Impact on User Experience

Imagine a world where paying your bills is as easy as sending an email. That’s the potential Google envisions with its plan to integrate bill payment directly into Gmail. This could be a game-changer for users, offering a streamlined and convenient way to manage their finances.

Benefits for Users

Integrating bill payment into Gmail could significantly improve the user experience in several ways.

- Increased Convenience: Paying bills directly from Gmail eliminates the need to navigate multiple websites or apps, simplifying the process and saving users time.

- Time-Saving: Users can quickly and easily pay bills without leaving their inbox, streamlining their financial management and freeing up valuable time.

- Improved Organization: With bills centralized in Gmail, users can easily track payment due dates, manage their finances, and avoid late fees.

Potential Drawbacks

While the potential benefits are enticing, there are also potential drawbacks to consider.

- Security Concerns: Integrating financial transactions into Gmail raises concerns about data security. Users need assurance that their sensitive financial information is protected from unauthorized access.

- Privacy Issues: The integration of bill payment into Gmail could raise privacy concerns. Users may be hesitant to share their financial information with Google, even if it’s for a legitimate purpose.

- User Confusion: Integrating bill payment into Gmail could potentially confuse users, especially those unfamiliar with managing their finances online. A clear and intuitive user interface is crucial for a smooth and positive experience.

Impact on User Behavior

The integration of bill payment into Gmail could significantly change user behavior and their interaction with the platform.

- Increased Gmail Usage: Users may spend more time in Gmail, relying on it for both communication and financial management.

- Shift in Financial Management: Users might adopt a more integrated approach to managing their finances, relying on Gmail as a central hub for bill payment and tracking.

- Potential for Increased Spending: The ease and convenience of bill payment could potentially lead to increased spending, as users might be more likely to make impulsive purchases or overlook their budget.

