Silence is an early stage climate tech vc fund with 35 million – Silence, a new early-stage climate tech VC fund with $35 million in capital, is poised to make a significant impact on the rapidly growing climate tech landscape. This fund is dedicated to investing in innovative startups tackling some of the most pressing environmental challenges, from renewable energy to sustainable agriculture.

The fund’s focus on early-stage companies reflects the belief that the most transformative solutions often emerge from nascent ventures. By providing crucial capital and mentorship, Silence aims to empower these startups to scale their solutions and accelerate the transition to a more sustainable future.

Silence as a VC Fund

Silence is a venture capital firm that focuses on early-stage climate tech companies. Their investment strategy is based on identifying and supporting companies that are developing innovative solutions to address the climate crisis. Silence believes that by investing in these companies, they can help accelerate the transition to a more sustainable future.

Investment Strategy

Silence’s investment strategy is focused on identifying and supporting early-stage climate tech companies that are developing innovative solutions to address the climate crisis. The firm has a team of experienced investors with a deep understanding of the climate tech sector. They use this expertise to identify companies with the potential to make a significant impact on the fight against climate change.

Fund Size

The $35 million fund size is significant in the context of early-stage climate tech investments. It allows Silence to invest in a portfolio of companies across a range of sectors, including renewable energy, energy storage, sustainable agriculture, and carbon capture. This diversified approach allows Silence to capitalize on the growing opportunities in the climate tech space.

Potential Impact

Silence’s investments have the potential to make a significant impact on the climate tech landscape. By providing capital and support to early-stage companies, Silence can help these businesses scale their operations and bring their innovative solutions to market. This can lead to the development of new technologies and solutions that can help reduce greenhouse gas emissions and mitigate the effects of climate change.

Climate Tech Investment Trends: Silence Is An Early Stage Climate Tech Vc Fund With 35 Million

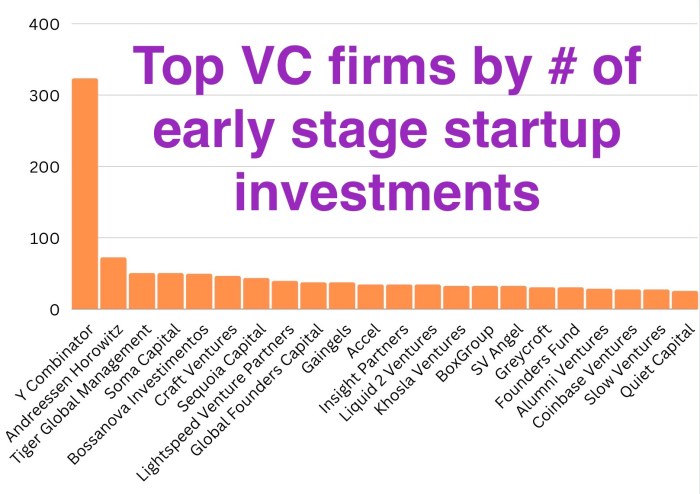

The climate tech sector is experiencing explosive growth, attracting significant investment from venture capitalists eager to back innovative solutions tackling the global climate crisis. While the landscape is constantly evolving, several key trends are shaping the direction of climate tech investments.

Areas of Focus

Climate tech investments are increasingly concentrated in specific areas that address key aspects of the climate challenge. These areas include:

- Renewable Energy: Investments in solar, wind, and other renewable energy technologies continue to dominate the climate tech landscape. This area includes companies developing new technologies, improving existing ones, and creating innovative business models for renewable energy adoption.

- Energy Storage: As the transition to renewable energy accelerates, the need for efficient and cost-effective energy storage solutions becomes crucial. Investments in battery technology, pumped hydro, and other storage solutions are rapidly growing.

- Carbon Capture and Removal: Companies developing technologies to capture and remove carbon dioxide from the atmosphere are attracting significant attention. These solutions are crucial for mitigating existing emissions and achieving net-zero goals.

- Sustainable Agriculture: Investments in sustainable agriculture technologies are gaining traction as investors seek to address the environmental impact of traditional farming practices. These technologies include precision agriculture, vertical farming, and alternative protein sources.

- Green Building and Infrastructure: The demand for sustainable building materials, energy-efficient construction practices, and smart infrastructure solutions is driving investments in this sector.

