Riverwood capital closes 1 8b fund says opportunity in latam has never been greater – Riverwood Capital Closes $1.8B Fund: Opportunity in Latin America Has Never Been Greater – a bold statement, but one backed by solid evidence. Riverwood, a leading private equity firm specializing in Latin America, has just closed a massive $1.8 billion fund, a testament to their unwavering belief in the region’s potential. This move signals a significant shift in the investment landscape, with Riverwood poised to capitalize on the region’s burgeoning growth and untapped opportunities.

This new fund reflects a growing trend of investors recognizing the enormous potential of Latin America. The region boasts a young and rapidly growing population, a diverse and dynamic economy, and a wealth of untapped resources. With its strategic focus on high-growth sectors like technology, consumer goods, and healthcare, Riverwood is well-positioned to identify and invest in companies poised for exponential growth.

Riverwood Capital’s Investment Strategy

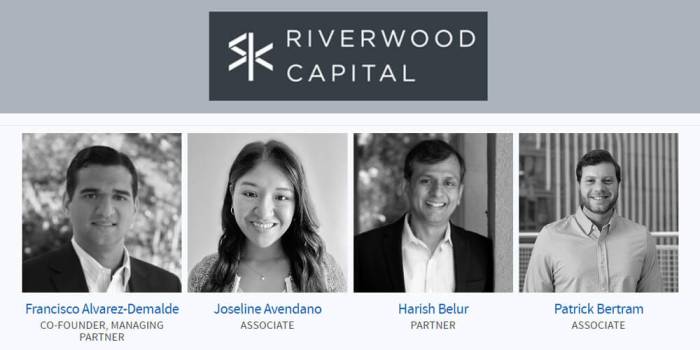

Riverwood Capital, a leading private equity firm, has announced the closing of its latest fund, raising $1.8 billion to invest in Latin America. This significant capital commitment highlights the firm’s unwavering belief in the region’s transformative growth potential. Riverwood’s strategy is driven by a deep understanding of the Latin American market, a seasoned team of investment professionals, and a proven track record of successful investments.

Riverwood Capital’s Focus on Latin America

Riverwood Capital’s investment strategy is centered on Latin America, a region that the firm sees as brimming with untapped potential. The firm’s focus on this region is driven by several key factors:

* Rapid Economic Growth: Latin America has witnessed substantial economic growth in recent years, fueled by rising consumer spending, technological advancements, and a growing middle class.

* Favorable Demographics: The region boasts a young and expanding population, which translates into a burgeoning workforce and a strong consumer base.

* Strategic Location: Latin America’s proximity to major markets in North America and Europe makes it an attractive hub for businesses seeking to expand their global reach.

* Government Support: Many Latin American governments are actively promoting economic development through policies aimed at attracting foreign investment and fostering innovation.

* Digital Transformation: The rapid adoption of digital technologies is revolutionizing industries across Latin America, creating new opportunities for growth and innovation.

Types of Companies Riverwood Invests In

Riverwood Capital focuses on investing in companies operating in various sectors, including:

* Technology: Riverwood targets technology companies that are leveraging digital innovation to disrupt traditional industries, such as fintech, e-commerce, and software-as-a-service (SaaS).

* Consumer: Riverwood seeks out consumer-facing businesses that are capitalizing on the growing middle class and rising consumer spending in Latin America, such as food and beverage, retail, and healthcare.

* Industrial: Riverwood invests in industrial companies that are benefiting from the region’s infrastructure development and resource extraction activities, such as energy, mining, and manufacturing.

* Financial Services: Riverwood targets financial services companies that are providing innovative solutions to meet the growing demand for financial products and services in Latin America, such as banking, insurance, and asset management.

Riverwood’s Approach to Value Creation

Riverwood Capital takes a hands-on approach to value creation, working closely with its portfolio companies to drive growth and profitability. The firm’s approach involves:

* Strategic Guidance: Riverwood provides strategic guidance to its portfolio companies, helping them develop and execute growth strategies, expand into new markets, and improve operational efficiency.

* Operational Expertise: Riverwood leverages its deep industry expertise and network of contacts to support its portfolio companies in areas such as product development, marketing, and sales.

* Financial Support: Riverwood provides financial support to its portfolio companies, enabling them to invest in growth initiatives, expand their operations, and acquire strategic assets.

* Governance and Oversight: Riverwood actively participates in the governance of its portfolio companies, ensuring sound management practices and responsible stewardship of capital.

The $1.8 Billion Fund

Riverwood Capital’s recent announcement of a $1.8 billion fund, its largest to date, signifies a significant commitment to the Latin American market. This move not only underscores the firm’s confidence in the region’s growth potential but also has substantial implications for the private equity landscape in Latin America.

