Sec account hacked sharing unauthorized tweet regarding bitcoin spot etf – SEC Account Hacked: Unauthorized Bitcoin Spot ETF Tweet – Imagine a scenario where the U.S. Securities and Exchange Commission (SEC), the very institution tasked with safeguarding our financial markets, falls victim to a cyberattack. What happens when hackers gain access to their official account and unleash a flurry of unauthorized tweets, including one about the highly anticipated Bitcoin spot ETF? This incident throws a spotlight on the vulnerabilities of even the most prominent institutions and the potential for chaos in the digital age.

This hypothetical scenario is a stark reminder of the evolving threats facing our financial systems. It forces us to question the security measures in place, the potential impact on investor trust, and the implications for the burgeoning Bitcoin spot ETF landscape. The unauthorized tweet could have sparked a wave of market volatility, manipulated public opinion, and potentially even influenced the SEC’s decision-making process regarding the ETF application.

Imagine the chaos if a tweet from the Securities and Exchange Commission (SEC) announced the approval of a Bitcoin spot ETF, sending shockwaves through the crypto market. This scenario, although fictional, highlights the potential havoc that could be unleashed by a hacked SEC account.

Unauthorized tweets from a high-profile organization like the SEC can have far-reaching consequences, affecting market sentiment, investor confidence, and even the legal landscape.

Potential Market Manipulation and Investor Confusion

The unauthorized release of information about a Bitcoin spot ETF could significantly impact the market.

- If the tweet suggested approval, the price of Bitcoin could skyrocket as investors rush to buy, creating a frenzy and potentially causing a market bubble.

- Conversely, if the tweet hinted at disapproval, Bitcoin’s price could plummet, leading to panic selling and losses for investors.

This kind of manipulation could leave investors confused and vulnerable, making them susceptible to market manipulation and financial losses.

Examples of Similar Incidents

History offers examples of similar incidents that highlight the potential for chaos.

- In 2013, a fake tweet from the Associated Press announced an explosion at the White House, causing a brief but sharp drop in the stock market. This incident illustrated the power of social media to spread misinformation and influence market sentiment.

- In 2017, a series of tweets from the official Twitter account of the Associated Press were hacked, spreading misinformation about a bomb attack in the White House, leading to a significant drop in the Dow Jones Industrial Average.

These incidents demonstrate the potential for a hacked SEC account to trigger similar market disruptions and investor uncertainty.

Legal Ramifications

The legal consequences of an unauthorized tweet from the SEC could be significant for both the individual responsible for the hack and the SEC itself.

- The individual could face charges of hacking, unauthorized access, and potentially market manipulation, leading to substantial fines and imprisonment.

- The SEC could face lawsuits from investors who suffered losses due to the misinformation spread by the hacked account. The agency could also face reputational damage and public scrutiny for its failure to protect its digital assets.

The potential legal ramifications underscore the seriousness of the situation and the need for robust cybersecurity measures to prevent such incidents.

Security Measures and Prevention

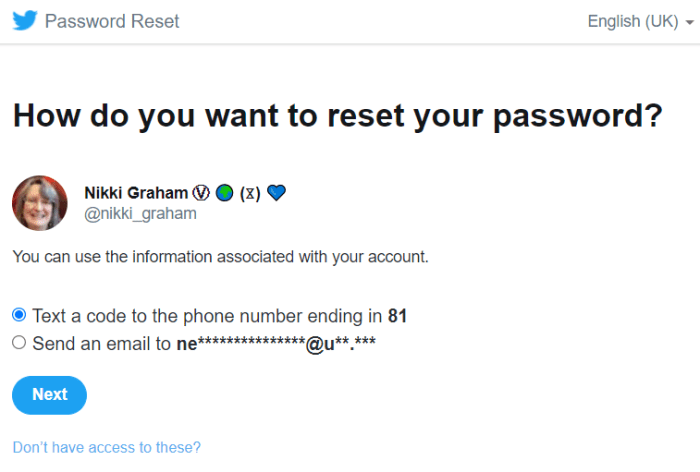

The unauthorized tweet regarding a Bitcoin spot ETF, attributed to the SEC, highlights the urgent need for robust security measures to protect government agencies from similar breaches. Implementing a comprehensive approach that addresses both technical and human vulnerabilities is crucial.

Multi-Factor Authentication and Robust Security Protocols

Multi-factor authentication (MFA) adds an extra layer of security to accounts by requiring users to provide multiple forms of identification, such as a password and a one-time code sent to their phone. This significantly reduces the risk of unauthorized access, even if a password is compromised.

