How fintech payjoy built a 300m business by letting the underserved use their smartphones as collateral for loans – How Fintech PayJoy Built a $300 Million Business by Letting the Underserved Use Their Smartphones as Collateral for Loans – it sounds like a crazy idea, right? But this innovative approach to lending, targeting those often excluded from traditional financial services, is actually a brilliant example of how technology can bridge the gap and empower individuals. PayJoy’s model, which uses smartphones as collateral, has not only revolutionized the lending landscape but also helped millions gain access to much-needed financial support.

The key to PayJoy’s success lies in understanding the challenges faced by the underserved population. Traditional lending practices often require credit history, income verification, and other hurdles that many individuals simply don’t have. PayJoy’s unique model circumvents these barriers by leveraging the ubiquitous nature of smartphones. By using the device itself as collateral, PayJoy provides a more accessible and convenient way for people to borrow money, empowering them to take control of their finances and build a better future.

PayJoy’s Business Model: A Fintech Revolution

PayJoy’s rise to a $300 million business is a testament to its innovative approach to lending, particularly in underserved markets. The company, founded in 2014, has disrupted traditional lending practices by leveraging smartphones as collateral for loans. This unconventional strategy has unlocked access to credit for millions who were previously excluded from the financial system.

PayJoy’s Smartphone Collateral Model

PayJoy’s business model centers around the concept of “smartphone collateralization.” Borrowers can secure loans by pledging their smartphones as collateral. This approach, while unconventional, has several key advantages:

- Accessibility: Smartphones are ubiquitous, particularly in emerging markets, making it a readily available asset for loan collateral. This eliminates the need for traditional collateral like land or property, which many underserved individuals lack.

- Affordability: The cost of smartphones has significantly decreased in recent years, making them a relatively affordable asset to pledge. This lowers the barrier to entry for borrowers, allowing them to access credit even with limited financial resources.

- Convenience: Smartphones are essential tools for communication, work, and information access in the digital age. Using them as collateral minimizes disruption to borrowers’ daily lives, as they can continue using their devices while repaying their loans.

Rationale for PayJoy’s Approach

PayJoy’s model is a response to the limitations of traditional lending practices in underserved markets. These limitations include:

- High Interest Rates: Traditional lenders often charge exorbitant interest rates to compensate for the perceived risk associated with lending to low-income individuals. This can trap borrowers in a cycle of debt, making it difficult to improve their financial situation.

- Lack of Access: Many underserved individuals lack the credit history, documentation, or assets required to qualify for traditional loans. This creates a significant barrier to accessing financial services and limits their opportunities for economic advancement.

- Complexity: Traditional lending processes can be cumbersome and time-consuming, requiring borrowers to navigate complex paperwork and lengthy approval procedures. This can be particularly challenging for individuals with limited financial literacy or access to technology.

Comparison with Conventional Lending Practices

PayJoy’s model contrasts sharply with traditional lending practices in several key ways:

- Collateral: Traditional lenders typically require tangible assets like land, property, or vehicles as collateral for loans. PayJoy’s use of smartphones as collateral is a significant departure from this norm.

- Risk Assessment: Traditional lenders rely heavily on credit history and income verification to assess borrower risk. PayJoy uses a combination of smartphone data, including usage patterns and social network connections, to create a more holistic view of borrowers’ creditworthiness.

- Accessibility: PayJoy’s model is designed to be more accessible to underserved populations, offering loans with lower interest rates and simplified application processes. This allows individuals who may be excluded from traditional financial systems to access credit and build their financial futures.

Advantages of PayJoy’s Model, How fintech payjoy built a 300m business by letting the underserved use their smartphones as collateral for loans

PayJoy’s unconventional approach to lending offers several advantages:

- Increased Financial Inclusion: By leveraging smartphones as collateral, PayJoy has made credit accessible to millions of individuals who were previously excluded from the financial system. This has empowered individuals to build their financial lives and participate in the formal economy.

- Lower Interest Rates: PayJoy’s risk assessment methods, combined with its focus on underserved markets, have allowed it to offer lower interest rates than traditional lenders. This makes it more affordable for borrowers to repay their loans and avoid falling into debt traps.

- Improved Financial Literacy: PayJoy’s model encourages borrowers to develop positive financial habits. By using their smartphones as collateral, borrowers are more likely to take their loan obligations seriously and manage their finances responsibly.

