Korean startup carta cap table management – Korean Startup Carta: Cap Table Management Simplified is a game-changer for the Korean startup scene. Carta, a leading cap table management platform, is revolutionizing how Korean startups manage their equity, investor relations, and compliance.

The platform streamlines the complexities of cap table management, offering features like automated equity tracking, investor communication tools, and seamless compliance reporting. This is especially crucial for Korean startups navigating a rapidly evolving and competitive market.

Introduction to Carta

Carta is a leading cap table management platform that simplifies the process of managing equity ownership for startups and private companies. It provides a centralized and secure system for tracking and managing all aspects of a company’s equity, including shares, options, warrants, and other equity instruments.

Carta’s role extends beyond simply managing cap tables; it empowers startups and private companies to streamline their equity administration, automate compliance tasks, and improve communication with investors.

Importance of Cap Table Management for Startups, Korean startup carta cap table management

Managing a cap table effectively is crucial for startups as it helps them:

- Maintain accurate records of equity ownership: A well-maintained cap table ensures that all stakeholders, including founders, employees, investors, and advisors, have a clear understanding of their equity holdings and rights. This is essential for preventing disputes and ensuring fair distribution of ownership.

- Facilitate fundraising and investment rounds: When a startup raises funds, the cap table serves as a crucial document for investors to understand the company’s equity structure and ownership distribution. A well-organized cap table helps streamline the fundraising process and attract potential investors.

- Ensure compliance with regulatory requirements: Cap tables are subject to various regulatory requirements, especially when a company prepares for an initial public offering (IPO) or other significant events. Carta helps companies comply with these regulations by providing tools for generating compliant documentation and reporting.

- Simplify employee equity management: Carta allows startups to easily manage employee stock options (ESOPs) and other equity incentives. This includes issuing options, tracking vesting schedules, and managing option exercises, making it easier for startups to attract and retain top talent.

Challenges Faced by Startups in Managing Cap Tables

Startups often face challenges in managing their cap tables, particularly in the early stages of growth:

- Manual processes and spreadsheets: Many startups initially rely on spreadsheets or manual processes to track their equity, which can be time-consuming, prone to errors, and difficult to scale as the company grows.

- Lack of expertise: Startups may lack the internal expertise to manage complex cap tables and navigate the complexities of equity administration and compliance.

- Limited resources: Early-stage startups often have limited resources and may struggle to invest in dedicated software solutions for cap table management.

- Rapid growth and changes: As startups grow rapidly, their cap tables can become increasingly complex, requiring frequent updates and adjustments to accommodate new equity grants, funding rounds, and other changes.

Carta’s Features and Benefits: Korean Startup Carta Cap Table Management

Carta is a comprehensive cap table management platform designed to streamline and simplify equity management for startups and investors. It offers a suite of features that cater to the unique needs of Korean startups, helping them navigate the complexities of equity ownership, investor relations, and compliance.

Simplifying Equity Management

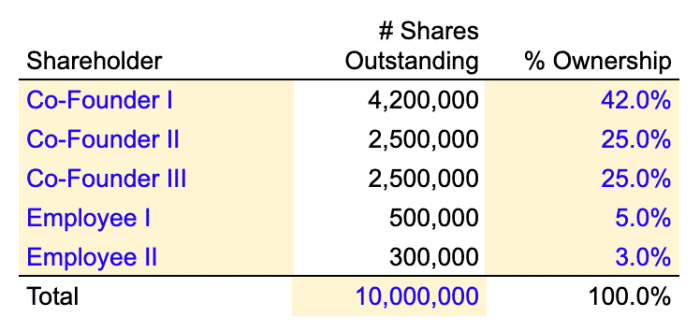

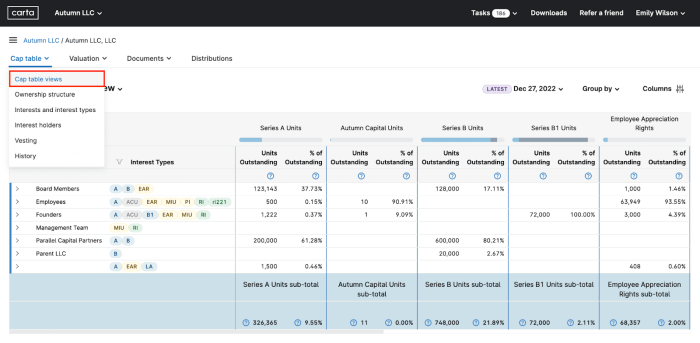

Carta’s cap table management capabilities are at the core of its value proposition. It provides a centralized platform to track and manage all aspects of equity ownership, from initial issuance to subsequent transactions, including:

- Issuance and Allocation: Carta enables efficient issuance and allocation of equity to founders, employees, investors, and other stakeholders. This includes the creation of stock options, restricted stock units (RSUs), and other equity instruments.