- Implementing MFA for all SEC accounts, including those used for social media platforms, is a fundamental step toward enhancing security.

- The SEC should also adopt other robust security protocols, such as regularly updating software and using strong, unique passwords for each account.

- Regular security audits should be conducted to identify vulnerabilities and ensure that existing protocols are effective.

Security Audit Process

A comprehensive security audit process for SEC accounts should be conducted regularly to assess the effectiveness of existing security measures and identify potential vulnerabilities. The audit should encompass:

- Account Access Review: A thorough examination of all user accounts, including permissions, access logs, and recent activity, to identify any suspicious patterns or unauthorized access.

- Network Security Assessment: Evaluating the security of the SEC’s network infrastructure, including firewalls, intrusion detection systems, and other security measures, to identify any weaknesses that could be exploited.

- Social Media Security Review: Analyzing the security of SEC social media accounts, including authentication protocols, account settings, and content moderation practices, to ensure they comply with best practices and mitigate risks.

- Vulnerability Scanning: Using automated tools to identify and assess potential security vulnerabilities in the SEC’s systems, applications, and network infrastructure.

- Penetration Testing: Simulating real-world attacks to identify and exploit vulnerabilities in the SEC’s security posture. This provides a realistic assessment of the effectiveness of existing security measures and helps identify areas for improvement.

Cybersecurity Awareness Training

Investing in cybersecurity awareness training for SEC employees is essential to equip them with the knowledge and skills needed to protect sensitive information and prevent breaches.

- Training should cover topics such as recognizing phishing attempts, understanding social engineering tactics, and implementing best practices for password management and data security.

- Regular cybersecurity awareness training sessions, combined with ongoing communication about emerging threats and best practices, can significantly reduce the risk of human error and enhance the overall security posture of the SEC.

The Bitcoin Spot ETF Landscape

The Bitcoin spot ETF landscape is a complex and rapidly evolving one, with significant regulatory hurdles and a wide range of stakeholders vying for influence. This section explores the key aspects of this landscape, including the regulatory environment, arguments for and against approval, and the key players involved.

Regulatory Landscape

The regulatory landscape for Bitcoin spot ETFs varies significantly across different countries. While the United States has been particularly cautious, other countries have embraced the idea more readily.

- United States: The Securities and Exchange Commission (SEC) has been hesitant to approve Bitcoin spot ETFs, citing concerns about market manipulation, investor protection, and the lack of a robust regulatory framework for the underlying asset. Several applications have been filed and subsequently rejected or withdrawn. However, the SEC has approved Bitcoin futures ETFs, which track the price of Bitcoin futures contracts traded on regulated exchanges.

- Canada: Canada was the first country to approve a Bitcoin spot ETF, with Purpose Bitcoin ETF launching in February 2021. Since then, several other Bitcoin spot ETFs have been approved in Canada, reflecting a more favorable regulatory environment.

- Europe: The European Union (EU) is developing a comprehensive regulatory framework for crypto assets, including Bitcoin spot ETFs. However, the regulatory landscape is still evolving, and there is no clear consensus on the approval of such products.

- Other Countries: Several other countries, including Australia, Brazil, and Hong Kong, have also seen the emergence of Bitcoin spot ETFs. The regulatory approach in these countries varies, but generally reflects a greater willingness to embrace the potential of Bitcoin and other cryptocurrencies.

Arguments for and Against Approval

The debate surrounding the approval of Bitcoin spot ETFs centers on a range of arguments, both for and against.

- Arguments for Approval: Proponents of Bitcoin spot ETFs argue that they would provide investors with a safe and regulated way to invest in Bitcoin, increasing market liquidity and attracting institutional investors. They also contend that the approval of Bitcoin spot ETFs would contribute to the overall legitimacy and mainstream adoption of Bitcoin.

- Arguments Against Approval: Opponents of Bitcoin spot ETFs express concerns about market manipulation, investor protection, and the potential for volatility in the underlying asset. They argue that the lack of a robust regulatory framework for Bitcoin creates significant risks for investors and could lead to market instability.

Key Players

The Bitcoin spot ETF debate involves a diverse range of stakeholders, each with their own perspectives and interests.

- Regulators: The SEC, as the primary regulator of securities in the United States, plays a critical role in determining the fate of Bitcoin spot ETFs. Their decisions are based on their assessment of market risks, investor protection, and the regulatory framework for the underlying asset.