The Underserved Market and Financial Inclusion

PayJoy’s innovative business model aimed to disrupt the traditional financial landscape by extending credit to the underserved population, often overlooked by traditional financial institutions. This segment, often lacking credit history or collateral, faced significant hurdles in accessing essential financial services. PayJoy recognized the untapped potential of this market and developed a unique approach to financial inclusion.

Challenges Faced by the Underserved Population

The underserved population, typically characterized by limited access to formal financial services, encountered various challenges in accessing traditional loans and credit:

- Lack of Credit History: Individuals without established credit history, particularly those new to the financial system, often struggled to obtain loans due to the perceived risk associated with their lack of track record. This barrier prevented them from accessing essential financial services, hindering their ability to improve their financial well-being.

- High Interest Rates and Fees: Traditional lenders often charged exorbitant interest rates and fees to compensate for the perceived risk of lending to the underserved. These high costs made borrowing financially unsustainable for many, trapping them in a cycle of debt and financial instability.

- Limited Collateral Options: Traditional lending practices typically required collateral, such as property or valuable assets, as security for loans. Many individuals in the underserved market lacked access to such assets, further restricting their ability to secure loans.

- Complex Application Processes: Traditional loan application processes often involved cumbersome paperwork, extensive documentation, and lengthy approval times, creating a significant barrier for individuals with limited resources or literacy skills.

PayJoy’s Approach to Financial Inclusion

PayJoy addressed these challenges by developing a unique and accessible model that leveraged the ubiquitous presence of smartphones as collateral:

- Smartphone as Collateral: PayJoy’s innovative approach utilized the smartphone, a readily available asset for many in the underserved market, as collateral for loans. This unconventional approach bypassed the traditional requirement for tangible assets, making credit accessible to a wider segment of the population.

- Mobile-First Platform: PayJoy’s platform was designed for mobile accessibility, allowing users to apply for loans, track payments, and manage their accounts conveniently through their smartphones. This user-friendly interface eliminated the need for physical branches and simplified the application process, making it accessible to individuals with limited access to traditional banking services.

- Data-Driven Risk Assessment: PayJoy utilized advanced data analytics and machine learning algorithms to assess the creditworthiness of borrowers, going beyond traditional credit scoring methods. By analyzing smartphone usage patterns and other digital footprints, PayJoy could make more informed lending decisions, extending credit to individuals who might have been overlooked by traditional lenders.

- Flexible Repayment Options: PayJoy offered flexible repayment options tailored to the borrowers’ needs and financial capabilities. This approach ensured that individuals could manage their repayments effectively and avoid falling into debt traps.

Impact on the Underserved Market

PayJoy’s model had a significant impact on the lives of individuals in the underserved market:

- Increased Access to Credit: PayJoy’s innovative approach to collateral and its data-driven risk assessment allowed individuals with limited credit history or assets to access essential financial services, including loans for emergency expenses, business opportunities, or education. This access to credit empowered individuals to improve their financial well-being and break free from the cycle of poverty.

- Financial Empowerment: By providing access to affordable and flexible credit, PayJoy helped individuals build their credit history and gain financial independence. This empowered them to make informed financial decisions and participate actively in the formal financial system.

- Economic Growth: PayJoy’s model fostered economic growth by enabling individuals to start businesses, invest in education, or meet unexpected financial needs. This positive impact extended beyond the individual level, contributing to broader economic development and social progress.

Technological Innovation and Smartphone Utilization

PayJoy’s business model relied heavily on technological innovation, particularly the use of smartphones, to facilitate loan processing, risk assessment, and collateralization. This approach not only allowed PayJoy to serve the underserved but also revolutionized the way financial services were delivered in emerging markets.

Smartphone as Collateral

PayJoy’s innovative approach to collateralization used smartphones as a valuable asset. The company recognized the widespread adoption of smartphones in emerging markets and the sentimental value they held for many individuals. By leveraging this, PayJoy created a unique system where borrowers could use their smartphones as collateral for loans. This addressed the traditional challenges of securing collateral, especially for individuals with limited assets.

Securing the Value of Smartphones

PayJoy employed several methods to secure the value of smartphones used as collateral:

- Remote Access and Data Monitoring: PayJoy gained remote access to borrowers’ smartphones, allowing them to monitor device usage, location data, and other relevant information. This provided a continuous assessment of the device’s value and allowed for early detection of potential risks, such as device theft or damage.

