Meta says it will pass on the apple tax to advertisers paying to boost posts on facebook and instagram – Meta says it will pass on the “Apple Tax” to advertisers paying to boost posts on Facebook and Instagram. This means that businesses who want to reach their target audience on these platforms will have to pay more for their advertising campaigns. The “Apple Tax” refers to the 30% commission that Apple takes from app developers, including Meta, for in-app purchases. Meta has stated that they will be passing on this cost to advertisers, which could have a significant impact on the advertising landscape.

The decision to pass on the “Apple Tax” has been met with mixed reactions from the advertising industry. Some advertisers are concerned that the increased costs will make it more difficult for them to reach their target audience, while others are hopeful that the change will ultimately benefit Meta’s users. Only time will tell how this decision will affect the advertising landscape, but it is clear that the “Apple Tax” is a significant development that could have a major impact on the way businesses market themselves online.

Impact on Advertisers

The “Apple Tax,” which refers to the 30% commission Apple takes on in-app purchases, has significant implications for advertisers using Facebook and Instagram. Meta, the parent company of these platforms, has announced that it will pass on this cost to advertisers, meaning they will need to pay more to boost their posts and reach their target audience.

Potential Challenges for Advertisers

This increased cost poses several challenges for advertisers. Firstly, it directly affects their advertising budgets, forcing them to either allocate more resources to digital marketing or potentially reduce their overall advertising spend. This can lead to a decrease in reach and engagement, impacting campaign effectiveness.

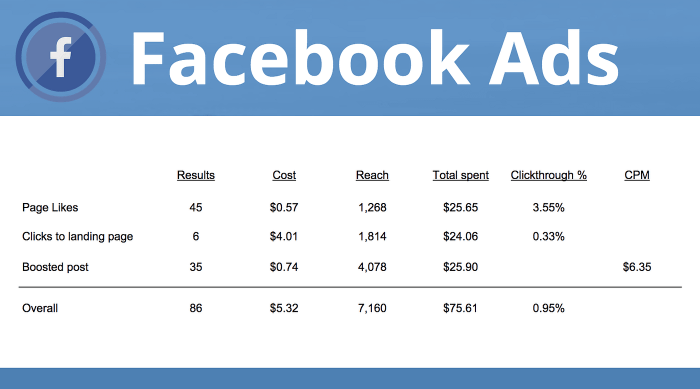

Comparison of Advertising Costs

The “Apple Tax” adds an extra layer of expense to the already existing cost of advertising on Meta platforms. Let’s consider a hypothetical example: An advertiser currently spends $1000 to reach 10,000 users on Facebook. With the “Apple Tax” implemented, they might need to spend $1300 to achieve the same reach, assuming a 30% commission. This increased cost can significantly impact an advertiser’s return on investment (ROI), potentially making digital advertising less attractive.

Meta’s Business Model

Meta’s business model revolves around connecting people and generating revenue through advertising. The company’s primary revenue stream comes from advertisers who pay to reach users on its platforms, primarily Facebook and Instagram. The “Apple Tax,” a 30% commission levied by Apple on in-app purchases, directly impacts Meta’s revenue model, specifically affecting its advertising revenue.

Impact of the “Apple Tax” on Meta’s Business Model

The “Apple Tax” significantly affects Meta’s business model by reducing its revenue from in-app purchases. This reduction in revenue impacts the company’s overall profitability and ability to invest in new products and services. The “Apple Tax” also forces Meta to adjust its pricing strategies for advertisers to compensate for the commission paid to Apple.

Potential Impact on Meta’s Revenue Streams

The “Apple Tax” could potentially affect Meta’s revenue streams in several ways:

- Reduced Advertising Revenue: The “Apple Tax” discourages advertisers from spending more on Meta’s platforms, leading to reduced advertising revenue. This is because advertisers are less willing to pay higher prices for ad campaigns due to the commission charged by Apple.

