The Defense Tech Investor Survey delves into the rapidly evolving landscape of defense technology investment, a realm where innovation and geopolitical shifts collide. This survey serves as a compass for investors navigating the complexities of this sector, offering insights into emerging trends, investment opportunities, and the potential impact of cutting-edge technologies like artificial intelligence and autonomous systems.

From analyzing the key factors driving investment decisions to exploring the concerns and challenges faced by investors, the survey paints a comprehensive picture of the defense tech investment landscape. It also provides a glimpse into the future, forecasting trends and analyzing the potential impact of geopolitical shifts on the industry.

The Landscape of Defense Tech Investing: Defense Tech Investor Survey

The defense technology sector is experiencing a period of rapid growth and innovation, driven by geopolitical tensions, technological advancements, and increasing defense budgets worldwide. This has created a dynamic and lucrative investment landscape for those seeking to capitalize on the future of warfare.

Key Trends Shaping the Industry

The defense technology sector is undergoing a transformation, shaped by several key trends:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are rapidly changing the battlefield, enabling autonomous systems, enhanced situational awareness, and improved decision-making.

- Cybersecurity: With increasing reliance on technology, cybersecurity has become a critical component of national security. Investments in cyber defense, offensive cyber capabilities, and data protection are on the rise.

- Space Technology: Space is becoming increasingly militarized, with investments in satellite constellations, space-based sensors, and anti-satellite weapons systems.

- Hypersonics: Hypersonic weapons, capable of traveling at speeds exceeding Mach 5, are a major area of investment, posing significant challenges to traditional defense systems.

- Robotics and Automation: Robots and drones are playing an increasingly prominent role in warfare, automating tasks, reducing risk to human soldiers, and enhancing battlefield capabilities.

Major Players and Investment Strategies

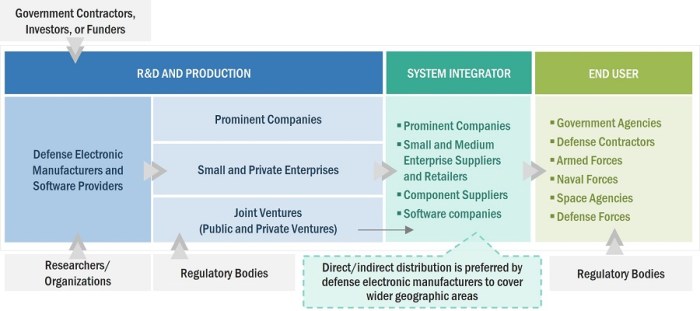

Several key players are driving investment in defense technology:

- Government Agencies: Governments worldwide are increasing defense budgets and investing heavily in research and development of advanced technologies.

- Defense Contractors: Traditional defense contractors like Lockheed Martin, Boeing, and Raytheon are adapting their businesses to incorporate emerging technologies and meet the evolving needs of their customers.

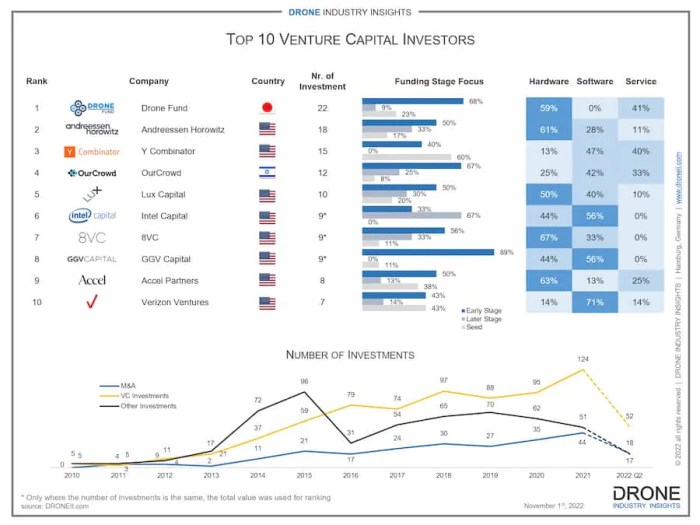

- Venture Capital Firms: Venture capital firms are increasingly investing in defense technology startups, recognizing the potential for disruptive innovation and high returns.

- Private Equity Firms: Private equity firms are acquiring defense companies and using their financial resources to drive growth and innovation.

Emerging Technologies with High Investment Potential

Several emerging technologies hold significant investment potential in the defense technology sector:

- Quantum Computing: Quantum computing has the potential to revolutionize cryptography, materials science, and sensor technology, providing significant advantages in defense applications.

