YUNOS payments orchestration valuation fintech is a hot topic, especially as the financial technology landscape evolves rapidly. YUNOS, a powerful platform designed to streamline and optimize payment processes, has become a key player in this dynamic space. Its innovative approach to payment orchestration is attracting significant attention from investors and industry leaders alike, prompting crucial discussions about its valuation and potential for growth.

The rise of YUNOS is closely tied to the broader fintech revolution. As consumers and businesses increasingly embrace digital payment solutions, the demand for efficient and secure payment infrastructure is soaring. YUNOS addresses this demand by providing a comprehensive platform that enables businesses to manage multiple payment channels, optimize transaction flows, and enhance security measures. This ability to simplify and streamline the payment experience for both businesses and consumers has positioned YUNOS as a key player in the fintech landscape.

YUNOS

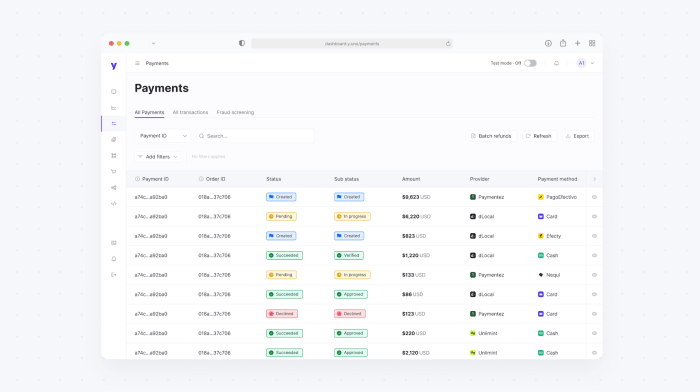

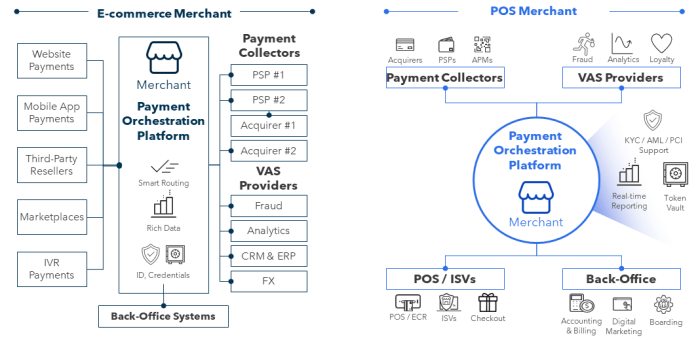

YUNOS is a leading payment orchestration platform that simplifies and streamlines the complex world of online payments. It’s designed to empower businesses of all sizes to manage multiple payment methods, optimize transaction flows, and enhance the overall payment experience for their customers.

Origins and Evolution of YUNOS

YUNOS emerged as a response to the growing need for a centralized and flexible payment management solution. Traditional payment processing systems were often rigid, cumbersome, and lacked the scalability required to meet the demands of the rapidly evolving digital landscape.

YUNOS evolved from its initial focus on simplifying payment processing to encompass a wider range of functionalities, including:

- Payment gateway aggregation: YUNOS integrates with multiple payment gateways, allowing businesses to accept payments from various sources, including credit cards, debit cards, e-wallets, and bank transfers.

- Payment routing and optimization: YUNOS intelligently routes transactions to the most efficient and cost-effective payment gateways, ensuring optimal processing speed and reduced transaction fees.

- Fraud detection and prevention: YUNOS incorporates advanced fraud detection mechanisms to protect businesses from fraudulent transactions and minimize financial losses.

- Real-time reporting and analytics: YUNOS provides detailed transaction data and insights, enabling businesses to monitor performance, identify trends, and make informed decisions.

Key Features and Functionalities of YUNOS

YUNOS offers a comprehensive suite of features designed to streamline payment processing and enhance the customer experience.

- Multi-currency support: YUNOS allows businesses to accept payments in multiple currencies, facilitating global expansion and cross-border transactions.

- Recurring billing and subscriptions: YUNOS enables businesses to easily manage recurring payments, such as subscriptions and membership fees.

- Customizable checkout experience: YUNOS allows businesses to tailor the checkout experience to their brand and preferences, enhancing customer engagement and conversion rates.