- Software-Based Locks and Restrictions: PayJoy implemented software-based locks and restrictions on the borrowers’ smartphones. These measures prevented unauthorized access or use of the device, ensuring its integrity and value.

- Device Insurance: PayJoy offered device insurance to borrowers, protecting the smartphone from unforeseen damage or theft. This insurance policy mitigated the risk for both the borrower and PayJoy, ensuring the value of the collateral remained intact.

Leveraging Smartphone Data for Enhanced Loan Processing

PayJoy’s platform utilized smartphone data to streamline and improve loan processing and repayment. This data provided valuable insights into the borrower’s behavior, financial stability, and overall risk profile:

- Credit Scoring and Risk Assessment: PayJoy’s platform analyzed smartphone usage patterns, call records, and social media activity to create a more comprehensive credit score. This allowed for more accurate risk assessment, enabling the company to offer loans to individuals who might not have traditional credit history.

- Personalized Loan Offers: By analyzing smartphone data, PayJoy could tailor loan offers to individual borrowers’ needs and financial capabilities. This personalized approach enhanced the customer experience and increased the likelihood of loan repayment.

- Repayment Reminders and Communication: PayJoy used smartphone notifications and messaging apps to send timely repayment reminders and communicate with borrowers. This proactive approach ensured borrowers stayed on top of their repayment schedules and reduced the risk of default.

Growth and Expansion of PayJoy’s Business

PayJoy’s remarkable journey from a nascent startup to a $300 million business is a testament to its innovative approach to financial inclusion and its strategic growth strategy. By leveraging the power of smartphones and building trust with underserved communities, PayJoy has achieved impressive growth, expanding its reach across multiple countries.

Factors Contributing to PayJoy’s Rapid Growth

PayJoy’s rapid growth can be attributed to several key factors:

- Addressing a Significant Market Need: PayJoy recognized the vast unmet demand for financial services among the underserved population. By offering accessible and affordable credit solutions, PayJoy tapped into a massive market segment that traditional financial institutions often overlooked. This strategic focus on financial inclusion was a major driver of PayJoy’s early success.

- Leveraging Smartphone Technology: PayJoy’s innovative use of smartphones as collateral for loans was a game-changer. This approach eliminated the need for traditional credit checks and collateral, making credit accessible to individuals who previously lacked access to financial services. The widespread adoption of smartphones in developing markets further fueled PayJoy’s growth.

- Building Trust and Relationships: PayJoy’s commitment to building trust and strong relationships with its customers was crucial. The company emphasized responsible lending practices and worked to empower its customers through financial literacy programs. This approach fostered loyalty and word-of-mouth referrals, driving organic growth.

- Data-Driven Approach: PayJoy’s use of data analytics and machine learning algorithms allowed the company to better understand its customers’ needs and risk profiles. This enabled PayJoy to offer personalized loan products and optimize its lending decisions, leading to improved loan performance and reduced defaults.

Expansion Strategies

PayJoy employed several strategies to expand its operations and reach new markets:

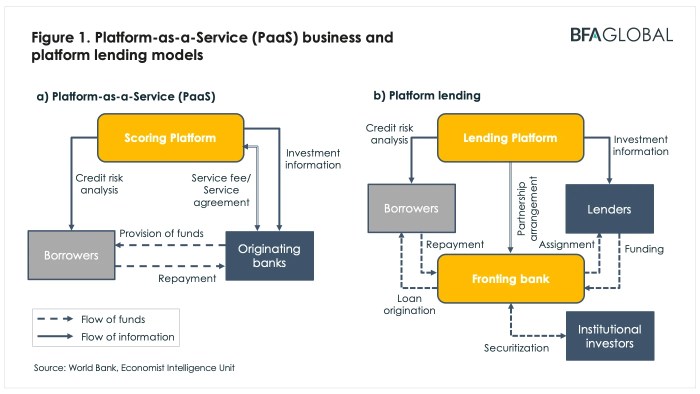

- Strategic Partnerships: PayJoy forged partnerships with mobile network operators, financial institutions, and other businesses to expand its reach and leverage existing infrastructure. These partnerships provided access to new customer segments and facilitated the integration of PayJoy’s services into existing ecosystems.

- Geographic Expansion: PayJoy strategically expanded its operations into new markets with significant potential for financial inclusion. The company targeted countries with high smartphone penetration and a large underserved population. This expansion strategy allowed PayJoy to capitalize on the growing demand for financial services in emerging markets.

