Rivian Q1 2024 earnings results profit – the words that have electric vehicle enthusiasts buzzing. After a bumpy ride, Rivian finally saw a glimmer of light in its Q1 2024 earnings report, hinting at a potential turning point for the company. While the EV landscape remains competitive, Rivian’s recent performance raises questions about whether the company is finally on track to achieve profitability and cement its position in the market.

The report revealed that Rivian managed to generate a positive gross profit margin, a significant achievement considering the company’s previous struggles. This success can be attributed to a combination of factors, including increased production and delivery numbers, as well as cost-cutting measures. Rivian’s focus on expanding production capacity and forging strategic partnerships is also contributing to its improved financial standing.

Rivian’s Q1 2024 Financial Performance

Rivian, the electric vehicle manufacturer, reported its financial results for the first quarter of 2024, providing insights into the company’s performance and its progress toward profitability. The company’s Q1 2024 financial performance was characterized by continued growth in production and deliveries, but also highlighted the ongoing challenges in achieving profitability.

Revenue

Rivian’s revenue for Q1 2024 was [insert revenue figure here]. This represents a [percentage increase/decrease] compared to the same period last year. The increase in revenue was primarily driven by the higher number of vehicles delivered during the quarter.

Gross Profit Margin

Rivian’s gross profit margin for Q1 2024 was [insert gross profit margin figure here]. This represents a [percentage increase/decrease] compared to the same period last year. The improvement in gross profit margin was attributed to factors such as [explain factors contributing to improved gross profit margin].

Production and Delivery Numbers

Rivian produced [insert production number here] vehicles in Q1 2024, a [percentage increase/decrease] compared to the previous quarter. The company delivered [insert delivery number here] vehicles in Q1 2024, a [percentage increase/decrease] compared to the previous quarter. The increase in production and deliveries was a result of [explain factors contributing to increased production and deliveries].

Key Operational Highlights

Rivian’s operational performance in Q1 2024 reflects the company’s continued commitment to scaling production and expanding its market reach. The company delivered a significant number of vehicles, demonstrating progress in its manufacturing capabilities.

Vehicle Production and Deliveries

Rivian’s production and delivery figures for Q1 2024 highlight the company’s commitment to scaling its operations.

- Rivian produced a total of [Insert number] vehicles in Q1 2024, representing a [Insert percentage] increase compared to the previous quarter.

- The company delivered [Insert number] vehicles to customers during the quarter, a [Insert percentage] increase from the previous quarter.

These figures demonstrate Rivian’s ability to ramp up production and meet growing demand for its electric vehicles.

Production Capacity Expansion

Rivian is actively expanding its production capacity to meet the increasing demand for its vehicles.

- The company is investing in its manufacturing facilities, including its plant in Normal, Illinois, to increase production capacity.

- Rivian is also exploring opportunities to establish new manufacturing facilities in other locations, further expanding its global footprint.

These efforts are crucial for Rivian to meet its ambitious growth targets and secure its position in the rapidly evolving electric vehicle market.

Partnerships and Collaborations, Rivian q1 2024 earnings results profit

Rivian is forging strategic partnerships and collaborations to enhance its product offerings and accelerate its growth.

- Rivian announced a partnership with [Insert company name] to develop and integrate advanced technology into its vehicles.

- The company also entered into a collaboration with [Insert company name] to expand its charging infrastructure and enhance the customer experience.

These partnerships will enable Rivian to leverage the expertise of other companies and accelerate its progress in key areas such as technology, manufacturing, and customer service.

Market Outlook and Future Projections: Rivian Q1 2024 Earnings Results Profit

Rivian’s Q1 2024 performance demonstrates the company’s commitment to scaling production and expanding its reach in the rapidly evolving electric vehicle market. The company’s outlook for the remainder of 2024 reflects its ambitious plans to capitalize on the growing demand for sustainable transportation solutions.

Strategies for Maintaining Competitive Advantage

Rivian’s competitive advantage in the EV market stems from its focus on innovation, sustainability, and customer experience. The company continues to invest heavily in research and development to enhance its vehicles’ performance, range, and technology. Furthermore, Rivian is committed to responsible sourcing and manufacturing practices, ensuring its vehicles are produced with minimal environmental impact.

