Google Wallet India Launch sets the stage for a digital payments revolution in one of the world’s fastest-growing economies. With India’s burgeoning tech scene and a population increasingly embracing digital solutions, the arrival of Google Wallet promises to shake things up. But is it a game changer, or just another player in a crowded field?

The Indian digital wallet market is already bustling with players like Paytm, PhonePe, and Google Pay, each vying for a slice of the ever-expanding pie. Google Wallet brings its own unique strengths to the table, leveraging its global reach and integration with existing Google services to offer a seamless and potentially disruptive user experience.

Google Wallet India Launch

The launch of Google Wallet in India marks a significant step for the digital payments landscape in the country. With a rapidly growing digital economy and a substantial mobile-first population, India has become a prime target for global tech giants like Google. Google Wallet’s entry is expected to intensify competition in the already bustling Indian digital wallet market.

Competitive Landscape

The Indian digital wallet market is already fiercely competitive, with players like PhonePe, Paytm, Google Pay, and BHIM UPI dominating the scene. These platforms have successfully established themselves by offering a wide range of services, including peer-to-peer (P2P) payments, bill payments, recharges, and online shopping. Google Wallet’s entry will add another formidable contender to this dynamic market.

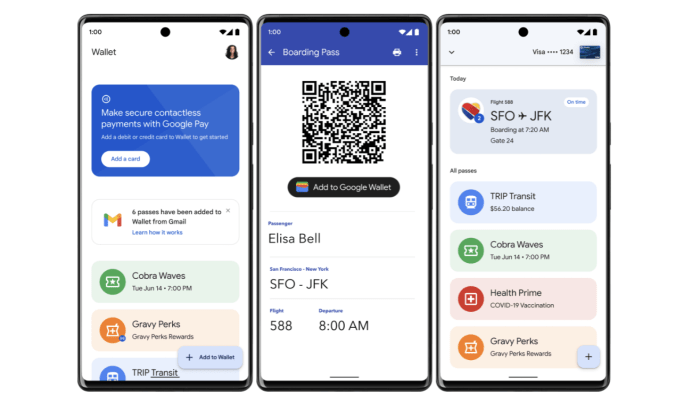

Key Features and Functionalities

Google Wallet offers a comprehensive suite of features designed to cater to the diverse needs of Indian users. Some key features include:

- Seamless Integration with Google Pay: Google Wallet leverages the existing infrastructure of Google Pay, allowing users to easily transfer their existing balances and transaction history. This seamless integration ensures a smooth onboarding experience for users familiar with Google Pay.

- Digital Wallet and Payment Platform: Google Wallet functions as a digital wallet that allows users to store and manage their payment information securely. It enables users to make online and offline payments through NFC-enabled devices, similar to other popular digital wallets in India.

- Support for UPI and Other Payment Methods: Google Wallet supports the Unified Payments Interface (UPI), a widely adopted real-time payment system in India. This ensures compatibility with existing payment systems and allows users to make payments through various banks and financial institutions.

- Enhanced Security Features: Google Wallet prioritizes user security with features like device-specific PINs, fingerprint authentication, and multi-factor authentication. These measures aim to protect user data and prevent unauthorized transactions.

- Rewards and Offers: Google Wallet aims to attract users by offering rewards and exclusive offers on various transactions, including online purchases, offline payments, and recharges. This strategy aligns with the competitive landscape and incentivizes user adoption.

Target Audience and Market Potential

Google Wallet’s arrival in India presents a compelling opportunity to tap into the country’s burgeoning digital payment landscape. Understanding the target audience and market potential is crucial for Google Wallet’s success.

The potential for digital wallets in India is significant, driven by a combination of factors, including the increasing smartphone penetration, a young and tech-savvy population, and a growing preference for cashless transactions.

Target Audience

The target audience for Google Wallet in India encompasses a diverse range of individuals and businesses.

- Millennials and Gen Z: This demographic, known for its tech-savviness and comfort with digital transactions, is expected to be a primary driver of Google Wallet adoption.

- Urban Population: Cities with higher internet and smartphone penetration, like Mumbai, Delhi, and Bangalore, are likely to witness early adoption of Google Wallet.

- Small and Medium Enterprises (SMEs): Google Wallet’s integration with existing payment systems can benefit SMEs by offering a convenient and secure payment solution for their customers.

- E-commerce Businesses: Online retailers can leverage Google Wallet’s seamless integration with their platforms to enhance customer experience and drive sales.

Market Potential

India’s digital payments market is experiencing rapid growth, driven by factors like:

- Government Initiatives: Initiatives like the Digital India program and the promotion of UPI (Unified Payments Interface) have spurred the adoption of digital payment methods.

- Financial Inclusion: Digital wallets provide access to financial services for individuals who may not have traditional bank accounts.

- Convenience and Security: Digital wallets offer a convenient and secure alternative to carrying cash, reducing the risk of theft or loss.

