Venture firms form alliance to standardize data collection, a move that could revolutionize the venture capital industry. The current landscape of data collection within venture capital is fragmented, leading to inconsistencies and inefficiencies that hinder effective decision-making. This alliance aims to address these challenges by establishing a standardized framework for collecting and analyzing data from portfolio companies, ultimately enhancing investment strategies and improving portfolio performance.

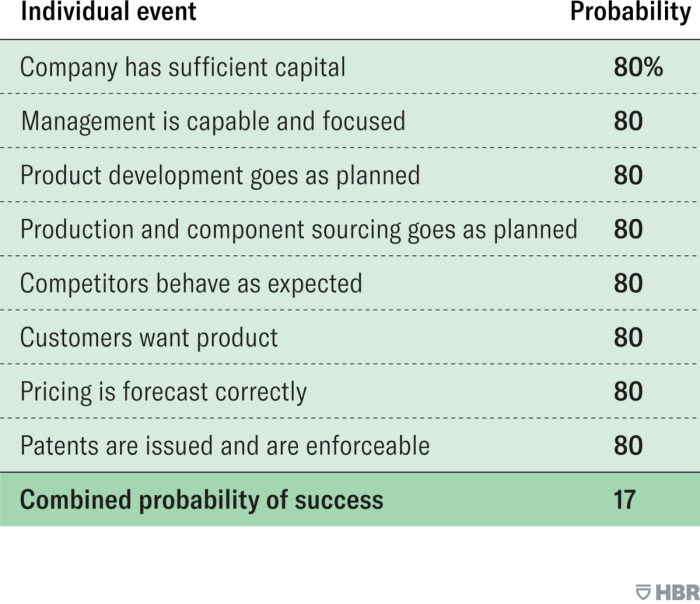

The alliance recognizes the importance of consistent data for informed decision-making in venture capital. By standardizing data collection, venture firms can gain a more comprehensive understanding of their portfolio companies, enabling them to identify trends, assess risks, and make more accurate investment decisions. The standardized framework will also facilitate benchmarking and comparisons across portfolio companies, providing valuable insights for investment analysis and portfolio management.

The Alliance’s Objectives: Venture Firms Form Alliance To Standardize Data Collection

This venture firm alliance aims to revolutionize the way data is collected and utilized within the venture capital industry. By establishing a standardized approach to data collection, the alliance seeks to create a more transparent, efficient, and data-driven ecosystem for both venture firms and portfolio companies.

Standardization of Data Collection Areas, Venture firms form alliance to standardize data collection

The alliance will focus on standardizing data collection across several key areas. These areas include:

- Financial Data: This encompasses critical metrics like revenue, expenses, profitability, and cash flow. Standardizing financial data will enable venture firms to compare portfolio companies more effectively and make more informed investment decisions.

- Operational Data: This includes metrics like customer acquisition cost, customer lifetime value, and key performance indicators (KPIs) related to product development, marketing, and sales. Standardizing operational data will provide a comprehensive view of a company’s performance and growth potential.

- Team Data: This includes information about the company’s founders, management team, and key employees, including their experience, expertise, and track records. Standardizing team data will help venture firms assess the quality and experience of the team driving the company’s success.

- Market Data: This includes information about the company’s target market, market size, growth potential, and competitive landscape. Standardizing market data will allow venture firms to better understand the company’s potential for growth and profitability within its industry.

Key Metrics and Data Points

The alliance will focus on a set of key metrics and data points that are essential for investment analysis. These metrics include:

- Annual Recurring Revenue (ARR): This metric is crucial for SaaS and subscription-based businesses, indicating the recurring revenue generated from existing customers. A high ARR demonstrates strong customer retention and a predictable revenue stream.

- Customer Acquisition Cost (CAC): This metric measures the cost of acquiring a new customer. A lower CAC indicates efficient marketing and sales strategies, contributing to profitability.

- Customer Lifetime Value (CLTV): This metric reflects the total revenue a company expects to generate from a single customer over their relationship with the business. A higher CLTV suggests strong customer loyalty and repeat business.

- Burn Rate: This metric represents the rate at which a company is spending its cash reserves. A controlled burn rate is essential for startups to manage their cash flow and extend their runway.

Benefits of Standardized Data Collection

Standardized data collection offers numerous benefits for both venture firms and portfolio companies.

Benefits for Venture Firms

- Improved Investment Decision-Making: By standardizing data collection, venture firms can gain a more accurate and consistent understanding of portfolio companies, enabling better investment decisions.

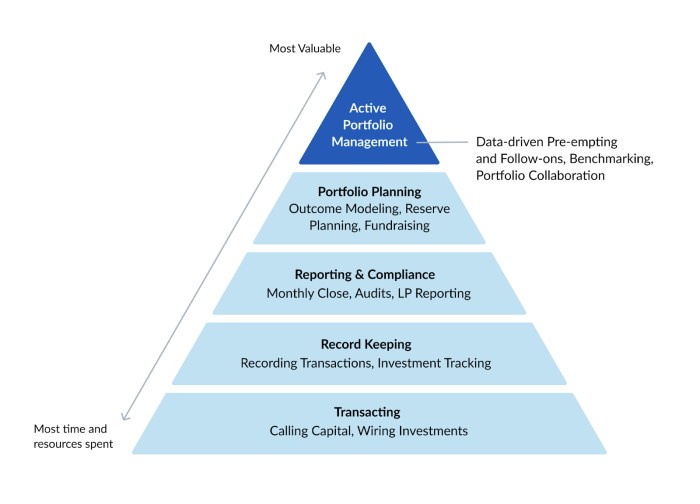

- Enhanced Portfolio Management: Standardized data allows venture firms to track and compare the performance of their portfolio companies more effectively, facilitating proactive portfolio management.