Integration with Existing Services

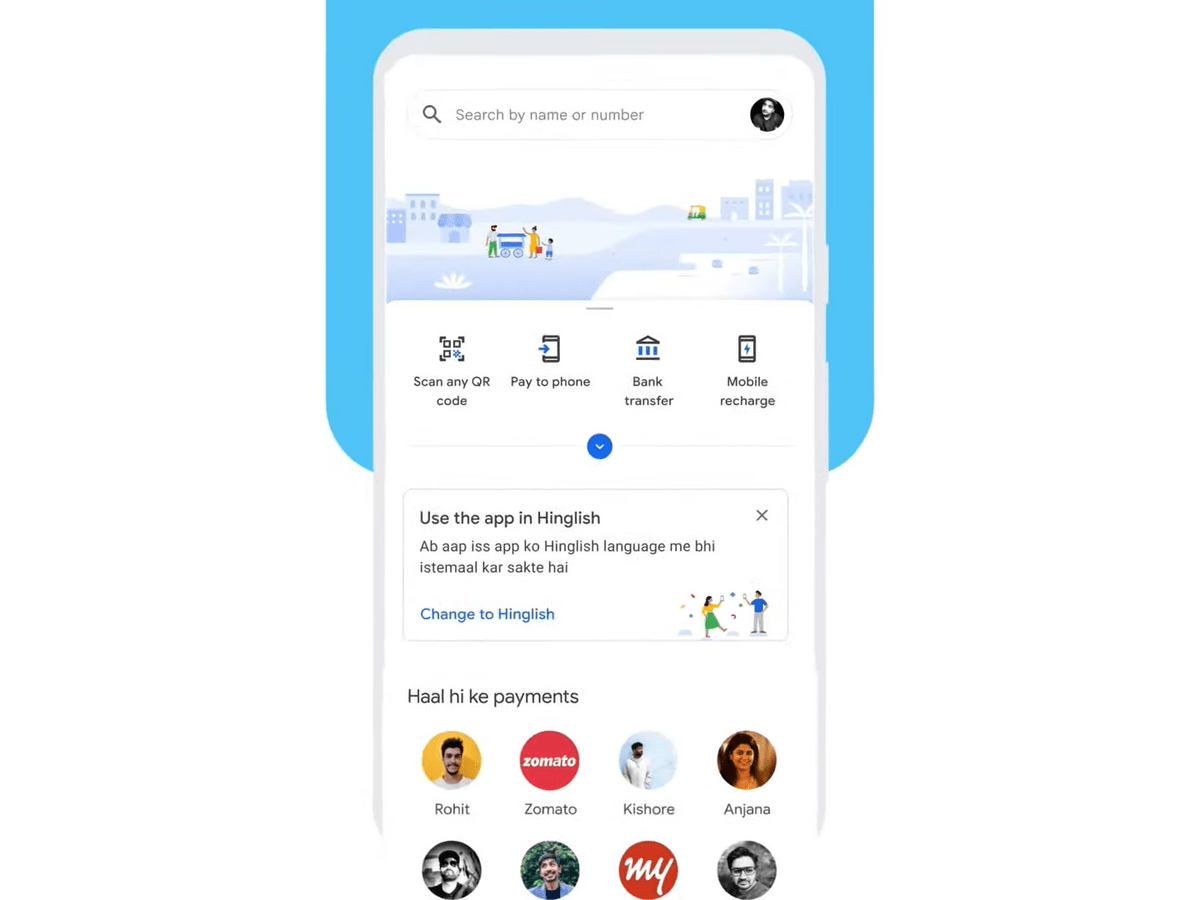

Google’s bill payment integration within Gmail could seamlessly connect with existing Google services, creating a streamlined financial management experience for users. This integration could leverage Google Pay, Google Wallet, and other payment platforms, offering a convenient and secure way to manage bills directly from the familiar Gmail interface.

Integration with Google Pay and Google Wallet

The integration of Google’s bill payment feature with Google Pay and Google Wallet would offer a unified platform for users to manage their finances. Users could effortlessly link their bank accounts or credit cards to their Gmail accounts, allowing them to pay bills directly through Google Pay or Google Wallet. This integration would eliminate the need for users to switch between different applications or websites to manage their bills, streamlining the process and improving efficiency.

Partnerships with Financial Institutions and Utility Providers

Google could collaborate with various financial institutions and utility providers to facilitate seamless bill payment. By partnering with banks, credit card companies, and utility companies, Google could ensure that users have access to a comprehensive range of bill payment options directly within Gmail. This integration would provide users with a convenient and secure way to manage their bills, regardless of the service provider.

Integration with Google Calendar and Other Google Services

The integration of Google’s bill payment feature with Google Calendar and other Google services would offer a comprehensive financial management solution. Users could set reminders for upcoming bill payments, track their payment history, and manage their budgets directly within Gmail. This integration would allow users to gain greater control over their finances and make informed decisions about their spending. For example, users could receive notifications in Gmail when a bill is due, and they could schedule automatic payments through Google Pay. This would help users avoid late fees and manage their finances more effectively.

Security and Privacy Considerations

Integrating bill payments into Gmail raises crucial concerns about user data security and privacy. Google must implement robust measures to safeguard sensitive financial information and ensure users’ trust in the platform.

Data Encryption and Secure Transmission, Google working on allowing users to pay bills directly inside gmail

Data encryption is fundamental to protect user information during transmission and storage. Google should employ industry-standard encryption protocols, such as Transport Layer Security (TLS) and Advanced Encryption Standard (AES), to secure communication between users’ devices and Google’s servers. This ensures that financial data, including account numbers, billing addresses, and payment details, remains confidential during transit.

Competition and Market Impact

Google’s foray into bill payment within Gmail introduces a significant player into a market already populated by established players like PayPal, Venmo, and various financial institutions. This move could reshape the competitive landscape, influencing user behavior and potentially disrupting the existing financial technology (FinTech) market.

Comparison with Existing Solutions

The bill payment feature within Gmail offers a unique proposition by integrating directly into a platform used by millions daily. This contrasts with existing solutions, which often require users to navigate separate apps or websites.

- PayPal and Venmo: These platforms primarily focus on peer-to-peer (P2P) payments and online shopping, with bill payment being a secondary feature. While they offer broad reach and established user bases, their integration with Gmail’s vast user base could be a significant advantage for Google.

- Financial Institutions: Banks and credit unions typically offer bill payment services through their online banking platforms. However, these services often lack the user-friendliness and integration with other services that Google’s approach offers.

Google’s integration with Gmail could offer a more streamlined and accessible experience for users, potentially leading to greater adoption and increased competition within the bill payment market.