- Increased Costs: Meta has to bear the cost of the “Apple Tax,” which increases its overall expenses. This can negatively impact the company’s profitability and its ability to invest in research and development.

- Shifted User Behavior: The “Apple Tax” could potentially lead to a shift in user behavior, as users may be less likely to make in-app purchases due to higher prices. This could result in a decline in Meta’s revenue from in-app purchases.

Strategies to Mitigate the Impact of the “Apple Tax”

Meta can employ several strategies to mitigate the impact of the “Apple Tax” on its business:

- Negotiating with Apple: Meta could attempt to negotiate a lower commission rate with Apple, similar to what other companies have achieved. This would directly reduce the impact of the “Apple Tax” on Meta’s revenue.

- Diversifying Revenue Streams: Meta can diversify its revenue streams by exploring new business models, such as subscription services or e-commerce platforms. This would reduce its reliance on advertising revenue, making it less vulnerable to the “Apple Tax.”

- Optimizing Advertising Platforms: Meta can optimize its advertising platforms to increase efficiency and attract more advertisers. This could involve improving targeting capabilities, offering more transparent pricing models, and enhancing ad formats.

- Investing in Innovation: Meta can continue to invest in innovative products and services that offer value to users and advertisers. This could involve developing new features, improving user experience, and creating new ad formats.

The Apple Tax Debate: Meta Says It Will Pass On The Apple Tax To Advertisers Paying To Boost Posts On Facebook And Instagram

The “Apple Tax” is a term used to describe the 30% commission that Apple takes from in-app purchases made through its App Store. This commission, known formally as the “App Store Commission,” has been a point of contention between Apple and developers, including Meta, who argue that it is an unfair and excessive fee. The debate surrounding this commission has raised important questions about the role of app stores, the power of tech giants, and the implications for developers and consumers.

Arguments for and Against the “Apple Tax”, Meta says it will pass on the apple tax to advertisers paying to boost posts on facebook and instagram

The “Apple Tax” has sparked a debate with both sides presenting compelling arguments. Here’s a table summarizing the key arguments for and against the commission from both Meta and Apple’s perspectives:

| Argument | Meta’s Perspective | Apple’s Perspective |

|---|---|---|

| App Store Commission | The 30% commission is excessive and unfairly restricts developers’ revenue. | The commission is justified as Apple provides a secure and trusted platform for developers and consumers. |

| Market Power | Apple’s dominant position in the app store market gives it undue leverage to dictate terms to developers. | Apple’s App Store is a carefully curated ecosystem that ensures quality and security for users. |

| Innovation and Competition | The commission stifles innovation and competition by making it difficult for smaller developers to compete with larger companies. | Apple’s commission enables it to invest in platform security, app development tools, and user privacy, fostering innovation. |

| Consumer Choice | Consumers should have the freedom to choose how they pay for apps and in-app purchases. | Apple’s App Store provides a secure and convenient platform for users to purchase apps and make in-app purchases. |

Ethical Considerations

The “Apple Tax” raises ethical concerns about fairness, competition, and the impact on the advertising industry. Some argue that the commission is an unfair burden on developers, particularly smaller ones, who may be forced to pass on the cost to consumers in the form of higher prices or reduced features. This could stifle innovation and limit consumer choice. Others argue that the commission is justified as Apple provides a valuable platform for developers and consumers.

Flow of Revenue

The following flowchart illustrates the flow of revenue from advertisers to Meta and Apple, highlighting the role of the “Apple Tax”:

Advertisers -> Meta -> Apple (30% commission) -> Meta (70% revenue)

In this scenario, advertisers pay Meta to promote their products or services on Facebook and Instagram. Meta then pays Apple a 30% commission on the revenue generated from in-app purchases made through the App Store. This commission is known as the “Apple Tax.” Meta retains the remaining 70% of the revenue.