- Transfer and Transactions: Carta facilitates seamless transfer of equity ownership through various transactions, including stock purchases, sales, and exercises of options. It also supports the management of complex transactions, such as mergers and acquisitions.

- Cap Table Visualization: Carta provides an interactive and intuitive cap table visualization tool that offers a clear and comprehensive overview of equity ownership, including ownership percentages, vesting schedules, and dilution factors.

- Reporting and Analytics: Carta offers robust reporting and analytics capabilities that provide insights into equity ownership, dilution, and other key metrics. These reports can be customized to meet specific needs and help stakeholders make informed decisions.

Streamlining Investor Relations

Carta simplifies investor relations by providing tools and features that enhance communication and transparency between startups and their investors.

- Investor Portal: Carta offers a secure investor portal where investors can access real-time information about their investments, including equity holdings, valuations, and dividends. This improves communication and fosters trust between startups and their investors.

- Document Management: Carta’s document management system allows startups to securely store and manage all investor-related documents, such as term sheets, cap tables, and shareholder agreements. This ensures easy access to critical information for both startups and investors.

- Investor Communication: Carta enables startups to communicate effectively with investors through email, notifications, and other channels. This facilitates efficient information sharing and reduces the risk of miscommunication.

Ensuring Compliance

Carta helps Korean startups navigate the complex regulatory landscape surrounding equity management and investor relations.

- Compliance Monitoring: Carta provides tools and resources to help startups stay compliant with relevant regulations, including the Financial Investment Services and Capital Markets Act (FISCMA) and the Corporate Governance Code. This ensures that startups operate within the legal framework and avoid potential legal issues.

- Audit Trail: Carta maintains a comprehensive audit trail of all equity transactions, ensuring transparency and accountability. This is crucial for meeting regulatory requirements and demonstrating compliance.

- Data Security: Carta prioritizes data security and employs industry-leading measures to protect sensitive information, ensuring compliance with data privacy regulations like the Personal Information Protection Act (PIPA).

Carta’s Impact on the Korean Startup Ecosystem

Carta’s entry into the Korean startup scene marks a significant development, offering a comprehensive cap table management solution that addresses the growing needs of Korean startups. The platform’s intuitive interface, robust features, and global reach have the potential to reshape the Korean startup landscape, fostering greater transparency, efficiency, and investor confidence.

Adoption of Carta by Korean Startups

The adoption of Carta by Korean startups is steadily increasing, driven by its user-friendly interface, comprehensive features, and competitive pricing. Several factors contribute to this growing trend:

- Increasing Funding Rounds: Korean startups are experiencing a surge in funding rounds, leading to more complex cap tables that require efficient management. Carta’s platform simplifies the process, streamlining equity management and ensuring accuracy.

- Global Investor Participation: Korean startups are attracting investors from around the world, demanding a platform that can handle international transactions and currencies. Carta’s global presence and support for multiple languages address this need.

- Regulatory Compliance: As Korean startups mature, regulatory compliance becomes increasingly important. Carta’s platform ensures compliance with local laws and regulations, providing peace of mind for both startups and investors.

Potential Impact of Carta on the Growth and Funding of Korean Startups

Carta’s impact on the Korean startup ecosystem extends beyond mere cap table management. Its features and capabilities have the potential to foster growth and attract funding in several ways:

- Improved Investor Confidence: Carta’s transparency and auditability instill confidence in investors, enabling them to make informed decisions based on accurate and readily available information.

- Simplified Fundraising: The platform streamlines the fundraising process, allowing startups to manage investor relations and track equity distributions more efficiently. This efficiency can attract investors seeking a seamless experience.

- Enhanced Valuation Accuracy: Carta’s comprehensive data and reporting capabilities provide startups with a clearer understanding of their valuation, facilitating accurate fundraising and equity distribution.

Comparison of Carta’s Features and Pricing to Other Cap Table Management Solutions in Korea

Carta competes with several cap table management solutions in the Korean market, each offering unique features and pricing structures. While a detailed comparison is beyond the scope of this discussion, key considerations include:

- Features: Carta offers a comprehensive suite of features, including cap table management, investor relations, fundraising tools, and regulatory compliance. Other solutions may offer a more limited feature set.

- Pricing: Carta’s pricing structure is competitive and transparent, offering various plans based on the startup’s stage and needs. Other solutions may have different pricing models, which could affect the overall cost for startups.

- Integration: Carta integrates seamlessly with other popular startup tools and platforms, enhancing efficiency and data sharing. Other solutions may have limited integration capabilities.

Case Studies of Korean Startups Using Carta

Carta has played a significant role in the growth and success of many Korean startups, providing them with a streamlined and efficient cap table management solution. This section will delve into the experiences of several successful Korean startups that have leveraged Carta to navigate their funding journeys and optimize their equity structures.