- Directed Energy Weapons: Directed energy weapons, such as lasers and high-power microwaves, offer a new approach to warfare, providing precision targeting and potential for non-lethal effects.

- Biotechnology: Biotechnology is being explored for its potential in developing new materials, enhancing human performance, and creating advanced weapons systems.

- Advanced Materials: Advanced materials, such as composites and metamaterials, are being used to create lighter, stronger, and more resilient weapons and defense systems.

Investor Priorities and Concerns

Investing in defense technology is a complex endeavor, driven by a unique set of priorities and concerns. Investors are navigating a landscape where innovation, government regulations, and geopolitical dynamics intertwine.

Key Factors Driving Investment Decisions

Investors in defense technology prioritize several key factors when making investment decisions. These factors are crucial for assessing the potential for success and ensuring a strong return on investment.

- Technological Advancement: Defense tech investors are drawn to companies developing cutting-edge technologies with the potential to revolutionize defense capabilities. This includes advancements in areas like artificial intelligence, autonomous systems, cyber security, and hypersonic weapons.

- Government Contracts: Government contracts are the lifeblood of the defense industry. Investors look for companies with a strong track record of securing contracts and demonstrating their ability to meet the demanding requirements of government agencies.

- Market Size and Growth: The defense industry is a global market with significant spending by governments worldwide. Investors assess the size and growth potential of the target market for a specific technology or product.

- Competitive Landscape: Understanding the competitive landscape is essential. Investors analyze the strengths and weaknesses of competitors to determine a company’s competitive advantage.

- Management Team: A strong and experienced management team is crucial for navigating the complexities of the defense industry. Investors evaluate the team’s expertise, track record, and vision for the company’s future.

Investor Concerns

While the potential for high returns exists in defense tech, investors also face specific concerns. These concerns require careful consideration and mitigation strategies.

- Government Regulations: The defense industry is heavily regulated, with strict rules governing the development, testing, and deployment of new technologies. Changes in regulations can significantly impact a company’s operations and profitability.

- Geopolitical Risk: Geopolitical events and tensions can influence government spending on defense, impacting demand for defense technologies. Investors need to consider the potential impact of geopolitical instability on their investments.

- Research and Development Costs: Developing advanced defense technologies requires significant investment in research and development. Investors need to assess a company’s ability to manage these costs and generate returns.

- Cybersecurity: The increasing reliance on technology in defense systems raises concerns about cybersecurity vulnerabilities. Investors need to ensure that companies have robust cybersecurity measures in place to protect sensitive data and systems.

- Ethical Considerations: The development and deployment of defense technologies raise ethical considerations. Investors need to evaluate the potential for unintended consequences and ensure that companies are operating within ethical boundaries.

Role of Government Regulations and Policies

Government regulations and policies play a crucial role in shaping the defense technology landscape. These regulations impact everything from the development of new technologies to the procurement process.

- Export Controls: Governments impose export controls to restrict the transfer of sensitive technologies to foreign entities. These controls can impact a company’s ability to sell its products or services to international customers.

- Procurement Processes: Government procurement processes are often complex and time-consuming. Companies need to navigate these processes effectively to secure contracts and funding.

- Research Funding: Governments provide funding for research and development in defense technology. This funding can be a significant source of capital for companies but comes with specific requirements and oversight.

- Defense Budgets: Government defense budgets fluctuate based on geopolitical events and priorities. Investors need to monitor these budgets to understand the potential impact on demand for defense technologies.

Risk Management and Due Diligence Practices

Defense tech investments involve unique risks that require careful risk management and due diligence practices.

- Financial Due Diligence: Investors conduct thorough financial due diligence to assess a company’s financial health, revenue streams, and profitability.

- Technological Due Diligence: This involves evaluating the technology’s maturity, potential for success, and competitive advantage. It also includes assessing the company’s intellectual property and its ability to protect it.

- Operational Due Diligence: Investors assess the company’s operational efficiency, manufacturing capabilities, and supply chain management. This includes evaluating the company’s ability to meet the demanding requirements of government contracts.

- Legal and Regulatory Due Diligence: This involves examining a company’s compliance with relevant laws and regulations, including export controls and data privacy laws.

- Geopolitical Risk Assessment: Investors assess the potential impact of geopolitical events on the company’s operations and profitability. This includes considering the risk of political instability, sanctions, or changes in government priorities.

Investment Opportunities and Challenges

The defense technology sector is experiencing rapid growth, fueled by increasing global defense budgets, advancements in artificial intelligence (AI), and the emergence of new technologies like hypersonics and directed energy weapons. This presents both opportunities and challenges for investors.