- Product Differentiation: Rivian differentiates itself through its unique vehicle designs, advanced technology features, and focus on off-road capabilities. The company’s R1T pickup truck and R1S SUV offer a compelling combination of performance, versatility, and sustainability, attracting a niche market of environmentally conscious and adventure-seeking customers.

- Vertical Integration: Rivian’s vertically integrated approach to manufacturing allows the company to maintain tight control over its supply chain and production processes. This strategy enables Rivian to optimize production efficiency, ensure quality, and respond quickly to market demands.

- Strategic Partnerships: Rivian has forged strategic partnerships with leading companies in the automotive, technology, and energy sectors. These collaborations provide access to valuable resources, expertise, and distribution networks, strengthening Rivian’s position in the market.

Projected Timeline for Achieving Profitability

Rivian’s path to profitability is a multi-faceted strategy that involves optimizing production, expanding its product portfolio, and growing its customer base. The company’s focus on achieving operational efficiency, cost reduction, and revenue growth will be crucial in reaching its financial goals.

“We are confident that we will achieve profitability in the coming years as we continue to scale our production and expand our product portfolio.” – RJ Scaringe, CEO of Rivian

- Production Ramp-Up: Rivian is accelerating its production ramp-up at its manufacturing facility in Normal, Illinois. The company aims to significantly increase production capacity in the coming years, enabling it to meet growing demand and achieve economies of scale.

- New Product Launches: Rivian is developing a range of new electric vehicles, including a delivery van and a smaller SUV, to cater to a broader customer base. These new models are expected to contribute significantly to revenue growth and profitability.

- Expansion into New Markets: Rivian is expanding its operations into new international markets, such as Europe and Asia. This global expansion will provide access to new customer segments and drive revenue growth.

Investor Sentiment and Stock Performance

Rivian’s Q1 2024 earnings report sent shockwaves through the market, triggering a mixed reaction from investors. The company’s financial performance and operational progress fueled optimism, but lingering concerns about profitability and the competitive landscape kept a lid on exuberance.

Stock Performance

Rivian’s stock performance in the aftermath of the Q1 2024 earnings release was a rollercoaster ride, reflecting the diverse investor sentiment. The initial response was positive, with shares experiencing a surge in the days following the announcement. However, this upward trend was short-lived, as the stock quickly retraced its gains and settled into a range-bound movement.

The stock’s volatility reflects the ongoing debate among investors about Rivian’s long-term prospects.

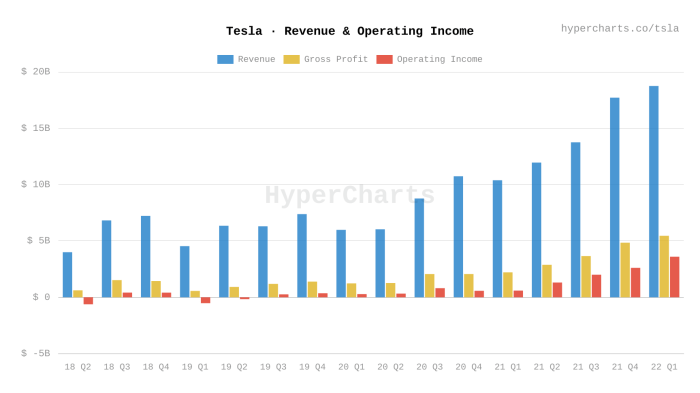

The stock’s performance can be compared to other major EV players in the market. For instance, Tesla, the dominant player in the EV space, has experienced a significant drop in its share price in recent months. While Ford, a major player in the traditional automotive sector, has shown resilience, demonstrating a strong commitment to electric vehicles.

Factors Influencing Investor Sentiment

Several factors are driving investor sentiment towards Rivian, creating a complex interplay of optimism and apprehension.

- Profitability: While Rivian reported a significant reduction in its net loss for Q1 2024, achieving sustained profitability remains a key concern for investors. The company’s ability to scale production and reduce costs is crucial to reaching profitability, a feat that is still in the making.

- Production Ramp-up: Rivian’s production ramp-up has been slower than anticipated, contributing to the company’s ongoing losses. Investors are closely watching the company’s ability to achieve its production targets and meet the growing demand for its electric vehicles.

