Nala Builds a B2B Payment Platform Too sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Nala, a company known for its prowess in cross-border payments, is expanding its reach by venturing into the B2B payment space. This move signifies a strategic shift for Nala, as it aims to capitalize on the growing demand for efficient and secure B2B payment solutions in its target markets.

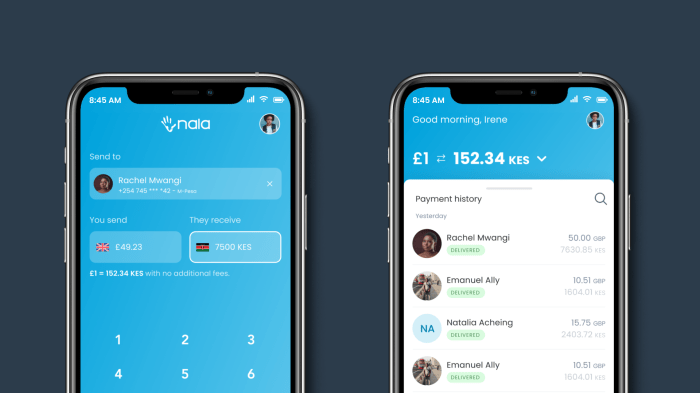

Nala’s B2B platform promises to revolutionize the way businesses handle payments, offering a user-friendly interface, robust security features, and a seamless integration with existing business systems. By leveraging its existing infrastructure and expertise in cross-border payments, Nala is well-positioned to cater to the specific needs of businesses operating in diverse regions.

Nala’s Expansion into B2B Payments

Nala, a company known for its innovative cross-border payments solutions, has taken a strategic leap by venturing into the B2B payment space. This move is driven by the company’s desire to capitalize on the burgeoning global B2B payments market and expand its service offerings to meet the evolving needs of businesses operating in a rapidly interconnected world.

The Rationale Behind Nala’s B2B Expansion

Nala’s decision to expand into B2B payments is underpinned by a combination of factors. The global B2B payments market is experiencing significant growth, driven by factors such as the increasing volume of cross-border transactions, the rise of e-commerce, and the demand for faster and more efficient payment solutions. This presents a compelling opportunity for Nala to leverage its existing infrastructure and expertise to capture a share of this growing market.

The B2B Payment Market Opportunity and Competitive Landscape

The B2B payment market is a vast and diverse landscape with a wide range of players, including traditional banks, fintech companies, and specialized payment processors. Nala’s target regions, particularly those with emerging economies and high remittance flows, present a particularly attractive opportunity. These regions are characterized by a growing demand for reliable and affordable B2B payment solutions, particularly for cross-border transactions.

Leveraging Existing Infrastructure and Expertise, Nala builds a b2b payment platform too

Nala’s existing infrastructure and expertise in cross-border payments provide a strong foundation for its B2B platform. The company’s network of partnerships with financial institutions and payment processors enables it to offer a wide range of payment options and reach a global customer base. Additionally, Nala’s experience in navigating the complexities of cross-border payments, including regulatory compliance and currency exchange, gives it a competitive advantage in the B2B space.

Nala’s Target Audience and Value Proposition

Nala’s B2B payment platform is designed to cater to a wide range of businesses, particularly those operating in emerging markets and facing challenges with traditional payment methods. The platform aims to simplify and streamline cross-border transactions, making it an attractive option for businesses seeking efficient and cost-effective payment solutions.

Nala’s value proposition centers around providing businesses with a secure, transparent, and cost-effective way to manage their international payments. The platform offers several key benefits compared to traditional payment methods, including faster processing times, lower transaction fees, and enhanced security features.

Businesses Targeting

Nala’s B2B platform targets businesses across various sectors, including:

- E-commerce businesses: Businesses selling goods and services online, especially those with international customer bases, can leverage Nala’s platform to simplify cross-border payments and reduce transaction costs.

- Freelancers and remote workers: Individuals working remotely for international clients can use Nala to receive payments efficiently and securely, regardless of their location.

- SMEs and startups: Small and medium-sized enterprises and startups often struggle with traditional payment methods due to high fees and complex processes. Nala provides a more accessible and affordable solution for managing international payments.

- NGOs and charities: Non-profit organizations operating in emerging markets can utilize Nala’s platform to streamline donations and financial transfers, ensuring funds reach beneficiaries efficiently.

- Travel and tourism companies: Businesses in the travel and tourism industry can benefit from Nala’s platform for managing payments from international customers and facilitating cross-border transactions.

Benefits and Value Proposition

Nala’s B2B payment platform offers several key benefits and value propositions to businesses:

- Faster transaction times: Nala’s platform leverages technology to expedite payment processing, reducing waiting times and improving efficiency.