Promising Areas for Investment in Defense Technology

The defense technology landscape is vast and dynamic, offering a wide range of investment opportunities.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are transforming defense operations, enabling autonomous systems, enhanced situational awareness, and improved decision-making. Investment opportunities include companies developing AI-powered platforms for target recognition, threat assessment, and mission planning.

- Cybersecurity: The increasing reliance on digital systems in defense operations makes cybersecurity a critical area for investment. Companies specializing in cybersecurity solutions for military networks, critical infrastructure, and data protection are attracting significant investor interest.

- Hypersonics: Hypersonic weapons, capable of traveling at speeds exceeding Mach 5, are revolutionizing warfare. Companies developing hypersonic missiles, engines, and related technologies are likely to experience substantial growth in the coming years.

- Directed Energy Weapons: Directed energy weapons, such as lasers and high-powered microwaves, offer a range of applications in defense, including counter-drone systems, electronic warfare, and missile defense. Investment opportunities exist in companies developing these technologies and their associated components.

- Space Technology: The increasing militarization of space is creating opportunities for companies developing space-based sensors, communications systems, and other technologies. Investments in space-related defense technology are likely to grow as the space domain becomes more contested.

Potential Return on Investment in Defense Technology Sectors

The potential return on investment in defense technology can vary significantly depending on the specific sector and company.

- AI and ML: The global AI market in defense is projected to reach \$17.8 billion by 2027, according to MarketsandMarkets. Companies developing AI-powered solutions for defense applications are likely to experience strong growth and generate substantial returns for investors.

- Cybersecurity: The global cybersecurity market in defense is expected to reach \$23.8 billion by 2027, according to ResearchAndMarkets. Companies specializing in cybersecurity for military networks and critical infrastructure are well-positioned to benefit from this growing market and provide attractive returns for investors.

- Hypersonics: The hypersonic weapons market is expected to reach \$15 billion by 2030, according to Statista. Companies developing hypersonic technologies are likely to see significant growth and offer substantial returns for investors, though the development and testing of these systems can be costly and time-consuming.

- Directed Energy Weapons: The directed energy weapons market is projected to reach \$2.8 billion by 2028, according to MarketsandMarkets. Companies developing lasers, high-powered microwaves, and related technologies are likely to benefit from the growing demand for these systems and offer attractive investment opportunities.

- Space Technology: The global space technology market is expected to reach \$1.4 trillion by 2030, according to Statista. Companies developing space-based sensors, communications systems, and other technologies for defense applications are likely to experience strong growth and offer attractive returns for investors.

Challenges Faced by Investors in Defense Tech

Investing in defense technology presents unique challenges, including:

- Government Regulations: Defense technology is subject to strict government regulations, including export controls, procurement processes, and technology transfer restrictions. Investors need to navigate these complexities and ensure compliance with applicable laws and regulations.

- Long Development Cycles: Defense technology often involves long development cycles, with significant time and resources required to bring new products to market. Investors need to have a long-term perspective and be willing to wait for returns on their investments.

- Technological Risk: Defense technology is rapidly evolving, and new threats and challenges are constantly emerging. Investors need to assess the technological risk associated with their investments and be prepared for potential disruptions.

- Market Volatility: The defense technology market can be volatile, influenced by geopolitical events, budget fluctuations, and changes in military doctrine. Investors need to be aware of these factors and manage their risk accordingly.

- Competition: The defense technology sector is highly competitive, with established players and emerging startups vying for market share. Investors need to carefully evaluate the competitive landscape and select companies with a strong competitive advantage.

Navigating the complexities of the defense technology industry requires a deep understanding of the market, its key players, and the evolving technological landscape.

- Conduct Thorough Due Diligence: Before investing in any defense technology company, investors should conduct thorough due diligence, including evaluating the company’s technology, market position, financial performance, and management team.

- Develop a Long-Term Perspective: Defense technology investments often require a long-term perspective, as development cycles can be lengthy and returns may not be realized immediately. Investors need to be patient and willing to hold their investments for the long haul.

- Stay Informed about Industry Trends: The defense technology landscape is constantly evolving, with new technologies emerging and geopolitical events shaping the market. Investors need to stay informed about industry trends, emerging threats, and new opportunities.

- Network with Industry Experts: Networking with industry experts, such as government officials, defense analysts, and other investors, can provide valuable insights into the defense technology market and its future direction.

- Consider Investing in Funds or ETFs: Investors who are not comfortable with direct investments in defense technology companies can consider investing in funds or exchange-traded funds (ETFs) that track the sector. This approach provides diversification and reduces risk.