Implications for the Latin American Private Equity Landscape

The size of this fund will have a notable impact on the region’s private equity landscape. It indicates a significant influx of capital into the market, creating a more competitive environment for both investors and entrepreneurs. This increased competition could lead to:

- Higher valuations: As more capital chases deals, companies may command higher valuations, making it more challenging for smaller funds to compete. This could also lead to increased competition for exits, as more funds seek to deploy their capital.

- More sophisticated deal structures: With larger funds, investors can afford to engage in more complex transactions and negotiate more favorable terms. This could lead to more sophisticated deal structures, including more complex financing arrangements and governance provisions.

- Greater focus on growth sectors: The increased capital could lead to greater focus on specific growth sectors within Latin America, such as technology, healthcare, and consumer goods. This could lead to a surge in investments in these sectors, potentially accelerating innovation and growth.

Potential Investment Areas

Riverwood Capital’s investment strategy is focused on supporting high-growth businesses in Latin America. Given the fund’s size, potential investment areas could include:

- Technology: Latin America is experiencing a surge in tech startups, particularly in e-commerce, fintech, and logistics. Riverwood could capitalize on this trend by investing in promising companies in these sectors.

- Healthcare: The region’s growing middle class and aging population are driving demand for healthcare services. Riverwood could invest in companies that provide innovative healthcare solutions, such as telemedicine and digital health platforms.

- Consumer goods: Latin America’s growing consumer base presents significant opportunities for companies in the consumer goods sector. Riverwood could invest in companies that offer products and services tailored to the region’s unique needs and preferences.

- Infrastructure: The region’s infrastructure needs are substantial, and Riverwood could invest in companies that develop and operate critical infrastructure projects, such as energy, transportation, and telecommunications.

Comparison to Previous Investments, Riverwood capital closes 1 8b fund says opportunity in latam has never been greater

This $1.8 billion fund represents a significant increase compared to Riverwood Capital’s previous investments. While the firm has not publicly disclosed the size of its previous funds, it has been actively investing in Latin America for over a decade. This new fund signifies a major expansion of the firm’s commitment to the region, suggesting a belief in its long-term growth potential.

Latin America’s Investment Landscape

Latin America is experiencing a surge in investment interest, driven by a confluence of economic and political factors. The region’s robust growth potential, coupled with its diverse and expanding markets, is attracting global investors seeking new opportunities.

Economic and Political Factors Influencing Investment

Several key economic and political factors are shaping the investment landscape in Latin America:

- Economic Growth: Latin America’s economies are experiencing a period of sustained growth, fueled by strong domestic demand, rising commodity prices, and structural reforms. The region’s GDP is projected to grow at a healthy pace in the coming years, making it an attractive destination for investors.

- Demographic Trends: Latin America’s population is young and growing, with a large middle class that is driving consumer spending and demand for goods and services. This demographic shift presents significant opportunities for businesses in sectors such as retail, healthcare, and education.

- Political Stability: While political instability has been a recurring theme in Latin America, many countries have made significant progress in strengthening their institutions and improving governance. This trend has boosted investor confidence and created a more favorable environment for investment.

- Free Trade Agreements: Latin America has signed numerous free trade agreements with countries around the world, facilitating trade and investment flows. These agreements have opened up new markets for Latin American businesses and attracted foreign investment.

- Government Incentives: Many Latin American governments are offering incentives to attract foreign investment, such as tax breaks, subsidies, and streamlined approval processes. These incentives are designed to promote economic growth and create jobs.

Emerging Industries and Sectors with Growth Potential

Several industries and sectors in Latin America are poised for significant growth in the coming years:

- Technology: Latin America is experiencing a rapid rise in technology adoption, with a growing number of startups and tech companies emerging in the region. The e-commerce, fintech, and digital media sectors are particularly promising.

- Renewable Energy: With abundant natural resources, Latin America is well-positioned to become a global leader in renewable energy. The region has significant potential for solar, wind, and hydroelectric power generation, attracting investments in this sector.

- Infrastructure: Latin America needs substantial investment in infrastructure, including roads, bridges, airports, and ports, to support its growing economy. This presents opportunities for investors in construction, engineering, and logistics.

- Consumer Goods: The rising middle class in Latin America is driving demand for consumer goods, such as automobiles, electronics, and apparel. This presents opportunities for investors in retail, manufacturing, and distribution.

- Healthcare: Latin America’s healthcare system is undergoing a transformation, with increasing demand for private healthcare services. This presents opportunities for investors in hospitals, clinics, and pharmaceuticals.