- API integration: YUNOS provides a robust API that allows businesses to integrate payment processing into their existing systems and applications.

- Customer support: YUNOS offers dedicated customer support to assist businesses with setup, troubleshooting, and ongoing management of their payment processing operations.

Comparison with Other Payment Orchestration Platforms

YUNOS competes with other prominent payment orchestration platforms, such as Stripe, PayPal, and Adyen. Each platform offers unique features and benefits, catering to specific business needs and industry requirements.

| Feature | YUNOS | Stripe | PayPal | Adyen |

|---|---|---|---|---|

| Payment gateway aggregation | Yes | Yes | Yes | Yes |

| Payment routing and optimization | Yes | Yes | Yes | Yes |

| Fraud detection and prevention | Yes | Yes | Yes | Yes |

| Real-time reporting and analytics | Yes | Yes | Yes | Yes |

| Multi-currency support | Yes | Yes | Yes | Yes |

| Recurring billing and subscriptions | Yes | Yes | Yes | Yes |

| Customizable checkout experience | Yes | Yes | Yes | Yes |

| API integration | Yes | Yes | Yes | Yes |

| Customer support | Yes | Yes | Yes | Yes |

YUNOS differentiates itself by offering a highly customizable platform that empowers businesses to tailor their payment processing solutions to their specific needs. Its focus on flexibility, scalability, and comprehensive features makes it a compelling choice for businesses seeking to optimize their payment operations and enhance the customer experience.

Fintech Landscape and YUNOS’ Role

The fintech industry is rapidly evolving, particularly in the payments sector. Fintech companies are disrupting traditional financial institutions by offering innovative solutions that are faster, more convenient, and often more affordable. This has led to a surge in investment and growth within the fintech space.

However, the fintech payments landscape also presents numerous challenges and opportunities. Fintech companies must navigate regulatory hurdles, compete with established players, and constantly innovate to stay ahead of the curve. YUNOS, with its payments orchestration platform, aims to address these challenges and capitalize on the opportunities presented by this dynamic industry.

YunOS Payments Orchestration, a valuation powerhouse in the fintech world, has been making waves with its innovative approach to streamlining payments. It’s fascinating to see how the industry is evolving, and it reminds us of the entrepreneurial spirit that drives innovation, like what we see with cruise founder Kyle Vogt’s return to the scene with his new robot startup.

The tech world is full of exciting ventures, and YunOS Payments Orchestration is certainly one to watch, as it continues to reshape the future of finance.

Challenges and Opportunities in Fintech Payments

Fintech companies in the payments space face a number of challenges, including:

- Regulatory Complexity: The payments industry is heavily regulated, and navigating these regulations can be complex and time-consuming. Fintech companies must comply with a variety of rules and regulations, which can vary depending on the region and type of payment service offered.

- Competition from Established Players: Fintech companies are competing with established financial institutions that have deep pockets and extensive customer bases. These institutions are also investing heavily in technology to improve their own offerings, making it difficult for fintech startups to gain market share.

- Data Security and Privacy Concerns: Payments data is highly sensitive, and fintech companies must implement robust security measures to protect it from breaches. Consumer concerns about data privacy are also growing, which can be a challenge for fintech companies.

- Integration Challenges: Integrating with existing payment systems and infrastructure can be challenging for fintech companies. This is especially true for companies that are developing innovative payment solutions that require integration with multiple systems.

Despite these challenges, there are also significant opportunities for fintech companies in the payments space. These opportunities include:

- Growing Demand for Digital Payments: The rise of e-commerce and mobile payments has led to a surge in demand for digital payment solutions. Fintech companies are well-positioned to capitalize on this trend by offering innovative and convenient payment options.

- Emerging Markets: Many emerging markets have a growing middle class and are rapidly adopting digital payments. Fintech companies can leverage these markets to expand their reach and customer base.

- Focus on Customer Experience: Consumers are increasingly demanding personalized and seamless payment experiences. Fintech companies can differentiate themselves by offering solutions that meet these demands.

- Innovation in Payment Technologies: The payments landscape is constantly evolving, with new technologies such as blockchain and artificial intelligence (AI) emerging. Fintech companies can leverage these technologies to develop innovative payment solutions.