Impact of Emerging Technologies

The defense technology landscape is rapidly evolving, driven by the emergence of groundbreaking technologies that are fundamentally changing the way warfare is conducted. These advancements are reshaping the battlefield, creating new opportunities for defense companies, and presenting unique challenges for investors.

Artificial Intelligence in Defense

AI is transforming defense technology by automating tasks, improving decision-making, and enhancing situational awareness. Its applications in defense are wide-ranging, from autonomous weapon systems to intelligence analysis and logistics optimization. AI-powered systems can analyze vast amounts of data, identify patterns, and predict future events, enabling faster and more informed decision-making. For example, AI-powered image recognition software can analyze satellite imagery to detect enemy troop movements, while AI-driven logistics systems can optimize supply chain operations and ensure the timely delivery of critical resources.

Future Outlook and Predictions

The defense technology landscape is in constant flux, driven by rapid advancements in artificial intelligence, robotics, and other emerging technologies. This section delves into the future trajectory of defense tech investments, analyzing the impact of geopolitical shifts and the role of innovation.

The Future of Defense Technology Investment, Defense tech investor survey

The future of defense technology investment is poised for significant growth, driven by several key factors:

- Increased Defense Budgets: Global defense spending is projected to rise in the coming years, fueled by geopolitical tensions and the increasing complexity of modern warfare. The US, China, and other major powers are increasing their military budgets to modernize their forces and maintain a competitive edge.

- Technological Advancements: The rapid pace of technological advancements, particularly in artificial intelligence, robotics, and autonomous systems, is creating new opportunities for defense applications. These technologies promise to revolutionize warfare, enhance situational awareness, and improve operational efficiency.

- Focus on Emerging Technologies: Governments and defense agencies are increasingly prioritizing investments in emerging technologies such as artificial intelligence, hypersonics, and quantum computing. These technologies are seen as critical for maintaining a technological edge in the future battlefield.

Impact of Geopolitical Shifts

Geopolitical shifts are playing a major role in shaping the defense technology landscape. The rise of China and other emerging powers, the increasing competition between major powers, and the ongoing conflicts in various regions are driving demand for advanced defense technologies.

- Great Power Competition: The strategic competition between the US and China is driving significant investments in defense technology, particularly in areas like hypersonics, artificial intelligence, and space warfare. Both countries are seeking to develop advanced capabilities to deter potential adversaries and maintain their dominance.

- Regional Conflicts: Ongoing conflicts in regions like the Middle East and Eastern Europe are creating demand for specific defense technologies, such as drones, unmanned systems, and advanced weapons systems. These conflicts are also driving the development of new technologies to address emerging threats.

- Cybersecurity Threats: The increasing reliance on technology in military operations has heightened the risk of cyberattacks. Governments and defense agencies are investing heavily in cybersecurity technologies to protect their networks and critical infrastructure from cyber threats.

Role of Innovation and Technological Advancements

Innovation is the lifeblood of the defense industry. The rapid pace of technological advancements is creating new opportunities for defense applications, leading to the development of more sophisticated and capable weapons systems, surveillance technologies, and communication networks.

- Artificial Intelligence: AI is revolutionizing warfare, enabling autonomous systems, improved target recognition, and enhanced decision-making. AI-powered systems can analyze vast amounts of data, identify patterns, and make predictions, providing valuable insights for military operations.

- Robotics: Robots are increasingly being used in defense applications, from reconnaissance and surveillance to combat operations. Robots can perform tasks that are too dangerous or difficult for humans, reducing risk and improving efficiency.

- Hypersonics: Hypersonic weapons travel at speeds exceeding five times the speed of sound, making them difficult to intercept. These weapons are being developed by several countries, including the US, China, and Russia, and are expected to have a significant impact on future warfare.

The Defense Tech Investor Survey is a valuable resource for anyone seeking to understand the current state and future trajectory of defense technology investment. It highlights the dynamic nature of this sector, where innovation and geopolitical realities are constantly shaping the landscape. As the world becomes increasingly complex, the insights gleaned from this survey offer a crucial guide for navigating the evolving world of defense technology.

A recent defense tech investor survey revealed a growing interest in the Indian market, particularly in the realm of digital payments. This interest is fueled by the government’s commitment to promoting digitalization, evident in its decision to delay caps on UPI market share , a move that benefits leading players like PhonePe and Google Pay. This delay reflects the government’s recognition of the vital role these platforms play in driving financial inclusion and economic growth, further solidifying India’s position as a key player in the global defense tech landscape.

Standi Techno News

Standi Techno News