Implications for the Future

The “Apple Tax” is not just a one-time event; it signifies a broader shift in the digital advertising landscape. This move by Apple has far-reaching consequences for both Meta and the entire advertising industry, potentially reshaping how companies reach consumers and how user privacy is protected.

Impact on Digital Advertising

The “Apple Tax” is a catalyst for a fundamental change in the way digital advertising operates. It’s pushing advertisers to explore alternative strategies to reach their target audiences, moving away from the traditional reliance on third-party data. This could lead to:

- Increased Focus on First-Party Data: Advertisers will increasingly prioritize collecting and leveraging first-party data, such as information directly provided by users through sign-ups or interactions on their platforms. This shift emphasizes building direct relationships with consumers and obtaining consent for data usage.

- Rise of Privacy-Focused Advertising Solutions: The “Apple Tax” has accelerated the development and adoption of privacy-centric advertising solutions. This includes contextual advertising, which targets users based on the content they consume, and privacy-preserving techniques like differential privacy, which anonymizes user data while still enabling effective targeting.

- Greater Transparency and Control for Users: The “Apple Tax” has ignited a broader conversation about user privacy and data control. This has led to greater transparency in how user data is collected and used, giving users more control over their information and advertising preferences.

The Future of User Privacy

The “Apple Tax” is a landmark event in the ongoing debate surrounding user privacy and data protection. It signals a shift towards a more privacy-conscious digital landscape where users have greater control over their data and how it’s used for advertising purposes. This could lead to:

- Increased Regulation and Enforcement: The “Apple Tax” has spurred regulatory efforts to strengthen user privacy protections. Governments around the world are increasingly implementing stricter data privacy laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States.

- Emergence of New Privacy Standards: The industry is actively developing new privacy standards and certifications to ensure responsible data collection and usage. These standards provide guidelines for companies to comply with evolving privacy regulations and demonstrate their commitment to user privacy.

- Focus on User Consent and Transparency: Users are becoming more aware of their data rights and demanding greater transparency from companies. This will push businesses to prioritize obtaining explicit consent for data collection and usage, providing clear explanations of how user data is used and offering options for opting out of data collection or targeted advertising.

Potential Future Developments

The “Apple Tax” has set in motion a chain of events that will continue to shape the advertising industry and user privacy landscape. Here’s a timeline outlining potential future developments:

- Short Term (Next 1-2 Years): Advertisers will refine their strategies to adapt to the limitations imposed by the “Apple Tax”. Expect to see a surge in investment in first-party data collection, privacy-preserving advertising technologies, and contextual targeting methods.

- Medium Term (Next 3-5 Years): The industry will see a consolidation of privacy-focused advertising solutions, with leading platforms emerging to provide effective targeting while respecting user privacy. New regulations and standards will further solidify the framework for data privacy and advertising.

- Long Term (Beyond 5 Years): The digital advertising landscape will likely evolve into a more privacy-centric ecosystem, where users have greater control over their data and advertising experiences. This could involve the development of decentralized platforms or new models of advertising that prioritize user privacy and data security.

The “Apple Tax” is a complex issue with implications for both advertisers and Meta. While the exact impact remains to be seen, it’s clear that this development could reshape the digital advertising landscape. Businesses will need to adapt their strategies to navigate these increased costs, while Meta will face the challenge of maintaining its revenue streams in a more competitive environment. This situation highlights the ongoing tension between tech giants and their users, as well as the evolving dynamics of online advertising.

Meta’s decision to pass on Apple’s “tax” to advertisers boosting posts on Facebook and Instagram might sound like a minor inconvenience, but it’s a crucial reminder of the evolving landscape of digital marketing. This shift underscores the need for a robust strategy, much like the one outlined in a sample Series A pitch deck , which helps startups secure funding and navigate the competitive market.

As the digital advertising ecosystem continues to adapt, understanding these trends and building a compelling pitch is essential for success.

Standi Techno News

Standi Techno News