Challenges and Opportunities Facing Investors

While Latin America offers significant investment opportunities, investors also face several challenges:

- Bureaucracy: Latin American countries often have complex bureaucratic processes that can make it difficult for investors to navigate. This can lead to delays and increased costs.

- Corruption: Corruption is a significant problem in some Latin American countries, which can deter investors and increase the risk of legal and regulatory challenges.

- Economic Volatility: Latin American economies are susceptible to economic volatility, due to factors such as commodity price fluctuations and political instability. This can create uncertainty for investors.

- Infrastructure Gaps: Despite recent progress, Latin America still has significant infrastructure gaps, which can hinder business operations and increase costs.

- Competition: Competition in Latin America is increasing, as more companies enter the region and seek to capitalize on its growth potential.

Investment Landscape Comparison

| Country | Economic Growth | Political Stability | Infrastructure | Corruption | Opportunities | Challenges |

|—|—|—|—|—|—|—|

| Brazil | 2.5% | Moderate | Moderate | High | Renewable energy, infrastructure, consumer goods | Bureaucracy, corruption, economic volatility |

| Mexico | 2.0% | Moderate | Moderate | Moderate | Manufacturing, tourism, technology | Bureaucracy, corruption, drug violence |

| Colombia | 3.5% | High | Moderate | Moderate | Oil and gas, agriculture, tourism | Security risks, bureaucracy |

| Chile | 2.8% | High | High | Low | Mining, renewable energy, technology | Limited domestic market, economic dependence on commodities |

| Peru | 3.0% | High | Moderate | Moderate | Mining, agriculture, tourism | Political instability, bureaucracy |

Future Implications and Potential Outcomes: Riverwood Capital Closes 1 8b Fund Says Opportunity In Latam Has Never Been Greater

Riverwood Capital’s $1.8 billion fund for Latin American investments signifies a significant commitment to the region’s growth potential. The fund’s deployment will likely have a ripple effect, influencing the trajectory of Latin American businesses and economies.

Impact on Latin American Businesses

Riverwood’s investment will likely provide a much-needed boost to Latin American businesses. The fund’s focus on growth-stage companies will provide access to capital and expertise, enabling them to scale their operations, expand into new markets, and innovate. This infusion of capital can fuel the growth of promising startups, helping them become major players in their respective sectors. For example, investments in technology companies can accelerate the adoption of digital solutions, leading to greater efficiency and productivity across industries.

Job Creation and Economic Development

The influx of investment from Riverwood and other venture capital firms can stimulate job creation in Latin America. As businesses grow and expand, they will require additional personnel to manage their operations, leading to new employment opportunities in various sectors. Moreover, the development of new industries and technologies can create a ripple effect, driving demand for skilled labor and contributing to overall economic development. This growth can lead to higher wages, improved living standards, and a more robust middle class in the region.

Challenges of Increased Investment Activity

While increased investment can bring significant benefits, it also presents potential challenges. One concern is the risk of overvaluation in certain sectors. As investors pour capital into promising startups, valuations can become inflated, creating a bubble that could burst if growth expectations are not met. Additionally, the influx of foreign investment can lead to concerns about job displacement, as companies may prioritize automation or outsourcing over local employment.

Long-Term Outlook for Investment in Latin America

Despite the challenges, the long-term outlook for investment in Latin America remains positive. The region boasts a young and growing population, increasing urbanization, and a rising middle class, creating a fertile ground for businesses to thrive. Moreover, ongoing efforts to improve governance and infrastructure are creating a more favorable investment climate. While short-term volatility is possible, the underlying fundamentals suggest a bright future for Latin American economies, making it an attractive destination for investors seeking long-term growth opportunities.

Riverwood’s $1.8 billion fund is more than just a financial commitment; it’s a vote of confidence in Latin America’s future. This investment is expected to fuel innovation, create jobs, and drive economic development across the region. As the world shifts its focus to emerging markets, Latin America is emerging as a frontrunner, and Riverwood is leading the charge. The “opportunity has never been greater” statement is not just a catchy tagline, but a clear indication of the exciting times ahead for Latin American businesses and investors alike.

Riverwood Capital’s massive $1.8 billion fund signals a huge bet on Latin America’s growth potential. But with so many players vying for a piece of the pie, understanding the market’s intricacies is crucial. That’s where the power of solo credit bureau first party data comes in, offering valuable insights into consumer behavior and creditworthiness, which can be a game-changer for investors navigating the complex Latin American landscape.

With this data-driven approach, Riverwood Capital can make informed decisions and capitalize on the region’s burgeoning opportunities.

Standi Techno News

Standi Techno News