Chase Support for Android Pay is Finally Here

Android Pay is a mobile payment system that lets you make purchases using your Android device. It’s a convenient and secure way to pay for goods and services, and it’s becoming increasingly popular. With Chase support, Android Pay users can now add their Chase credit and debit cards to their Android Pay wallets and make purchases with ease.

Benefits of Using Chase with Android Pay

This integration provides several benefits for Chase customers, making it a compelling option for everyday transactions.

- Convenience: You can leave your physical wallet at home and still make purchases with your Chase cards. This is especially useful when you’re in a hurry or don’t have your wallet with you.

- Security: Android Pay uses tokenization to protect your card information. This means that your actual card number is not stored on your device or shared with merchants. Instead, a unique token is used to process transactions, ensuring your card details remain safe.

- Speed: Android Pay transactions are typically faster than traditional payment methods. This is because you don’t have to fumble for your card or wait for a receipt to be printed.

- Rewards: You can still earn rewards points or cash back on your Chase cards when you use Android Pay.

Features and Functionality

Chase’s integration with Android Pay brings a host of convenient features to users. This partnership allows you to seamlessly make payments with your Chase accounts directly from your Android device, making transactions easier and more secure.

Linking Chase Accounts to Android Pay

Linking your Chase accounts to Android Pay is a straightforward process. First, ensure you have the latest version of the Android Pay app installed on your Android device. Then, open the Android Pay app and tap on the “Add a card” button. You’ll be prompted to enter your Chase account information, including your card number, expiration date, and security code. Once you’ve entered the required details, verify your identity by entering the one-time code sent to your registered mobile number or email address. Your Chase account will then be linked to your Android Pay wallet, allowing you to make purchases using your Chase cards.

Supported Payment Methods

Android Pay supports a range of payment methods through Chase.

- Chase Debit Cards: Use your Chase debit card to make purchases at participating merchants and withdraw cash from ATMs.

- Chase Credit Cards: Make purchases with your Chase credit card and enjoy the benefits associated with your card, such as rewards points or cash back.

- Chase Prepaid Cards: Utilize your Chase prepaid card for purchases and manage your spending effectively.

User Experience

The integration of Chase with Android Pay has been met with positive feedback from users, who appreciate the seamless and convenient experience it provides. The combination of these two services allows users to make purchases quickly and securely, eliminating the need for physical cards or cash.

User Testimonials and Reviews

The integration has been praised for its ease of use and convenience. Many users have shared their positive experiences on online forums and social media platforms. For example, one user commented, “I love how easy it is to use Chase with Android Pay. I can just tap my phone and pay, no need to fumble for my wallet.” Another user noted, “I’ve been using Chase with Android Pay for a few months now, and I’m so impressed with how secure and reliable it is.”