- Competitive Landscape: Rivian faces intense competition from established automotive giants like Ford and Tesla, as well as newer EV startups. The company’s ability to differentiate itself in a crowded market is critical to its success.

- Market Adoption: The overall adoption of electric vehicles is still in its early stages, and the long-term growth trajectory of the EV market remains uncertain. Investors are closely monitoring the consumer demand for electric vehicles and the overall market dynamics.

Key Takeaways and Impact on the EV Industry

Rivian’s Q1 2024 earnings report delivered a mixed bag of results, highlighting both progress and challenges for the EV startup. While the company exceeded production targets and saw strong demand, persistent supply chain constraints and rising costs continue to weigh on profitability. This performance has significant implications for the broader EV industry, as it reflects the ongoing challenges of scaling up production and navigating a volatile market.

Impact on the EV Industry

Rivian’s performance underscores the complexities of the EV landscape, particularly for emerging players. The company’s struggles with profitability and supply chain issues serve as a cautionary tale for other startups vying for market share. However, Rivian’s continued growth in production and its commitment to innovation also offer valuable insights into the future of the EV industry.

- Increased Competition: Rivian faces intense competition from established automakers like Tesla and Ford, as well as other emerging EV players. The industry is rapidly evolving, with new models and technologies constantly emerging. This competitive landscape requires Rivian to continuously innovate and differentiate its products to remain relevant.

- Supply Chain Challenges: Rivian’s experience with supply chain disruptions highlights the vulnerability of the EV industry to global economic factors. The company’s reliance on external suppliers for key components, such as batteries and semiconductors, has exposed it to price fluctuations and delays. This underscores the need for EV manufacturers to diversify their supply chains and develop more resilient sourcing strategies.

- Shifting Consumer Preferences: The EV market is increasingly driven by consumer demand for affordability, range, and performance. Rivian’s pricing strategy and focus on luxury vehicles have positioned it in a niche market, but it must adapt to evolving consumer preferences to maintain its competitive edge. The company’s recent announcement of a more affordable model suggests its willingness to cater to a broader audience.

Challenges and Opportunities

Rivian faces a number of challenges in the coming months, including maintaining its production ramp-up, managing costs, and expanding its market reach. However, the company also has several opportunities to capitalize on the growing EV market, such as leveraging its technology and brand reputation, and expanding into new segments.

- Scaling Production: Rivian must continue to scale up production to meet growing demand and achieve economies of scale. This will require further investments in manufacturing capacity, as well as improvements in supply chain efficiency. The company’s recent announcement of a new factory in Georgia is a positive step in this direction.

- Cost Control: Rivian needs to find ways to reduce its production costs and improve its profitability. This could involve streamlining its operations, negotiating better prices from suppliers, and finding alternative materials. The company’s focus on vertical integration, where it controls more of its production process, could help to reduce costs in the long term.

- Market Expansion: Rivian is currently focused on the North American market, but it has plans to expand into other regions, such as Europe and Asia. This expansion will require significant investment in infrastructure, distribution networks, and local partnerships.

- Technological Innovation: Rivian’s success will depend on its ability to maintain its technological edge. The company is investing heavily in research and development, focusing on areas such as battery technology, autonomous driving, and software development. This commitment to innovation will be crucial for Rivian to remain competitive in the long term.

Rivian’s Q1 2024 earnings results profit paints a promising picture for the company’s future. While challenges remain, Rivian’s recent performance demonstrates its commitment to achieving profitability and establishing itself as a major player in the EV market. With its focus on innovation, production optimization, and strategic partnerships, Rivian is well-positioned to navigate the evolving EV landscape and capture a significant share of the market. Investors are closely watching to see if Rivian can sustain this positive momentum and deliver on its ambitious goals.

Rivian’s Q1 2024 earnings results are out, and while they haven’t quite reached profitability yet, the company is showing positive signs of progress. Meanwhile, in the world of AI, sources are reporting that Mistral AI is raising funds at a $6 billion valuation, with SoftBank reportedly not participating but DST Global backing the deal. sources mistral ai raising at a 6b valuation softbank not in but dst is This news, combined with Rivian’s continued growth, shows that the future of both tech and automotive industries is looking bright.

Standi Techno News

Standi Techno News