Valuation and Investment Considerations

Valuing YUNOS, a payments orchestration fintech, requires a nuanced approach considering its unique business model, market dynamics, and growth potential. This section will delve into the factors influencing YUNOS’s valuation, its financial performance, and key investment considerations for potential stakeholders.

Key Valuation Drivers, Yunos payments orchestration valuation fintech

The valuation of YUNOS is influenced by several key factors, including:

- Market Size and Growth: The global payments orchestration market is rapidly expanding, driven by the increasing adoption of digital payments, e-commerce, and cross-border transactions. YUNOS’s valuation will be significantly impacted by its ability to capture a substantial share of this growing market.

- Revenue Model and Profitability: YUNOS’s revenue model, which likely involves transaction fees, subscription fees, and value-added services, will be crucial in determining its profitability and valuation.

- Technology and Innovation: YUNOS’s proprietary technology platform and its ability to innovate and adapt to evolving payment trends will be critical in driving its valuation.

- Customer Acquisition and Retention: YUNOS’s ability to attract and retain a large customer base, including merchants, businesses, and individuals, will be a key driver of its valuation.

- Competitive Landscape: YUNOS’s valuation will be influenced by the competitive landscape, including the presence of established players and emerging startups in the payments orchestration market.

- Regulatory Environment: The regulatory environment surrounding payments and fintech in YUNOS’s operating regions will have a significant impact on its valuation.

Financial Performance and Growth Potential

To assess YUNOS’s valuation, it’s essential to analyze its financial performance and growth potential.

- Revenue Growth: YUNOS’s revenue growth trajectory, both in terms of absolute value and year-over-year percentage growth, will be a crucial indicator of its financial health and potential.

- Profitability: YUNOS’s ability to generate profits, as measured by metrics like gross margin, operating margin, and net income, will be a key factor in determining its valuation.

- Customer Acquisition Costs (CAC): YUNOS’s CAC, which reflects the cost of acquiring new customers, will be an important metric to assess its efficiency in acquiring and retaining customers.

- Customer Lifetime Value (CLTV): YUNOS’s CLTV, which represents the total revenue generated from a customer over their relationship with the company, will provide insights into the long-term value of its customer base.

Investment Considerations

Potential investors in YUNOS should consider several key factors:

- Management Team: The experience, expertise, and track record of YUNOS’s management team will be crucial in driving the company’s success.

- Market Opportunity: Investors should assess the size and growth potential of the payments orchestration market and YUNOS’s ability to capitalize on this opportunity.

- Competitive Advantage: Investors should evaluate YUNOS’s competitive advantage, including its technology, product offerings, and go-to-market strategy.

- Risk Factors: Investors should be aware of the risks associated with investing in a fintech company, such as regulatory changes, competition, and technological disruption.

- Exit Strategy: Investors should consider YUNOS’s potential exit strategy, such as an initial public offering (IPO), acquisition, or other liquidity events.

YUNOS’ Impact on the Payment Ecosystem: Yunos Payments Orchestration Valuation Fintech

YUNOS, as a payment orchestration platform, has the potential to significantly impact the payment ecosystem by streamlining payment processes, enhancing security, and fostering innovation. Its impact extends to various stakeholders, including merchants, consumers, and financial institutions, bringing both benefits and challenges.

Impact on Merchants

The benefits of YUNOS for merchants are multifaceted. By centralizing payment processing, YUNOS allows merchants to manage multiple payment methods and gateways from a single platform. This simplifies operations, reduces administrative overhead, and enhances efficiency. YUNOS also enables merchants to accept payments from a wider range of customers, including those using alternative payment methods, thereby expanding their reach and customer base.

“YUNOS’ payment orchestration capabilities allow us to offer a seamless checkout experience to our customers, regardless of their preferred payment method. This has significantly increased our conversion rates and customer satisfaction.” – CEO of a leading e-commerce platform.

Furthermore, YUNOS’ fraud detection and prevention features can help merchants minimize losses from fraudulent transactions, improving their financial security. The platform’s analytics and reporting capabilities provide merchants with valuable insights into customer behavior and payment trends, enabling them to optimize their operations and marketing strategies.

Impact on Consumers

YUNOS offers consumers a more convenient and secure payment experience. With YUNOS, consumers can choose from a wider range of payment methods, including digital wallets, mobile payments, and bank transfers. This flexibility empowers consumers to select the payment method that best suits their needs and preferences.