- Mobile-First Economy: India’s mobile-first economy, with a large smartphone user base, creates a favorable environment for the adoption of digital wallets.

Factors Influencing Adoption

Several factors influence consumer adoption of digital wallets in India:

- Trust and Security: Consumer confidence in the security of digital wallets is paramount. Google Wallet’s reputation for security and data privacy can play a significant role in gaining user trust.

- Ease of Use: A user-friendly interface and intuitive navigation are crucial for widespread adoption. Google Wallet’s integration with existing Google services can simplify the onboarding process.

- Merchant Acceptance: The availability of Google Wallet at a wide range of merchants is essential for its adoption. Google’s partnerships with leading businesses can ensure broad merchant acceptance.

- Incentives and Promotions: Attractive offers, discounts, and cashback programs can encourage early adoption and drive user engagement.

Integration and Partnerships: Google Wallet India Launch

Google Wallet’s launch in India leverages existing Google services and partnerships to offer a seamless and convenient payment experience. By integrating with popular apps and services, Google Wallet aims to simplify transactions and boost adoption. The partnerships with banks, merchants, and other stakeholders play a crucial role in expanding its reach and creating a robust ecosystem.

Integration with Google Services, Google wallet india launch

Google Wallet seamlessly integrates with various Google services, enhancing user convenience and accessibility. This integration offers a unified payment experience across different platforms.

- Google Pay: Users can easily link their Google Wallet accounts to their existing Google Pay accounts, allowing them to make payments using their preferred payment method. This integration provides a familiar and convenient payment experience for users already familiar with Google Pay.

- Google Maps: Google Wallet integrates with Google Maps, enabling users to pay for parking, tolls, and other services directly through the app. This integration simplifies transactions and reduces the need for physical cash or cards.

- Google Search: Google Wallet can be used to make payments for online purchases directly through Google Search. This integration allows users to complete transactions quickly and easily without leaving the search results page.

Partnerships with Banks and Financial Institutions

Google Wallet has established partnerships with various banks and financial institutions in India to ensure a wide range of payment options and secure transactions.

- Axis Bank: Axis Bank is one of the first banks to partner with Google Wallet, offering users the ability to link their bank accounts to their Google Wallet accounts. This partnership provides users with a secure and convenient way to manage their finances.

- HDFC Bank: HDFC Bank, another major bank in India, has also partnered with Google Wallet, allowing users to make payments through their bank accounts. This partnership expands the reach of Google Wallet and provides users with more payment options.

- ICICI Bank: ICICI Bank has joined the Google Wallet ecosystem, providing users with the ability to link their bank accounts and make payments through the platform. This partnership further strengthens Google Wallet’s presence in the Indian market.

Partnerships with Merchants and Businesses

Google Wallet has forged partnerships with various merchants and businesses in India to facilitate seamless payments and enhance user experience.

- Amazon India: Google Wallet is integrated with Amazon India, allowing users to make payments for online purchases directly through the platform. This partnership provides users with a convenient and secure way to shop online.

- Flipkart: Google Wallet has partnered with Flipkart, another major e-commerce platform in India, enabling users to make payments for online purchases. This partnership expands Google Wallet’s reach and provides users with more options for online shopping.

- Swiggy: Google Wallet has partnered with Swiggy, a popular food delivery platform in India, allowing users to pay for food orders through the app. This partnership simplifies the ordering and payment process, providing users with a convenient and secure way to order food online.

Benefits of Integrations and Partnerships

The integrations and partnerships offer significant benefits to both users and businesses:

For Users:

- Convenience: Google Wallet offers a convenient and seamless payment experience, allowing users to make payments quickly and easily across various platforms and services.

- Security: Google Wallet employs advanced security measures to protect user data and transactions, ensuring a secure payment experience.

- Wide Acceptance: The partnerships with banks, merchants, and businesses expand the acceptance of Google Wallet, allowing users to make payments at a wide range of locations.

For Businesses:

- Increased Reach: Google Wallet’s partnerships with banks and merchants expand the reach of businesses, allowing them to tap into a larger customer base.

- Simplified Transactions: Google Wallet simplifies the payment process for businesses, reducing the need for manual processing and minimizing errors.

- Improved Customer Experience: Google Wallet provides a seamless and convenient payment experience for customers, leading to increased customer satisfaction and loyalty.

User Experience and Security

Google Wallet’s user interface and security features are crucial for its success in India. The app must be intuitive and easy to use, while also providing robust protection for user data and financial transactions.

User Interface and User Experience

The user interface (UI) of Google Wallet is designed to be simple and straightforward, making it easy for users to navigate and perform transactions. The app utilizes a clean and modern design, with clear icons and intuitive menus. It’s designed to be accessible to users of all technical abilities, including those who are new to digital wallets.

- Easy Setup: Google Wallet’s setup process is streamlined and user-friendly. Users can easily add their bank accounts, credit cards, and debit cards to the app, and the app automatically detects and saves card information for future transactions.