Ease of Use and Convenience

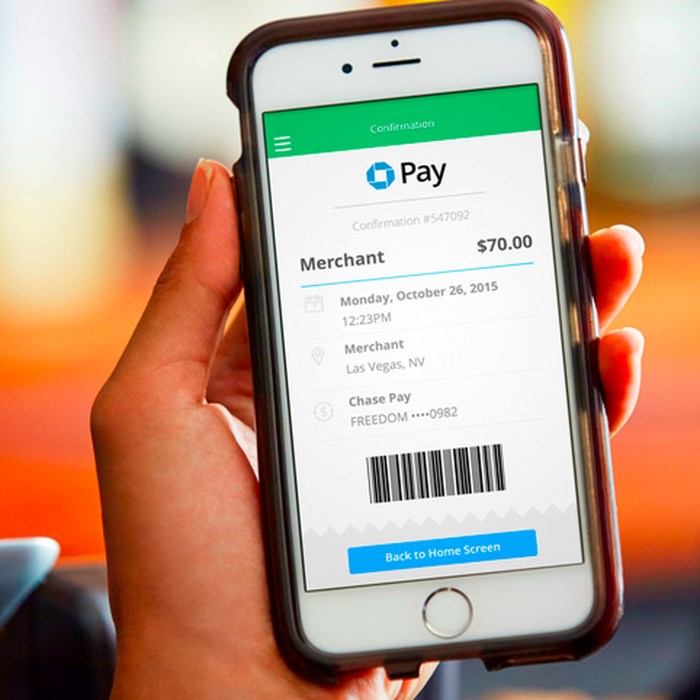

Chase with Android Pay offers a simple and straightforward user experience. To make a purchase, users simply need to open the Android Pay app, select their Chase card, and hold their phone near the payment terminal. The transaction is processed quickly and securely, without the need for any additional steps. The integration also allows users to manage their Chase cards and transactions within the Android Pay app, making it easy to track their spending and monitor their account balances.

Potential Challenges and Limitations

While the integration of Chase with Android Pay offers numerous benefits, there are also some potential challenges and limitations that users might encounter. One challenge is that the integration may not be available in all regions or with all Chase cards. Another potential limitation is that some merchants may not accept Android Pay, although this is becoming increasingly less common. Finally, users should be aware of the security risks associated with any digital payment method, and take steps to protect their account information.

Security and Privacy

Using Android Pay with Chase means your transactions are protected by a robust security system that ensures your financial data is safe and your privacy is respected. Chase employs a multi-layered approach to safeguard your money and personal information.

Security Measures

Chase leverages various security measures to protect your transactions through Android Pay. These measures include:

- Tokenization: When you add your Chase card to Android Pay, your actual card number is not stored on your device or with Google. Instead, a unique digital token is generated and used for transactions, making it impossible for anyone to access your actual card information.

- Biometric Authentication: Android Pay supports fingerprint and facial recognition for added security, ensuring only you can access your payment information on your device.

- Secure Element: Your payment information is stored in a secure element on your device, a dedicated chip that provides an extra layer of protection against unauthorized access.

- Chase Fraud Monitoring: Chase continuously monitors your transactions for suspicious activity and will alert you if any potential fraud is detected. You can also set up transaction alerts to receive notifications about your purchases.

Privacy Policies

Chase is committed to protecting your privacy and adheres to strict data protection policies.

- Data Encryption: Your personal information and transaction data are encrypted during transmission and storage, making it virtually impossible for unauthorized parties to access them.

- Data Minimization: Chase only collects and stores the information necessary for providing and improving its services. This includes your card information, transaction history, and contact details.

- Data Transparency: Chase’s privacy policy clearly Artikels how your data is collected, used, and shared. You can review the policy at any time to understand your rights and how Chase protects your privacy.

Security Comparison, Chase support for android pay is finally here

Chase’s security features for Android Pay are comparable to, and in some cases, exceed those of other payment methods.

- Traditional Credit Cards: While credit cards have security features like chip and PIN technology, Android Pay offers additional layers of protection through tokenization, biometric authentication, and secure element technology.

- Other Digital Wallets: Android Pay’s security features are similar to those offered by other popular digital wallets like Apple Pay and Samsung Pay. However, Chase’s integration with its fraud monitoring system and its commitment to data privacy offer additional peace of mind.

Chase support for android pay is finally here – The integration of Chase support into Android Pay marks a significant milestone in the evolution of mobile payments. This partnership not only enhances the user experience for Chase customers but also contributes to the broader adoption of mobile payment technologies. With the convenience, security, and accessibility offered by this integration, Android Pay is poised to become an integral part of our everyday financial lives. As the future of payments continues to evolve, we can expect to see further advancements and collaborations in the mobile payment landscape, making transactions even more seamless and convenient for all.

Finally, Chase joins the Android Pay party! Now, you can ditch the wallet and pay with your Chase card seamlessly. Speaking of ditching annoying things, Blizzard’s new tweaks to Overwatch are a welcome change for anyone tired of trolls ruining their games. Now, with the convenience of Android Pay and a less toxic gaming environment, we can all focus on what truly matters: slaying those dragons and earning those rewards!

Standi Techno News

Standi Techno News