Facebook Messenger Payments: Facebook Messenger Payments Uk France

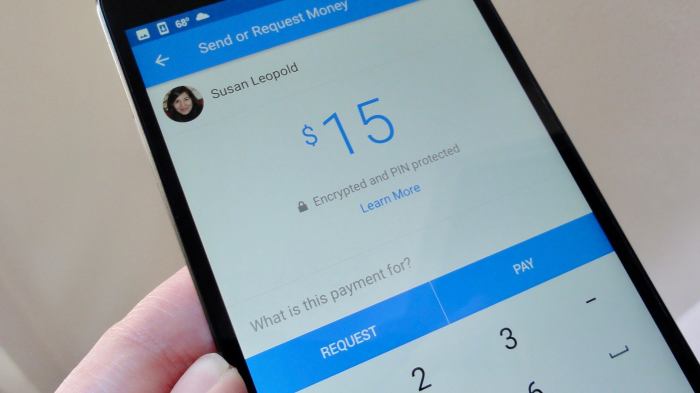

Facebook Messenger Payments has become a popular way for people to send and receive money within the Facebook Messenger app. It was initially launched in the US in 2015, allowing users to make payments quickly and easily to friends and family. In 2018, Facebook Messenger Payments expanded to the UK and France, bringing its convenient payment features to a wider audience.

Evolution of Facebook Messenger Payments

Facebook Messenger Payments has undergone a significant evolution since its inception. It initially launched in the US in 2015, primarily targeting peer-to-peer (P2P) payments. The service was later expanded to the UK and France in 2018, bringing its convenient payment features to a wider audience.

Regulatory Landscape and Compliance

Facebook Messenger Payments, like any online payment service, must navigate a complex regulatory landscape in the UK and France. These regions have robust frameworks designed to protect consumers and ensure financial stability.

Regulatory Bodies and their Roles

The regulatory landscape for online payment services in the UK and France is overseen by several key bodies, each with distinct responsibilities.

- Financial Conduct Authority (FCA) – UK: The FCA is the primary regulator of financial services in the UK, including payment services. It sets standards, licenses firms, and enforces compliance with relevant legislation. The FCA’s focus is on ensuring consumer protection, market integrity, and financial stability.

- Autorité de Contrôle Prudentiel et de Résolution (ACPR) – France: The ACPR is the French prudential supervisor for banks and insurance companies, also overseeing payment service providers. It plays a significant role in licensing, supervision, and enforcing compliance with relevant regulations. The ACPR’s primary focus is on ensuring the financial soundness of institutions under its purview.

- The Payment Services Regulations 2017 (PSR 2017) – UK: This legislation Artikels the regulatory framework for payment services in the UK, covering various aspects, including licensing requirements, consumer protection, and data security. It sets out the conditions under which firms can operate and the standards they must adhere to.

- Directive on Payment Services (PSD2) – EU: This EU directive, implemented in both the UK and France, aims to harmonize payment services across the EU. It covers aspects such as open banking, strong customer authentication, and security measures for online payments. The PSD2 encourages innovation in the payment industry while protecting consumers and fostering competition.

Compliance Measures Implemented by Facebook Messenger Payments

Facebook Messenger Payments has implemented several measures to ensure compliance with local regulations and data privacy laws in the UK and France. These include:

- Licensing: Facebook Messenger Payments has obtained the necessary licenses from the FCA in the UK and the ACPR in France to operate as a payment service provider. This ensures they meet the regulatory requirements for offering payment services in these regions.

- Data Protection: Facebook Messenger Payments adheres to the General Data Protection Regulation (GDPR) in the EU, which includes the UK, and the French Data Protection Act. They have implemented appropriate technical and organizational measures to protect user data and ensure compliance with data privacy principles.

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): Facebook Messenger Payments complies with AML/CTF regulations in both the UK and France. They have implemented robust procedures for customer due diligence, transaction monitoring, and reporting suspicious activities to relevant authorities.

- Consumer Protection: Facebook Messenger Payments adheres to consumer protection regulations, including those related to dispute resolution, refunds, and chargebacks. They provide clear and transparent information to users about their services and rights.

User Adoption and Market Penetration

Facebook Messenger Payments, despite its potential, has faced a mixed reception in the UK and France. While it offers convenience and integration with a widely used platform, several factors influence its adoption rate and market penetration.

User Adoption Rates in the UK and France

The adoption rate of Facebook Messenger Payments in the UK and France is influenced by various factors, including demographics, payment preferences, and awareness levels.

- Demographics: Younger generations, particularly those aged 18-35, are more likely to adopt Facebook Messenger Payments due to their familiarity with social media and digital payments. Older demographics may be less inclined to use this platform due to a lack of familiarity or preference for traditional payment methods.

- Payment Preferences: Users in both countries have a diverse range of payment preferences, including credit cards, debit cards, and digital wallets. While Facebook Messenger Payments offers a convenient option, it faces competition from established players like PayPal and Apple Pay.

- Awareness Levels: Awareness of Facebook Messenger Payments varies significantly. Many users may not be aware of its existence or its functionalities, hindering its adoption. Effective marketing and promotion campaigns are crucial to raise awareness and encourage trial.

Market Penetration of Facebook Messenger Payments

Facebook Messenger Payments faces stiff competition from established players like PayPal and Apple Pay, which have already established a strong presence in the UK and France.

