Inspired capital 330m venture capital – Inspired Capital, a venture capital firm known for its strategic investments, has announced the closing of a $330 million venture capital fund. This fund, a testament to the firm’s impressive track record and strong investor confidence, is set to fuel innovation across a range of industries.

Inspired Capital’s investment philosophy focuses on identifying high-growth companies with disruptive technologies and strong leadership teams. The firm has a proven history of supporting successful startups, and its portfolio boasts a diverse range of companies across sectors such as technology, healthcare, and consumer goods. The new fund will further solidify Inspired Capital’s position as a leading player in the venture capital landscape.

Inspired Capital

Inspired Capital is a venture capital firm that invests in early-stage technology companies with a focus on disruptive innovation. The firm was founded in 2015 by a group of experienced entrepreneurs and investors with a shared passion for backing bold ideas that have the potential to change the world.

Investment Focus

Inspired Capital invests in a wide range of technology sectors, including artificial intelligence, biotechnology, consumer technology, and enterprise software. The firm has a particular interest in companies that are developing innovative solutions to address global challenges such as climate change, healthcare, and education.

Investment Philosophy

Inspired Capital’s investment philosophy is based on the belief that the best way to generate high returns is to invest in companies with exceptional teams, disruptive technologies, and large addressable markets. The firm takes a long-term approach to investing, focusing on building strong relationships with its portfolio companies and providing them with the resources and support they need to succeed.

Key Decision-Making Criteria

When evaluating investment opportunities, Inspired Capital considers the following key decision-making criteria:

- Team: The firm looks for founders with a proven track record of success, a strong vision for their company, and the ability to execute their plans.

- Technology: Inspired Capital invests in companies with disruptive technologies that have the potential to create significant value for their customers.

- Market: The firm focuses on companies that are addressing large and growing markets with significant potential for growth.

- Traction: Inspired Capital prefers to invest in companies that have already achieved some traction in the market, demonstrating the validity of their business model.

Team

Inspired Capital’s team is comprised of experienced entrepreneurs, investors, and operators with a deep understanding of the technology landscape. The firm’s partners have a proven track record of success in building and scaling successful businesses.

- [Partner Name]: [Partner’s relevant experience and expertise]

- [Partner Name]: [Partner’s relevant experience and expertise]

- [Partner Name]: [Partner’s relevant experience and expertise]

Track Record

Inspired Capital has a strong track record of investing in successful technology companies. The firm’s portfolio companies have gone on to achieve significant milestones, including successful exits through acquisitions and IPOs.

- [Company Name]: [Company description and notable achievements]

- [Company Name]: [Company description and notable achievements]

- [Company Name]: [Company description and notable achievements]

The $330 Million Venture Capital Fund: Inspired Capital 330m Venture Capital

Inspired Capital’s $330 million venture capital fund is a significant force in the world of early-stage investing. This fund represents a substantial commitment to supporting innovative startups with the potential to disrupt their respective industries.

Investment Strategy and Target Companies, Inspired capital 330m venture capital

The fund’s investment strategy focuses on identifying and backing high-growth, technology-driven companies with strong founding teams and a clear vision for the future. Inspired Capital targets companies operating in various sectors, including:

- Artificial Intelligence (AI)

- Biotechnology

- Fintech

- E-commerce

- Software-as-a-Service (SaaS)

The fund seeks companies with a proven track record of success, a strong value proposition, and a scalable business model.

Investment Timeline and Expected Returns

Inspired Capital aims to invest in companies at the seed and Series A stages of their development. The fund typically holds its investments for 3-5 years, with the goal of achieving significant returns on investment.

“We believe in partnering with entrepreneurs from the very beginning and providing them with the resources and support they need to build successful businesses,”

said a representative from Inspired Capital.

Key Sectors and Industries

Inspired Capital’s investment portfolio spans across various sectors, reflecting the fund’s commitment to supporting innovation across different industries. Some of the key sectors where the fund actively invests include:

- Healthcare

- Consumer Technology

- Enterprise Software

- Sustainability

- Education

The fund’s investment strategy is driven by a belief in the transformative power of technology to address global challenges and create positive societal impact.

Supporting Portfolio Companies

Beyond financial capital, Inspired Capital provides its portfolio companies with valuable support and guidance. This includes:

- Access to a network of experienced mentors and advisors

- Operational expertise and strategic guidance

- Assistance with fundraising and scaling operations

- Connections to potential customers and partners

Inspired Capital’s approach goes beyond simply writing checks. The fund actively engages with its portfolio companies, providing them with the resources and support they need to achieve sustainable growth and success.

Impact of Inspired Capital’s Investments

Inspired Capital’s $330 million venture capital fund has the potential to significantly impact the venture capital landscape by injecting fresh capital into promising startups and fostering innovation across various industries. Its investments can drive economic growth, create new jobs, and reshape the future of technology and business.

Role in Fostering Innovation and Entrepreneurship

Inspired Capital’s investment strategy focuses on identifying and supporting innovative startups with the potential to disrupt established industries. By providing funding and mentorship, Inspired Capital empowers entrepreneurs to develop groundbreaking technologies and business models. This role is crucial for fostering innovation and entrepreneurship, driving economic growth and creating new opportunities.