Emerging Technologies

Climate tech is a dynamic field, and emerging technologies are constantly pushing the boundaries of what’s possible. Some of the most exciting areas include:

- Artificial Intelligence (AI): AI is being applied to optimize energy efficiency, improve renewable energy forecasting, and develop new carbon capture technologies.

- Blockchain: Blockchain technology is being explored for its potential to track carbon emissions, facilitate carbon markets, and create transparent and secure supply chains for sustainable products.

- Biotechnology: Biotechnology is playing a key role in developing sustainable agriculture solutions, such as bio-based materials and engineered crops.

- Geothermal Energy: Geothermal energy is gaining traction as a reliable and sustainable source of baseload power.

Silence’s Investment Strategy

Silence’s investment strategy distinguishes itself from other climate tech VC funds in several ways.

- Early-Stage Focus: Silence is committed to investing in early-stage companies with disruptive technologies and strong potential for impact.

- Global Reach: Silence invests in companies across the globe, seeking out innovative solutions from diverse markets.

- Cross-Sectoral Approach: Silence takes a cross-sectoral approach to climate tech investing, identifying opportunities across various industries.

- Impact-Driven: Silence prioritizes investments in companies with a strong commitment to positive environmental and social impact.

Challenges and Opportunities for Early-Stage Companies

Early-stage climate tech companies face a unique set of challenges and opportunities in seeking funding.

- Competition: The climate tech sector is highly competitive, with numerous startups vying for investor attention.

- Long-Term Impact: Climate tech solutions often require significant time and resources to develop and scale, presenting a challenge for investors seeking quick returns.

- Regulatory Landscape: The regulatory environment for climate tech is constantly evolving, creating uncertainty for startups.

- Market Adoption: Gaining market adoption for climate tech solutions can be challenging, especially for disruptive technologies.

- Access to Capital: Early-stage climate tech companies often struggle to access sufficient capital, especially in comparison to other sectors.

The Role of Early-Stage Funding

Early-stage funding is crucial for climate tech startups, acting as the lifeblood that fuels their growth and innovation. It provides the financial resources necessary to develop and test their solutions, allowing them to navigate the complex and often challenging landscape of climate change mitigation and adaptation.

The Impact of Silence’s Investments

Silence’s investments play a pivotal role in accelerating the development and adoption of innovative climate solutions. By providing capital to early-stage startups, Silence enables them to:

- Develop and refine their technologies: Early-stage funding allows startups to invest in research and development, refine their technologies, and build prototypes. This is essential for testing and validating the efficacy of their solutions.

- Build their teams and infrastructure: Startups require talented individuals to bring their ideas to life. Early-stage funding helps them recruit and retain skilled engineers, scientists, and business professionals, building a strong foundation for growth.

- Scale their operations: As startups prove their solutions, they need capital to scale their operations, expand their reach, and meet growing demand. Silence’s investments provide the necessary resources to navigate this critical phase of development.

The Long-Term Impact of Early-Stage Funding

Early-stage funding can have a profound impact on the long-term success of climate tech companies. By providing crucial resources during the formative years, Silence helps startups:

- Secure future funding: Early successes, often driven by early-stage funding, demonstrate the viability and potential of a startup, making it more attractive to later-stage investors. This access to capital enables continued growth and expansion.

- Develop sustainable business models: Early-stage funding allows startups to experiment with different business models and find the most sustainable and impactful approach. This helps them build a foundation for long-term profitability and growth.

- Create lasting impact: Early-stage funding empowers startups to develop and deploy solutions that can have a meaningful and lasting impact on climate change mitigation and adaptation. By supporting innovation at the earliest stages, Silence contributes to the development of a more sustainable future.

The Climate Tech Ecosystem

The climate tech ecosystem is a complex and dynamic network of investors, startups, research institutions, and policymakers working together to develop and deploy solutions to mitigate and adapt to climate change. This ecosystem is essential for driving innovation and scaling up climate-friendly technologies.

Key Players in the Climate Tech Ecosystem

The climate tech ecosystem comprises various players, each playing a critical role in driving innovation and scaling up solutions.

| Role | Examples |

|---|---|

| Investors |

|

| Startups |

|

| Research Institutions |

|

Examples of Successful Climate Tech Startups

Several climate tech startups have successfully raised early-stage funding and developed innovative solutions to address climate change.

- Beyond Meat, a company that produces plant-based meat alternatives, has raised over $1 billion in funding and has become a household name.

- SolarCity, a leading solar panel installer, was acquired by Tesla in 2016 for $2.6 billion.