- Market Share: Facebook Messenger Payments holds a relatively small market share compared to other digital payment platforms in both countries. This is due to its relatively late entry into the market and the existing dominance of established players.

- Competitive Landscape: The competitive landscape for digital payments is highly dynamic. New players, like Google Pay, continue to emerge, further challenging Facebook Messenger Payments’ market penetration.

Factors Driving or Hindering Adoption

Several factors can influence the adoption of Facebook Messenger Payments in the UK and France.

- User Trust: Trust is a critical factor in digital payments. Users must feel confident that their financial information is secure and protected. Facebook’s history with data privacy concerns could hinder user trust in its payment platform.

- Convenience: Facebook Messenger Payments offers convenience by integrating with a widely used messaging platform. This can be a significant advantage, particularly for users who frequently make small payments through Messenger.

- Competitive Landscape: The competitive landscape for digital payments is highly saturated. Facebook Messenger Payments must differentiate itself from established players by offering unique features or benefits to attract users.

Business Impact and Opportunities

Facebook Messenger Payments has the potential to revolutionize the way businesses operate in the UK and France, offering a seamless and convenient payment experience for customers while streamlining operations and boosting sales. The platform’s integration with the popular messaging app allows for a natural and familiar payment flow, fostering a more engaged customer base and driving business growth.

Impact on Businesses

Facebook Messenger Payments offers a multitude of benefits for businesses in the UK and France, including:

- Streamlined Transactions: Businesses can integrate Messenger Payments directly into their existing platforms, eliminating the need for customers to redirect to external payment gateways. This seamless integration simplifies the checkout process, reducing friction and increasing conversion rates.

- Enhanced Customer Engagement: By integrating payments within Messenger, businesses can interact with customers in a more personalized and engaging manner. This fosters a sense of trust and convenience, encouraging repeat purchases and loyalty.

- Boosted Sales: The ease and convenience of Messenger Payments can significantly impact sales figures. Customers are more likely to complete purchases when the process is simple and familiar, leading to increased revenue for businesses.

Business Opportunities

Facebook Messenger Payments presents a range of opportunities for businesses across various sectors, particularly in:

- E-commerce: Online retailers can leverage Messenger Payments to simplify the checkout process, allowing customers to make purchases directly within the messaging app. This streamlined experience can boost conversion rates and increase customer satisfaction.

- Peer-to-Peer Payments: The platform enables individuals to send and receive money easily through Messenger, opening up opportunities for businesses in the gig economy, freelance work, and social commerce.

- Micro-transactions: Messenger Payments is ideal for facilitating small-value transactions, such as subscriptions, donations, and in-app purchases. This opens up new avenues for businesses in gaming, content creation, and digital services.

Successful Businesses

Several businesses in the UK and France have successfully integrated Facebook Messenger Payments into their operations, reaping significant benefits. For example:

- Deliveroo: The food delivery platform integrated Messenger Payments to allow customers to pay for their orders directly within the app, streamlining the checkout process and reducing order abandonment rates. This resulted in increased customer satisfaction and a boost in sales.

- Etsy: The online marketplace for handmade goods implemented Messenger Payments to provide a seamless payment experience for buyers and sellers. This simplified transaction process, reduced friction, and encouraged more frequent purchases.

Future Trends and Predictions

Facebook Messenger Payments, still in its early stages of adoption in the UK and France, holds immense potential for growth. Its future trajectory will be shaped by several key factors, including technological advancements, evolving consumer behavior, and the regulatory landscape.

Technological Advancements and Emerging Technologies

The integration of emerging technologies like blockchain and cryptocurrency will significantly impact Facebook Messenger Payments. Blockchain technology can enhance security and transparency, streamlining transactions and reducing fraud risks. Cryptocurrencies, particularly stablecoins, can facilitate cross-border payments and reduce transaction fees. Facebook’s foray into the metaverse could also integrate Messenger Payments, allowing users to make purchases within virtual environments.

Consumer Behavior and Adoption, Facebook messenger payments uk france

Consumer behavior is a critical factor in the success of Facebook Messenger Payments. The platform’s widespread use and familiarity among users, coupled with its seamless integration into the messaging app, can drive adoption. The convenience of paying directly within a familiar environment, along with the increasing demand for digital payment solutions, will further contribute to its popularity.

Competitive Landscape and Future Challenges

The UK and France boast a vibrant digital payment landscape, with established players like PayPal, Apple Pay, and Google Pay. Facebook Messenger Payments will face stiff competition from these entrenched players. The platform needs to differentiate itself by offering unique features, such as personalized payment experiences, loyalty programs, and seamless integration with other Facebook services.

Regulatory Changes and Compliance

The regulatory landscape for digital payments is constantly evolving. Facebook Messenger Payments must comply with regulations concerning data privacy, consumer protection, and anti-money laundering. The platform’s ability to navigate these regulatory complexities will be crucial for its long-term success.

Facebook messenger payments uk france – From streamlining transactions to boosting sales, Facebook Messenger Payments is making waves in the UK and France. Its future looks bright, driven by technological advancements and a growing demand for convenient and secure digital payment options. While challenges remain, the platform’s adaptability and global reach suggest a significant role in the future of online payments.

Sending money to your mates in France or the UK through Facebook Messenger is as easy as pie, but sometimes life throws you a curveball. Just like when Blizzard removes the Rift Trials feature from Diablo 3 , leaving players feeling a little deflated. But hey, at least you can still send that virtual pizza to your friend in Paris, right?

Standi Techno News

Standi Techno News