- Lower transaction fees: Compared to traditional payment methods, Nala offers competitive transaction fees, saving businesses money on every transaction.

- Enhanced security: Nala prioritizes security and employs advanced encryption and fraud prevention measures to protect sensitive financial data.

- Transparency and tracking: Businesses can track their payments in real-time, providing greater transparency and control over their finances.

- Multiple payment methods: Nala supports a wide range of payment methods, including bank transfers, mobile money, and debit/credit cards, providing flexibility for businesses and their customers.

Examples of Business Use Cases

Nala’s B2B platform can be utilized in various ways to streamline business operations and reduce costs:

- International e-commerce: An online retailer based in the United States can use Nala to accept payments from customers in Africa, simplifying the payment process and reducing transaction fees.

- Remote workforce payments: A tech company with remote employees in different countries can use Nala to pay their employees securely and efficiently, regardless of their location.

- NGO fundraising: An international NGO can use Nala to collect donations from supporters worldwide, ensuring funds are transferred quickly and securely to beneficiaries.

- Travel booking platform: A travel booking platform can use Nala to facilitate payments from international travelers, simplifying the booking process and reducing payment processing costs.

Technological Considerations and Partnerships: Nala Builds A B2b Payment Platform Too

Nala’s B2B payment platform necessitates a robust technological foundation and strategic partnerships to ensure seamless operation, scalability, and security. This section delves into the technology stack, potential partnerships, and integration capabilities required for Nala’s B2B success.

Technology Stack and Infrastructure

The technology stack for Nala’s B2B platform must be designed to handle high volumes of transactions, ensure data security, and provide a user-friendly interface. Key components include:

- Secure Payment Gateway: A reliable payment gateway is crucial for processing transactions securely and efficiently. This gateway should be PCI DSS compliant and offer robust fraud detection and prevention mechanisms.

- API Integration: Nala’s B2B platform should have well-defined APIs to enable integration with various business systems, such as ERP, CRM, and accounting software. This allows businesses to automate payments and streamline their workflows.

- Scalable Infrastructure: The platform’s infrastructure should be scalable to accommodate increasing transaction volumes and user base. Cloud-based solutions offer flexibility and scalability, allowing for easy expansion as needed.

- Data Security and Compliance: Robust security measures, including encryption, access control, and regular security audits, are essential to protect sensitive financial data. Compliance with relevant regulations, such as GDPR and PCI DSS, is mandatory.

- Real-time Analytics: The platform should provide real-time insights into transaction data, enabling businesses to track performance, identify trends, and make informed decisions.

Potential Partnerships

Strategic partnerships can significantly enhance Nala’s B2B offering and reach a wider audience. Some potential partners include:

- Financial Institutions: Partnerships with banks and other financial institutions can provide access to a wider range of payment methods, currency exchange services, and regulatory compliance expertise.

- Software Providers: Collaborating with ERP, CRM, and accounting software providers allows Nala’s platform to seamlessly integrate with existing business systems, simplifying adoption and enhancing user experience.

- Technology Companies: Partnerships with technology companies specializing in areas like data analytics, fraud detection, and security can enhance the platform’s capabilities and provide valuable insights.

- Industry Associations: Joining industry associations and collaborating with other players in the B2B payments space can facilitate knowledge sharing, network expansion, and industry best practices.

Integration with Existing Business Systems

Nala’s B2B platform should be designed to integrate seamlessly with existing business systems, such as:

- ERP (Enterprise Resource Planning) Systems: Integration with ERP systems allows businesses to automate invoice processing, payment reconciliation, and other financial tasks, streamlining workflows and reducing manual effort.

- CRM (Customer Relationship Management) Systems: Integrating with CRM systems enables businesses to manage customer accounts, track payment history, and provide personalized customer service experiences.

- Accounting Software: Seamless integration with accounting software simplifies financial reporting, reconciliation, and analysis, providing businesses with a comprehensive view of their financial operations.

Nala’s foray into the B2B payment space marks a significant milestone in its growth trajectory. With its innovative platform, Nala is poised to become a leading player in the B2B payment landscape, empowering businesses to streamline their operations and reduce costs. The platform’s ability to facilitate secure and efficient cross-border transactions holds immense potential for businesses operating in a globalized economy. As Nala continues to expand its reach and refine its B2B offering, it will undoubtedly shape the future of B2B payments, creating a more connected and efficient business world.

Nala’s new B2B payment platform is all about making business transactions smoother and more efficient. But it’s not just about streamlining payments; it’s about empowering businesses to thrive in an increasingly digital world. This is especially important considering the Biden administration’s recent push for net neutrality restoration, which argues will increase online free speech and create a more equitable digital landscape.

By removing barriers to access and information, Nala’s platform can help businesses of all sizes reach their full potential in this new era of digital freedom.

Standi Techno News

Standi Techno News