Impact on the Competitive Landscape

Google’s entry into the bill payment market could significantly impact the competitive landscape, forcing existing players to adapt and innovate.

- Increased Competition: The presence of Google, with its vast user base and resources, will likely intensify competition in the bill payment market. Existing players will need to differentiate themselves and enhance their offerings to maintain market share.

- Innovation and Feature Enhancements: To compete effectively, existing players will likely need to invest in developing more user-friendly interfaces, improving security features, and offering more value-added services.

- Potential for Consolidation: As the market becomes more competitive, some players may be forced to merge or be acquired by larger entities to achieve economies of scale and better compete with Google.

Google’s move could accelerate innovation and lead to a more dynamic and competitive bill payment market, benefiting consumers in the long run.

Influence on User Adoption of Other Google Services

Google’s bill payment feature could act as a catalyst for user adoption of other Google services, particularly within the financial realm.

- Cross-Platform Integration: Integrating bill payment into Gmail could encourage users to explore other Google services like Google Pay and Google Finance.

- Enhanced User Experience: A seamless bill payment experience within Gmail could increase user trust and engagement with other Google services.

- Data-Driven Insights: Google’s vast data resources could be leveraged to offer personalized financial insights and recommendations to users, further enhancing their overall experience.

By providing a convenient and integrated bill payment solution, Google could position itself as a dominant player in the FinTech space, potentially disrupting the existing financial services market.

Future Development and Expansion: Google Working On Allowing Users To Pay Bills Directly Inside Gmail

The integration of bill payment into Gmail has the potential to revolutionize how users manage their finances. Google’s vast resources and user base open doors to innovative features and functionalities that can enhance the bill payment experience and make it more convenient, efficient, and personalized.

Recurring Payments

Recurring payments are a crucial feature that can simplify bill management for users. By allowing users to set up recurring payments for bills like utilities, subscriptions, and loans, the Gmail bill payment system can automate these payments and eliminate the need for manual intervention. This automation saves users time and reduces the risk of missed payments, contributing to a smoother financial experience.

Automatic Bill Reminders

Another valuable addition would be automatic bill reminders. The Gmail bill payment system can leverage user data and bill payment history to send timely reminders before due dates, ensuring that users are aware of upcoming payments and can plan accordingly. These reminders can be customized to suit individual preferences, including notification frequency and delivery method.

Personalized Financial Insights

Google can leverage its vast data repository to provide personalized financial insights to users. By analyzing user spending patterns, bill payment history, and other relevant data, the system can generate customized reports and recommendations to help users understand their financial health, identify areas for improvement, and make informed financial decisions. These insights can be presented in an intuitive and easy-to-understand manner, empowering users to take control of their finances.

Leveraging Existing Infrastructure and Data

Google’s existing infrastructure and data can be leveraged to develop innovative bill payment solutions. For example, Google Assistant can be integrated with the Gmail bill payment system to enable voice-based bill payments. This allows users to pay bills hands-free, making the process even more convenient. Google’s data on user preferences, spending habits, and location can be used to personalize the bill payment experience, offering tailored recommendations and suggestions.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML can play a significant role in enhancing the bill payment experience. AI-powered chatbots can be used to provide customer support and answer user queries related to bill payments. ML algorithms can be used to detect potential fraudulent activities and prevent unauthorized payments. AI can also be used to optimize payment scheduling and predict future payment needs, ensuring that users have enough funds available to meet their financial obligations.

Google working on allowing users to pay bills directly inside gmail – The integration of bill payment into Gmail could revolutionize how we manage our finances. It offers the potential for convenience and efficiency, but it also raises questions about security, privacy, and the impact on the existing financial technology landscape. The success of this endeavor will depend on Google’s ability to address these concerns and build a system that is both user-friendly and secure.

Google is making our lives easier by letting us pay bills directly within Gmail, eliminating the need to switch tabs or open separate apps. This is just another example of how tech giants are constantly innovating to streamline our daily tasks. And speaking of streamlining, did you know that Windows 10 will take up less space on your computer now?

It’s a win-win situation, with Google making bill payments more convenient and Microsoft ensuring we have more space for all those important files. So, get ready to say goodbye to cluttered inboxes and hello to a more efficient digital life!

Standi Techno News

Standi Techno News