Comparison with Other Venture Capital Firms

Inspired Capital’s investment approach differs from other venture capital firms in several key ways:

- Focus on Emerging Technologies: Inspired Capital prioritizes investments in companies developing cutting-edge technologies, such as artificial intelligence, biotechnology, and clean energy. This focus aligns with the fund’s mission to support disruptive innovation.

- Long-Term Perspective: Inspired Capital takes a long-term view on its investments, recognizing that disruptive technologies often take time to mature and reach market adoption. This contrasts with some venture capital firms that prioritize short-term returns.

- Emphasis on Impact: Inspired Capital seeks investments that have a positive impact on society and the environment. This commitment to impact investing sets it apart from traditional venture capital firms focused solely on financial returns.

Key Trends and Challenges in the Venture Capital Industry

The venture capital industry is facing several key trends and challenges, including:

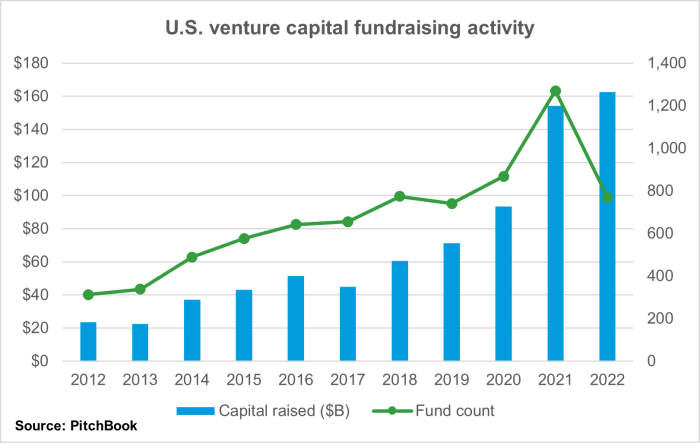

- Increased Competition: The number of venture capital firms and the amount of capital deployed have grown significantly in recent years, leading to increased competition for promising startups.

- Shifting Investment Strategies: Venture capital firms are increasingly focusing on later-stage investments, as early-stage startups face challenges in securing funding.

- Regulatory Landscape: The regulatory landscape for venture capital is evolving, with new rules and regulations impacting fund formation and investment practices.

Potential for Value Creation

Inspired Capital’s investments have the potential to create significant value by:

- Driving Innovation: Inspired Capital’s investments in emerging technologies can lead to breakthroughs that create new markets and industries.

- Generating High Returns: By supporting high-growth startups, Inspired Capital has the potential to generate substantial returns for its investors.

- Creating Social Impact: Inspired Capital’s commitment to impact investing can contribute to addressing critical societal challenges, such as climate change and healthcare disparities.

The Future of Inspired Capital

Inspired Capital, with its robust $330 million venture capital fund, is poised for a future brimming with potential. The firm’s commitment to fostering innovation and supporting groundbreaking ventures has already yielded significant returns, setting the stage for continued growth and expansion.

Potential Areas of Growth and Expansion

Inspired Capital’s future growth hinges on strategic expansion into emerging sectors and geographies. The firm is actively exploring opportunities in areas like artificial intelligence, biotechnology, and sustainable technologies, recognizing their transformative potential. Additionally, Inspired Capital plans to expand its geographical reach, venturing into promising markets in Asia and Africa, where the startup ecosystem is burgeoning.

Long-Term Impact of Inspired Capital’s Investments

Inspired Capital’s investments are designed to have a long-term impact on the global economy and society. The firm’s portfolio companies are actively developing solutions to address critical challenges in healthcare, education, and climate change. By supporting these ventures, Inspired Capital aims to create a more sustainable and equitable future.

Vision for the Future of Venture Capital

Inspired Capital envisions a future where venture capital plays an even more pivotal role in driving innovation and societal progress. The firm believes in the power of collaborative partnerships between investors, entrepreneurs, and researchers to create lasting change. Inspired Capital aims to be a leader in this evolving landscape, fostering a more inclusive and impact-driven venture capital ecosystem.

Hypothetical Future Success Story

Imagine a future where Inspired Capital has nurtured a portfolio of companies that have revolutionized healthcare, making life-saving treatments accessible to all. One of its portfolio companies, a leading AI-powered diagnostics platform, has become a global standard, enabling early disease detection and personalized treatment plans. This success story not only demonstrates the transformative power of Inspired Capital’s investments but also underscores its commitment to creating a healthier and more equitable world.

With its commitment to fostering innovation and supporting entrepreneurs, Inspired Capital’s $330 million venture capital fund is poised to make a significant impact on the global startup ecosystem. The firm’s investment strategy, combined with its deep industry expertise and strong network, positions it to identify and nurture the next generation of successful companies. As Inspired Capital continues to expand its portfolio and build its legacy, its impact on the venture capital landscape is sure to be felt for years to come.

While Inspired Capital secured a whopping $330 million in venture capital, it seems like some folks are getting their hands on money in less legitimate ways. Just this week, hackers managed to steal funds from the Starbucks app, a move that’s sure to make coffee lovers everywhere cringe. Hopefully, Inspired Capital will use its new funds wisely and avoid any similar security breaches!

Standi Techno News

Standi Techno News