“Using YUNOS, I can easily pay for online purchases using my preferred digital wallet, without having to enter my credit card details repeatedly. It’s convenient and secure.” – A satisfied YUNOS user.

YUNOS also enhances payment security through advanced fraud detection and prevention mechanisms. This ensures that consumer transactions are protected from unauthorized access and fraudulent activities. Additionally, YUNOS’ integration with multiple payment gateways allows consumers to complete transactions seamlessly, regardless of their location or the merchant they are dealing with.

Impact on Financial Institutions

YUNOS can play a crucial role in transforming the way financial institutions operate and interact with their customers. By providing a robust and secure payment infrastructure, YUNOS enables financial institutions to offer innovative payment solutions and enhance their service offerings.

“YUNOS’ API-based architecture allows us to easily integrate our payment solutions with various third-party platforms, expanding our reach and providing a more comprehensive customer experience.” – Head of Payments at a leading financial institution.

YUNOS’ data analytics capabilities can also help financial institutions gain deeper insights into customer behavior and market trends, enabling them to develop more targeted and personalized financial products and services. The platform’s compliance features ensure that financial institutions meet regulatory requirements and maintain a secure payment environment.

Future Trends and Developments

The payments landscape is constantly evolving, driven by technological advancements, changing consumer preferences, and regulatory shifts. Understanding these trends is crucial for YUNOS to navigate the future and maintain its competitive edge. This section explores key trends shaping the payments ecosystem and how YUNOS can adapt to them, ultimately impacting its valuation.

The Rise of Embedded Finance

Embedded finance refers to integrating financial services seamlessly into non-financial platforms and products. This trend allows businesses to offer financial solutions directly to their customers, eliminating the need for separate financial institutions. For example, an e-commerce platform could offer embedded payment options, micro-loans, or insurance directly through its platform. YUNOS can leverage this trend by developing APIs and integrations that allow businesses to easily embed its payment orchestration capabilities into their own platforms. This can significantly expand YUNOS’s reach and customer base, ultimately increasing its valuation.

The Growing Importance of Data Security and Privacy

Data security and privacy are paramount in the payments industry. As more transactions shift online, concerns about data breaches and identity theft are growing. YUNOS can address these concerns by implementing robust security measures and adhering to industry best practices. This includes encryption, tokenization, and multi-factor authentication. YUNOS can also invest in advanced fraud detection and prevention technologies. By prioritizing data security, YUNOS can build trust with customers and partners, enhancing its brand reputation and contributing to a higher valuation.

The Emergence of Open Banking

Open banking allows third-party applications to access customer financial data with their consent. This enables innovative financial services and personalized experiences. YUNOS can leverage open banking by integrating with other financial institutions and platforms, providing access to a wider range of payment options and data. This can enhance the functionality and value of YUNOS’s platform, attracting more customers and partners, ultimately increasing its valuation.

The Adoption of Digital Currencies

Digital currencies, including cryptocurrencies and stablecoins, are gaining traction, offering new payment possibilities. YUNOS can adapt to this trend by integrating support for digital currencies into its platform. This can enable businesses to accept and process digital currency payments, expanding their customer base and providing them with new payment options. Integrating digital currency support can enhance YUNOS’s value proposition and increase its appeal to businesses seeking innovative payment solutions.

The Importance of Sustainability

Sustainability is becoming increasingly important in all industries, including finance. Consumers are demanding environmentally conscious financial products and services. YUNOS can contribute to a sustainable payments ecosystem by partnering with businesses that promote sustainable practices and by implementing its own sustainable initiatives. For example, YUNOS can optimize its operations to reduce its carbon footprint and invest in renewable energy sources. This commitment to sustainability can enhance YUNOS’s brand image and attract environmentally conscious customers and investors, ultimately contributing to a higher valuation.

The valuation of YUNOS reflects its unique position within the fintech ecosystem. Its ability to address critical challenges in the payments space, coupled with its robust features and potential for growth, makes it an attractive investment proposition. As the fintech industry continues to evolve, YUNOS is poised to play a pivotal role in shaping the future of payments. Its innovative approach, coupled with its commitment to delivering value to stakeholders, suggests that YUNOS is well-positioned for continued success in the years to come.

Standi Techno News

Standi Techno News