- Impossible Foods, another company developing plant-based meat alternatives, has raised over $1.5 billion in funding and is rapidly expanding its market reach.

Government Policies and Regulations

Government policies and regulations play a crucial role in supporting the growth of the climate tech sector. Governments can incentivize investment in climate tech through tax credits, subsidies, and other financial mechanisms.

- For example, the U.S. government’s Investment Tax Credit (ITC) for solar energy has significantly boosted the solar industry’s growth.

- Similarly, the European Union’s Emissions Trading System (ETS) has encouraged companies to reduce their carbon emissions.

- Government regulations, such as fuel efficiency standards for vehicles and building codes that promote energy efficiency, can also create demand for climate-friendly technologies.

Impact of Climate Tech on Sustainability

Climate tech solutions are essential for achieving global sustainability goals, and Silence is playing a crucial role in driving this change. By investing in innovative companies tackling climate change, Silence is helping to reduce greenhouse gas emissions, mitigate the effects of climate change, and build a more sustainable future.

Contribution of Climate Tech to Sustainability Goals

Climate tech solutions are designed to address the root causes of climate change and promote sustainable practices across various sectors. These solutions contribute to achieving the United Nations Sustainable Development Goals (SDGs), particularly SDG 13 (Climate Action) and SDG 7 (Affordable and Clean Energy).

- Renewable Energy: Climate tech companies are developing advanced technologies for solar, wind, and geothermal energy, reducing reliance on fossil fuels and promoting clean energy sources.

- Energy Efficiency: Innovations in energy efficiency technologies, such as smart grids, building automation, and energy-saving appliances, help reduce energy consumption and minimize waste.

- Carbon Capture and Storage: Climate tech companies are developing technologies to capture and store carbon dioxide emissions from industrial processes, preventing their release into the atmosphere.

- Sustainable Agriculture: Climate tech solutions are being implemented in agriculture to improve water efficiency, reduce fertilizer use, and enhance crop yields, contributing to food security and environmental sustainability.

- Sustainable Transportation: Electric vehicles, autonomous vehicles, and advanced public transportation systems are reducing emissions from the transportation sector and promoting sustainable mobility.

Impact of Silence’s Investments on Climate Change, Silence is an early stage climate tech vc fund with 35 million

Silence’s investments in climate tech companies are expected to have a significant impact on reducing greenhouse gas emissions and mitigating climate change. By supporting early-stage companies developing groundbreaking solutions, Silence is contributing to the development and deployment of technologies that can:

- Reduce carbon footprint: Silence’s portfolio companies are developing technologies that directly reduce greenhouse gas emissions, such as renewable energy generation, energy efficiency solutions, and carbon capture technologies.

- Promote sustainable practices: Silence’s investments are supporting companies that are developing sustainable practices in various sectors, including agriculture, transportation, and manufacturing.

- Drive innovation and adoption: By providing early-stage funding, Silence is helping to accelerate the development and adoption of climate tech solutions, creating a ripple effect across the industry.

Examples of Climate Tech Innovations

Several climate tech innovations are already making a positive impact on the environment:

- Solar Power: Companies like Tesla and Sunrun are leading the way in solar panel manufacturing and installation, enabling homeowners and businesses to generate clean energy.

- Electric Vehicles: Tesla, Rivian, and Lucid Motors are producing electric vehicles with impressive performance and range, reducing transportation emissions.

- Carbon Capture: Companies like Climeworks and Global Thermostat are developing technologies to capture and store carbon dioxide emissions from industrial sources.

- Precision Agriculture: Companies like John Deere and Trimble are using sensors and data analytics to optimize crop yields and reduce water and fertilizer use.

Silence’s commitment to supporting early-stage climate tech companies is a testament to the power of innovation in addressing climate change. By providing critical funding and resources, the fund is helping to nurture the next generation of climate tech leaders, paving the way for a more sustainable and resilient planet.

Silence, a new early-stage climate tech VC fund with $35 million in its coffers, is making waves in the industry. The fund, focused on backing companies tackling climate change, has attracted attention for its commitment to sustainability. This news comes on the heels of Miles Grimshaw leaving Benchmark to rejoin Kushner’s Thrive Capital , a move that could signal a shift in the VC landscape.

While Grimshaw’s move may be unrelated to Silence, it highlights the growing interest in climate tech and the potential for VC funds like Silence to play a significant role in shaping the future of the industry.

Standi Techno News

Standi Techno News