- Intuitive Navigation: The app’s interface is intuitive, with clear menus and icons. Users can easily find the features they need, such as sending money, making payments, and managing their wallet.

- Personalized Experience: Google Wallet offers a personalized experience by allowing users to customize their wallet with different themes and backgrounds. Users can also set up transaction notifications and alerts, keeping them informed about their spending activities.

- Offline Functionality: Google Wallet offers limited offline functionality, allowing users to make payments even when they are not connected to the internet. This feature is particularly useful in areas with poor network connectivity.

Security Features

Google Wallet prioritizes user security by implementing robust security measures to protect user data and financial transactions. These features include:

- Two-Factor Authentication (2FA): Google Wallet utilizes two-factor authentication (2FA) to add an extra layer of security to user accounts. When users log in or make a transaction, they are required to enter a one-time code sent to their registered mobile number or email address.

- Device Security: Google Wallet is integrated with the device’s security features, such as fingerprint authentication and facial recognition. Users can set up these features to ensure that only authorized individuals can access their wallet.

- Transaction Encryption: Google Wallet encrypts all transaction data, ensuring that it is secure during transmission. This means that even if someone intercepts the data, they will not be able to decipher it.

- Fraud Detection: Google Wallet uses advanced fraud detection algorithms to identify and prevent fraudulent transactions. The app monitors user activity and can flag suspicious transactions, preventing unauthorized payments.

Best Practices for User Security

To ensure the security of their Google Wallet accounts, users should follow these best practices:

- Strong Passwords: Users should create strong passwords for their Google Wallet accounts, combining uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable passwords.

- Enable Two-Factor Authentication: Users should enable two-factor authentication (2FA) for their Google Wallet accounts. This adds an extra layer of security and makes it much harder for unauthorized individuals to access their accounts.

- Regularly Review Transactions: Users should regularly review their transaction history to identify any unauthorized activity. If they notice any suspicious transactions, they should report them to Google Wallet support immediately.

- Keep Software Updated: Users should keep their Google Wallet app and device software updated. Updates often include security patches that fix vulnerabilities and improve security.

- Be Cautious of Phishing Attempts: Users should be wary of phishing attempts, which are designed to trick users into revealing their personal information. Never click on links in suspicious emails or text messages.

Future Prospects and Impact

Google Wallet’s entry into the Indian digital payments ecosystem is poised to reshape the landscape, bringing significant implications for both businesses and consumers. The platform’s potential to revolutionize how people transact and manage their finances is undeniable.

Impact on the Indian Digital Payments Ecosystem

The arrival of Google Wallet in India is expected to accelerate the adoption of digital payments. The platform’s widespread reach and user-friendly interface will encourage individuals who have yet to embrace digital payments to join the digital economy. Google’s existing user base in India, coupled with the platform’s seamless integration with Android devices, will make it easier for people to adopt Google Wallet. This will lead to an increase in digital transactions, boosting the growth of the Indian digital payments ecosystem.

Future Developments and Innovations

Google Wallet is likely to evolve and incorporate new features and innovations tailored to the Indian market. Some potential developments include:

- Integration with UPI: Google Wallet is likely to integrate with the Unified Payments Interface (UPI), India’s dominant real-time payment system. This will enable users to make payments to any UPI-enabled account, further expanding the platform’s reach and convenience.

- Localized Features: Google Wallet could introduce features specific to the Indian market, such as support for regional languages, integration with local payment gateways, and partnerships with popular Indian e-commerce platforms.

- Financial Inclusion: Google Wallet has the potential to contribute to financial inclusion by making digital payments accessible to underserved populations. This could be achieved through partnerships with microfinance institutions and initiatives that promote financial literacy.

Implications for Businesses and Consumers

Google Wallet’s arrival will present both opportunities and challenges for businesses and consumers in India.

- Businesses: Google Wallet will offer businesses a convenient and secure platform to accept payments. The platform’s potential to reach a vast user base could lead to increased sales and customer engagement. Businesses will need to adapt to the evolving payment landscape and embrace digital payment options like Google Wallet to stay competitive.

- Consumers: Google Wallet will empower consumers with a seamless and secure way to make payments, manage their finances, and access various services. The platform’s convenience and security features will likely encourage consumers to adopt digital payments and embrace a cashless lifestyle.

The Google Wallet India launch is a significant event, marking a new chapter in the country’s digital payments landscape. Whether it will truly disrupt the existing players or simply become another option remains to be seen. However, one thing is clear: the competition is heating up, and Indian consumers stand to benefit from the innovation and convenience that these digital payment solutions offer.

Google Wallet is finally here in India, making digital payments even more accessible. While we’re excited about the convenience, we can’t help but wonder if Google is paying attention to the new apple tandem oled ipad with its stunning display. With the competition heating up, Google Wallet needs to stay ahead of the game to truly capture the Indian market.

Standi Techno News

Standi Techno News