- Investors: Investors, both institutional and retail, are eager to gain exposure to Bitcoin through regulated investment products. The approval of Bitcoin spot ETFs would provide them with a convenient and transparent way to invest in the cryptocurrency.

- Industry Participants: Bitcoin miners, exchanges, and other industry participants have a vested interest in the success of Bitcoin spot ETFs. They see these products as a catalyst for greater adoption and liquidity in the Bitcoin market.

The application process for Bitcoin spot ETFs has been marked by a series of significant events, highlighting the ongoing debate and the evolving regulatory landscape.

| Date | Event | Outcome |

|---|---|---|

| February 2021 | Purpose Bitcoin ETF launches in Canada | First Bitcoin spot ETF approved globally |

| October 2021 | ProShares Bitcoin Strategy ETF launches in the United States | First Bitcoin futures ETF approved in the United States |

| February 2022 | SEC rejects application for a Bitcoin spot ETF from WisdomTree | Rejection based on concerns about market manipulation and investor protection |

| June 2023 | BlackRock files application for a Bitcoin spot ETF | Application under review by the SEC |

Investor Impact and Trust

The unauthorized tweet regarding a Bitcoin spot ETF, falsely attributed to the SEC, could significantly impact investor trust in the agency. This incident raises concerns about the SEC’s cybersecurity protocols and its ability to safeguard sensitive information. It also highlights the potential for misinformation to spread rapidly in the digital age, with the potential to influence financial markets.

The Role of Transparency and Accountability

Transparency and accountability are crucial for maintaining public confidence in financial regulators. When a security breach occurs, the SEC must be transparent about the incident, providing clear and concise information about what happened, the potential impact, and the steps being taken to address the situation.

- Transparency builds trust by demonstrating that the SEC is taking the incident seriously and is committed to protecting investors.

- Accountability involves taking responsibility for the breach and implementing measures to prevent similar incidents from happening in the future.

The Importance of Clear Communication and Timely Updates

In the event of a security breach, the SEC must communicate clearly and effectively with investors. This involves providing timely updates on the situation, including the nature of the breach, the steps being taken to mitigate the damage, and the timeline for restoring security.

- Clear and concise communication helps to alleviate investor anxiety and prevents the spread of misinformation.

- Timely updates demonstrate that the SEC is actively working to resolve the situation and is keeping investors informed.

Strategies for Rebuilding Trust

Rebuilding trust with investors after a security breach requires a multi-pronged approach. The SEC must demonstrate its commitment to cybersecurity by implementing robust security measures, conducting thorough investigations, and holding those responsible accountable.

- Enhanced Cybersecurity Measures: The SEC should invest in advanced cybersecurity technologies and implement comprehensive security protocols to prevent future breaches. This could include multi-factor authentication, regular security audits, and employee training on cybersecurity best practices.

- Independent Investigations: The SEC should conduct a thorough and independent investigation into the unauthorized tweet incident, ensuring that all aspects of the breach are investigated and any potential vulnerabilities are addressed. This investigation should be transparent and publicly available.

- Accountability and Consequences: The SEC should hold those responsible for the breach accountable, whether it involves internal employees or external actors. This could include disciplinary actions, legal proceedings, or other appropriate consequences.

- Public Apology and Commitment: The SEC should publicly apologize to investors for the breach and reiterate its commitment to protecting their interests. This apology should be sincere and accompanied by concrete steps to improve security and prevent future incidents.

The SEC account hack scenario serves as a wake-up call, demanding a thorough examination of cybersecurity protocols and a renewed focus on safeguarding our financial infrastructure. Beyond the immediate fallout, it raises profound questions about the future of financial regulation in the digital age. As we navigate the complexities of a rapidly evolving technological landscape, it’s crucial to ensure that our institutions are equipped to withstand the growing cyber threats and maintain the public’s trust in the integrity of our markets.

Remember that time someone’s SEC account got hacked and they tweeted about a Bitcoin spot ETF? It’s a wild world out there, and it’s a good reminder to be extra careful about your online security. Speaking of wild, did you hear about ButcherBox acquiring Truffle Shuffle ? It’s a pretty big deal in the meat and gourmet food world.

But back to that SEC account hack, the whole thing was a pretty good reminder to be extra vigilant about online security. You never know what’s lurking out there!

Standi Techno News

Standi Techno News