- Product Diversification: PayJoy expanded its product offerings beyond microloans to include other financial services such as mobile money transfers, bill payments, and insurance. This diversification allowed the company to cater to a wider range of customer needs and generate additional revenue streams.

Future Plans and Growth Potential

PayJoy continues to invest in innovation and expansion, with plans to further penetrate existing markets and enter new territories. The company is exploring opportunities to leverage emerging technologies such as artificial intelligence (AI) and blockchain to enhance its services and improve operational efficiency.

PayJoy’s future growth potential is significant, driven by the increasing demand for financial services in emerging markets and the company’s proven track record of success. With its innovative approach, strong customer relationships, and commitment to financial inclusion, PayJoy is well-positioned to become a leading player in the global fintech landscape.

PayJoy’s Impact and Lessons Learned: How Fintech Payjoy Built A 300m Business By Letting The Underserved Use Their Smartphones As Collateral For Loans

PayJoy’s innovative approach to lending, utilizing smartphones as collateral, has not only revolutionized the financial landscape but also played a crucial role in promoting financial inclusion. By extending credit to the underserved population, PayJoy has empowered individuals to access essential financial services and build their credit history, leading to a ripple effect of positive outcomes.

PayJoy’s Contribution to Financial Inclusion

PayJoy’s model has demonstrably contributed to financial inclusion by bridging the gap in access to credit for individuals traditionally excluded from traditional financial systems. This has had a significant impact on the lives of millions, enabling them to:

- Access Essential Financial Services: By providing access to loans, PayJoy empowers individuals to meet urgent financial needs, such as medical expenses, education costs, or business opportunities, which otherwise would be inaccessible.

- Build Credit History: PayJoy’s responsible lending practices allow borrowers to build a positive credit history, which opens doors to future financial opportunities like mortgages, car loans, and credit cards.

- Improve Financial Well-being: Access to credit allows individuals to invest in their education, health, and businesses, ultimately contributing to their overall financial well-being and upward mobility.

Lessons Learned from PayJoy’s Success

PayJoy’s success provides valuable insights for other fintech companies seeking to disrupt traditional financial systems and expand financial inclusion. Key lessons learned include:

- Focus on the Underserved: PayJoy’s success demonstrates the vast potential of targeting underserved populations with innovative financial solutions. This approach not only fulfills a critical market need but also unlocks significant growth opportunities.

- Leverage Technology for Accessibility: PayJoy’s utilization of smartphones as collateral showcases the power of technology in creating accessible and efficient financial services. This approach reduces reliance on traditional credit scoring methods and makes credit accessible to individuals with limited credit history.

- Build Trust and Transparency: PayJoy’s commitment to ethical lending practices and transparent communication has fostered trust among its customers. This trust is essential for building a sustainable business and achieving long-term success in the financial services sector.

Challenges and Opportunities for PayJoy

While PayJoy has achieved remarkable success, it faces ongoing challenges and opportunities in the evolving fintech landscape:

- Competition: The fintech industry is becoming increasingly competitive, with new players entering the market and existing companies expanding their offerings. PayJoy needs to continue innovating and adapting to stay ahead of the curve.

- Regulatory Landscape: The regulatory landscape for fintech companies is constantly evolving. PayJoy must navigate these regulations effectively to ensure compliance and maintain its operational efficiency.

- Expanding Reach: PayJoy has the potential to expand its reach to new markets and customer segments. This expansion requires careful consideration of local market conditions, regulatory requirements, and cultural nuances.

PayJoy’s story is a testament to the power of innovation and the potential of fintech to create a more inclusive financial system. By tapping into the untapped potential of the underserved market, PayJoy has not only built a successful business but also made a significant impact on the lives of millions. As the company continues to expand and refine its model, we can expect to see even greater advancements in financial inclusion and a more equitable financial landscape for all.

PayJoy’s innovative approach to lending, using smartphones as collateral, opened up a world of financial access for millions. This strategy, combined with the rise of mobile-first technology, allowed them to reach underserved communities. The ability to run Android apps on Chrome OS, chrome os run android apps , further enhances this accessibility, ensuring users can leverage the full potential of their devices for both work and financial management.

This approach, coupled with PayJoy’s focus on responsible lending practices, has helped them build a successful business and empower millions around the world.

Standi Techno News

Standi Techno News