious plans to transform Twitter into a “everything app” face significant challenges. Whether Twitter can recover and reclaim its former glory remains to be seen, but one thing is clear: the social media landscape has changed, and Twitter is now fighting for its place in the digital age.

Twitter’s valuation plummeted 56% in a year, a stark reminder of the volatile tech landscape. While the platform grapples with its future, innovation marches on. Doublepoint launches its WowMouse gesture touch control app for Pixel Watch 2 , offering a glimpse into the potential of wearables to enhance user experiences. This kind of creative thinking might be just what Twitter needs to regain its footing in the digital world.

Standi Techno News

Standi Techno News