- Increased Transparency: Standardized data collection promotes transparency within the venture capital ecosystem, fostering trust and collaboration between venture firms and portfolio companies.

Benefits for Portfolio Companies

- Streamlined Reporting: Standardized data collection reduces the burden of reporting for portfolio companies, simplifying their reporting processes.

- Improved Fundraising: Consistent data collection enhances a company’s attractiveness to investors, making it easier to secure funding and build relationships with venture firms.

- Enhanced Operations: Standardized data collection can lead to improvements in operational efficiency, as companies gain a clearer understanding of their performance and identify areas for improvement.

Implementation and Adoption

The Alliance is committed to ensuring widespread adoption of the standardized data collection framework by venture firms. This requires a multifaceted approach that addresses both the practical and strategic aspects of implementation.

Strategies for Encouraging Adoption

The Alliance is employing a range of strategies to encourage adoption of the standardized framework by participating venture firms. These strategies include:

- Providing clear benefits and value proposition: The Alliance is highlighting the tangible benefits of adopting the standardized framework, such as improved data quality, enhanced decision-making, and increased efficiency. This includes showcasing success stories from early adopters and providing data-driven evidence of the framework’s effectiveness.

- Facilitating knowledge sharing and collaboration: The Alliance is fostering a collaborative environment where venture firms can share best practices, learn from each other’s experiences, and overcome common challenges. This includes organizing workshops, webinars, and online forums where participants can discuss implementation strategies and share insights.

- Offering technical support and resources: The Alliance is providing technical support and resources to help venture firms implement the standardized framework. This includes offering guidance on data integration, system configuration, and data analysis. The Alliance is also developing a comprehensive toolkit that includes templates, guidelines, and best practices for implementing the framework.

- Building a strong network of advocates: The Alliance is working to build a strong network of advocates who can champion the standardized framework within their respective firms and industry. This includes engaging key stakeholders, such as CEOs, CIOs, and data analysts, and providing them with the necessary information and resources to support the adoption process.

Supporting Implementation

The Alliance is actively supporting venture firms in implementing the standardized framework and integrating it into their existing systems. This includes:

- Developing customized implementation plans: The Alliance is working with participating venture firms to develop customized implementation plans that take into account their specific needs and circumstances. This includes assessing their current data collection practices, identifying areas for improvement, and developing a phased implementation strategy.

- Providing training and mentorship: The Alliance is offering training programs and mentorship opportunities to help venture firm personnel develop the skills and knowledge needed to effectively implement and utilize the standardized framework. This includes training on data collection techniques, data analysis methods, and best practices for data governance.

- Facilitating data integration and system interoperability: The Alliance is working to ensure that the standardized framework is compatible with existing data systems and platforms used by venture firms. This includes developing data mapping tools, providing guidance on data migration strategies, and fostering collaboration between technology providers and venture firms.

Addressing Challenges and Barriers

The adoption of any new framework can face challenges and barriers. The Alliance recognizes these potential obstacles and is developing strategies to overcome them. Some common challenges include:

- Resistance to change: Some venture firms may be resistant to adopting a new data collection framework due to concerns about disruption to existing processes or the need for significant investment. The Alliance is addressing this challenge by demonstrating the clear benefits of the standardized framework and providing comprehensive support to facilitate a smooth transition.

- Lack of resources: Some venture firms may lack the resources, such as personnel or technology, to effectively implement the standardized framework. The Alliance is working to address this challenge by providing financial assistance, technical support, and access to a network of experienced professionals.

- Data privacy and security concerns: Venture firms may have concerns about data privacy and security when adopting a standardized framework. The Alliance is addressing these concerns by ensuring that the framework is compliant with relevant data privacy regulations and by providing guidance on data security best practices.

- Interoperability issues: The standardized framework may not be compatible with all existing data systems and platforms used by venture firms. The Alliance is working to address this challenge by developing data mapping tools, providing guidance on data migration strategies, and fostering collaboration between technology providers and venture firms.

The venture firm alliance’s initiative to standardize data collection marks a significant step towards improving the efficiency and effectiveness of the venture capital industry. By promoting consistent data collection practices, the alliance aims to create a more transparent and data-driven investment environment, benefiting both venture firms and portfolio companies. The potential impact of this initiative extends beyond improved investment decision-making, as it could lead to greater collaboration and knowledge sharing within the industry, ultimately fostering innovation and growth within the venture capital ecosystem.

Imagine a future where venture firms work together to create a universal language for data collection, making analysis and insights flow seamlessly. This is the dream behind the new alliance, aiming to streamline the process and unlock new possibilities. But what about the data itself? How do we ensure its preservation for generations to come? That’s where fahrenheit 2451 helps preserve data for all time comes in, offering robust solutions to safeguard our digital legacy.

By standardizing data collection and ensuring its longevity, we pave the way for a future where insights are readily available and progress is fueled by the collective knowledge of humanity.

Standi Techno News

Standi Techno News