Benefits and Challenges Experienced by Korean Startups Using Carta

Carta has provided numerous benefits to Korean startups, including:

* Simplified Cap Table Management: Carta’s user-friendly interface and automated features have significantly simplified cap table management for Korean startups, allowing them to efficiently track equity ownership, shareholder information, and funding rounds.

* Enhanced Transparency and Communication: Carta’s platform fosters transparency and communication among stakeholders, including investors, founders, and employees. This has facilitated easier decision-making and a more collaborative environment.

* Improved Fundraising Efficiency: Carta has streamlined the fundraising process for Korean startups by providing a centralized platform for investor relations, due diligence, and closing deals.

* Scalability and Adaptability: Carta’s platform can adapt to the evolving needs of startups as they scale, providing them with a flexible and scalable solution for cap table management.

However, some Korean startups have also encountered challenges in using Carta:

* Language Barriers: While Carta offers support for multiple languages, including Korean, some startups may still face language barriers in navigating the platform and accessing customer support.

* Integration with Local Systems: Integrating Carta with existing local systems and regulations can sometimes pose challenges for Korean startups.

* Cost Considerations: While Carta offers a range of pricing plans, the cost of using the platform can be a consideration for early-stage startups with limited resources.

Case Study: Coupang

Coupang, a leading e-commerce platform in South Korea, has successfully used Carta to manage its complex cap table and navigate its rapid growth. As Coupang raised multiple rounds of funding from various investors, Carta’s platform helped the company efficiently track equity ownership, manage shareholder information, and facilitate communication with investors. This has allowed Coupang to streamline its fundraising process and focus on expanding its operations.

Case Study: Toss

Toss, a popular mobile financial platform in South Korea, has also utilized Carta for cap table management. As Toss expanded its services and raised significant funding, Carta’s platform helped the company maintain a clear and accurate record of its equity structure. This has been crucial in attracting new investors and ensuring transparency in its financial operations.

Case Study: Yanolja

Yanolja, a leading travel and accommodation platform in South Korea, has experienced the benefits of using Carta in managing its cap table and facilitating its growth. Carta’s platform has enabled Yanolja to streamline its fundraising process, manage shareholder information, and ensure transparency in its equity structure. This has been instrumental in attracting new investors and supporting Yanolja’s expansion into new markets.

Future Trends in Cap Table Management for Korean Startups

The Korean startup ecosystem is rapidly evolving, and with it, the need for efficient and transparent cap table management solutions is growing. As startups scale, their equity structures become more complex, necessitating sophisticated tools to track ownership, manage shareholder rights, and ensure compliance with regulations.

The Impact of Emerging Technologies on Cap Table Management

Emerging technologies like blockchain and artificial intelligence (AI) are poised to revolutionize cap table management, offering significant benefits for Korean startups.

- Blockchain Technology: Blockchain can enhance security and transparency in cap table management. Its decentralized and immutable nature provides a secure and auditable record of ownership, reducing the risk of fraud and errors. This technology can streamline equity transactions, making them faster and more efficient. Moreover, blockchain can facilitate fractional ownership and automated dividend distribution, making it easier for startups to manage complex equity structures.

- Artificial Intelligence (AI): AI can automate repetitive tasks in cap table management, such as data entry, reconciliation, and reporting. AI-powered systems can analyze large datasets to identify potential issues and provide insights into equity ownership and valuation. This can help startups make informed decisions about fundraising and equity management.

The Future Role of Carta in the Korean Startup Ecosystem

Carta is well-positioned to play a pivotal role in the future of Korean startup cap table management. As the leading cap table management platform globally, Carta offers a comprehensive suite of features, including:

- Secure and Transparent Cap Table Management: Carta’s platform provides a secure and auditable record of equity ownership, ensuring transparency and compliance.

- Simplified Equity Management: Carta streamlines equity management processes, making it easier for startups to issue shares, track ownership, and manage shareholder rights.

- Integration with Other Tools: Carta integrates with other essential startup tools, such as accounting software and legal platforms, streamlining workflows and reducing administrative burdens.

- Global Reach: Carta’s global reach and experience in supporting startups in various markets, including the United States and Europe, provide valuable insights and best practices for Korean startups.

As the Korean startup ecosystem flourishes, Carta’s impact on the industry is undeniable. By simplifying cap table management, Carta empowers Korean startups to focus on growth and innovation, ultimately contributing to a more robust and dynamic tech scene in Korea.

Korean startup Carta’s cap table management software is a lifesaver for founders navigating the complex world of equity. It’s especially crucial as the price of zero-day exploits rises , highlighting the need for robust security measures. Carta’s platform helps startups maintain a secure and transparent record of their ownership structure, which is essential for attracting investors and building trust in the company.

Standi Techno News

Standi Techno News